- Intel Bulls Have Given Up. Why There May Still Be Hope for The Stock. (barrons)

- ‘The Claman Countdown’ panelists Thomas Hayes and Nick Timiraos evaluate the state of the U.S. economy. (foxbusiness)

- ‘I’m really desperate now’: Temu sellers revolt against fines and withheld pay (cnn)

- The government—either a Harris or Trump administration—will need Intel to thrive if the U.S. has any hope of achieving chip making independence. (barrons)

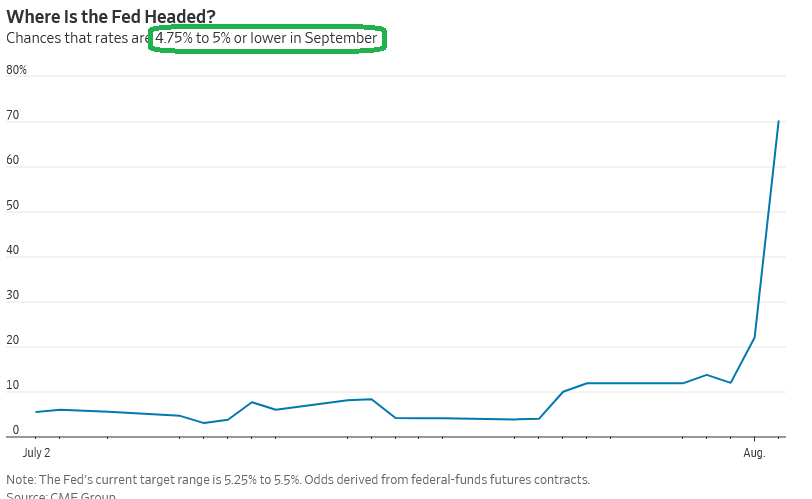

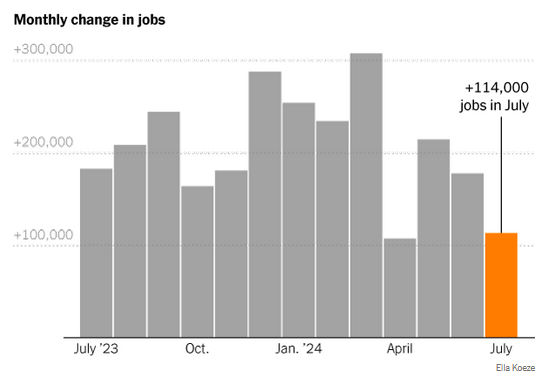

- Job Slowdown Will Ignite Debate Over Larger Half-Point Rate Reduction (wsj)

- How a Jobs Report Sent the Fed From a Soft Landing to Behind the Curve (barrons)

- What 100 Years of Rate Cuts Says Happens Next (barrons)

- Amazon’s Jeff Bezos Stopped Selling Stock When It Dipped Below $200 (barrons)

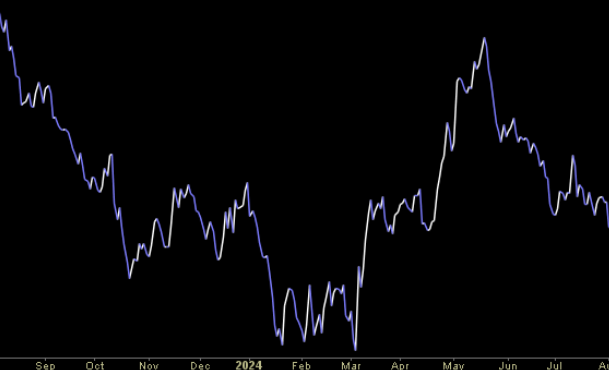

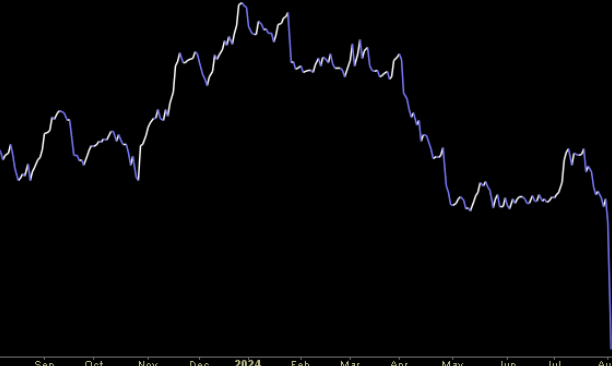

- Pump Up the Value. Fed Rate Cuts Will Boost These Stocks. (barrons)

- Wall Street’s Year of Calm Snaps as Most Reliable Trades Flop (bloomberg)

- Dollar Eyes Worst Day This Year as Jobs Data Boosts Expectations for Fed Cuts (barrons)

- Mortgage rates plunge to lowest level in more than a year after weak jobs report (cnbc)

- Tech companies show no signs of slowing spending on artificial intelligence, even though a payoff looks a long way away. (nytimes)

- Japan stocks plunge by nearly 6% in biggest drop since start of pandemic (cnn)

- The 10 Best Companies to Invest in Now (morningstar)

Tom Hayes – Fox Business Appearance – The Claman Countdown – 8/2/2024

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – August 2, 2024

Watch in HD directly on Fox Business

Where is money flowing today?

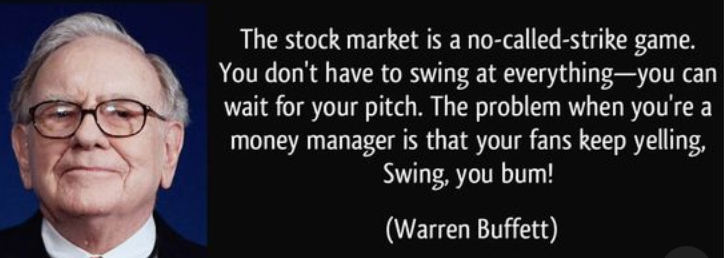

Quote of the Day…

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 17 key reads for Friday…

- PBOC to Step Up Support for Economy, Shifts Focus to Consumption (bloomberg)

- BofA’s Hartnett Says Sell Stocks at the Fed’s First Rate Cut (bloomberg)

- Automobile sales in the U.S. rebound after crippling cyberattack (marketwatch)

- US job growth misses expectations in July; unemployment rate rises to 4.3% (reuters)

- The July jobs report is likely to raise concerns that the Fed has waited too long to begin cutting rates. (nytimes)

- Nvidia being probed by Justice Department, two separate reports say (marketwatch)

- Japanese Stocks Suffer Biggest Fall Since 2020 on Economic Concerns (wsj)

- Japanese stocks fell 6 percent as a long-running surge faltered. (nytimes)

- Temu’s office besieged by Chinese suppliers protesting refund policy (businessinsider)

- “Intel’s second-quarter earnings report on Thursday wasn’t all bad. CEO Pat Gelsinger continued to reiterate that the company’s ambitious plan for “5 nodes in 4 years” to enable its foundry business (for both internal and external customers) to catch up to Taiwan Semiconductor Manufacturing is still on track and executing as planned. Intel has shipped more than 15 million of its first “AI PC” chips, codenamed Meteor Lake, and is confident it will have 40 million units shipped by the end of 2024. That’s a huge milestone and dwarfs what AMD or Qualcomm could hope to do in the same time frame.” (marketwatch)

- Cooper Standard Second Quarter Gross Profit Ramps Higher; Further Margin Expansion Expected in Second Half of the Year (cps)

- Here’s the dividend-paying stock playbook for Fed rate cuts (marketwatch)

- Intel to Cut Jobs and Suspend Dividend in Cost-Saving Push (wsj)

- Why the Fed Risks Falling Behind (wsj)

- Recession Triggered: Payrolls Miss Huge, Up Just 114K As Soaring Unemployment Rate Activates “Sahm Rule” Recession (zerohedge)

- NDRC Reiterates Ministry of Finance Policy Support (chinalaastnight)

- GM Chief Financial Officer Paul Jacobson Buys the Stock Dip (barrons)