Data Source: Finviz

Be in the know. 17 key reads for Friday…

- Move Over, Aristocrats. Meet the Dividend Kings. (Barron’s)

- 5 Ultra-Safe Dividend Stocks to Buy Now as a Market Correction May Have Started (24/7 Wall Street)

- Look for Health Stocks to Stop Lagging, Start Leading (Wall Street Journal)

- Emerging-Market Investors Are Immune to New Covid Threat—for Now (Barron’s)

- Bond King Jeff Gundlach says there is a simple reason Treasury yields are so low even as inflation surges (MarketWatch)

- There’s a New Growth Area in Tech. Pay Attention to These Stocks. (Barron’s)

- Intel Is in Talks to Buy GlobalFoundries for $30 Billion: Report (Barron’s)

- A Chip Peak Like No Other (Wall Street Journal)

- Wall Street Opens Back Up to Oil and Gas—but Not for Drilling (Wall Street Journal)

- Fed’s Powell Concedes Anxiety About Higher Inflation but Resists Policy Shift (Wall Street Journal)

- TSMC Expects Auto-Chip Shortage to Abate This Quarter (Wall Street Journal)

- The U.S. Housing Market Is Losing Some of Its ‘Frenzy,’ as More Homes List for Sale (Wall Street Journal)

- As U.S. Home Prices Surge, American Buyers Set Their Sights on Europe (Wall Street Journal)

- As U.S. Home Prices Surge, American Buyers Set Their Sights on Europe (Wall Street Journal)

- The Reassuring Data on the Delta Variant (Wall Street Journal)

- Gain in U.S. Retail Sales Underscores Solid, Steady Consumer (Bloomberg)

- Citigroup Is Closing in on Peers in One Key Way (Wall Street Journal)

Tom Hayes – Quoted in Reuters article – 7/14/2021

Thanks to Herb Lash and Marc Jones for including me in their article on Reuters yesterday. You can find it here:

Thanks to Herb Lash and Marc Jones for including me in their article on Reuters yesterday. You can find it here:

Click Here to View The Full Article on Reuters

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Data Source: barchart

Today some institution/fund purchased 4,066 contracts of Jan 2022 $275 strike calls (or the right to buy 406,600 shares of Alibaba Group Holding Limited (BABA) at $275). The open interest was just 1,183 prior to this purchase. Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”

Unusual Options Activity – The Boeing Company (BA)

Data Source: barchart

Today some institution/fund purchased 4,029 contracts of June 2022 $235 strike calls (or the right to buy 402,900 shares of The Boeing Company (BA) at $235). The open interest was just 877 prior to this purchase. Continue reading “Unusual Options Activity – The Boeing Company (BA)”

Where is money flowing today…

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 20 key reads for Thursday…

- Alibaba and Tencent Consider Opening Up Their ‘Walled Gardens’ (Wall Street Journal)

- How This Top Financial Advisor Lured $270 Billion In Assets (Investor’s Business Daily)

- AMC Stock Has Given Up Most of Its Gains Since June (Barron’s)

- China Is on Track to Meet Its Growth Target for 2021. What to Know. (Barron’s)

- Taiwan Semiconductor Reports 11% Profit Rise and Sees Strong Chip Demand (Barron’s)

- Netflix Gaming Plan Clashes With Meme Stock GameStop (Barron’s)

- Businesses See Above-Average Price Increases, Worry About Lingering Inflation, Fed Beige Book Says (Wall Street Journal)

- Wells Fargo Emerges From Pandemic Slump (Wall Street Journal)

- Citigroup Profit Soars as Consumers Rebound (Wall Street Journal)

- OPEC Reaches Compromise With U.A.E. Over Oil Production (Wall Street Journal)

- Powell Says Fed Still Expects Inflation to Ease (Wall Street Journal)

- Powell: Progress toward full employment, 2% inflation is “still a ways off,” hinting Fed may not be on verge of cutting bond-buying stimulus (USA Today)

- NHL offseason tracker: Analyzing the moves in what promises to be a busy offseason (USA Today)

- New York Manufacturing Expands at Record Pace, Price Gauge Rises (Bloomberg)

- Aston Martin’s Upcoming Valhalla Supercar Tops Out at 217 Miles Per Hour (Bloomberg)

- Moderna Looks at Potential of mRNA to Fight Flu, Cancer, HIV (Bloomberg)

- Netflix Plans to Offer Video Games in Push Beyond Films, TV (Bloomberg)

- 19 dividend stocks to help you combat inflation (MarketWatch)

- Citigroup Is Closing in on Peers in One Key Way (Wall Street Journal)

- Cliff Asness Is Back Doing What He Does Best: Defending Value (Bloomberg)

The “Whole Lotta Nothin'” Stock Market (and Sentiment Results)…

If it feels like the market is running in place, you’re right. Look at the Small Caps (Russell 2000) above and the Dow Jones below, and your suspicions are confirmed: Continue reading “The “Whole Lotta Nothin’” Stock Market (and Sentiment Results)…”

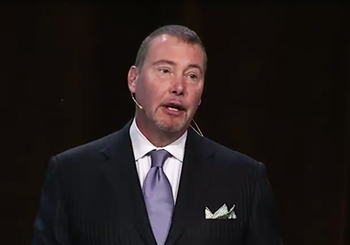

Tom Hayes – CGTN America Appearance – 7/14/2021

CGTN America – Thomas Hayes – Chairman of Great Hill Capital – July 14, 2021