Be in the know. 15 key reads for Monday…

- Pfizer, US health officials to discuss COVID boosters on Monday (New York Post)

- President Biden’s Executive Order Opens New Front in Battle With Big Tech (Wall Street Journal)

- Nordstrom, Eyeing 20-Somethings, Strikes Deal With the Online Giant Asos (New York Times)

- Richard Branson’s Virgin Galactic Flight Opens Door to Space Tourism (Wall Street Journal)

- The Las Vegas Business Trip Is Back (Mostly) (Wall Street Journal)

- Disney’s ‘Black Widow’ Tops Box Office, Lifting Prospect of Moviegoing Rebound (Wall Street Journal)

- How Dollar Tree Sells Nearly Everything for $1, Even When Inflation Lurks (Wall Street Journal)

- Higher Inflation Is Here to Stay for Years, Economists Forecast (Wall Street Journal)

- Netflix Proves It’s Essential, Pandemic or Not (Bloomberg)

- China’s Slowing V-Shaped Economic Recovery Sends Global Warning (Bloomberg)

- Israel Approves 3rd Vaccine Dose for Immunocompromised, TV Says (Bloomberg)

- For SPACs, one characteristic seems to determine the investing winners from losers (CNBC)

- Warren Buffett allowed Ndamukong Suh to shadow him for several weeks. The NFL star shared his 3 key takeaways (Business Insider)

- Spread of Delta variant casts shadow over Europe’s economic rebound (Financial Times)

- US banks enter earnings season with eyes on loan growth (Financial Times)

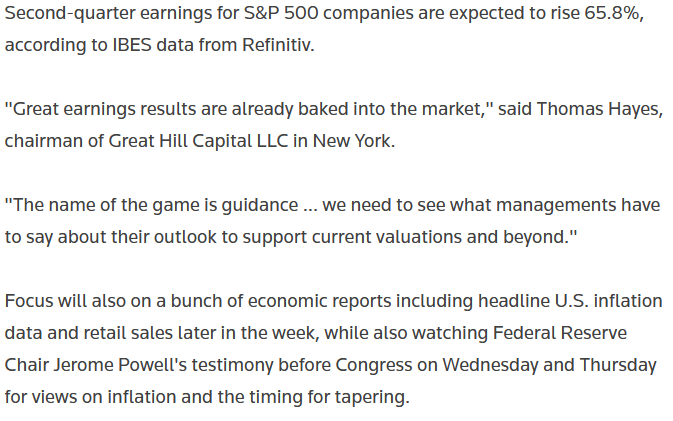

Tom Hayes – Quoted in Reuters article – 7/12/2021

Thanks to Devik Jain and Shreyashi Sanyal for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Tom Hayes – Cheddar News TV Appearance – 7/12/2021

Cheddar TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – July 12, 2021

Watch Directly on Cheddar

Be in the know. 15 key reads for Sunday…

- China’s Attacks on Tech Are a Losing Strategy in Cold War II (Bloomberg)

- John D. Rockefeller Was the Richest Person To Ever Live. Period (smithsonianmag)

- Megacap Tech Stocks Roar Back Into Vogue as Haven From Slowdown (Bloomberg)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Virgin Galactic launches Richard Branson to edge of space: How to watch live (CNET)

- The World’s Deepest Swimming Pool Has Opened in Dubai (Maxim)

- We Took Ferrari’s Portofino M on a Wild Ride Through The Florida Keys (Maxim)

- Heinz Petitions to Put Equal Number of Hot Dogs and Buns in Packages (Maxim)

- ‘Succession’ Season 3 Trailer: The Roy Family is Out For Blood (Maxim)

- Shenzhen blazes trail for national data regulation: experts (technode)

- UFC 264: It was Dustin Poirier’s night, but don’t expect Conor McGregor to fade away (ESPN)

- Shrinkflation: Inflation’s Sneaky Cousin (NPR Planet Money)

- How The Tampa Bay Lightning Won Another Stanley Cup — And Made History (fivethirtyeight)

- How Does a Quantum Computer Work? (scientificamerican)

- There’s A Lot of Wealth (theirrelevantinvestor)

Be in the know. 30 key reads for Saturday…

- Rare Vintage Warren Buffett University of Tennessee talk (DVD) 2003 Best of Warren Buffett video (YouTube)

- How Warren Buffett got a 51.6% dividend yield on CocaCola (TD Ameritrade Network)

- Understanding Compounding and Getting Rich Late in Life (DGI)

- Didi Tried Balancing Pressure From China and Investors. It Satisfied Neither. (Wall Street Journal)

- Some Chinese Stocks Are Starting to Look Like Bargains. Where to Look. (Barron’s)

- An Infrastructure Spending Bust Might Boost Markets. Here’s Why. (Barron’s)

- Look Out Alphabet, Amazon, and Apple: Biden Takes Aim at Big Business in Exec Order. (Barron’s)

- Banks Are About to Kick Off Earnings Season. Keep an Eye on Citigroup. (Barron’s)

- There’s a New Growth Area in Tech. Pay Attention to These Stocks. (Barron’s)

- Which Company Can Reach $1 Trillion After Facebook? Here’s Our Guess. (Barron’s)

- 3 Things That Matter More for Boeing Stock Than China (Barron’s)

- What’s in Biden’s Big Business Executive Order (Wall Street Journal)

- Wharton School’s Jeremy Siegel on what yields pullback means for stocks (YouTube)

- Biden Revives Net Neutrality, Targets Big Broadband Providers (Wall Street Journal)

- Drug Prices Are One Focus of Biden’s Push to Boost Competition (Wall Street Journal)

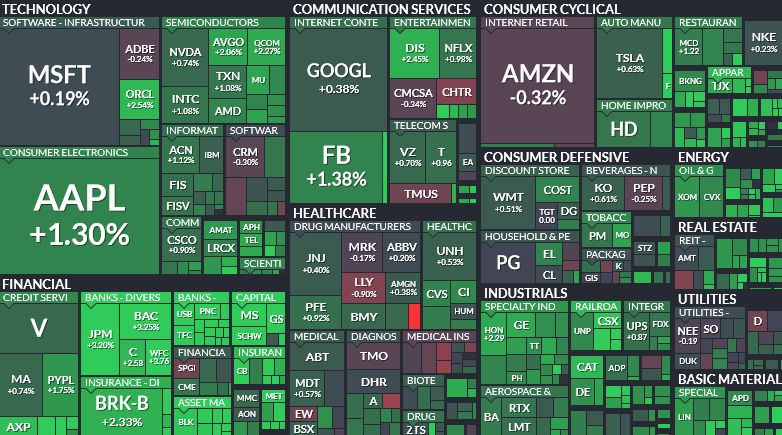

- S&P 500 Perfect Earnings Record Is on the Line With Peak Growth (Bloomberg)

- IAC CEO says Apple ‘worse’ than Google, will be next U.S. antitrust target (CNBC)

- Opinion: The bull market in stocks may last up to five years — here are six reasons why (MarketWatch)

- America desperately needs 1 million more construction workers (CNN)

- Steve Cohen – America’s Most Profitable Day Trader (YouTube)

- NEW Lotus Emira First Look: Supercar Looks For Sports Car Money (YouTube)

- China to impose security checks on overseas listings (Financial Times)

- Another Big Stock-Market Rotation Is Under Way, and Tech Is on Top Again (Wall Street Journal)

- How Dua Lipa Shut Down the Trolls and Conquered International Pop (VanityFair)

- Elon Musk Slams Bitcoin’s Underlying Technology (Futurism)

- Exposure of Wall Street’s ‘Dirty Little Secret’ Could Shift ETF Assets Back to Mutual Funds (Institutional Investor)

- The AirBNBs (paulgraham)

- S11 E2 Tony Robbins Points to the Keys to Fulfillment (DoubleLine)

- 2022 Lotus Emira revealed: Lotus’ last internal combustion sports car (CNET)

- Katz: Recent pullback in financials could be a great opportunity to step in and buy (YouTube)

Tom Hayes – TD Ameritrade Network Appearance – 7/9/2021

TD Ameritrade Network Appearance – Thomas Hayes – Chairman of Great Hill Capital – July 9, 2021

Watch Directly on TD Ameritrade Network

Tom Hayes – The Claman Countdown – Fox Business Appearance – 7/9/2021

Unusual Options Activity – Takeda Pharmaceutical Company Limited (TAK)

Data Source: barchart

Today some institution/fund purchased 1,111 contracts of Jan $16 strike calls (or the right to buy 111,100 shares of Takeda Pharmaceutical Company Limited (TAK) at $16). The open interest was just 177 prior to this purchase. Continue reading “Unusual Options Activity – Takeda Pharmaceutical Company Limited (TAK)”