Hedge Fund Tips with Tom Hayes – Podcast – Episode 80

Be in the know. 12 key reads for Friday…

- Pfizer and BioNTech Plan to Seek FDA Approval for Covid-19 Booster (Barron’s)

- Here Are the Cheapest Stocks in Each Sector. Some Deserve the Discount, Others Look Like Bargains. (Barron’s)

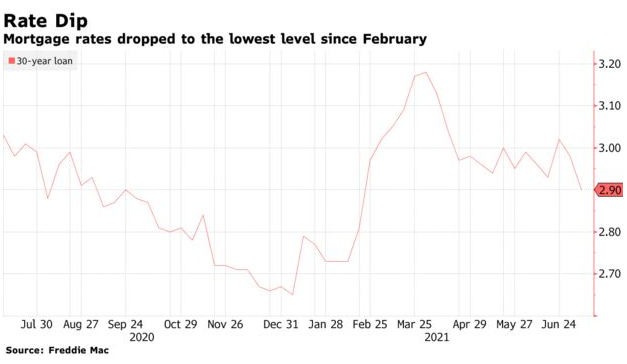

- Mortgage Rates Are Their Lowest in Months. Will They Stay This Way? (Barron’s)

- Apple Is Next: Why State and Federal Lawsuits Over the App Store Are Inevitable (Barron’s)

- GE Stock Needs a Catalyst. Here Are 3. (Barron’s)

- Novak Djokovic’s Secret Weapon: the Tactical Bathroom Break (Wall Street Journal)

- ‘Financially hobbled for life’: The elite master’s degrees that don’t pay off (Fox Business)

- One-Third of Allocators Plan on Upping Their Hedge Fund Investments Over the Next Six Months (Institutional Investor)

- Peak Demand Delayed. The Energy Report 07/09/2021 (Phil Flynn)

- Americans are reaching for their credit cards again and taking out more auto loans (MarketWatch)

- Boeing (BA) Gains on Reports It Is Nearing China Return (Street Insider)

- China’s Central Bank Pivots to Easing as Growth Risks Build (Bloomberg)

Unusual Options Activity – Alibaba Group Holding Limited (BABA)

Data Source: barchart

Today some institution/fund purchased 1,294 contracts of March 2022 $200 strike calls (or the right to buy 129,400 shares of Alibaba Group Holding Limited (BABA) at $200). The open interest was just 198 prior to this purchase. Continue reading “Unusual Options Activity – Alibaba Group Holding Limited (BABA)”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Tips (PCN) – Position Completion Notification

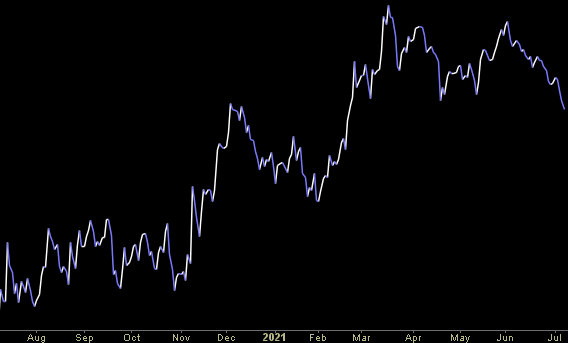

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Tom Hayes – Quoted in Reuters article – 7/8/2021

Thanks to Devik Jain and Ambar Warrick for including me in their article on Reuters today. You can find it here:

Thanks to Devik Jain and Ambar Warrick for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 30 key reads for Thursday…

- China’s powerful internet regulator flexes muscles with Didi probe: “China’s policy remains unchanged. We continue to open up and support the development of internet platforms and we will continue to encourage Chinese companies to engage in international exchanges and cooperation,” foreign ministry spokesman Wang Wenbin said. (Reuters)

- Tampa Bay Lightning close out Montreal Canadiens in Game 5 to win second straight Stanley Cup (ESPN)

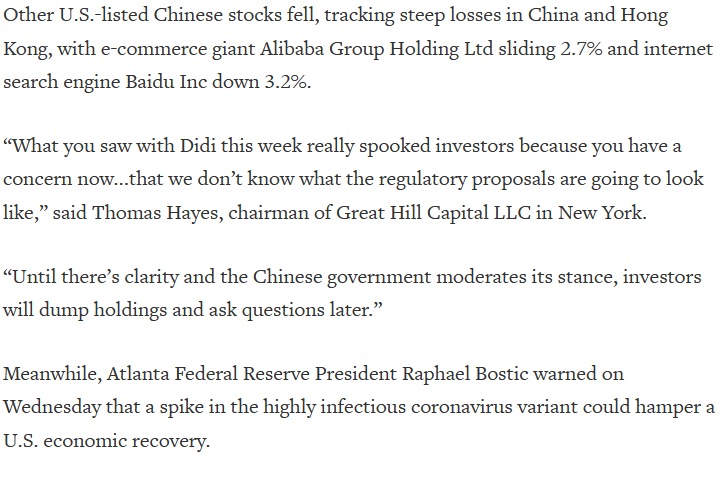

- Growth worries, Chinese tech rout set to drag Wall St lower (Reuters)

- China signals easier monetary policy, reviving worries about weaker growth (CNBC)

- How Laura Alber Varnished Williams-Sonoma With Success (IBD)

- Beijing’s Regulatory Plans Could Hurt U.S.-Listed Chinese Companies. The Pitfalls Investors Need to Know. (Barron’s)

- China and the U.S. Share a Long History—Sometimes as Friends (Barron’s)

- Why the Manager of an Eclectic $17B Value Fund Thinks Facebook and Citi Stock Are Deals (Barron’s)

- FDA Narrows Its Label on Biogen’s Alzheimer’s Drug a Month After Approving It (Barron’s)

- Mortgage Applications Are Stuck at May 2020 Levels. Here’s Why. (Barron’s)

- S. Treasury Yields Extend Steep Decline (Wall Street Journal)

- Delta Covid-19 Variant Is Dominant U.S. Strain, CDC Data Show (Wall Street Journal)

- Americans Can Travel to Europe Again. Here’s How to Get Around. (Wall Street Journal)

- 3M workers remain on jobless benefits as weekly claims tick up to 373K (New York Post)

- Jeffrey Katzenberg has ‘work’ to do in Sun Valley as power players mingle (New York Post)

- Dozens of states sue Google alleging antitrust violations (New York Post)

- COVID-19 pandemic destroyed 22M jobs and many aren’t coming back: OECD (New York Post)

- Fed officials were divided over inflation risks and bond-buying when they met in June. (New York Times)

- Tokyo organizers say Olympics to be held without fans due to COVID-19 (USA Today)

- Bonds Lead Rethink on Reflation as Central Banks Signal Support (Bloomberg)

- Manhattan’s Apartment Glut Eases as Renters Race to Sign Leases (Bloomberg)

- The New Ducati Monster May Look Different, But It’s Better Than Ever (Bloomberg)

- S. Mortgage Rates Slide to Lowest Since February at 2.9% (Bloomberg)

- OPEC+ spat is likely to be resolved ‘sooner rather than later’: Energy analyst (CNBC)

- Now May Be a Good Time to Buy Mortgage Stocks (Wall Street Journal)

- Walgreens expands same-day prescription delivery service to nearly all U.S. locations (MarketWatch)

- Wheels Up wants to be ‘Uber of the sky,’ CEO says (Fox Business)

- Spending Rotated From Goods to Services in June, Travel Spending Improving in Early July – BofA (Street Insider)

- 5 Blue Chip Stocks to Buy With Huge Dividends as Interest Rates Plunge (24/7 Wall Street)

- Beijing asked Didi to change mapping function over security fears (Financial Times)