Thanks to Devik Jain and Medha Singh for including me in their article on Reuters today. You can find it here:

Thanks to Devik Jain and Medha Singh for including me in their article on Reuters today. You can find it here:

I had to look hard for a song to describe this week’s stock market sentiment, but I think I found the one in Sam Hunt’s recent country hit, “Breaking Up Was Easy In The 90’s”: Continue reading “The Sam Hunt, “Breaking Up Was Easy In The 90’s” Stock Market (and Sentiment Results)…”

Bloomberg Radio Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 23, 2021

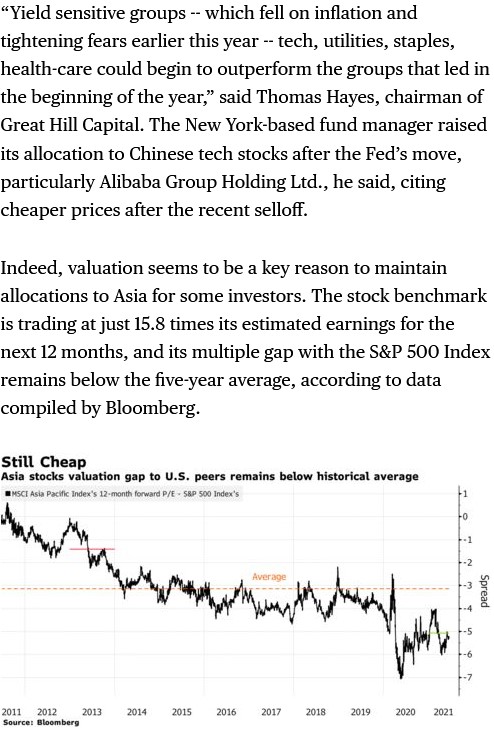

Thanks to Ishika Mookerjee and Moxy Ying for including me in their article on Bloomberg. You can find it here:

Thanks to Ishika Mookerjee and Moxy Ying for including me in their article on Bloomberg. You can find it here: