Unusual Options Activity – Paysafe Limited (PSFE)

Data Source: barchart

Today some institution/fund purchased 3,286 contracts of Jan $15 strike calls (or the right to buy 328,600 shares of Paysafe Limited (PSFE). The open interest was 2,369 prior to this purchase. Continue reading “Unusual Options Activity – Paysafe Limited (PSFE)”

Where is money flowing today?

Be in the know. 17 key reads for Monday…

- Bank Stocks Got Beaten Up by the Fed. How the Fed Can Help Them Bounce Back. (MarketWatch)

- ‘Nice underpinning to the market’: Buybacks may prop stock market rattled after Fed meeting (MarketWatch)

- Consolidation May Be Coming to a Screen Near You (Wall Street Journal)

- This Home Builder Stock Is a Buy. Here’s Why. (MarketWatch)

- Gilead says real-world data shows COVID-19 drug Veklury can reduce the risk of death (MarketWatch)

- Nuclear Talks on Hold. The Energy Report 06/21/2021 (Phil Flynn)

- 3 Of Jefferies Top Value Stocks To Buy Are Mega-Cap Tech and Defense Giants (24/7 Wall Street)

- Inflation hasn’t dented earnings forecasts: Morning Brief (Yahoo! Finance)

- The natural-gas glut has evaporated, driving prices higher (Fox Business)

- Germany’s Armin Laschet warns against cold war with China (Financial Times)

- Michael Burry Issues Grim Warning On Cryptocurrency, Stonks: Losses Will ‘Approach The Size Of Countries’ (Benzinga)

- EU tech policy is not anti-American, says Vestager (Financial Times)

- Olympic venues to cap number of spectators at 10,000 (Financial Times)

- Bitcoin drops as China intensifies crypto mining crackdown (CNBC)

- China has administered more than 1 billion doses of its Covid-19 vaccines (CNBC)

- Cruise Operators Win Relief as Florida Judge Rules Against CDC’s Sailing Order (Barron’s)

- Lidar Technology Will Enable a Self-Driving Future. What to Know About 6 Stocks. (Barron’s)

Be in the know. 12 key reads for Sunday…

- Robert Cialdini on the Psychology of Influence (Podcast) (Bloomberg)

- Down Triple Witching Weeks Trigger More Weakness Week After (Almanac Trader)

- Amazon Prime Day 2021 Is Three Days Away—Here’s Everything To Know (Forbes)

- 23andMe’s Anne Wojcicki Becomes Newest Self-Made Billionaire After SPAC Deal With Richard Branson (Forbes)

- 10 Best Dividend Stocks to Buy According to Billionaire David Tepper (Insider Monkey)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Fed Reverse Repos Surge to Record of $756 Billion After Rate Tweak Wall Street Journal)

- Beverly Hills Tour d’Elegance Hits the Road This Weekend with a $100M+ Convoy (TheDrive)

- AirTags and Find My are ushering in a whole new Apple era (TNW)

- Meet Dr. Jennifer Doudna: she’s leading the biotech revolution (Big Think)

- Listen to the One-Off Bugatti Bolide’s Wild Straight-Piped 1850-HP W-16 Engine (roadandtrack)

- Why Ram Parameswaran Says the World’s Biggest Tech Stocks Are Ridiculously Cheap Right Now (Bloomberg)

Be in the know. 20 key reads for Saturday…

- Tesla Isn’t the Only Self-Driving Car Company. The Stocks to Buy—and Ones to Avoid. (Barron’s)

- S. Faces a Housing Shortage. This Builder Can Help Fill the Gap—and Its Stock Is a Buy. (Barron’s)

- Markets to the Fed: Your Hawkish Turn Isn’t Fooling Anyone (Barron’s)

- Disney Stock Looks Set to Get a Boost From a Quicker Reopening (Barron’s)

- The Reopening Could Send Six Flags Stock Vertical (Barron’s)

- Energy Stocks Have Potential New Appeal: Dividends (Barron’s)

- Why Moderna, Illumina, or Meituan Could Be the Next Tesla Stock (Barron’s)

- Rate-Hike Worries Send Dow to Worst Week Since October (Wall Street Journal)

- At Olympic Swim Trials, the Battle Is in the Warm-Up Pool (Wall Street Journal)

- CVS and Walgreens Were Reeling From Pandemic, but Fortunes Have Changed (Wall Street Journal)

- Boeing’s largest 737 Max model jets off on maiden flight (New York Post)

- Fed Shocks Stocks With Blow to Dreams of Value Investor Nirvana (Bloomberg)

- The Fed’s latest policy decision will prop up stocks through 2021 but it may be a misstep for the central bank, Mohamed El-Erian says (Business Insider)

- Fed’s Kashkari opposed to rate hikes at least through 2023 (CNBC)

- 16 short-squeeze targets in the stock market, including Canoo, Tootsie Roll and a prison operator (MarketWatch)

- Empty Oil Tanks at Key Storage Hub Show Speedy Demand Rebound (Bloomberg)

- The Long-Term Forecast for U.S. Stock Returns (Morningstar)

- Billionaire investor David Tepper says ‘the stock market is still fine’ after Fed announcements (CNBC)

- Seizing The Middle: Chess Strategy in Business (Farnam Street)

- “The stock market is not created for Value Investors” – Li Lu (YouTube)

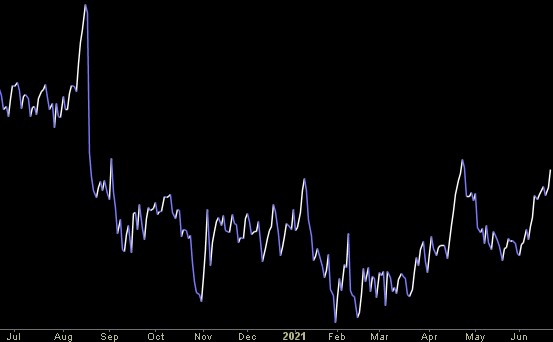

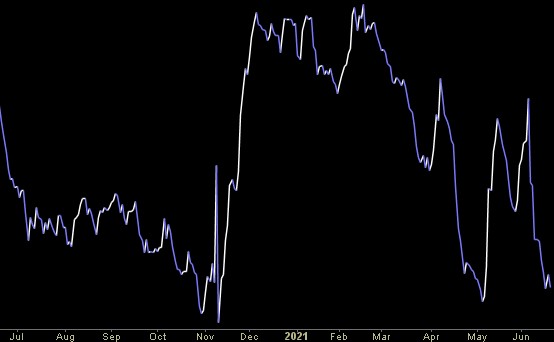

Where is money flowing today?

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 87

Article referenced in VideoCast above:

The Prince “When Doves Cry” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 77

Article referenced in podcast above:

The Prince “When Doves Cry” Stock Market (and Sentiment Results)…