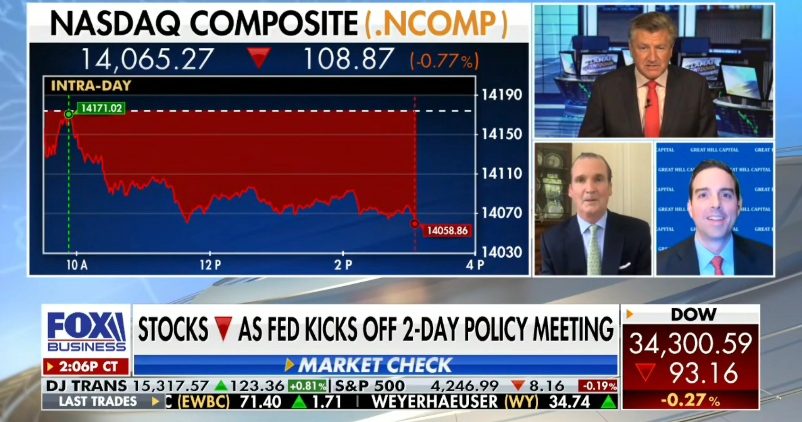

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 15, 2021

Where is money flowing today?

Quote of the Day…

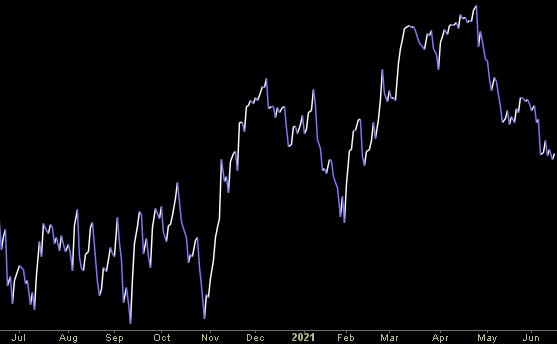

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 17 key reads for Tuesday…

- The Bond Market Is Acting Strange. An Economic Slowdown Could Be Ahead (Barron’s)

- AstraZeneca, Pfizer Vaccines Offer Strong Protection From Delta Variant (Barron’s)

- Here are 7 reasons to stay bullish on stocks and why the S&P is headed to 4,600, from Credit Suisse (MarketWatch)

- Here’s what the market wants — and doesn’t want — to hear from Powell on inflation at Fed meeting (MarketWatch)

- U.S. and Europe Set to Call Truce Over 17-Year Airbus and Boeing Feud (Barron’s)

- Jamie Dimon says JPMorgan is sitting on about $500 billion in cash, waiting to invest in higher rates (MarketWatch)

- ‘Do not read too much into this month’s bond rally’: it doesn’t mean markets see inflation receding, says JPMorgan (MarketWatch)

- ‘Fastest production car you can buy’: Jay Leno impressed by Tesla’s Model S Plaid (New York Post)

- U.S. Retail Sales Drop, Hinting at Shift to Spending on Services (Bloomberg)

- NBC Says Olympics May Be Most Profitable Ever Despite Pandemic (Bloomberg)

- A full rundown of what to expect from the Federal Reserve on Wednesday (CNBC)

- Here’s what you need to know about Biden and Putin’s high-stakes meeting (CNBC)

- Jaguar Land Rover is developing a hydrogen-powered vehicle and plans to test it out this year (CNBC)

- One corner of health care could lead Nasdaq’s next record rally, Oppenheimer analyst predicts (CNBC)

- Copper Falls to Eight-Week Low on Fear China Might Release Stockpiles (Wall Street Journal)

- Walgreens offers same-day delivery service through Uber Eats (MarketWatch)

- Wells Fargo (WFC) Likely to Announce a Material Dividend Increase, PT Raised to $52 at Raymond James (Street Insider)

Where is money flowing today?

Tom Hayes – Quoted in Reuters article – 6/14/2021

Thanks to Medha Singh and Devik Jain for including me in their article on Reuters today. You can find it here:

Thanks to Medha Singh and Devik Jain for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 20 key reads for Monday…

- Disney, Amazon In Race For Next Big Streaming Prize (Investor’s Business Daily)

- Novavax Stock Soars as Study Shows Covid Vaccine 90% Effective (Barron’s)

- What to Expect From the Fed Meeting (Barron’s)

- How Tech Stocks Could Beat Financials Stocks (Barron’s)

- Here’s what the market wants — and doesn’t want — to hear from Powell on inflation at Fed meeting (MarketWatch)

- 21 Stocks for the Next Phase of the Oil Rebound (Barron’s)

- How oil soaring to $100 a barrel could be bad for this boom-bust sector and the economy (MarketWatch)

- G-7 Leaders Rally to Biden’s Call to Challenge China (Wall Street Journal)

- How Japan’s Big Bet on Hydrogen Could Revolutionize the Energy Market (Wall Street Journal)

- Markets Are Leaving Little Room for the Fed to Be Wrong on Inflation (Wall Street Journal)

- Biotech Rally Sparked by Alzheimer’s Drug Has Staying Power (Wall Street Journal)

- Oil price hits pandemic high as investors bet on green energy (Fox Business)

- China Clouds Biden’s Transatlantic Reunion (Wall Street Journal)

- Strategists still don’t think inflation is a problem for stocks: Morning Brief (Yahoo! Finance)

- G7 set to agree ‘green belt and road’ plan to counter China’s influence (Financial Times)

- Lumber Prices Post Biggest–Ever Weekly Drop With Buyers Balking (Bloomberg)

- Authers’ Indicators: Here’s When to Worry About Inflation (Bloomberg)

- Bank of America CEO says consumer spending is 20% higher this year than 2019 (CNBC)

- Why 4 Jefferies Franchise List Stocks Could Be Big Second-Half Winners (24/7 Wall Street)

- The G7 was stronger on values than hard cash (Financial Times)

Be in the know. 15 key reads for Sunday…

- Alibaba Cloud offers to build livestream shopping platforms for global clients (technode)

- MiB: Brad Stone on Bezos & Amazon (Bloomberg)

- In Defense of SPACs (New YorkTimes)

- Here’s What Could Happen When $300 Unemployment Expires, According To Goldman Sachs (Forbes)

- G7 leaders agreed to keep the money taps open -source (Reuters)

- 5 Undervalued Blue Chip Stocks Hedge Funds Are Piling Into (Insider Monkey)

- Long-Term Look at the CPI (advisorperspectives)

- Parking Garages May Soon Become Mini Airports for Electric Air Taxis (Robb Report)

- What Makes Quantum Computing So Hard to Explain? (pocket)

- DARPA’s Latest Defense Weapon Knocks Drones Out of the Sky Using Advanced… Confetti Streamers? (gizmodo)

- Tesla delivers the first 25 Model S Plaid sedans (TheVerge)

- The Availability Bias: How to Overcome a Common Cognitive Distortion (Farnam Street)

- G-7 leaders hammer out a global minimum tax for companies. Here’s how it would work (Fox Business)

- Aston Martin V12 Speedster Is Pure Vehicular Art (Road and Track)

- Bullet-Proof Treasury Market Eyes Fed Meeting With Trepidation (Bloomberg)