Article referenced in VideoCast above:

Hedge Fund Tips with Tom Hayes – Podcast – Episode 49

Tom Hayes – Article Featured on MarketWatch – 12/3/2020

Thanks to Shawn Langlois for featuring my article/interview on MarketWatch yesterday We are very grateful.

Be in the know. 20 key reads for Friday…

- Ignore the ‘top callers,’ there’s still ‘easy money’ to be made this year, hedge-fund manager says (MarketWatch)

- Value Stock Rally Buoys Returns of Dividend Payers (Barron’s)

- Banks could see a windfall as economy recovers: ‘Biggest reserve release in the history of banking’ (CNBC)

- BofA Hikes Price Target on GE (GE) to $13 After Raising Numbers Amid Covid-19 Update (Street Insider)

- Boeing (BA) Confirms Ryanair Ordered 75 More 737 MAX Jets (Street Insider)

- Paul Tudor Jones sees ‘massive boom’ after COVID-19 vaccine gets released (Yahoo! Finance)

- Moderna Says It Will Ship 100M-125M COVID-19 Vaccine Doses Worldwide In Q1 (Benzinga)

- Best Bet in a Down Year: The Dividend Aristocrats (Barron’s)

- Oil pushes toward $50 a barrel after OPEC+ deal to slowly taper production cuts (MarketWatch)

- Why a rising stock market and a weak dollar are likely to keep going hand in hand (MarketWatch)

- Marvell Stock Dips After Earnings Report Warns of Supply Constraints (Barron’s)

- Pfizer Denies Its Vaccine Production Is Seeing New Delays (Barron’s)

- Pfizer And Moderna Face Their Biggest Challenge: Vaccinating The World (Investor’s Business Daily)

- Where’s the stock market going next? Look at the 1960s for an answer, says a Fidelity strategist (MarketWatch)

- Mortgage Industry Roars to Best Year Ever, Courtesy of the Fed (Bloomberg)

- Pelosi and McConnell resume talks as Congress rushes to strike a Covid stimulus deal (CNBC)

- The 12 best Christmas songs to listen to this holiday season and beyond (New York Post)

- Coronavirus Stimulus Talks Moving in Right Direction, Party Leaders Say (Wall Street Journal)

- Dry Ice Demand Swells as Covid-19 Vaccines Prepare for Deployment (Wall Street Journal)

- Could the ‘China Hustle’ Law End the Big Short? (Institutional Investor)

Unusual Options Activity – Gilead Sciences, Inc. (GILD)

Data Source: barchart

Today some institution/fund purchased 1,809 contracts of June $62.50 strike calls (or the right to buy 180,900 shares of Gilead Sciences, Inc. (GILD) at $62.50). The open interest was just 961 prior to this purchase. Continue reading “Unusual Options Activity – Gilead Sciences, Inc. (GILD)”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 22 key reads for Thursday…

- CVS, Walgreens Gear Up to Deliver Covid-19 Vaccines to Nursing Homes (Wall Street Journal)

- Shell’s Cash Flow Story Is ‘Too Good to Ignore.’ It’s Time to Buy the Stock, Says Bernstein. (Barron’s)

- Energy Stock Short Sellers Took A $6.3B Loss In November As Oil Prices Rebounded (Benzinga)

- GE Stock Has Been on the Rise. Here’s Why. (Barron’s)

- Do we have a Deal? The Energy Report 12/03/2020 (Phil Flynn)

- The U2, “Elevation” Stock Market (and Sentiment Results)… (ZeroHedge)

- House Passes China Delisting Bill. What That Means for Investors. (Barron’s)

- China services-sector activity sped up in November (MarketWatch)

- Intel Has Been Missing an AI Business to Compete With Nvidia. It’s Finally Here. (Barron’s)

- Lyft Shares Spike on an Improving Cost Outlook (Barron’s)

- Economists at Goldman Sachs expect $700 billion stimulus (MarketWatch)

- The Market Should Worry About 2022, Not 2021 (Wall Street Journal)

- Travis Scott earned $20M from McDonald’s partnership: report (Fox Business)

- Wall Street is already increasing its 2021 price targets: Morning Brief (Yahoo! Finance)

- Teradyne CEO Jagiela Prizes Knowledge Over Power (Investor’s Business Daily)

- Alarmists are pushing a false narrative on the US economy. Here are the clear and obvious reasons to be hopeful about an American bounce back. (Business Insider)

- 4 reasons why the S&P 500 will soar 25% by the end of 2022, according to Goldman’s US stock chief (Business Insider)

- The Best Car I Drove in 2020—Plus Eight Runners-Up (Bloomberg)

- Saudi Arabia, Qatar Near U.S.-Brokered Deal to End Lengthy Rift (Bloomberg)

- Going After Big Tech Is One Thing Global Leaders Agree On (Bloomberg)

- Coronavirus-Stimulus Efforts Pick Up Speed (Wall Street Journal)

- Amazon in Talks to Buy Podcast Maker Wondery (Wall Street Journal)

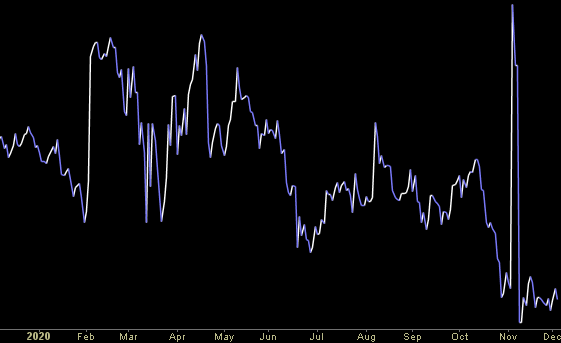

The U2, “Elevation” Stock Market (and Sentiment Results)…

With the market as elevated as it is, the song we chose to embody this week’s sentiment is U2’s “Elevation:” Continue reading “The U2, “Elevation” Stock Market (and Sentiment Results)…”

Tom Hayes – Yahoo! Finance Appearance – 12/02/2020

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – December 2, 2020