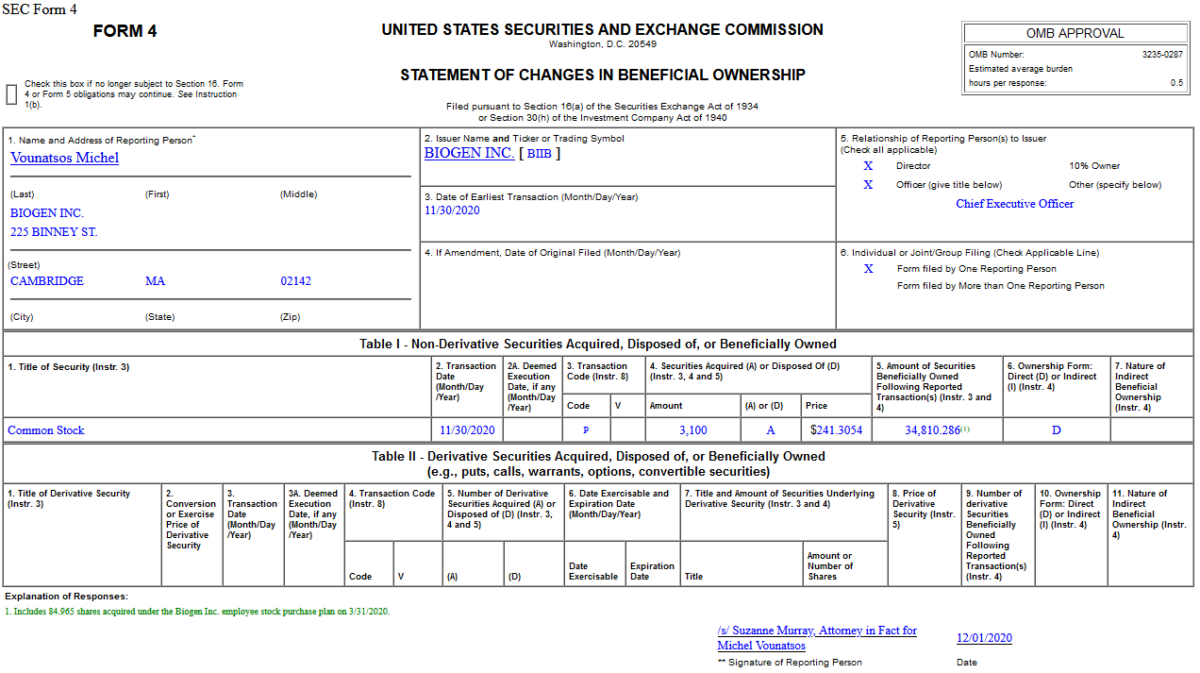

On Nov. 30, 2020, Michel Vounatsos – CEO of Biogen Inc. (BIIB) – purchased 3,100 shares of BIIB at $241.31. His out of pocket cost was $748,047.

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 15 key reads for Wednesday…

- FDIC: Banks’ net profits climbed $32.4 billion to $51.2 billion in the third quarter. Earnings were largely boosted by a $47.5 billion decline in loan-loss provisions. (Business Insider)

- Why 2021 May at Last Be the Year of the Great Rotation (Barron’s)

- Investors are overlooking this one thing, major bank says as it sets 4,000 target on S&P 500 (MarketWatch)

- Bank of America says says investor bullishness is rising, but is not yet euphoric. Here why that signals the S&P 500 could gain 10% over the next year. (Business Insider)

- The Manufacturing Recovery Continues. That’s Good News for These Stocks. (Barron’s)

- China Delisting Bill Could Pass This Week in U.S. What That Means For Investors. (Barron’s)

- Mnuchin, Pelosi Discuss Stimulus Package (Barron’s)

- Asserting Authority. The Energy Report 12/02/2020 (Phil Flynn)

- Pelosi, McConnell Fan Stimulus Hopes With 2020 Clock Running Out (Bloomberg)

- U.K. Clears Pfizer Covid Vaccine for First Shots Next Week (Bloomberg)

- Asia’s 20 Richest Families Control $463 Billion (Bloomberg)

- Mortgage demand from homebuyers spikes 28%, and the average loan amount sets a record high (CNBC)

- Jefferies Raises 2021 S&P Target to 4200 as GDP Beat Expectations and Positive Vaccine News (Street Insider)

- Biden says will not kill Phase 1 trade deal with China immediately: NYT (Reuters)

- Will Moneyball Finally Crack the Game of Active Management? (Institutional Investor)

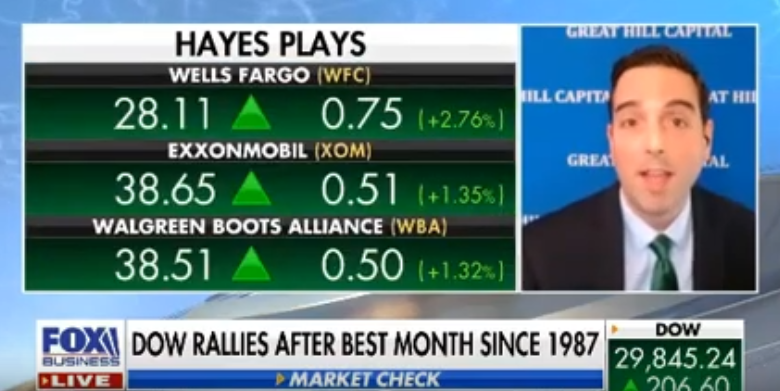

Tom Hayes – The Claman Countdown – Fox Business Appearance – 12/1/2020

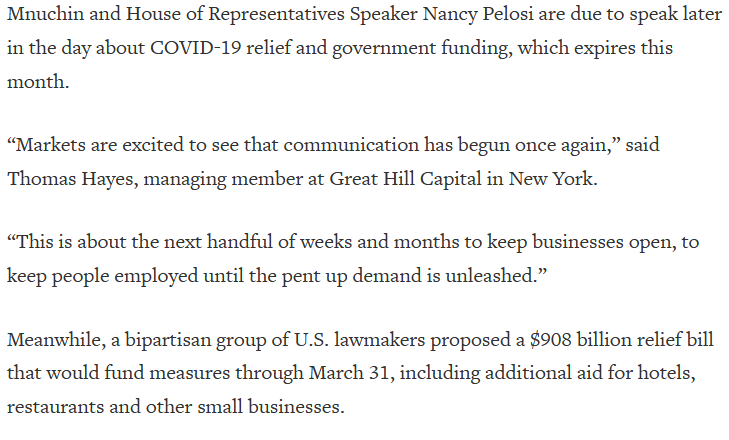

Tom Hayes – Quoted in Reuters article – 12/1/2020

Thanks to Shriya Ramakrishnan and Medha Singh for including me in their article on Reuters today. You can find it here:

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 15 key reads for Tuesday…

- U.S. congressional hearing likely to spotlight Powell, Mnuchin split over pandemic lending (Reuters)

- Biden plan to end U.S. fossil fuel subsidies faces big challenges (Reuters)

- FDA announces advisory committee meeting to discuss Moderna vaccine candidate (Fox Business)

- The Dark Money Secretly Bankrolling Activist Short-Sellers — and the Insiders Trying to Expose It (Institutional Investor)

- Opec+ meeting delayed as split deepens over oil production cuts (Financial Times)

- Nio Deliveries Jump 109% In November, Boosts Production Capacity To Keep Pace With Rising Demand (Benzinga)

- Holiday Specials 2020: From Mariah Carey to ‘Peanuts,’ these are must-watch viewing (New York Post)

- ‘100% of Americans that want the vaccine will have had the vaccine’ by June, says Operation Warp Speed official (MarketWatch)

- BlackRock poised to replace Goldman Sachs inside the White House (New York Post)

- Exxon (XOM) Cuts Billions in CapEx Spending Which Will Help Support Dividend (Street Insider)

- China’s factory activity hits quickest expansion in 10 years in November, driven by a burst in output and new orders (Business Insider)

- Barron’s Daily: It’s Time for Value Stocks to Shine (Barron’s)

- Powell Says Fed Actions Unlocked $2 Trillion to Support Economy (Wall Street Journal)

- Facebook, Google to Face New Antitrust Suits in U.S. (Wall Street Journal)

- The Stock Market’s Rally Is Finally Widening (Wall Street Journal)