- Intel Stock May Have Hit Rock Bottom. How to Position for a Rally. (Barron’s)

- Japan’s Stock-Playing Central Bank Racks Up $56 Billion Gain (Wall Street Journal)

- BlackRock’s Hildebrand Says Global Inflation Isn’t Dead (Bloomberg)

- Warren Buffet’s Berkshire Hathaway isn’t alone in struggling to make a big acquisition. Past partner 3G Capital is also coming up short (Business Insider)

- Crude Inventory Data Shows Draw of 754 Thousand Barrels Last Week (Street Insider)

- OPEC+ panel to hold informal online talks on Saturday (Reuters)

- Covid Vaccines Look Promising. How Emerging Markets Could Benefit. (Barron’s)

- Social Media’s Liability Shield Is Under Assault (Wall Street Journal)

- Covid Won’t Steal Christmas (Wall Street Journal)

- Factbox: The top contenders to run Biden’s financial agencies (Reuters)

Be in the know. 22 key reads for a Happy Thanksgiving!

- How to fry a turkey and live to tell about it (USA Today)

- Barclays predicts some stocks like BP could rally more than 50% next year (CNBC)

- OPEC-Watchers Expect Group to Delay Supply Boost by Three Months (Bloomberg)

- The S&P 500 Could Jump 20% Next Year. A Vaccine Is the Key. (Barron’s)

- Equal-Weighted Indexes Are Winning—and That’s a Good Sign for Stocks (Barron’s)

- Mid-Cap Stocks Are Making a Comeback. Here Are 8 That Can Help Anyone Looking for Income. (Barron’s)

- Here’s How Many People Flew for Thanksgiving, and What It Means for Airline Stocks (Barron’s)

- New-Home Sales Are Still Ultrahigh. Properties Are Scarce. (Barron’s)

- T. Rowe Price Is Splitting in Two. What That Means for Investors. (Barron’s)

- GE stock set to extend win streak after UBS lifts target a second time in a month (MarketWatch)

- The New Move in Oil Has ‘Enormous’ Implications for Investors (Barron’s)

- UPS and FedEx reportedly facing shortage of delivery vans (New York Post)

- Czech Billionaire Raises Foot Locker Stake to Become Top Holder (Bloomberg)

- Deutsche Bank bullish about the 2021 economic recovery — but there are risks (CNBC)

- JPMorgan sees opportunities in Southeast Asia for medium term (CNBC)

- Joe Biden considers Roger Ferguson to lead National Economic Council, Gary Gensler for Deputy Treasury Secretary (CNBC)

- The stock-market impact of millennial investors has gotten overblown amid declining trading volumes — and it’s actually the older crowd that’s exerted more influence, JPMorgan says (Business Insider)

- US corporate profits jumped a record $495 billion in the 3rd quarter as the economy reopened (Business Insider)

- Warren Buffett joked he would be ‘eating Thanksgiving dinner at McDonald’s’ if the US government didn’t bail out the banks in 2008 (Business Insider)

- Covid Won’t Steal Christmas (Wall Street Journal)

- China hits 26% of 2020 target for U.S. energy imports under trade deal (Reuters)

- Delta and Alitalia to launch ‘quarantine free’ flights from US to Italy (Financial Times)

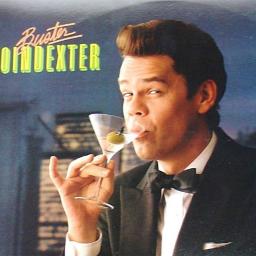

The Buster Poindexter – Hot Hot Hot – Stock Market (and Sentiment Results)…

I chose this song “Hot Hot Hot,” by Buster Poindexter, to embody the sentiment of this week’s stock market. After breaking 30,000 on the DOW, my mom is now calling me to ask if she should buy Pfizer. “Must be a top,” say the contrarians. But are they right? Continue reading “The Buster Poindexter – Hot Hot Hot – Stock Market (and Sentiment Results)…”

Unusual Options Activity – Exxon Mobil Corporation (XOM)

Data Source: barchart

Today some institution/fund purchased 5,038 contracts of Jan 2023 $20 strike calls (or the right to buy 503,800 shares of Exxon Mobil Corporation (XOM) at $20). The open interest was just 111 prior to this purchase. Continue reading “Unusual Options Activity – Exxon Mobil Corporation (XOM)”

Tom Hayes – Mark Simone Show Appearance with Larry Mendte on 710 WOR – 11/25/2020

Mark Simone Show Appearance with Larry Mendte on 710 WOR – Thomas Hayes – Chairman of Great Hill Capital – November 25, 2020.

Thanks to the legendary Larry Mendte for inviting me on the Mark Simone Show today to talk Stock Market and the Economy.

Mendte has over 80 Regional Emmy Awards from the New York, San Diego, Chicago and Philadelphia markets, and holds the record in several categories in Philadelphia and Chicago. In Philadelphia, he has won a record 4 Emmy Awards in the Outstanding Anchor category and seven in various writing categories.

Where is money flowing today?

Be in the know. 12 key reads for Wednesday…

- Equal-Weighted Indexes Are Winning—and That’s a Good Sign for Stocks (Barron’s)

- Deere’s Blowout Earnings Are Good News for Caterpillar and Others (Barron’s)

- 4 Energy Companies Pumping Out Cash for Dividends (Barron’s)

- A Homebound Nation Goes All Out With Lavish Christmas Decorations (Wall Street Journal)

- Durable Goods Orders Expand Faster Than Expected in October (Bloomberg)

- U.S. Corporate Profits Surge at Record Pace, GDP Report Shows (Bloomberg)

- Wall Street Dealers in Hedging Frenzy Get Blamed for Volatility (Bloomberg)

- Another record low mortgage rate just caused demand to jump for both refinances and home purchases (CNBC)

- Dow 30,000 could draw in investors from the sidelines with more stocks participating in the next leg (CNBC)

- ECB says European banks can restart dividend payments next year if they show resilience, according to a report (Business Insider)

- The ‘surprisingly robust’ stock market will finish the year strong — and wary traders should stay invested, says Fundstrat’s Tom Lee (Business Insider)

- Oil’s Surge Toward $50 Risks Giving OPEC+ Yet Another Headache (Bloomberg)

Unusual Options Activity – Exxon Mobil Corporation (XOM)

Data Source: barchart

Today some institution/fund purchased 5,414 contracts of Jan 2023 $30 strike calls (or the right to buy 541,400 shares of Exxon Mobil Corporation (XOM) at $30). The open interest was just 956 prior to this purchase. Continue reading “Unusual Options Activity – Exxon Mobil Corporation (XOM)”