- Dividends and Buybacks Look Poised for a 2021 Rebound (Barron’s)

- BioNTech believes its vaccine with Pfizer works on new strain (CNBC)

- BioNTech says it can produce new vaccine for Covid variant in 6 weeks (Financial Times)

- Travel stocks recover from hit after countries ban flights from UK (Yahoo! Finance U.K. )

- Meet the Preliminary Dogs of the Dow for 2021 (24/7 Wall Street)

- Financial stocks a ‘safe’ recovery play: Expert (Fox Business)

- U.S. Congress passes nearly $900 billion COVID-19 aid bill, awaits Trump approval (Reuters)

- Apple shares rise on report of 2024 car rollout plan (Reuters)

- Banks Need Spenders to Be Stimulated (Wall Street Journal)

- Wells Fargo set to be freed from AML consent order (American Banker)

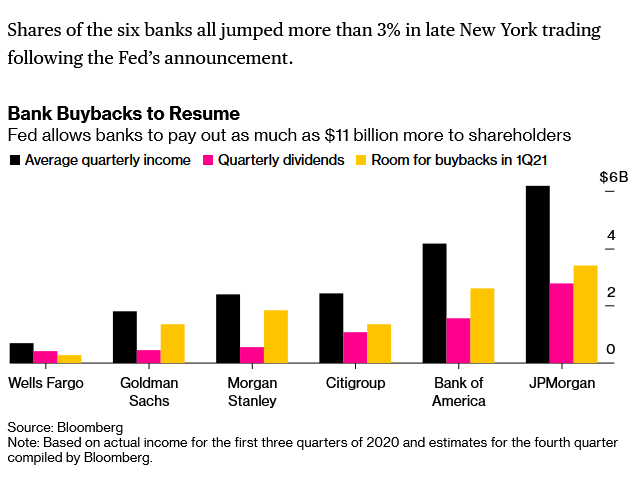

- Banks Can Buy Back Stocks Again. Wall Street Is Cheering. (Barron’s)

- Bank Stocks Are Going to Be Higher Next Year, Expert Says (Barron’s)

- Better Returns With Less Risk? Goldman Has a Basket of Stocks for That. (Barron’s)

- COVID-19 stimulus bill will let businesses seek second PPP loan (New York Post)

- Sex-crazed ‘roaring ‘20s’ awaits post-pandemic: Yale prof (New York Post)

- U.S. Economy Gets a Bridge to the Spring (Wall Street Journal)

- Brussels urges EU states to reopen their borders with the UK (Financial Times)

- Sneak Peek At Guy Fieri’s ‘Restaurant Hustle’ Documentary (Benzinga)

- Alaska Air boosts Boeing 737 orders and options to 120, to ‘largely’ replace Airbus fleet (MarketWatch)

- Goldman Sachs, once reserved for the rich, is close to offering wealth management for the masses (CNBC)

- Larry Culp Locks Up $47 Million Payday by Winning Over GE’s Doubters (Bloomberg)

- Beer, Restaurants and Nascar Win Tax Breaks in Virus-Relief Bill (Bloomberg)

- Billionaire Reubens Bet Big on Manhattan’s Battered Real Estate (Bloomberg)

- Billionaire investor Sam Zell questions Tesla and Bitcoin, predicts workers will return to offices, and warns the US dollar could be replaced as the world’s reserve currency in a new interview. (Business Insider)

- Diamondback Buys West Texas Shale Driller QEP Resources (Wall Street Journal)

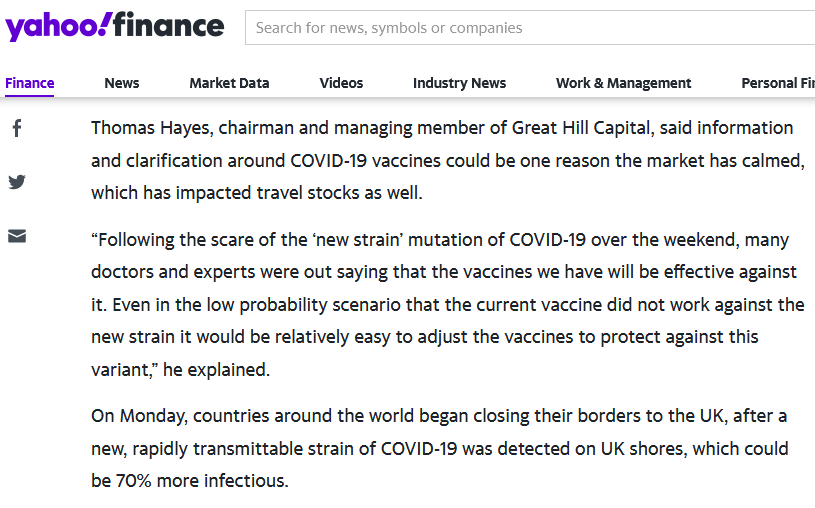

Tom Hayes – Quoted in Yahoo! Finance article – 12/22/2020

Thanks to Saleha Riaz for including me in her article on Yahoo! Finance today. You can find it here:

Unusual Options Activity – Invesco Mortgage Capital Inc. (IVR)

Data Source: barchart

Today some institution/fund purchased 26,256 contracts of Jan 2023 $3.50 strike calls (or the right to buy 2,625,600 shares of Invesco Mortgage Capital Inc. (IVR) at $39). The open interest was 8,292 prior to this purchase. Continue reading “Unusual Options Activity – Invesco Mortgage Capital Inc. (IVR)”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 20 key reads for Monday…

- What’s in the $900 billion U.S. COVID-19 aid package? (Reuters)

- Bank Stocks Are Going To Be Higher Next Year, Expert Says (Barron’s)

- Lockheed Buys Aerojet Rocketdyne (Barron’s)

- Experts expect vaccines to protect against the UK’s fast-spreading Covid strain (CNBC)

- Are COVID-19 vaccines effective against new coronavirus strain? Here’s what we know (cnbctv18)

- Why You Shouldn’t Freak Out About the New Strain of Coronavirus (healthline)

- What is the new Covid strain – and will vaccines work against it? (The Guardian)

- Mutant Meltdown. The Energy Report 12/21/2020 (Phil Flynn)

- A new COVID-19 strain is sending stocks plunging, but here’s why investors shouldn’t panic, says this analyst (MarketWatch)

- Philip Morris’ Next CEO Says Investors Are Underestimating the Company’s Smoke-Free Future (Barron’s)

- How a weaker dollar could help fuel a commodities boom in 2021 (MarketWatch)

- The Fed Says Banks Can Buy Back Stock Again. (Barron’s)

- The Antitrust Case Against Big Tech, Shaped by Tech Industry Exiles (New York Times)

- Congress Reaches Final Agreement on Pandemic Relief (Wall Street Journal)

- Alacazoom! Magic Acts Disappear from Theaters, Reappear Online (Wall Street Journal)

- Affluent Families Ditch Public Schools (Bloomberg)

- Regeneron (REGN) Reports Publication of Initial Clinical Data from Ongoing Ph. 1/2/3 Trial of Antibody Cocktail Casirivimab & Imdevimab in Non-Hospitalized Patients with COVID-19 (Street Insider)

- Walgreens Boots Alliance (WBA) Initiates Administration of Pfizer’s (PFE) COVID-19 Vaccine in Long-Term Care Facilities (Street Insider)

- Diamondback Energy to Buy QEP and Guidon for Combined $3 Billion (Yahoo! Finance)

- China rethinks the Jack Ma model (Financial Times)

Be in the know. 18 key reads for Sunday…

- Real Santa Claus Rally (Almanac Trader)

- What’s Wrong with Wind and Solar? (Manhattan Institute)

- The Year in Deals Can Be Summed Up in 4 Letters (New York Times)

- California Reports Record COVID Cases And Deaths… Despite Strictest Lockdown (ZeroHedge)

- Boom conditions for US homebuilders defy the pandemic (Financial Times)

- Congress poised to vote on COVID aid package after Fed compromise (Reuters)

- ECRI Weekly Leading Index Update (advisorperspectives)

- Billion-Dollar Dynasties: These Are The Richest Families In America (Forbes)

- Senate Leaders Clear Last Hurdle on Covid-19 Package (Wall Street Journal)

- ‘Coming 2 America’: First Look At Eddie Murphy’s Sequel to Comedy Classic (Maxim)

- Guy Fieri’s Epic ‘Trash Can Nachos’ Are Now Available For Delivery Across U.S. (Maxim)

- This Classic Aston Martin Drophead Coupe Could Be Yours (Maxim)

- Epidemologist explains why COVID-19 mutations shouldn’t scare you (thenextweb)

- Tiger Woods Proudly Looks on as Son Charlie, 11, Drains Impressive Shot at PNC Championship: ‘Atta Boy’ (People)

- Without Frank’s RedHot There’d Be No Buffalo Wings (howstuffworks)

- 41 Festive Facts About Christmas Vacation (Mental Floss)

- The 10 Best Movies to Watch on Netflix This Holiday Season (Mental Floss)

- Everything You Need to Know About Indian Creek Island, Miami’s Most Exclusive Enclave (townandcountry)

Be in the know. 20 key reads for Saturday…

- Federal Reserve loosens restrictions on big bank stock buybacks (MarketWatch)

- U.S. liquefied natural gas exports set a record in November (EIA)

- The S&P 500 Could Gain Another 10% Next Year, Experts Say (Barron’s)

- Washington avoids government shutdown, but no stimulus vote until Sunday at earliest (MarketWatch)

- Why the Future Now Looks Brighter for Value Investing (troweprice)

- The Fed Just Said Banks Could Buy Back Stock Again. (Barron’s)

- Banks Have Begun to Merge Again. Next Year Could See Even More Deals. (Barron’s)

- FDA approves second Covid vaccine for emergency use as it clears Moderna’s for U.S. distribution (CNBC)

- Fed allows banks to resume share buybacks, JPMorgan stock jumps 5% (CNBC)

- While you’re buying value stocks for your portfolio, add some diversity too (MarketWatch)

- JPMorgan, Goldman to Restart Buybacks as Fed Gives Green Light (Bloomberg)

- Why Natural-Gas Prices Could Continue to Rise (Barron’s)

- The Last 10 Years and the Next 10 (compoundadvisors)

- Fed Stress Tests Show U.S. Banks Can Withstand Covid-19 Pandemic (Wall Street Journal)

- Wells Fargo to Sell Student Loan Book to Apollo, Blackstone (Bloomberg)

- The Transcript 12.14.20 (theweeklytranscript)

- Roblox and the Dispersal of Creativity (profgalloway)

- What Do We Mean By Reinvestment? (akrecapital)

- Siren Songs: IPOs & SPACs (investoramnesia)

- Charlie Munger Interview (CalTech)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 61

Article referenced in VideoCast above:

The Luke Combs, “Lovin’ On You” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 51

Article referenced in podcast above:

The Luke Combs, “Lovin’ On You” Stock Market (and Sentiment Results)…