- Yen Soars to Strongest Since March as BOJ Reignites Rally (bloomberg)

- Alibaba to deploy AI-powered sourcing engine to boost trade for global merchants (scmp)

- Japan’s Central Bank Hikes Key Rate Hours Before the Fed (bloomberg)

- Japan Spent $36.6 Billion to Prop Up Yen in Past Month (bloomberg)

- Intel to Cut Thousands of Jobs to Reduce Costs, Fund Rebound (bloomberg)

- PayPal Shares Surge on Higher Forecast for Profit, Buybacks (bloomberg)

- Boeing’s stock jumps after company names industry veteran Robert K. Ortberg CEO (marketwatch)

- Opinion: Microsoft and AMD earnings show that AI remains a game of optics (marketwatch)

- Disney Bets on Deadpool, Wolverine and Dirty Jokes to Save Marvel (bloomberg)

- ADP says 122,000 jobs added in July. Smallest gain in six months points to weaker labor market. (marketwatch)

- AMD Raises AI Chip Guidance Again. The Stock Jumps. (barrons)

- TSMC, Broadcom, Intel Stocks Rise. 3 Reasons the Chip Companies Are Moving. (barrons)

- Job quitting falls to nearly 4-year low and job openings dip in sign labor market is cooling (marketwatch)

- We’re raising our Stanley Black & Decker price target on the stock’s earnings rally (cnbc)

- Jobs Are Now a Big Focus for the Fed. 6 Charts That Tell the Story. (marketwatch)

- Norwegian Cruise Line Stock Sails Higher. Earnings Were That Good. (barrons)

- Starbucks CEO Said the Company Is Making “Real Progress” Amid Sales Decline in U.S. and China (barrons)

- The U.S. Wanted to Knock Down Huawei. It’s Only Getting Stronger. (wsj)

- Higher, Stronger…Slower? Why the Paris Olympic Pool Has a Problem (wsj)

- Investors on Alert for Fed Signals of September Rate Cut (wsj)

- US Labor Costs Rise Less Than Forecast as Inflation Eases (bloomberg)

- US Will Host Chinese Officials for New Talks on Curbing Fentanyl (bloomberg)

- This strategist is predicting a big rally after the Fed decision. He’s been more right than wrong this year. (marketwatch)

- ASML shares jump on U.S. exemption from China chip export restrictions – Reuters (streetinsider)

- Politburo Release Review (chinalastnight)

Tom Hayes – CEO.ca Appearance – 7/30/2024

Where is money flowing today?

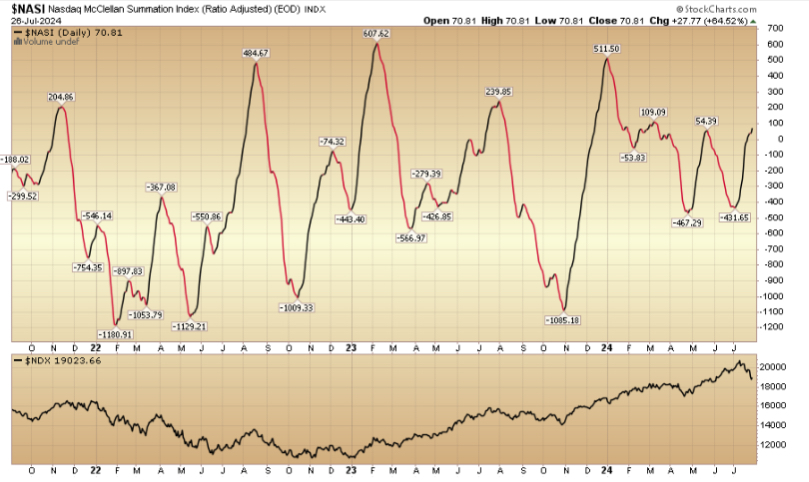

Indicator of the Day (video): Nasdaq – Advance-Decline Issues

Quote of the Day…

Be in the know. 30 key reads for Tuesday…

- PayPal Stock Rises Sharply After Beat-and-Raise Quarter (barrons)

- China’s Xi calls for faster measures to boost domestic consumption (ft)

- Alibaba’s Taobao and ByteDance’s Douyin seek e-commerce price war detente with new policies (scmp)

- PayPal’s stock gains as earnings bring big positive surprise on this key number (marketwatch)

- Pfizer beats earnings estimates, hikes full-year outlook as drugmaker cuts costs (cnbc)

- ‘Fed Whisperer’ Nick Timiraos: Fed May Signal Sep’s Rate Cut (aastocks)

- Alibaba Shares Jump on Plans to Boost Service Fee for Merchants (bloomberg)

- In the 1,500, There’s Katie Ledecky and Then There’s Everyone Else (nytimes)

- Japan Wanted Higher Inflation. It’s Here, and It Hurts. (nytimes)

- Alibaba Cloud raises prices for domain name auctions amid AI compute price war (scmp)

- Nvidia Stock Swoon Didn’t Slow CEO Jensen Huang’s Sales (barrons)

- Alibaba’s Monetization Moves The Stock, Domestic Investors Plead “Jia You” (chinalastnight)

- Boeing Has a New CEO Candidate. (barrons)

- The Olympics Are Here. Take Gold With These 3 Stocks. (barrons)

- Why 3M Stock Rose 23% on Friday (and Why Investors Should Have Seen It Coming) (barrons)

- Guinness a bright spot as Johnnie Walker-maker Diageo drops on full-year sales decline (cnbc)

- Don’t Count on a Fed Rate Cut to Boost Stocks (barrons)

- Newell Stock Got a Boost From Earnings. CEO Says Stressed Consumers Won’t Hold It Back. (barrons)

- Investors on Alert for September Rate Cut Signals (wsj)

- Traders are focused on a central bank this week. But it may not be the Fed. (marketwatch)

- What to look for in Friday’s jobs report (marketwatch)

- Surge in Commercial-Property Foreclosures Suggests Bottom Is Near (wsj)

- In a Troubled Box Office, Premium Still Sells (wsj)

- Why Global Investors Are Watching What Japan Does Next (nytimes)

- The Science Behind Olympic Greatness, Revealed Through Motion (nytimes)

- Starbucks CEO Gets Cover for a Belated Overhaul (bloomberg)

- Inside The Berkshire Hathaway Inc. Annual General Meeting

- Houston Cofield/Bloomberg

- Buffett Cuts BofA Stake, Unloading $3 Billion This Month (bloomberg)

- Inside the race to make the world’s fastest running shoes (ft)

Where is money flowing today?

Quote of the Day…

Be in the know. 10 key reads for Monday…

- Hartnett: The World’s Most Crowded Trades Are Getting Liquidated (zerohedge)

- The Zombie Mall King Doesn’t Want to Be a Bottom-Feeder Forever (bloomberg)

- Hedge Funds Post Biggest Retreat on Bearish Yen Bets Since 2011 (bloomberg)

- Traders Fret as 32-Hour Central Banking Spree Hangs Over Markets (bloomberg)

- Canada Goose boss avoided printing ‘CEO’ on business cards for years after taking over at 27 (fortune)

- Even September may be too late for a rate cut to swing the U.S. economy out of a recession, warns former Fed president (fortune)

- Alibaba Cloud and OBS Unveil AI-powered OBS Cloud 3.0 at Paris 2024 (alizila)

- Alibaba International’s Aidge AI Toolkit Hits Half a Million Merchant Adoptions (alizila)

- ‘Deadpool & Wolverine’ smashes R-rated record with $205 million debut (ap)

- Fed’s next moves could seal the fate of tech stocks and small-caps (marketwatch)