- Amazon in talks to buy MGM for $9bn (Financial Times)

- Burry of ‘The Big Short’ has bet against Tesla: report (Fox Business)

- Investors bet on commercial real estate, undeterred by empty offices and hotel rooms (Fox Business)

- Brent crude hits $70 as traders bet on sustained revival in oil demand (Financial Times)

- Rolls-Royce courts investors for mini nuclear plants (Financial Times)

- Earnings up, multiples down: Morning Brief (Yahoo! Finance)

- Frank Sinatra’s historic homes: From NYC to Palm Desert (New York Post)

- ‘Succession’ Meets ‘90 Day Fiancé’ in WarnerMedia-Discovery Deal (New York Times)

- Foreign investors tiptoe into frontier markets in search of returns (Financial Times)

- Service sector activity surged at record pace in May, NY Fed survey finds (Reuters)

- U.S. housing starts drop sharply; building permits rise modestly (Reuters)

- Biggest Shorting Of Tech Stocks By Hedge Funds In 5 Years: Goldman Prime (ZeroHedge)

- Baidu (BIDU) Tops Q1 EPS by 23c, Revenues Beat; Offers 2Q Revenues Outlook (Street Insider)

- Fisker (FSR) Won’t Accept or Invest in Bitcoin (BTC) as It Is ‘Not Environmental-Friendly’ (Street Insider)

- Elliott Wants Duke Energy (DUK) to Split Into Three Regionally-Focused Utilities (StreetInsider)

- Walmart Raises Full-Year Guidance as Earnings Beat Expectations (Barron’s)

- SolarEdge Stock Is Beaten Down. Why It’s Not Out. (Barron’s)

- Home Depot’s Earnings Smash Forecasts (Barron’s)

- Glaxo Has Good News on Another Vaccine. It’s a Tougher Market Now. (Barron’s)

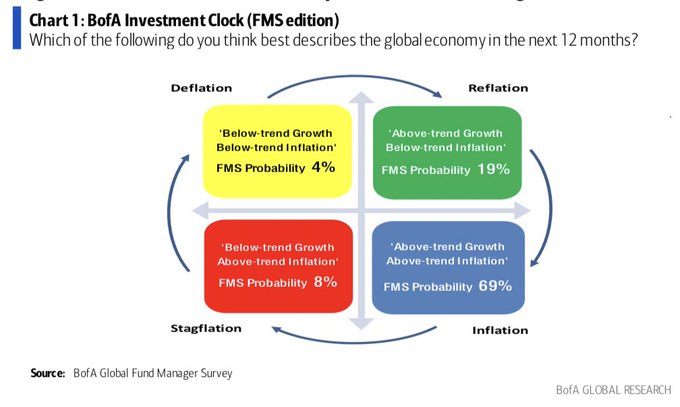

- Fund managers position for ‘boom expectations’ with tech demand at three-year lows, Bank of America survey finds (MarketWatch)

- Clarida says economy hasn’t made the progress needed for Fed to scale back asset purchases (MarketWatch)

- Fund Managers Say ‘Long Bitcoin’ Is the Most Crowded Trade in the World (Bloomberg)

- The Businessweek How-To Issue: 50+ Lessons From Really Smart People (Bloomberg)

- EU Suspends Plans to Raise Tariffs on U.S. Whiskey, Other Goods (Wall Street Journal)

- Energy and Materials Shares Lead the Way in a Turbulent Stretch for Stocks (Wall Street Journal)

May Bank of America Global Fund Manager Survey Results (Summary)

~200 Managers overseeing ~$600B AUM responded to this month’s BofA survey. Continue reading “May Bank of America Global Fund Manager Survey Results (Summary)”

Tom Hayes – Quoted in Yahoo! Finance article – 5/18/2021

Thanks to Saleha Riaz for including me in her article on Yahoo! Finance today. You can find it here:

Click Here to View The Full Article on Yahoo! Finance

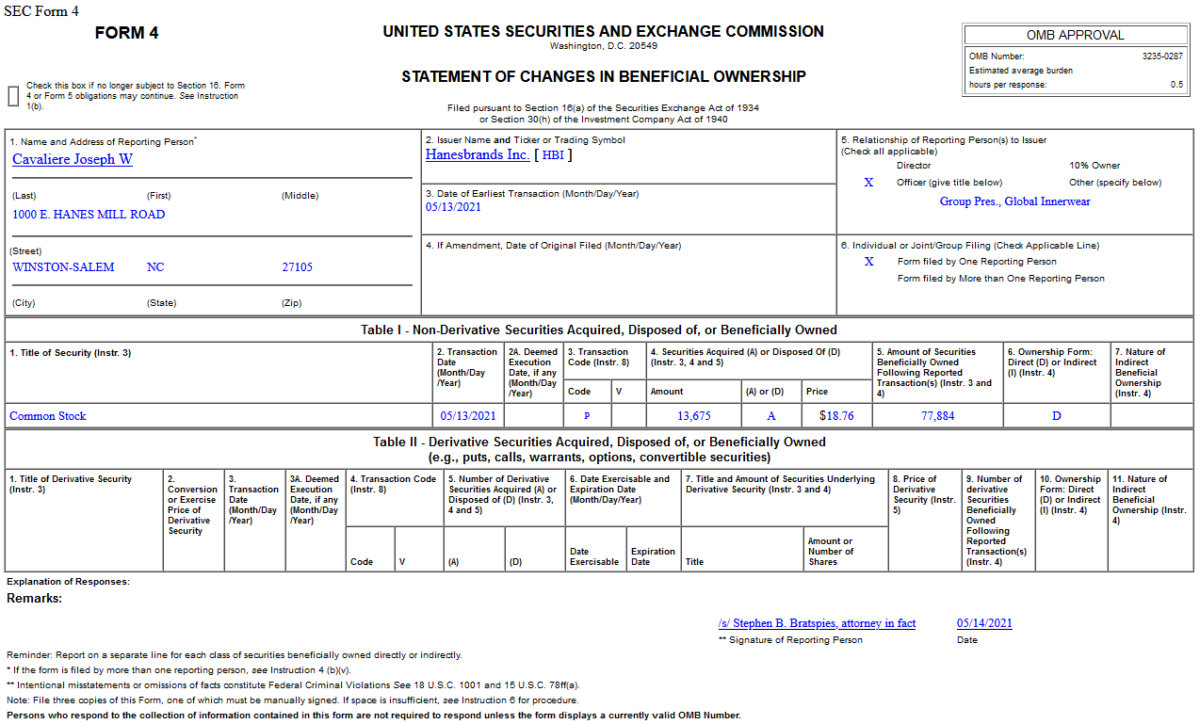

Insider Buying in Hanesbrands Inc. (HBI)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 15 key reads for Monday…

- Sanofi and Glaxo Are Back With a Covid-19 Vaccine (Barron’s)

- Shares of Realogy Look Cheap as Housing Booms (Barron’s)

- New Oil Barons Strike It $329 Billion Richer On Powerful Rally (Investor’s)

- Will Demographics Tank China’s Housing Market? (Wall Street Journal)

- Inside Jeff Bezos’ Obsessions (New York Times)

- AT&T signs deal to combine media business with Discovery (USA Today)

- Elon Musk says bitcoin isn’t decentralized as he goes to war with crypto bulls (Business Insider)

- The red-hot commodity market is being underappreciated in the long term by investors still obsessed with stocks, JPMorgan says (Business Insider)

- Foxconn the carmaker? Disruption in the era of electric vehicles (Financial Times)

- Swiss Central Bank Bought Li Auto, XPeng, Zoom, and This Marijuana Stock (Yahoo! Finance)

- Central banks seek out riskier assets for reserves in yield drought (Financial Times)

- Markets weigh prospect of new commodities supercycle (Financial Times)

- U.S. screens 1.85 million people on Sunday at airports, highest since March 2020 (Street Insider)

- Rackspace Technology (RXT) Sees Insider Buys from 3 C-Level Executives (Street Insider)

- Companies Ponder Speeding Up Plans to Bring Workers Back to Offices (Wall Street Journal)

Be in the know. 10 key reads for Sunday…

- Soros buys stocks linked to Bill Hwang’s Archegos collapse – Bloomberg News (Reuters)

- Hedge Fund Investor Letters Q1 2021 (Insider Monkey)

- Daniel Kahneman on Behavioral Economics (Podcast) (Bloomberg)

- US banks could cut 200,000 jobs over next decade, top analyst says (Financial Times)

- Major Rare And Vintage Car Shows Making A Comeback This Spring And Summer (Forbes)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- GoodRx helps people afford drugs. But is it improving health care or profiting off a broken system? (Fortune)

- How Bumble’s Whitney Wolfe Herd Became the Youngest Female Self-Made Billionaire (Robb Report)

- 2021 NHL Playoffs: The Storylines That Will Shape This Year’s Postseason (Men’s Journal)

- Inside the Hotel du Cap, The South Of France’s Legendary Celebrity Getaway (Maxim)

Be in the know. 20 key reads for Saturday…

- Here’s What Could Stop Inflation in Its Tracks (Barron’s)

- GE Stock Is Getting a Boost From Wall Street (Barron’s)

- Lumber prices fall for a 5th straight day in a reprieve for surging commodity prices (Business Insider)

- Inflation Is Here and Hotter Than It Looks. Why It’s Time to Worry. (Barron’s)

- Shares of Realogy, an Unlikely Hero of the Realty Revolution, Look Cheap (Barron’s)

- Income Investors, Meet GARY: It Brings Growth and Reasonable Yield (Barron’s)

- Disney CEO: CDC mask rule will spur ‘immediate’ jump in theme park attendance (New York Post)

- Value Investing Still Beats Growth Investing, Historically (Alpha Architect)

- Lessons from the 2021 Berkshire Meeting (Novel Investor)

- U.S. Shoppers Continued Stimulus-Fueled Spending in April (Wall Street Journal)

- Marijuana Medical Research Growers Receive U.S. Approval (Wall Street Journal)

- The Capitalist Culture That Built America (Wall Street Journal)

- The summer of inflation: will central banks and investors hold their nerve? (Financial Times)

- Israel’s Iron Dome keeps toll of rockets in check (Finacial Times)

- US day trading frenzy eases as investors ‘move on to other things’ (Financial Times)

- Solar panels are key to Biden’s energy plan. But the global supply chain may rely on forced labor from China (CNN)

- When Inflation Is High, Hedge Fund Managers Thrive (Institutional Investor)

- A Look Under the Hood For Inflation (DGI)

- David Swensen: The Peter Lynch of Institutional Investing (Morningstar)

- The Pygmalion Effect: Proving Them Right (Farnam Street)

Unusual Options Activity – Las Vegas Sands Corp. (LVS)

Data Source: barchart

Today some institution/fund purchased 2,840 contracts of Jan 2023 $57.5 strike calls (or the right to buy 284,000 shares of Las Vegas Sands Corp. (LVS) at $57.50). The open interest was just 497 prior to this purchase. Continue reading “Unusual Options Activity – Las Vegas Sands Corp. (LVS)”