Data Source: Finviz

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 15 key reads for Monday…

- Billionaire investor Dan Loeb praised SPACs, revealed his winning bets, and predicted a surge in risky debt in his latest investor letter (Business Insider)

- Yellen’s Views on the Deficit and Rates Have Been Consistent—Even if Wrong (Barron’s)

- Australian business conditions hit record high (MarketWatch)

- Higher Prices Leave Consumers Feeling the Pinch (Wall Street Journal)

- Sotheby’s, Christie’s Expect to Sell $1 Billion in Art at Spring Auctions (Wall Street Journal)

- Economists Disagree Over How Much Covid-19 ‘Herd Immunity’ Needed for Recovery (Wall Street Journal)

- As Scrutiny of Cryptocurrency Grows, the Industry Turns to K Street (New York Times)

- Hacked Pipeline May Stay Shut for Days, Raising Concerns About Fuel Supply (New York Times)

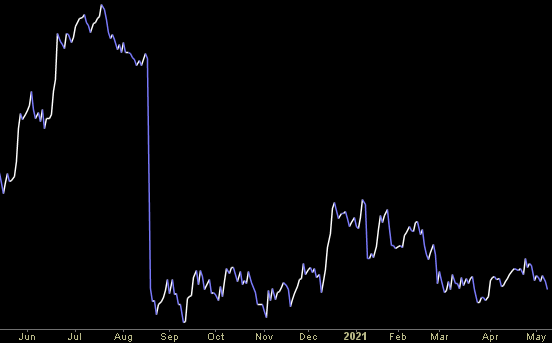

- VIX Higher Than Actual Volatility Is Good News for Stock Bulls (Bloomberg)

- Alibaba’s Ant Group will let more users test China’s digital yuan (CNBC)

- This is the ‘greatest threat’ to Big Tech’s S&P 500 dominance, Goldman says (MarketWatch)

- BioNTech shares soar 8% in premarket as COVID-19 vaccines help revenues smash estimates (MarketWatch)

- Retail Participation In Stock Trading Has Collapsed (ZeroHedge)

- COLONIAL PIPELINE POP. The Energy Report 05/10/2021 (Phil Flynn)

- Will inflation thwart the US economic recovery? (Financial Times)

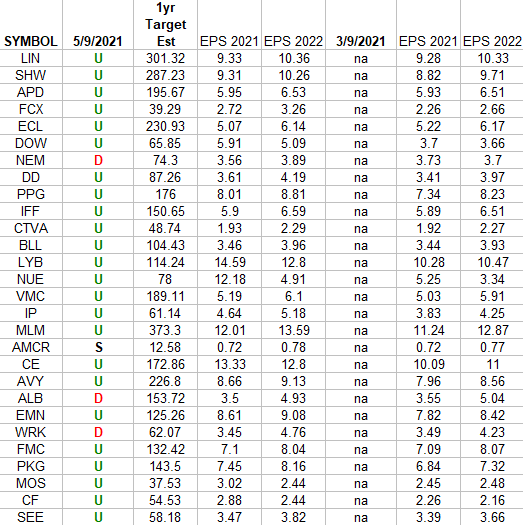

Basic Materials Sector (XLB) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2021 and 2022 estimates were: 3/9/2021 and today.

Continue reading “Basic Materials Sector (XLB) – Earnings Estimates/Revisions”

Be in the know. 10 key reads for Sunday…

- Here Is Every Michelin-Starred New York Restaurant for 2021 (Robb Report)

- Guy Fieri Talks Chevys and Cheeseburgers With R&T Crew (roadandtrack)

- Jeff Bezos Is Building a Superyacht So Big It Needs a ‘Support Yacht’ With a Helipad (Maxim)

- 2021 Ferrari Roma: First Drive Review (Maxim)

- Inside L.A.’s Lowrider Car Clubs (smithsonian)

- Reposition in May – Seasonality Works (Almanac Trader)

- Elon Musk a bigger autograph draw on ‘SNL’ than BTS or Justin Bieber (New York Post)

- First Look at the New Summer-Ready One & Only Portonovi Resort in Montenegro (Robb Report)

- Efficiency is the Enemy (Farnam Street)

- Lewis Hamilton Now Has 100 Formula 1 Poles (roadandtrack)

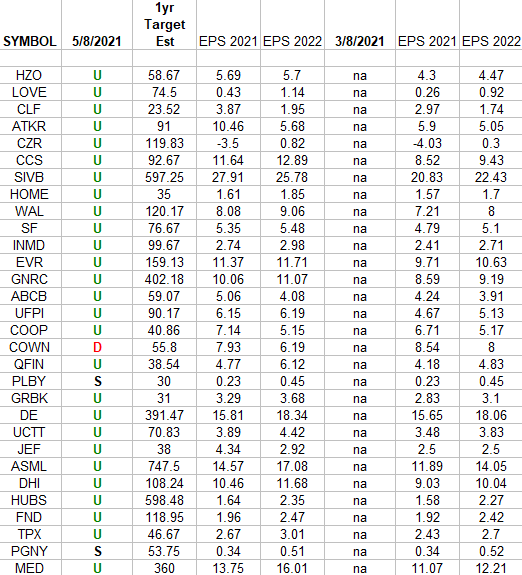

IBD 50 Growth Index (top 30 weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted stocks in the IBD 50 Growth Index (ETF: FFTY) Continue reading “IBD 50 Growth Index (top 30 weights) Earnings Estimates”

Unusual Options Activity – Energy Transfer LP (ET)

Data Source: barchart

Yesterday some institution/fund purchased 94,976 contracts of Jan 2023 $5 strike calls (or the right to buy 9,497,600 shares of Energy Transfer LP (ET) at $39). The open interest was 19,327 prior to this purchase. Continue reading “Unusual Options Activity – Energy Transfer LP (ET)”

Be in the know. 33 key reads for Saturday…

- 6 Stocks That Let You Sleep at Night (Morningstar)

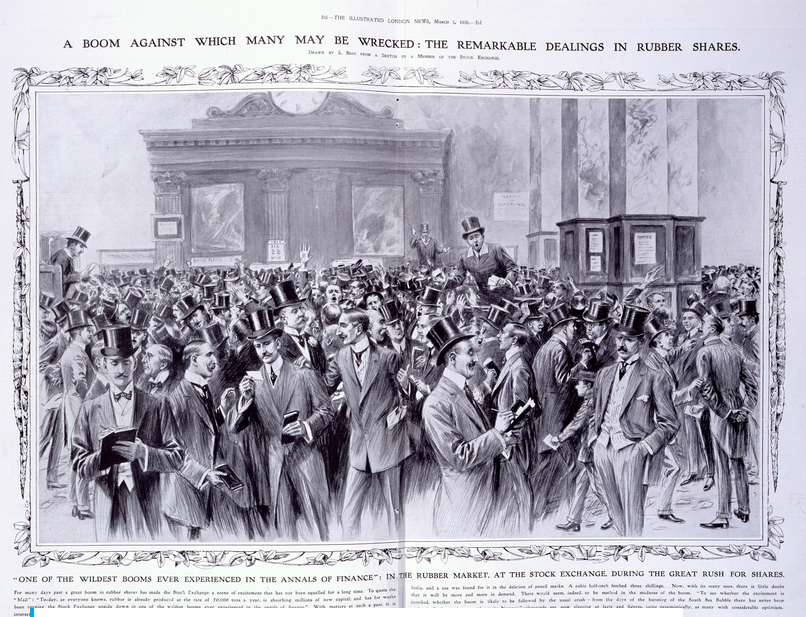

- A History of Commodity Booms & Busts (investoramnesia)

- Tussle Over Covid Vaccine Patents Looks Overblown (Barron’s)

- Swap Into Nokia Shares From Ericsson. The Momentum May Be Changing. (Barron’s)

- ‘Wrath of Man’ Heist Film Is Set to Top Weekend Box Office (Bloomberg)

- Imagining the Next 100 Years in Business, Science, and Investing (Barron’s)

- U.S.’s Biggest Gasoline Pipeline Halted After Cyber-Attack (Bloomberg)

- Consumers getting socked with higher prices — and it could last months or years (New York Post)

- On Barron’s 100th Anniversary, We Look Ahead as Well as Behind (Barron’s)

- The stock market will face a ‘day of reckoning’ this year when an inevitable inflation spike forces the Fed’s hand, says Wharton professor Jeremy Siegel (Business Insider)

- How the Green Economy Will Be a Gold Mine for Copper (Barron’s)

- Graham & Doddsville Newsletter Spring 2021 (Columbia University)

- 6 Agricultural Stocks Poised to Ride Food Prices Higher (Barron’s)

- Movie-Theater Stocks Leap Despite Quarterly Losses (Barron’s)

- Clarence W. Barron, Father of Financial Journalism, Was Full of Contradictions (Barron’s)

- Time to Get Dressed for the Reopening. These Stocks Will Benefit. (Barron’s)

- How Barron’s Writer Abe Briloff Exposed Companies’ Shady Accounting (Barron’s)

- Unemployment Benefits Become Target Amid Hiring Difficulty (Wall Street Journal)

- U.S. Covid-19 Metrics Signal Hopeful Turn (Wall Street Journal)

- The Next Decade in European Value (verdadcap)

- Pfizer Lifts Covid-19 Vaccine Production Targets for 2021, 2022 (Wall Street Journal)

- 2021 Virtual Value Investing Conference | Keynote Speaker: Howard Marks (YouTube)

- What We Learned From 100 Years of the Trader Column (Barron’s)

- April’s Weak Jobs Report Says We’re Overstimulated (Barron’s)

- Some of Barron’s Biggest Hits—and Misses—Over the Past Century (Barron’s)

- ‘I love this setup’ — star stock-picker Cathie Wood keeps cool over ARK Innovation ETF’s dismal May start (MarketWatch)

- Billionaire Leon Cooperman Says Bond Market Is in a Bubble (Bloomberg)

- Chinese Consumers Are Opening Their Wallets Again (Wall Street Journal)

- For Better Burgers, Try a Backyard Flat-Top Griddle (Wall Street Journal)

- EU’s Michel says US vaccine patent waiver will not solve supply problem (Financial Times)

- End the $300 federal unemployment bonus, business group says (USA Today)

- Energy production in the United States fell by more than 5% in 2020 (EIA)

- Peter Lynch’s advice to Bill Miller (alphaideas)