Data Source: Finviz

Be in the know. 30 key reads for Wednesday…

- Yellen Says She Isn’t Predicting Higher Interest Rates (Wall Street Journal)

- 10 Reasons to Buy Bank Stocks (Barron’s)

- Electric vehicles and renewables will need a dramatic rise in mineral supply, IEA warns (CNBC)

- Higher Taxes Won’t Squash the Biden Boom (Wall Street Journal)

- Vaccine Rollouts Are a Key Ingredient for Big Food (Wall Street Journal)

- Yellen’s Interest-Rate Comment Illustrates the Market’s Greatest Worry (Wall Street Journal)

- U.S. LNG Club Could Get More Exclusive (Wall Street Journal)

- Biden Aims to Get 70% of Adults at Least One Covid-19 Vaccine Dose by July 4 (Wall Streeet Journal)

- Pfizer Expects Vaccine Will Be “Durable Revenue Stream” As It Seeks Approval For Children 2 To 11 (ZeroHedge)

- Europe’s Vaccine Rollout Relies Heavily On Pfizer/BioNTech (ZeroHedge)

- Pfizer Reaps Hundreds of Millions in Profits From Covid Vaccine (New York Times)

- Boeing-backed start-up Wisk inks first deal to operate air taxis in the U.S. (CNBC)

- Washington shies away from declaration to defend Taiwan (Financial Times)

- Fed’s Evans says policy likely on hold for some time (Reuters)

- U.S. private payrolls post biggest gain in seven months in April (Reuters)

- Bitcoin will soon be available through hundreds of US banks in a partnership with crypto firm NYDIG, report says (Business Insider)

- BofA Securities Upgrades ConocoPhillips (COP) to Buy for 3 Reasons (streetinsider)

- Lyft Shares Rally As March Quarter Results Top Guidance (Barron’s)

- Hedge funds had become ‘extreme’ sellers of stocks even before Yellen’s interest-rate remarks. Here’s why. (MarketWatch)

- The Untold Story of How Jeff Bezos Beat the Tabloids (Bloomberg)

- Jessica Alba’s Honest Co. IPO valued at $1.4 billion (Fox Business)

- Cobalt price jump underscores reliance on metal for electric vehicle batteries (Financial Times)

- Krispy Kreme files for IPO (New York Post)

- Canada authorizes Pfizer’s COVID-19 vaccine for kids between the ages of 12 and 15 years old (MarketWatch)

- Foil Maker Reynolds Sees Three Rounds of Price Hikes in 2021 (Bloomberg)

- Fed’s Kaplan, in interview, says it’s time to open discussion on tapping brakes on central-bank support for economy (MarketWatch)

- Pfizer’s next play: A vaccine maker and pandemic ‘partner’ to governments (MarketWatch)

- Suburban Homes and Retail Are the Budding New Office Hotspot (Wall Street Journal)

- The Man With More SPACs Than Anyone (Wall Street Journal)

- Jamie Dimon on Booming Economy and Finally Getting Off Zoom (Wall Street Journal)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 20 key reads for Tuesday…

- Pfizer lifts sales forecast for COVID-19 vaccine to $26 billion (Reuters)

- Pfizer (PFE) Tops Q1 EPS by 15c, Raises FY Guidance (StreetInsider)

- Pfizer plans to file for full FDA approval of Covid vaccine at the end of this month (CNBC)

- Clorox is still selling many more cleaning products than it was pre-pandemic (MarketWatch)

- Consumer Lenders Face a New Challenge: Each Other (Wall Street Journal)

- Starboard Value Finally Makes Its Move on Box (Barron’s)

- How Inflation Could Shape the Next Phase of the Stock Market (Barron’s)

- U.S. Stock Market Futures Mixed, With Airlines Lifted by Travel Reopening Plans in Europe (Barron’s)

- Apple and Epic Games Trial Has Started. What to Know. (Barron’s)

- Bank Stocks Continue to Gain. Why Wall Street Says the Rally Still Has Steam. (Barron’s)

- Why Ether is Soaring to New Highs (Barron’s)

- The world risks ‘running out of copper’ — and here’s how high prices may rise as the economy reopens, BofA warns (MarketWatch)

- The Fed Doesn’t Want to Talk Tapering Yet. Wait for Summer, Wall Street Says. (Barron’s)

- ‘Buy in May and go away’: Why US stocks can trade higher into the summer months, according to JPMorgan’s quant guru (Business Insider)

- Mohamed El-Erian says inflation is here to stay and won’t be ‘transitory’ like the Fed claims (Business Insider)

- Why supply-chain bottlenecks, price pressures may ease by year end (MarketWatch)

- OPEC Keeps Crude Production Steady Before Planned Increases (Bloomberg)

- UPDATE 2-ConocoPhillips profit tops as travel demand boosts oil prices (Reuters)

- New York, New Jersey Lift Covid-19 Capacity Limits on Businesses (Wall Street Journal)

- Record Share of Companies Are Beating Earnings Estimates (Wall Street Journal)

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Tom Hayes – Fox News Appearance – America’s Newsroom – 5/3/2021

Where is money flowing today?

Be in the know. 15 key reads for Monday…

- Apple Has Two Trillion Reasons to Fight for the App Store (Wall Street Journal)

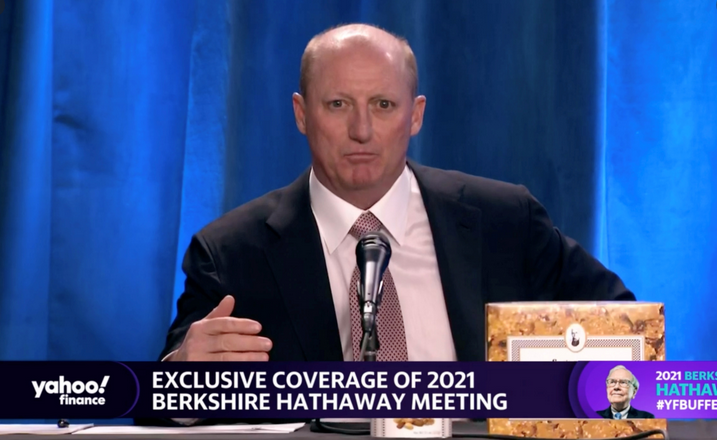

- Berkshire Hathaway’s Greg Abel Is Planned Successor to Buffett Abel oversees Berkshire’s big non-insurance operations. (Barron’s)

- Exxon Mobil Board Fight Enters Final Rounds (Barron’s)

- 3 Things to Know From Berkshire Hathaway’s Shareholder Meeting (Barron’s)

- Biden’s Plan to Spend $4.5 Trillion Without Boosting Deficits Depends on Factors Beyond His Control (Wall Street Journal)

- Americans Can’t Get Enough of the Stock Market (Wall Street Journal)

- Covid-19 Savings Stockpile Could Accelerate Economy—if Consumers Spend It (Wall Street Journal)

- Epic vs. Apple Trial: Tim Cook, Tim Sweeney and the Other Key Players in ‘Fortnite’ Maker’s Antitrust Lawsuit (Wall Street Journal)

- Workers are coming back to the office – slowly (USA Today)

- Verizon sells Yahoo and AOL as part of $5 billion deal (USA Today)

- EU Looks to Open Its Borders After a Year of Pandemic Isolation (Bloomberg)

- New York City Is Roaring Back to Life, One Year After Its Nadir (Bloomberg)

- Buffett says Berkshire is seeing ‘very substantial inflation’ and raising prices (CNBC)

- Treasury Secretary Janet Yellen says Americans can expect a ‘big return’ from Biden’s $4.1 trillion spending proposal (Business Insider)

- Intel CEO stresses more U.S. chip production, fewer stock buybacks (MarketWatch)

- A 10% drop or at least a pause could be looming for the S&P 500. Take shelter in these sectors, says veteran strategist (MarketWatch)

- Bridgewater Co-CIO: The Market Is “Very, Very Dangerous” (ZeroHedge)

- China stocks take lion’s share as EM flows bounce back in April –IIF (Reuters)

- U.S. Supreme Court refuses to revive Wells Fargo accounts scandal suit (Reuters)

- 9 Takeaways From Berkshire Hathaway’s Annual Shareholder Meeting (Benzinga)