- Guy Fieri, Fired Up: The Food Network King, With a Massive New Deal, Pushes for More Restaurant Relief (Hollywood Reporter)

- Bridgewater on Bubbles (Podcast) (Bloomberg)

- Warren Buffett’s Deputy Calls Bitcoin ‘Disgusting’ And Bad For Civilization (Forbes)

- Berkshire Hathaway Annual Meeting 2021: Highlights and storylines (Yahoo! Finance)

- Buffett says Berkshire “not competitive” with SPACs on deals (Reuters)

- 12 Best Vacation Stocks to Buy Now (insidermonkey)

- NYC falls to second on billionaire list as new tax hikes push wealthy out (New York Post)

- Americans Can’t Get Enough of the Stock Market (Wall Street Journal)

- A Chinese province powered 8% of all Bitcoin mining. Then the government gave miners 2 months to get out (Fortune)

- Thinking of Buying a Pro Sports Team? 10 Things Successful Owners Think You Should Know (RobbReport)

- Here’s What It’s Like to Drive McLaren’s 611 HP Street-Legal Racer, the 620R (RobbReport)

- The World’s Largest Aircraft, With a Wingspan Longer Than a Football Field, Just Completed Its Second Test Flight (RobbReport)

- Forget Batteries, This New Lightweight Hypercar Will Be Powered Entirely by Hydrogen (RobbReport)

- Jerry Jones’s Custom Airbus Chopper Is a Dallas Cowboy for the Skies (RobbReport)

- Big Tech is now worth so much we’ve forgotten to be shocked by the numbers (TechCrunch)

- Aston Martin Unveils Roofless V12 Speedster Special Edition (Maxim)

- Wayfair’s $112 billion plan to take over your entire home (Fast Company)

- Inflation, Unemployment And The Phillips Curve (NPR Planet Money)

- Lotus Wants Its First Electric Sports Car to Weigh the Same as Its Last Gas-Powered Car (Road and Track)

- How Costco Is Masking A 14% Price Jump With Shrinkflation (ZeroHedge)

Be in the know. 30 key reads for Saturday…

- Apple Hit With Landmark Antitrust Charges in Europe Over App Store (Barron’s)

- Here’s What Biden’s Corporate Tax Plan Means for Investors (Barron’s)

- Biden’s $4 Trillion Economic Plan, in One Chart (New York Times)

- What the cluck? Fast food chains warn of dire chicken shortage in US (New York Post)

- Bank of America Stock Is a Buy. Here’s Why. (Barron’s)

- PracticesThe Price of the Stuff That Makes Everything Is Surging (Bloomberg)

- Legalized Marijuana Will Be a Big Win for U.S. Pot Stocks. How to Bet on the Sector. (Barron’s)

- Exxon, Chevron Preach Prudence Even as Cash Waterfall Returns (Bloomberg)

- Summers Sees Signs of Scarce Workers as Harbinger of Inflation (Bloomberg)

- U.S. Personal Incomes Soar by Most on Record on Fiscal Stimulus (Bloomberg)

- Thanks to Spotify, the Music Is Stopping for Apple (Bloomberg)

- 8 different areas have taken turns leading the latest bull market in stocks – and that diversity is part of what makes the climb so sustainable, says one Wall Street chief strategist (Business Insider)

- Why investors should invest in asset bubbles rather than avoid them, according to JPMorgan (Business Insider)

- Berkshire Hathaway’s annual meeting is here: What to expect from Warren Buffett and Charlie Munger (CNBC)

- Berkshire Hathaway’s operating earnings jump, Buffett continues to buy back stock (CNBC)

- Clorox weighs price increases on products in response to inflationary costs (CNBC)

- Value investing: Is this the biggest opportunity since the tech bubble? (BNP)

- U.S. stocks have risen to all-time highs this year. Should you ‘sell in May and go away’? (MarketWatch)

- Railroad Stocks Are Rallying. What That Means for the Economy (Barron’s)

- Residents Furious at Release of 500 Million Gene-Hacked Mosquitoes (Futurism)

- Taxing Speculation (investoramnesia)

- Why ‘Black Swan’ author Nassim Taleb calls bitcoin an ‘open Ponzi scheme’ (CNBC)

- Dining out is back, as America gets vaccinated (CNN)

- The last clean energy boom turned to bust. Will this time be any different? (CNN)

- More than 90 New Airlines Are Launching in 2021. They Say It’s the Perfect Time. (Wall Street Journal)

- Rally in Transportation Stocks Nears 122-Year-Old Record Streak (Wall Street Journal)

- 2021 Ferrari Roma: A High-Tech Sports Car With a Midcentury Look (Wall Street Journal)

- Investors move into cash at fastest rate since March last year (Financial Times)

- Why a $10,000 Tax Deduction Could Hold Up Trillions in Stimulus Funds (New York Times)

- Deepest Backwardation Since ‘07 Shows World Short on Commodities (Bloomberg)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 80

Article referenced in VideoCast above:

The Chuck Berry “Ridin’ Along” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 70

Article referenced in podcast above:

The Chuck Berry “Ridin’ Along” Stock Market (and Sentiment Results)…

Unusual Options Activity – Gilead Sciences, Inc. (GILD)

Data Source: barchart

Today some institution/fund purchased 14,641 contracts of June $67.50 strike calls (or the right to buy 1,464,100 shares of Gilead Sciences, Inc. (GILD) at $67.50). The open interest was 7,786 prior to this purchase. Continue reading “Unusual Options Activity – Gilead Sciences, Inc. (GILD)”

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 20 key reads for Friday…

- Warren Buffett will discuss stocks, deals, and the pandemic at Berkshire Hathaway’s annual meeting on Saturday. Here are 18 questions he might answer. (Business Insider)

- EU says Apple’s App Store breaks competition rules after Spotify complaint (CNBC)

- Goldman Sachs Sees $80 Oil This Year: 4 Conviction List Energy Stocks to Buy Now (24/7 Wall Street)

- AstraZeneca Reveals Covid-19 Vaccine Sales. That Isn’t Why the Stock Is Rising. (Barron’s)

- It May Be Time to Check In to InterContinental Stock (Barron’s)

- Why It’s Great News That Cyclical Stocks Are Selling Off on Earnings (Barron’s)

- SPACs Switch Their Ticker Symbols—and Shares Climb. What’s Really Going On. (Barron’s)

- What Ails Gilead’s Sales (Barron’s)

- Apple’s Spectacular Earnings Aren’t Lifting the Stock. The Worry Is Growth. (Barron’s)

- Kraft-Heinz thrives as pandemic spurs home dining (New York Post)

- Cyclical Stocks Are Selling Off on Earnings. Why That’s Great News. (Barron’s)

- Apple v. Epic: What to expect from a trial that could change antitrust law and the mobile-app ecosystem (MarketWatch)

- Oil’s Rebound Greases the Way for Energy Giants’ Green Pitch (Wall Street Journal)

- U.S. fast-food chains cash in, seize market share during pandemic (Reuters)

- 5 Best Chinese Stocks To Buy And Watch Now (IBD)

- Amazon Continues To Outpace Google, Facebook On Ad-Revenue Growth: What You Need To Know (Benzinga)

- Cobalt price jump underscores reliance on metal for electric vehicle batteries (Financial Times)

- Exxon and Chevron surge back to profit (Financial Times)

- Colgate-Palmolive stock gains after profit, sales top expectations (Yahoo! Finance)

- Warren Buffett generates half of his dividend income from these stocks: Apple, Bank of America, Coca-Cola (USA Today)

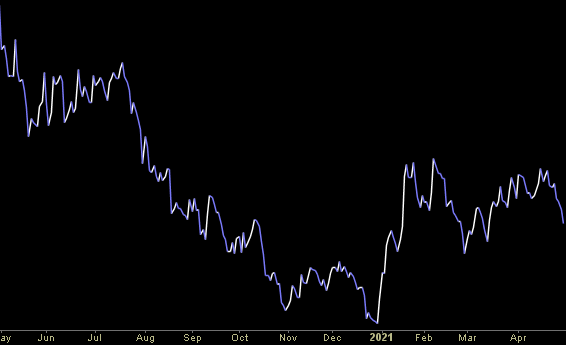

Tom Hayes – Quoted in Reuters article – 4/29/2021

Thanks to Shivani Kumaresan and Shreyashi Sanyal for including me in their article on Reuters today. You can find it here:

Unusual Options Activity – Citigroup Inc. (C)

Data Source: barchart

Today some institution/fund purchased 50,001 contracts of Jan ’22 $40 strike calls (or the right to buy 5,000,100 shares of Citigroup Inc. (C) at $40). The open interest was just 6,237 prior to this purchase. Continue reading “Unusual Options Activity – Citigroup Inc. (C)”