- Guy Fieri’s Bacon-Wrapped Danger Dogs Are a Ticket to Flavortown (Bloomberg)

- Manchin warns Dems about going it alone on Biden’s spending plan (Fox Business)

- Investors Need to Watch the Labor Shortage. Here’s Why. (Barron’s)

- Tiger Cubs: How Julian Robertson built a hedge fund dynasty (Financial Times)

- Lumber Prices Slump As Historic Boom Hits A Wall (ZeroHedge)

- The Best Investment of All: The People You Love the Most (New York Times)

- Fund Managers Are Ignoring Meme Stocks. That’s a Good Thing. (Barron’s)

- Brinker Stock Looks Set to Soar on Chili’s Comeback (Barron’s)

- Hedge fund stars shy away from the limelight (Financial Times)

- Banks Need Loan Growth to Keep Rallying. These Stocks Already Have It. (Barron’s)

- Why Boeing Could Fly High Again (Barron’s)

- Charlie Munger’s Book Recommendation List (CMQ)

- Driving the undriveable Ferrari (Financial Times)

- Payne: When I was a kid, getting a job was like winning the lottery (Fox Business)

- 4 Undervalued Stocks With Momentum (Morningstar)

- Dividends Are the Next Oil Catalyst. Here Are the Stocks that Could Benefit. (Barron’s)

- Natural-Gas Prices Stir Heading Into Summer (Barron’s)

- Peter Lynch on Common Investor Mistakes (Novel Investor)

- One stunning chart shows just how much faster the US labor market is recovering now compared to the financial crisis (Business Insider)

- A Wave of Global Spending Is Great News for Humanity (and Investors) (Barron’s)

- The Stock Market’s Long Run of Nothing Continued Last Week. What to Know. (Barron’s)

- Solar Power’s Land Grab Hits a Snag: Environmentalists (Wall Street Journal)

- Facebook’s Marketplace Faces Antitrust Probes in EU, U.K. (Wall Street Journal)

- iPhone? AirPods? MacBook? You Live in Apple’s World. Here’s What You Are Missing. (Wall Street Journal)

- Why Does Anyone Care About a Superyacht? (Wall Street Journal)

- Bill Gates, Warren Buffett building nuclear reactor in coal-rich Wyoming (New York Post)

- G-7 Strikes Historic Deal to Revamp Global Tax on Tech Firms (Bloomberg)

- How Ronald Read managed to accumulate a dividend portfolio worth $8 million (DGI)

- Emerging-Market Stocks in Pole Position to Gain as World Reopens (Bloomberg)

- Rosneft Warns of ‘Severe’ Oil Shortage Amid Hasty Energy Shift (Bloomberg)

- Bonds Aren’t Freaking Out About Inflation (Bloomberg)

- S.-China Trade Relationship Significantly Imbalanced, Tai Says (Bloomberg)

- Crypto investor Vignesh Sundaresan: ‘It’s the NFT that changed the world’ (Financial Times)

- Royal Caribbean sets 2021 cruises in Florida, Texas and Alaska (CNBC)

- Interactive Brokers founder says problem with AMC Entertainment memes: ‘People…will lose a very substantial amount of money’ (MarketWatch)

- Pete Najarian Sees Unusual Options Activity In Tapestry And IQIYI (Benzinga)

- Electric Car Batteries Are Turning This Country Into an Actual Hellscape (Futurism)

- Bill Ackman’s SPAC Is in Talks to Buy a Stake in Universal Music —But So Far It’s Not Music to Investors’ Ears (Institutional Investor)

- The Pied Piper of SPACs (New Yorker)

- Lots of Liquidity (Yardeni)

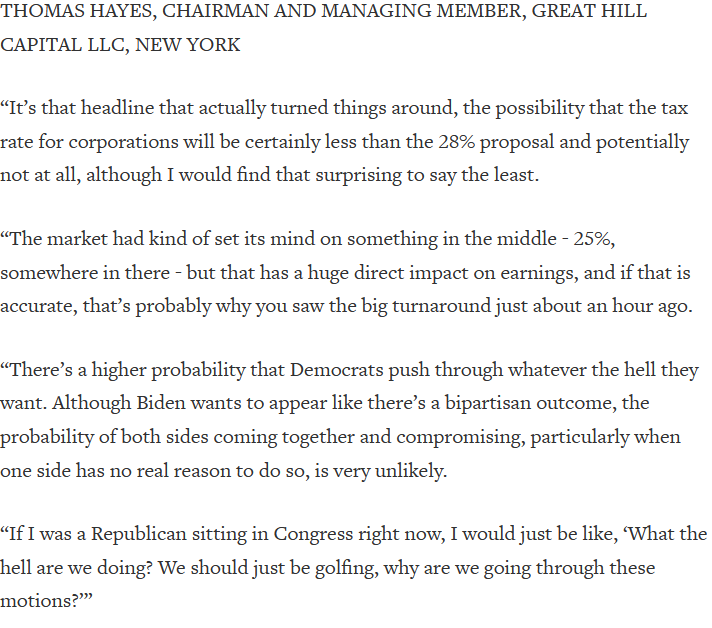

Tom Hayes – The Claman Countdown – Fox Business Appearance – 6/4/2021

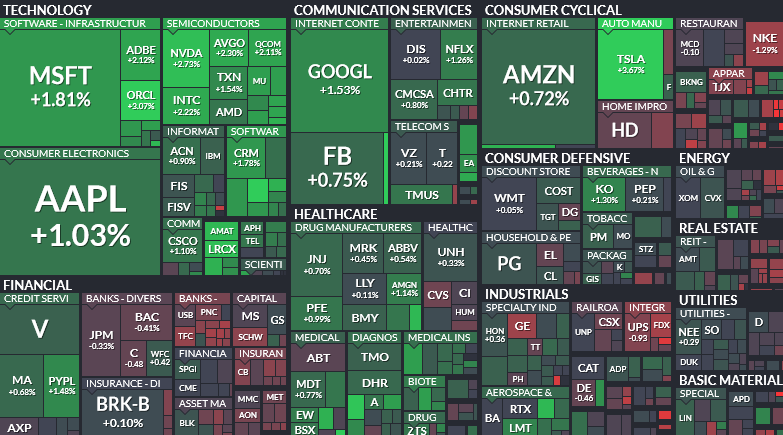

Where is money flowing today?

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 85

Be in the know. 25 key reads for Friday…

- FDA’s Call on Biogen’s Alzheimer’s Drug Is Coming Soon (Barron’s)

- Viva Las Vegas: Sin City Presses Its Luck in the Postpandemic Era (Barron’s)

- May’s Employment Report Is Another Disappointment (Barron’s)

- Buy Take-Two Interactive Because a Whole Lot of Videogames Are in the Works (Barron’s)

- Alibaba, Alphabet, and Amazon Stock Are Bargains, This Value Manager Says (Barron’s)

- How Pitchers Are Conquering Baseball’s Home Run Revolution (Wall Street Journal)

- Ant to Change How It Makes Loans With New Consumer-Finance Company (Wall Street Journal)

- Services Boom? You Ain’t Seen Nothing Yet (Wall Street Journal)

- Biden Narrows Infrastructure Request, but Hurdles Remain for Bipartisan Deal (New York Times)

- The Momentum Is With Active Fund Managers for Now (Bloomberg)

- Texas Rising: Hedge Funds, Big Tech Drive Lone Star Wealth Boom (Bloomberg)

- Palantir gets aggressive in SPAC investments, backing digital health, aviation and robot companies (CNBC)

- Billionaire hedge-fund manager Julian Robertson endorses high-flying US tech stocks — and says their valuations aren’t lofty (Business Insider)

- Apple’s Big Show May Not Be Enough (Wall Street Journal)

- Cloud Software’s Low-Hanging Fruit Is a Tempting Target (Wall Street Journal)

- Apple stock on track for longest weekly losing streak in more than 2 1/2 years (MarketWatch)

- Is the Fed ‘tightening cycle’ already happening? (MarketWatch)

- Italian Artist Sells Invisible Sculpture For $18,000 (ZeroHedge)

- Strong Inflows to Cash Continue, Largest Selling of Tech Stocks Since December 2018 – BofA’s Flow Show (Street Insider)

- Northrop Grumman (NOC) Upgraded to ‘Buy’ at Stifel on Compelling Valuation (Street Insider)

- Apple’s (AAPL) WWDC Unlikely to Blunt the Deceleration Narrative – Wolfe Research (Street Insider)

- Biden open to dropping corporation tax rise in infrastructure talks (Financial Times)

- UK approves Pfizer jab for younger adolescents (Financial Times)

- Tiger’s Julian Robertson bets big tech stocks will keep marching higher (Finaicial Times)

- Washington to bar US investors from 59 Chinese companies (Financial Times)

Hedge Fund Tips with Tom Hayes – Podcast – Episode 75

Unusual Options Activity – JD.com, Inc. (JD)

Data Source: barchart

Today some institution/fund purchased 18,260 contracts of Sept. $77.5 strike calls (or the right to buy 1,826,000 shares of JD.com, Inc. (JD) at $77.5). The open interest was just 1,592 prior to this purchase. Continue reading “Unusual Options Activity – JD.com, Inc. (JD)”

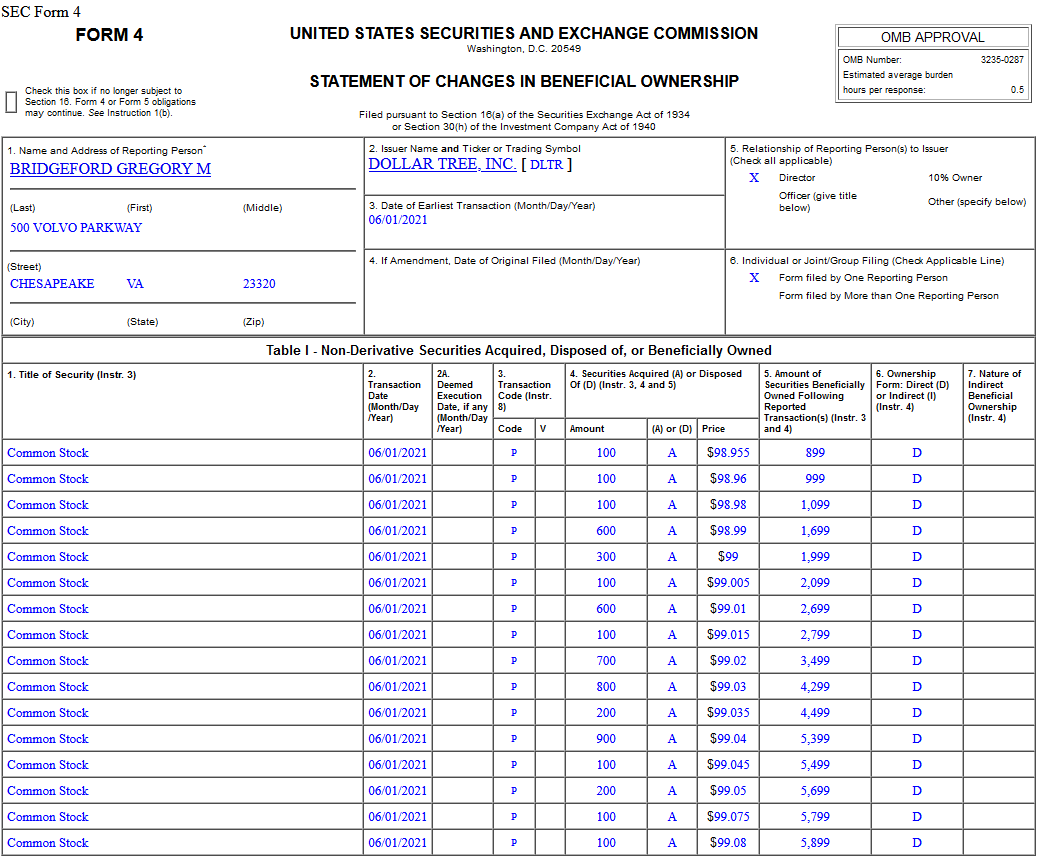

Insider Buying in Dollar Tree, Inc. (DLTR)

Tom Hayes – Quoted in Reuters article – 6/3/2021

Thanks to Herb Lash for including me in his article on Reuters today. You can find it here: