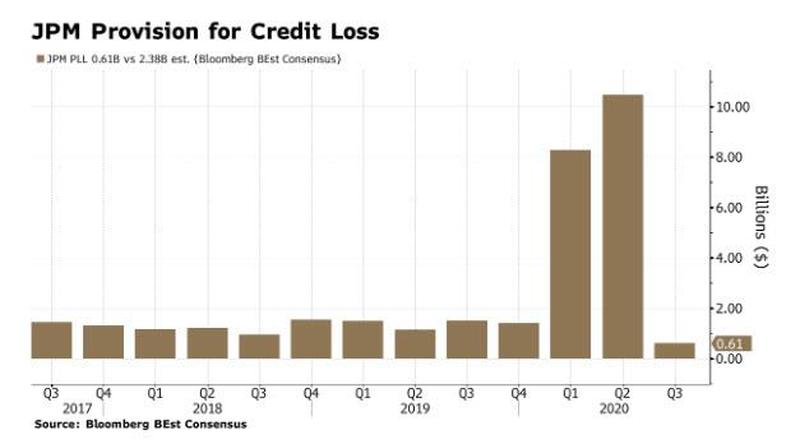

- Dimon Signals The All Clear: JPMorgan Earnings Smash Expectations As Loss Provisions Plummet 94% (ZeroHedge)

- Exxon Mobil upgraded to Neutral from Sell at Goldman Sachs (TheFly)

- Citi Posts Biggest Quarterly Profit of Pandemic (Bloomberg)

- Day-Trader Options Action Is Spotted Yet Again in Nasdaq Surge (Bloomberg)

- Desperate Americans hit by pandemic beg Congress, Trump to pass economic relief bill (Reuters)

- U.S. small business confidence at highest since February (Reuters)

- China’s imports, exports surge as global economy reopens (Reuters)

- Johnson & Johnson Covid-19 vaccine study paused due to illness: report (FoxBusiness)

- “Nancy Pelosi take this deal!” Andrew Yang, a former Democratic presidential candidate, tweeted on Saturday. “Put politics aside people are hurting.” (FoxBusiness)

- Why You Didn’t Notice a Japanese Stock Index Beating the Nasdaq This Year (Wall Street Journal)

- JPM: Credit costs of $611 million included $569 million of net reserve releases (Street Insider)

- Ford and General Electric are headed back to the double digits, Jim Cramer says (CNBC)

- JPMorgan’s Earnings Were Better Than Expected. Here’s How the Bank Did. (Barron’s)

- A New Roaring ‘20s Is Coming for Industrial Stocks (Barron’s)

- The American Dream: Bringing Factories Back to the U.S. (Barron’s)

- Lotus Goes Electric With a US$2.1 Million Hypercar (Barron’s)

- Oil bounces after sharp jump in Chinese imports (MarketWatch)

- JPMorgan beats analysts’ profit estimates as the bank sets aside less for loan losses (CNBC)

- Disney Elevates Streaming Business in Major Reorganization (Wall Street Journal)

- BofA Survey Shows Investors Braced for Contested U.S. Election (Bloomberg)

- Natural Gas Surges as Traders Brace for Cold Winter (Wall Street Journal)

- Key U.S. Inflation Gauge Rises at Slowest Pace in Four Months (Bloomberg)

- Warren Buffett once used LeBron James to explain the risk of diversification, and compared his return to Cleveland to new Coke’s demise (BusinessInsider)

- Top Analyst Raises Price Targets on 4 High Dividend-Paying Bank Stocks (24/7 Wall Street)

- Citi Posts Biggest Quarterly Profit of Pandemic. Loan provisions return to normal after surging in first half. (Bloomberg)

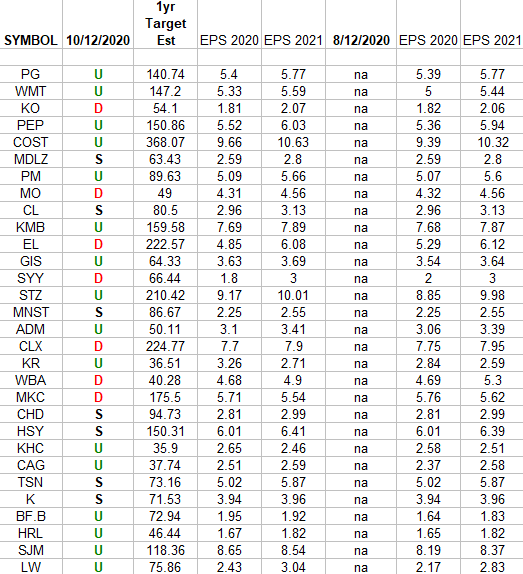

Consumer Staples (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Staples Sector ETF (XLP) top 30 weighted stocks. Continue reading “Consumer Staples (top 30 weights) Earnings Estimates/Revisions”

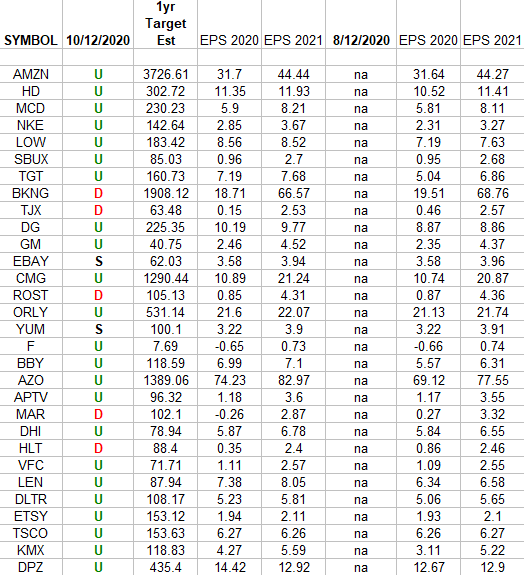

Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Discretionary Sector ETF (XLY) top 30 weighted stocks. Continue reading “Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions”

Unusual Options Activity – Citigroup Inc. (C)

Data Source: barchart

Today some institution/fund purchased 6,945 contracts of March $52.50 strike calls (or the right to buy 694,500 shares of Citigroup Inc. (C) at $52.50). The open interest was just 3,217 prior to this purchase. Continue reading “Unusual Options Activity – Citigroup Inc. (C)”

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 20 key reads for Monday…

- This Quarter Will Test Bank Stocks. Here’s How to Find Good Buys in the Sector. (Barron’s)

- Opinion: Get ready for a good earnings season for big U.S. banks (MarketWatch)

- Is The Next “October Surprise” An Unexpected Moment Of Clarity? (ZeroHedge)

- If You’re So Smart, Why Aren’t You Rich? (Bloomberg)

- Banks Have a Chance to Come Up for Air (Wall Street Journal)

- JPMorgan Upgrades Rocket Cos Inc. (RKT) to Overweight; ‘Bringing Scale and Efficiency to Massive and Fragmented Market’ (Street Insider)

- BofA Securities Upgrades Franklin Resources (BEN) Two-Notches to Buy on LM Deal, Strong Balance Sheet (Street Insider)

- Gilead’s remdesivir shaved five days off COVID-19 recovery time, reduced risk of death in some (Street Insider)

- Goa Game Changer: Indian State’s Health Authority Approves & Distributes Ivermectin & Doxycycline to Treat COVID-19 as Prophylaxis (TrialSiteNews)

- Danbury, Connecticut officially naming sewage plant after John Oliver (Fox Business)

- Earnings Season Is About to Start. It Could Be Better Than You Think. (Barron’s)

- How to Fix Industrial Stocks’ Underperformance, With One Simple Move (Barron’s)

- Investors Are Betting Corporate Earnings Have Turned a Corner (Wall Street Journal)

- Inhaled Vaccines Aim to Fight Coronavirus at Its Point of Attack (Bloomberg)

- The Fed Still Has a Powder Keg at Its Disposal (Bloomberg)

- Chinese shoppers spend big during the Golden Week holidays (CNBC)

- Berkshire Hathaway Vice Chair’s Foundation Sells Stock (Barron’s)

- Warren Buffett phoned Treasury Secretary Hank Paulson with a stimulus idea when the 2008 financial crisis erupted. It may have saved the US economy (Business Insider)

- UBS lays out 3 reasons why the stock market will continue to rise – and breaks down how investors should position their portfolios for the next leg of the rally (Business Insider)

- A chief investment strategist explains why making short-term bets ahead of the election is a risky strategy Business Insider)

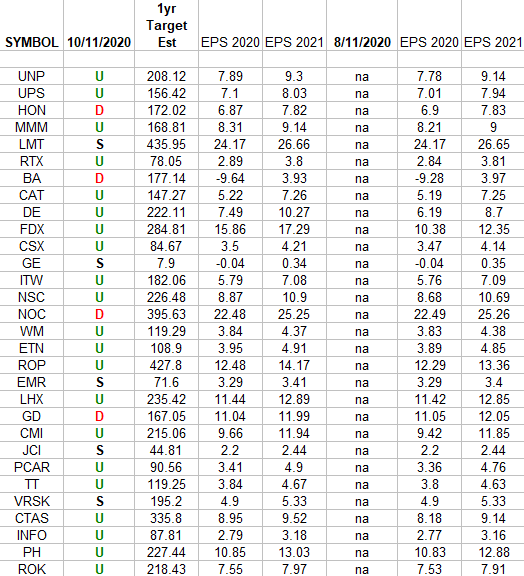

Industrials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the 2020 and 2021 earnings estimates for the Industrials Sector ETF (XLI) top 30 weighted stocks. The column under the date 10/11/2020 has a letter that represents the movement in 2020 earnings estimates since the most recent print (8/11/2020). Continue reading “Industrials (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 15 key reads for Sunday…

- Banks Have Barely Touched the Fed’s Main Street Lending Program. Except This One. (Wall Street Journal)

- Ferris Bueller, Style Icon? The Patterned Sweater Vest Is Back (Wall Street Journal)

- Joel Greenblatt on Relative Value Investing (Podcast) (Bloomberg)

- Thrill seeker Jared Isaacman made a small fortune training fighter pilots but his wealth soared this summer when he took his payments processing business public amid the pandemic. (Forbes)

- Seasonals Are Back In Style Again (Almanac Trader)

- Take Five: Banks, bottom lines, Brexit (Reuters)

- Lilly’s Rheumatoid Arthritis Drug, Combined With Remdesivir, Benefits Covid-19 Patients Who Need Oxygen (Forbes)

- These Custom-Wrapped, Rally Race Ford GT40 Recreations Can Soon Be Yours (RobbReport)

- McLaren Unveils ‘High-Performance Hybrid’ Supercar (Maxim)

- How Media Mogul Barry Diller Made His $3 Billion Fortune (Maxim)

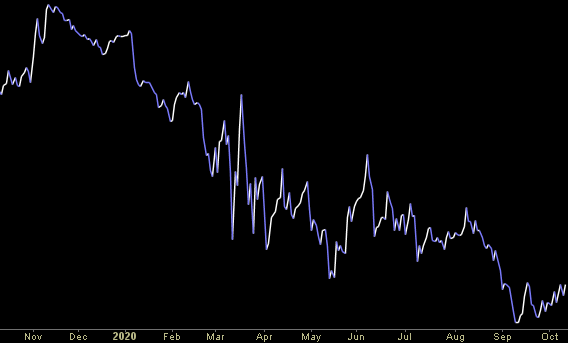

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Where’s Everyone Moving To? (NPR Planet Money)

- What It Takes To Win At Quant Investing (Podcast) (Bloomberg)

- COVID-19 lockdowns were a risky experiment — and one that failed (New York Post)

- Tale of Two Economies: Housing-Related Boom vs Pandemic-Challenged-Services Bust (Yardeni)