Cheddar TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – September 29, 2020

Unusual Options Activity – Carnival Corporation & Plc (CCL)

Data Source: barchart

Today some institution/fund purchased 15,220 contracts of April $20 strike calls (or the right to buy 1,522,000 shares of Carnival Corporation & Plc (CCL) at $20). The open interest was just 3,773 prior to this purchase. Continue reading “Unusual Options Activity – Carnival Corporation & Plc (CCL)”

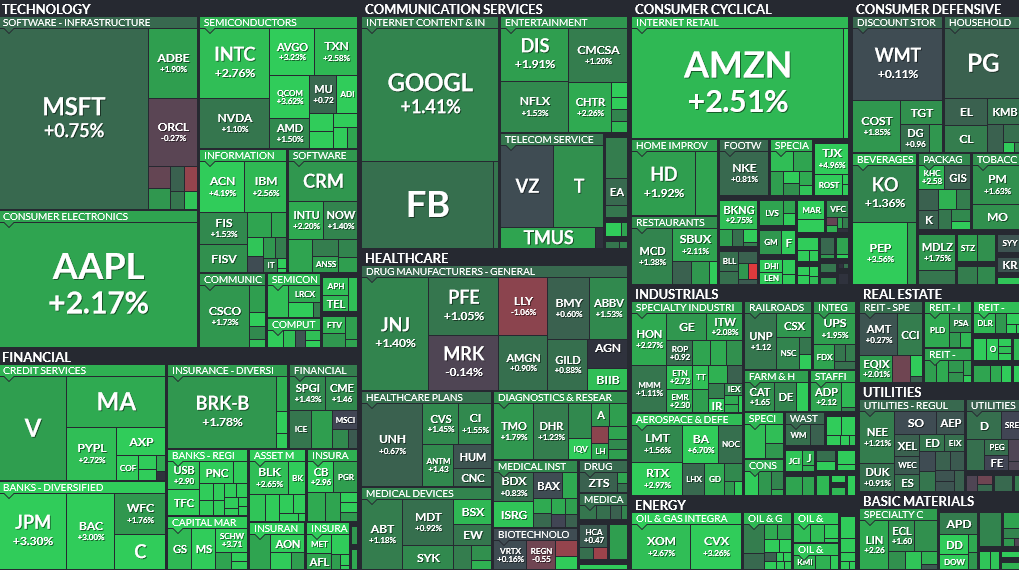

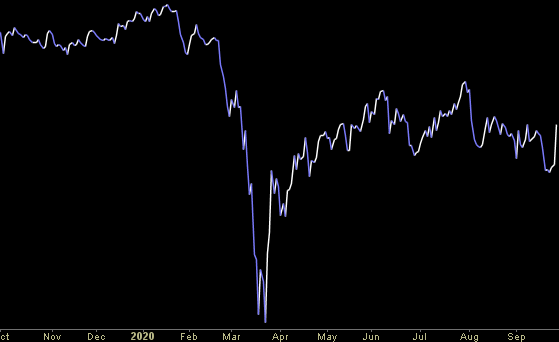

Where is money flowing today?

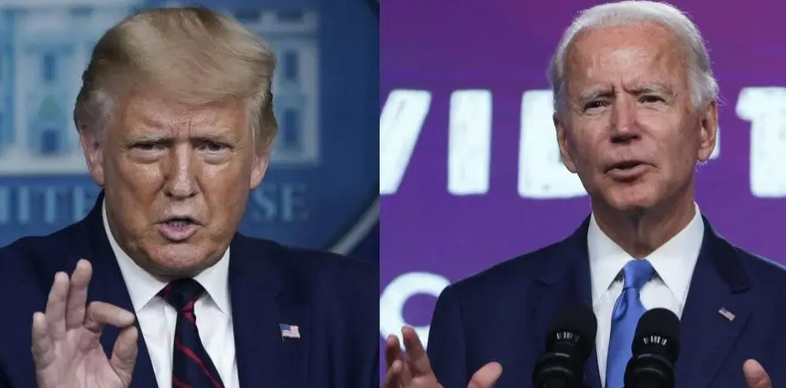

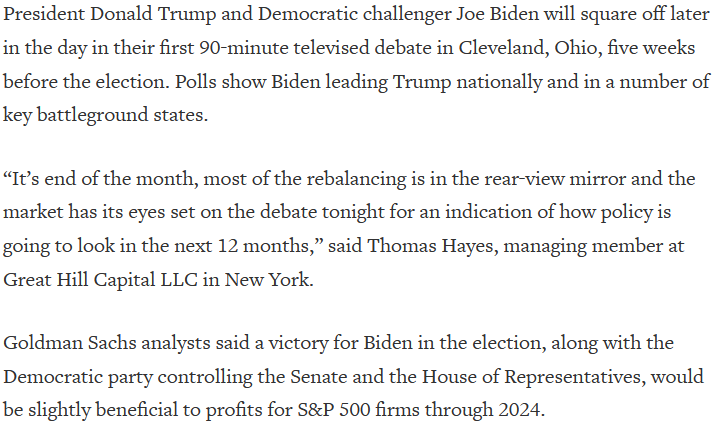

Tom Hayes – Quoted in Reuters article – 9/29/2020

Thanks to Devik Jain and Shreyashi Sanyal for including me in their article on Reuters today. You can find it here:

Be in the know. 20 key reads for Tuesday…

- 10 Big Financial Stocks at Deep Discounts to Book Value (24/7 Wall Street)

- Stocks Rally, Driven by Bank and Energy Sectors (Wall Street Journal)

- The Federal Aviation Administration has certified General Electric’s GE9X engine for commercial flight (Barron’s)

- Trump-Biden debate could be an ‘important catalyst’ for investors, Goldman says, as its strategists remain ‘pro-risk’ (MarketWatch)

- It’s not too late to buy into the rebound, according to one strategist (CNBC)

- 5 charts show how much the U.S. and Chinese economies depend on each other (CNBC)

- Goldman Sachs says higher real yields ‘exacerbated’ the stock market sell-off (Business Insider)

- House Democrats roll out new $2.2 trillion stimulus plan that includes $600 federal unemployment benefits and a 2nd round of $1,200 direct payments (Business Insider)

- Stock Boom Gets Even Better for Banks (Wall Street Journal)

- Hot Stocks Molson Coors, Coca-Cola enter agreement to bring Topo Chico Hard Seltzer to U.S. (The Fly)

- 2021 Ford F-150 sets class tow rating record (FoxNews)

- Research Affiliates Finds No Value Explanation for ‘Exorbitantly Priced’ Tech Stocks (Institutional Investor)

- Navigating Q4 2020: Paul Tudor Jones’ 10 Investing Rules (ZeroHedge)

- 4 Small-Cap Energy Stocks With Healthier Balance Sheets (Barron’s)

- Mondelez Has Oreos. What More Does It Need to Thrive Even After the Pandemic? (Barron’s)

- Tampa Bay Lightning Win Stanley Cup After Season Played in Quarantine (Bloomberg)

- What to Expect at the First Presidential Debate of the 2020 Election (Barron’s)

- Here’s how the stock market tends to perform after the first presidential debates (MarketWatch)

- Safe havens are performing like ‘insurance that covers just one bedroom in the house,’ says JP Morgan (MarketWatch)

- Investors Remain Jittery After Biggest Equities Outflows Since March (Institutional Investor)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 9/28/2020

Where is money flowing today?

Tom Hayes – Quoted in Wall Street Journal article – 9/28/2020

Thanks to Alexander Osipovich and Anna Isaac for including me in their article in The Wall Street Journal today. You can find it here:

Click Here to View The Full Article at The Wall Street Journal

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 15 key reads for Monday…

- What the Election Means for Industrial Stocks. Hint: Rotation (Barron’s)

- New 72-Year Study Reveals Where Stocks Are Headed (Investor’s)

- Wanted in Covid-19 Fight: ‘Superdonors’ of Convalescent Plasma (Wall Street Journal)

- China’s Export Machine Looks Inward as Global Risks Rise (Wall Street Journal)

- U.S. Sets Export Controls on China’s Top Chip Maker (Wall Street Journal)

- Chinese Companies Head Home to Raise Money, as Beijing’s Relations With U.S. Fray (Wall Street Journal)

- Small Firms Less Apocalyptic as 60% See Survival Past Six Months (Bloomberg)

- Sustainable Footwear Maker Allbirds Lands $100 Million in Funding (Wall Street Journal)

- A Bet on Europe Is a Bet on Drugs, Against Tech (Wall Street Journal)

- US presidential debate will be more of a ‘key driver’ for markets than the next jobs report, one strategist says (BusinessInsider)

- HSBC shares rebound after China’s Ping An increases its stake (Financial Times)

- University of North Texas Team Use Advanced Supercomputers to Improve Remdesivir Effectiveness (TrialSiteNews)

- There are four coronavirus vaccines in late-stage studies — here’s how they differ (MarketWatch)

- Check out the Mustang Mach-E, Ford’s electric SUV (MarketWatch)

- Hedge funds race to cover crude short positions: Kemp (Reuters)