- Ruth Bader Ginsburg says this is the secret to living a meaningful life (CNBC)

- Inside Saudi Arabia’s $360 Billion Sovereign-Wealth Fund (Barron’s)

- Seeking Stock-Market Bargains? Try Europe and Japan (Barron’s)

- Don’t Count Bank Stocks Out Just Yet. For One Thing, They’re Cheap. (Barron’s)

- Malone at Bat: Will He Use the Mets Deal to Boost the Braves’ Value? (Barron’s)

- Fed Releases Its Second Round of Stress Tests. What That Means for Banks. (Barron’s)

- Some Investors Tried to Win by Losing Less. They Lost Anyway. (Wall Street Journal)

- Soybean Prices Hit Two-Year High, Buoyed by Chinese Demand (Wall Street Journal)

- Bank Investors Don’t Have to Be So Anxious About New Stress Tests (Wall Street Journal)

- New York’s Star Attractions Are Reopening. Here’s What You Need to Know. (Wall Street Journal)

- Forget the President. Senate Races Could Matter More for Markets (Bloomberg)

- Amy Coney Barrett Emerges as Front-Runner for Trump Court Pick (Bloomberg)

- Multiple market forces are aligning in favor of continued stock gains — and they all trace back to record-low bond yields, according to a top Wall Street strategist (Business Insider)

- Walmart increasing pay for approximately 165,000 hourly workers across U.S. stores, introducing new roles (USA Today)

- Ferrari’s new convertible is worth every penny (CNN Business)

- High Hopes for Amgen and Gilead at Europe’s Biggest Cancer Research Conference (Barron’s)

- When Technology Takes Revenge (Farnam Street)

- Quality is Missing the Point (Advisor Perspectives)

- Snowflakes and Bubbles (Compound Advisors)

- Howard Marks: History Can Be a Useful Guide in Today’s Market (Guru Focus)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 48

Article referenced in VideoCast above:

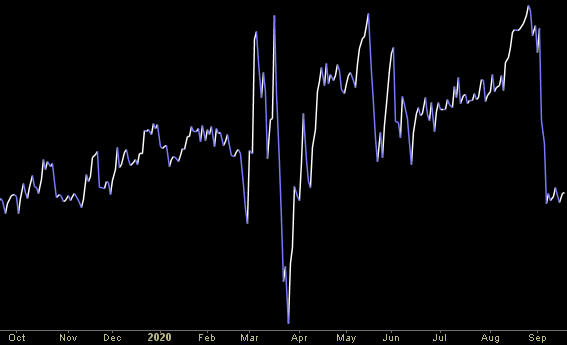

The Scott McCreery, “In-Between” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 38

Article referenced in podcast above:

The Scott McCreery, “In-Between” Stock Market (and Sentiment Results)…

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

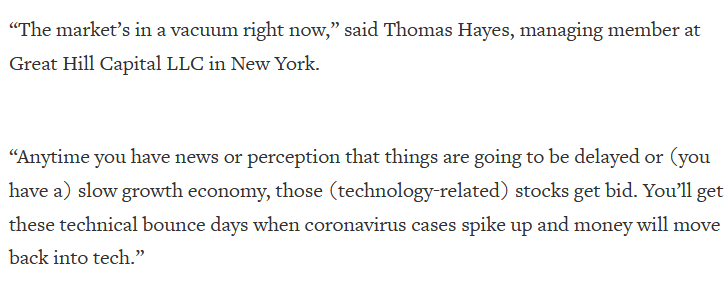

Tom Hayes – Quoted in Reuters article – 9/18/2020

Thanks to Devik Jain and Shreyashi Sanyal for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Be in the know. 15 key reads for Friday…

- Energy and Financials May Have Biggest Potential Upside: 5 Top Buys for 2021 (27/4 Wall Street)

- FANGs in Retreat Are a Sign of Optimism (Bloomberg)

- OPEC+ urges ‘full conformity’ with production cuts, and Saudi Arabia’s energy minister warns market gamblers will be hurt ‘like hell’. (Business Insider)

- GE Stock Jumped Because It Expects Positive Free Cash Flow. What Wall Street Is Saying. (Barrons)

- Goldman Sachs says oil prices are set to move ‘meaningfully higher’ into next year. Here are 7 reasons why the firm is bullish, and 5 stocks it recommends buying in advance. (Business Insider)

- Trump administration to ban TikTok downloads starting Sunday: report (New York Post)

- Mike Tyson nearly takes trainer’s head off in jaw-dropping video (New York Post)

- Car Loans Dodge Distress for Now (Wall Street Journal)

- Bond Market Shows U.S. Is Leading in Race to Reflate the Economy (Bloomberg)

- The next wave of the global recovery could send commodity prices soaring (CNBC)

- Sell(ing) Rosh Hashanah, Buy Yom Kippur (Almanac Trader)

- What are the Fed’s new hurdles for rate hikes? (Reuters)

- Bond Investors Regain Appetite for Emerging Markets (Wall Street Journal)

- Federal Reserve weighs bank dividends as it prepares second stress test (CNBC)

- An Old Drug Tackles New Tricks: Ivermectin Treatment in Three Brazilian Towns (TrailSiteNews)