Where is money flowing today?

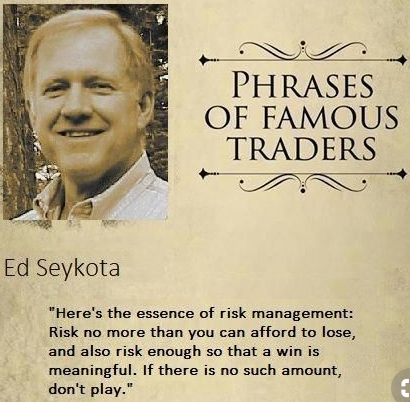

Quote of the Day…

Be in the know. 20 key reads for Thursday…

- Rockets Hit Iraq Base Hosting U.S. Troops Amid Tension With Iran (Wall Street Journal)

- How the Oil Lobby Learned to Love Carbon Taxes (Bloomberg)

- The Inflation Regime Change Is Already Upon Us (Bloomberg)

- Boeing Stock Is Nearing a Key Level. More Gains Could Be Ahead. (Barron’s)

- Be Like Warren Buffett. Use This Options Strategy. (Barron’s)

- The Stock Market Stands to Win Big in a New Stimulus Program (Barron’s)

- Flashing Caution Lights Are Ahead in China. Here’s How Investors Should Proceed. (Barron’s)

- The Treasury Market Is Spooking Tech Stocks Again. Here’s Why. (Barron’s)

- Nuclear Power Finds a New Role in Renewable Energy. That Will Boost Uranium Prices. (Barron’s)

- Why the S&P 500’s bull-market run probably is only getting started (MarketWatch)

- Exxon, Once a Skeptic, Sees Profit in Capturing Carbon Emissions (Wall Street Journal)

- OPEC+ debates whether to raise or freeze oil output as price recovers (Reuters)

- Frequent Fliers Itch to Take Off a Year After Being Grounded (Wall Street Journal)

- Can Eddie Murphy’s ‘Coming 2 America’ Live Up to the Hype? (Wall Street Journal)

- How the Oil Market Bounced Back From a Year of Crisis (Wall Street Journal)

- Inside Pfizer’s Fast, Fraught, and Lucrative Vaccine Distribution (Bloomberg)

- Buffett’s NetJets to Buy 20 Supersonic Luxury Planes From Aerion (Bloomberg)

- Vaccine Shipments Present a Security Challenge Worthy of a James Bond Film (Bloomberg)

- Novartis agrees to help make CureVac COVID-19 vaccine (MarketWatch)

- Hedge funds cash in on the ‘great reflation trade’ (Financial Times)

The Diana Ross “Upside Down” Stock Market (and Sentiment Results)…

The song we chose to embody this week’s stock market sentiment is Diana Ross’, “Upside Down”: Continue reading “The Diana Ross “Upside Down” Stock Market (and Sentiment Results)…”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 25 key reads for Wednesday…

- More Rate Scares Ahead for Stocks (Wall Street Journal)

- Exxon vs activists: can disenchanted investors force change? (Financial Times)

- US Treasury bond wobble heightens concerns over health of $21tn market (Financial Times)

- Financials may be a silver lining in bond market rout (Financial Times)

- Property and the pandemic: the great reckoning that never seems to arrive (Financial Times)

- Saudi Arabia says Khashoggi report won’t set back US relations (Financial Times)

- Bitcoin cannot replace the banks (Financial Times)

- Las Vegas Sands sells the Venetian, Sands Expo for $6.25B (FoxBusiness)

- SPACs are now a $700 billion market: Morning Brief (Yahoo! Finance)

- Analysis: Fed may need more than words in next battle with markets (Reuters)

- Oil up as OPEC+ considers rollover rather than raising output (Street Insider)

- Apollo to Acquire Retailer Michaels for $3.3 Billion in Cash (Bloomberg)

- Companies Are Feeling the Inflation Pinch. What to Watch Next. (Barron’s)

- Forget GameStop. If You Want Real Risk, Invest in Supercars (Bloomberg)

- Fox News Finds It’s Back in Familiar Spot: Prime-Time Lead (Bloomberg)

- ‘Big Short’ investor Michael Burry says governments may ‘handicap’ bitcoin – and doubts it can disrupt global finance (Business Insider)

- Oil industry is getting greener faster as U.S. policy shifts to climate change (CNBC)

- Cruise Stocks Get Upgraded by Macquarie, Because Covid’s Worst Is in the Past (Barron’s)

- There Probably Won’t Be a Post-Covid Wave of Foreclosures (Barron’s)

- U.S. Vaccine Shortage Could Soon End With Oversupply (Barron’s)

- Democrats Are Already Looking Ahead to More Economic Relief (Barron’s)

- Here’s the problem the Fed is fueling — and it’s not inflation, strategist says (MarketWatch)

- Big Oil ‘Friends’ the Carbon Tax (Wall Street Journal)

- CVS, Walgreens Look for Big Data Reward From Covid-19 Vaccinations (Wall Street Journal)

- Houston’s Big Oil Conference Goes Green as Energy Transition Accelerates (Wall Street Journal)

Unusual Options Activity – PG&E Corporation (PCG)

Data Source: barchart

Today some institution/fund purchased 19,817 contracts of Dec $15 strike calls (or the right to buy 1,981,700 shares of PG&E Corporation (PCG) at $15). The open interest was just 405 prior to this purchase. Continue reading “Unusual Options Activity – PG&E Corporation (PCG)”