Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 15 key reads for Tuesday…

- The Money Gusher Says There’s No Stocks Bubble Yet (Bloomberg)

- Space Will Be a Software Business Too (Barron’s)

- Goldman Sachs says it’s the beginning of a structural bull market in commodities (MarketWatch)

- Value Investing Is Finding Favor in Emerging Markets. Here’s What To Own Now. (Barron’s)

- Wall Street Bullishness Is Becoming a Contrarian Sell Signal (Bloomberg)

- The Energy Report 03/02/2021 (Phil Flynn)

- Big Oil Faces Off Against Clean-Energy Giants (Wall Street Journal)

- Rocket’s Mortgage Engine Is Still Running Hot (Wall Street Journal)

- Fed policy changes could be coming in response to bond market turmoil, economists say (CNBC)

- Saudi Arabia and Russia are at loggerheads again, but OPEC meeting ‘unlikely to ruin the oil party’ (CNBC)

- Investor Dan Loeb says he’s been exploring cryptocurrencies to bridge the gap between traditional finance and new ‘controversial ideas’ (Business Insider)

- Warren Buffett May Yet Have His Revenge on Dave Portnoy (Bloomberg)

- More Space Stocks Are Coming. Investors Are Pleased. (Barron’s)

- U.S. to Take Hard Line on Chinese Trade Practices, Administration Says (Wall Street Journal)

- United Airlines Buys 25 New Boeing 737 MAX Jets (Wall Street Journal)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 3/1/2021

Where is money flowing today?

Be in the know. 15 key reads for Monday…

- These Undervalued Stocks Are Set to Beat Pre-Covid Earnings (Barron’s)

- J&J’s Vaccine Is Authorized. Here’s What It Means for the Stock. (Barron’s)

- 12 Stocks and Funds to Play the Coming Green Boom for Utilities (Barron’s)

- U.K. Builders Are Surging. Morgan Stanley Says Government Program to Help Housing Market. (Barron’s)

- Iran Rejects Offer of Direct U.S. Nuclear Talks, Ratcheting Up Tension With West (Wall Street Journal)

- Biden offers support to Amazon workers attempting to unionize in Alabama (New York Post)

- Trump calls on states to address tech monopolies if congress fails to act (New York Post)

- 10-year Treasury yield holds below 1.50% as bond market selloff cools (MarketWatch)

- How Exxon Could Send Its Stock Even Higher (Barron’s)

- Oil prices resume rally ahead of this week’s OPEC+ decision on crude production (MarketWatch)

- South Korean exports rise for 4th straight month (MarketWatch)

- 5 Industrial Stocks Poised to Benefit From Rising Inflation (Barron’s)

- U.S. Enlists Allies to Counter China’s Technology Push (Wall Street Journal)

- How Europe Became the World’s Biggest Electric-Car Market—and Why It Might Not Last (Wall Street Journal)

- OPEC oil output falls in February on Saudi additional cut – survey (Reuters)

- Australian central bank boosts bond purchases after borrowing costs soar (Financial Times)

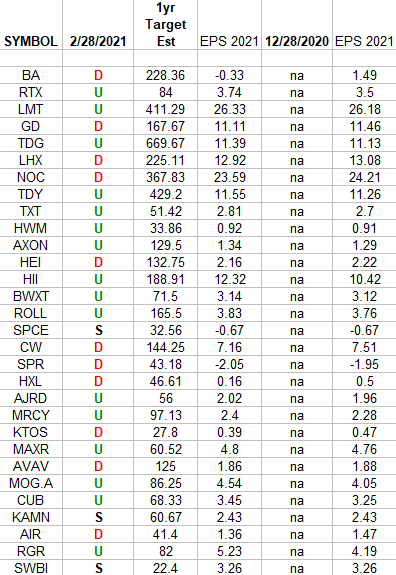

Defense & Aerospace Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Defense & Aerospace ETF (ITA). Continue reading “Defense & Aerospace Earnings Estimates/Revisions”

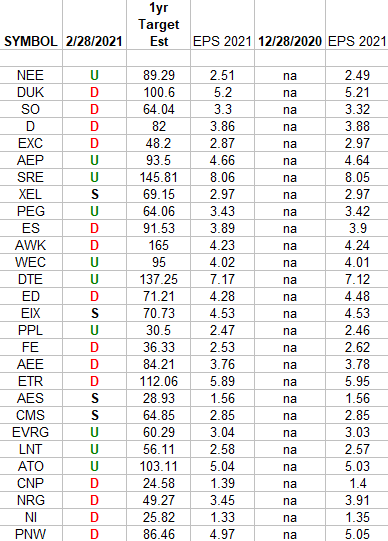

Utilities Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Utilities Sector ETF (XLU) top weighted stocks. Continue reading “Utilities Earnings Estimates/Revisions”

Be in the know. 30 key reads for Sunday…

- Warren Buffett Defends Berkshire Hathaway’s $25 Billion in Buybacks (Wall Street Journal)

- Great-Grandma Who’s a Dodge Superfan Still Drag Races for Fun (thedrive)

- House passes $1.9tn Covid stimulus package (Financial Times)

- Maserati’s New 630 HP MC20 Is the Marque’s First Supercar in Nearly Two Decades (Robb Report)

- Cold weather results in near-record withdrawals from underground natural gas storage (EIA)

- Pfizer Vaccine Curbs COVID Transmissions in Israel by Nearly 90% (Futurism)

- Texas natural gas production fell by almost half during recent cold snap (EIA)

- Free of IPO Constraints, SPACs Can Make ‘Absurd’ Financial Projections — And This Hedge Fund Manager Says The Fallout Is Coming (InstitutionalInvestor)

- Technology & The Financial Printing Press (OSAM)

- ‘Excessive stimulus’ puts value stocks on track to outperform growth over next 4 years, says Stifel’s Bannister (MarketWatch)

- Howard Marks: ETNow (Oaktree Capital)

- Our Ultimate Stock-Pickers’ Top 10 High-Conviction Purchases (Morningstar)

- Cruise operators see brighter horizon as vaccines spur bookings (Financial Times)

- Treasury yields fall after savage bond sell-off abates (Financial Times)

- Buffett warns of ‘bleak future’ for debt investors (Financial Times)

- The art insider’s guide to Italy (Financial Times)

- US removes stumbling block to global deal on digital tax (Financial Times)

- Charlie Munger, Vice Chairman of Berkshire Hathaway, speaks at the Daily Journal Annual Meeting (Yahoo! Finance)

- Historically High Froth in Speculative Stocks (quantifiableedges)

- Opinion: Most investors don’t like accelerating inflation — but this one group does (MarketWatch)

- Recent Typical March Trading: Strength Early & After Mid-Month (Almanac Trader)

- Americans of All Stripes Are Flush With Cash (Wall Street Journal)

- During COVID, e-sports have been big business (Fortune)

- If you haven’t followed NFTs, here’s why you should start (techcrunch)

- 2022 Land Rover Defender Gets Beastly 518-Horsepower V8 (mensjournal)

- To Prevent Blackouts from Happening Again, Texas Should Go Nuclear (manhattan-institute)

- Mexico’s Long War: Drugs, Crime, and the Cartels (CFR)

- The Florida Panthers Haven’t Made A Real Playoff Run In Decades. That Could Change This Year. (538)

- The Feynman Learning Technique (Farnam Street)

- What’s Behind the Boom in Agricultural Commodities (Podcast) (Bloomberg)