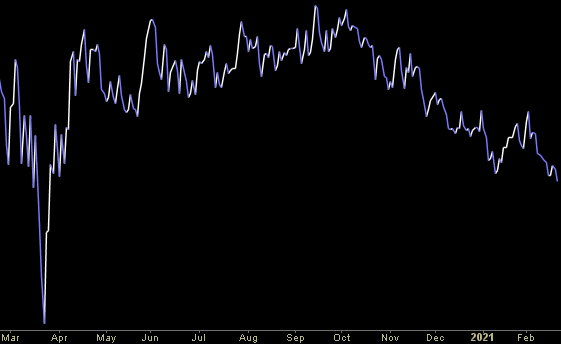

Data Source: Finviz

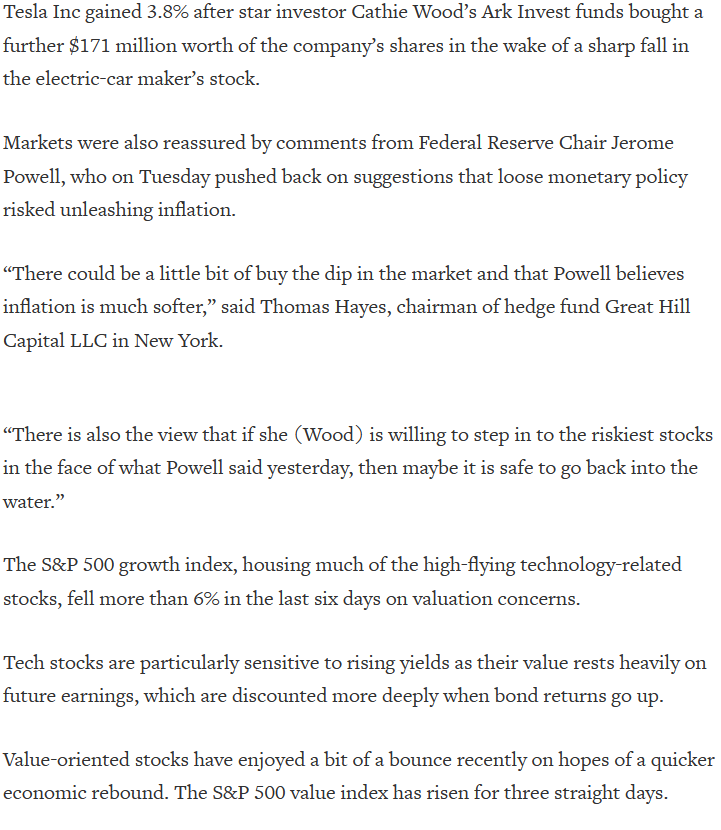

Tom Hayes – Quoted in Reuters article – 2/24/2021

Thanks to Devik Jain for including me in his article on Reuters today. You can find it here:

Be in the know. 22 key reads for Wednesday…

- The Cereal Industry Had a Very Weird Year (Bloomberg)

- To Make More Covid-19 Vaccines, Rival Drugmakers Team Up (Wall Street Journal)

- Why the Fed Needs to Prove Its New Tolerance for Inflation (Barron’s)

- Stocks Rise as Fed Chair Says Light at the End of the Tunnel Remains Distant (New York Times)

- ‘Reflation Trade’ Looks Promising. These Assets Look Too Hot. (Barron’s)

- Box Shares Rally on Report Starboard May Seek Three Additional Board Seats (Barron’s)

- Wells Fargo Is Streamlining More of Its Operations. What It Means for the Stock. (Barron’s)

- Structured Notes Saw Record Demand in a Volatile 2020. Investors Should Mind the Fine Print. (Barron’s)

- Credit Suisse Raised its S&P 500 Price Target. Thank Earnings Momentum. (Barron’s)

- Powell Focuses on Economic Need at Key Moment in Markets and Politics (NYT)

- Why it may be time to buy airline stocks (Yahoo! Finance)

- 5 Analyst Favorite Stocks at Raymond James Are Perfect Reopening Theme Buys (24/7 Wall Street)

- P&G CEO expects higher demand for cleaning products to outlast pandemic (CNBC)

- Roblox is going public: 5 things to know about the tween-centric gaming platform (MarketWatch)

- If you think it’s time to shift to value stocks, here are Wall Street’s favorites (MarketWatch)

- Here are 3 reasons why the stock market can survive rising bond yields in 2021 (MarketWatch)

- CVS says it will reach millions of new customers as it administers COVID vaccine (MarketWatch)

- J&J Single-Shot Covid Vaccine Found Effective Before FDA Review (Bloomberg)

- Delta CEO Predicts Business Travel Comeback With Two Key Metrics (Bloomberg)

- Exelon to Separate Power-Generation Business Via Spinoff (Bloomberg)

- For the Posh, Bentley’s New Flying Spur Is Practically Pious (Bloomberg)

- Iran Limits Access to Nuclear Sites but Open to Talks With U.S. (Wall Street Journal)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 2/23/2021

Where is money flowing today?

Be in the know. 30 key reads for Tuesday…

- Powell says inflation is still ‘soft’ and the Fed is committed to current policy stance (CNBC)

- 6 Inexpensive Stocks for Market Contrarians (Barron’s)

- World’s Largest Hedge Fund Manager Warns Emerging Tech Stocks In “Extreme Bubble” (ZeroHedge)

- Tesla Stock Is in a Bear Market. It’s Taking Other EV Stocks With It. (Barron’s)

- Consumer Demand Snaps Back. Factories Can’t Keep Up. (Wall Street Journal)

- Tech Stocks Outside U.S. Also Hammered as Interest Rates Rise (Barron’s)

- Roblox Sets Date to Go Public Through a Direct Listing (Barron’s)

- Carl Icahn Charges Up FirstEnergy Stock (Barron’s)

- The Reflation Trade Is Well Underway. How Long Can Investors Keep Smiling? (Barron’s)

- U.S. Consumers Have Spending Power. Here Are 11 Retail Stocks to Play the Economic Recovery. (Barron’s)

- How Much Do Central Banks Fear the Bond Toddler? (Bloomberg)

- Analysis: How rich is Saudi Arabia? Kingdom does the math in balance sheet overhaul (Reuters)

- Fed’s Powell heads to Congress with economy at a crossroads (Reuters)

- Wells Fargo Sheds Its Asset Manager as Scharf Reshapes Bank (Bloomberg)

- House committee clears $1.9T COVID relief package (FoxBusiness)

- The Energy Report 02/23/2021 (Phil Flynn)

- When is stimulus too much for markets? (Financial Times)

- Re-opening trades keep ripping: Morning Brief (Yahoo! Finance)

- US Home Prices Accelerate At Fastest Pace Since 2014 (ZeroHedge)

- BofA hikes 2021 Brent price view by $10/bbl on strong oil balances (Reuters)

- AMC Stock Jumps as New York City Says Cinemas Can Reopen (Barron’s)

- Historic Gains in Small Stocks Highlight Investor Exuberance (Wall Street Journal)

- More Than 209 Million Shots Given: Covid-19 Vaccine Tracker (Bloomberg)

- Astra Antibody Trials Show Promising Signs Against Variants (Bloomberg)

- Oil and Gas Industry ‘Demonized,’ Novatek Says: IP Week Update (Bloomberg)

- Indian billionaire says the country’s regulators need to ‘step in and ban bitcoin’ (CNBC)

- Churchill Capital Corp IV plunges 35% after Lucid Motors strikes SPAC deal to go public with a $24 billion valuation (Business Insider)

- A tangled market web of Tesla-bitcoin-ARK Investment could spell trouble for investors, warns strategist (MarketWatch)

- F.C.C. Broadband Plan Includes $50 Monthly Subsidy for Millions (New York Times)

- Australia, Facebook agree to lift news ban (USA Today)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 15 key reads for Monday…

- Gas Surges Above $3 In These States as Oil Prices Jump (24/7 Wall Street)

- If Inflation Is Coming, These Stocks Will Benefit the Most (Barron’s)

- Texas Looks to Rebuild. Here Are 6 Stocks That Could Benefit. (Barron’s)

- Four Things to Know About the Housing Market in 2021 (Barron’s)

- Blue-Collar Jobs Boom as Covid-19 Boosts Housing, E-Commerce Demand (Wall Street Journal)

- Bond Selloff Prompts Stock Investors to Confront Rising Rates (Wall Street Journal)

- Why an Animated Flying Cat With a Pop-Tart Body Sold for Almost $600,000 (New York Times)

- Canada To Follow Australia’s Lead In Charging Facebook For Links (ZeroHedge)

- The 20th Annual Rich List, the Definitive Ranking of What Hedge Fund Managers Earned in 2020 (Iinstitutional Investor)

- Biden’s $1.9 Trillion Stimulus Plan Enters Three-Week Congress Dash (Bloomberg)

- Strategists Pick Commodities as a Favorite Way to Play Reflation (Bloomberg)

- Wall Street Is Inflation-Proofing Its Debt-Market Portfolios (Bloomberg)

- Exxon Pushed for Net-Zero Goal by Activist Shareholder (Bloomberg)

- Bubble Warnings Go Unheeded as Everyone Is a Buyer in Stocks (Yahoo! Finance)

- The Four Basic Truths of Macroeconomics (Bloomberg)

- This strategist lists 7 reasons that stocks are a buy even as bond yields climb (MarketWatch)

- General Electric (GE) PT Raised to $15 After Goldman Sachs Hosts Virtual NDR (StreetInsider)

Be in the know. 12 key reads for Sunday…

- Smartphone sales have dropped two calendar years straight for the first time, according to Gartner. (CNBC)

- Inflation Angst Is About to Rewrite the Stock Market Playbook (Bloomberg)

- The Transcript 02.15.2020 (theweeklytranscript)

- ‘Trillions’ Are the New Billions: How the Federal Budget Grew Detached from Reality (manhattan-institute)

- Facebook pulled the trigger on Australian news — and shot itself in the foot (thenextweb)

- How Mathematician Katherine Johnson Helped Make Human Space Flight Possible (Robb Report)

- Is A/D Line Signally Late-February Weakness? (Almanac Trader)

- Bugatti Reveals $8.8 Million, 1,600-HP Centodieci Hypercar (Maxim)

- form follows aerodynamics with the all-new mclaren artura hybrid supercar (designboom)

- Bitcoin and ethereum prices ‘seem high,’ says Musk (Reuters)

- From Tokyo to Texas, Forbes Travel Guide’s New Five-Star Hotels For 2021 (Forbes)

- David Lynch’s Industrious Pandemic (The New Yorker)