Where is money flowing today?

Be in the know. 20 key reads for Thursday…

- Wells Fargo stock extends surge after Wall Street’s lone bear said it’s no longer a sell (MarketWatch)

- Mercedes Owner Daimler Says Profit Surged 48% in 2020 on High Demand for Premium Vehicles, Will Spin-Off and List its Daimler Truck Division (StreetInsider)

- VIX Outlook ‘Less Controversial’ Going Forward After Dipping Below 20 for the First Time in 255 Days – UBS (StreetInsider)

- Hedge funds, Robinhood face grilling by Congress over GameStop Reddit rally (StreetInsider)

- U.S. weekly jobless claims unexpectedly rise (Reuters)

- Food Prices Continue to Rise. Expect Bigger Grocery Bills. (Barron’s)

- GE CEO Larry Culp Is Talking About 2021. Cash Flow Is the Key. (Barron’s)

- U.S. Retail Sales Rose Strongly on Stimulus in January (Wall Street Journal)

- Should AT&T Or Verizon Try To Acquire Nokia In 2021? (Yahoo! Finance)

- Dogecoin Has a Top Dog Worth $2.1 Billion (Wall Street Journal)

- Oil Prices Are Up, but Frackers Stay on the Sidelines—for Now (Wall Street Journal)

- Wells Fargo’s $8 Billion Question: How to Slash Costs Without Angering Regulators (Wall Street Journal)

- McLaren’s $258,000 Hybrid Boasts Blazing Speed (Bloomberg)

- U.S. Housing Starts Fell in January for First Time Since August (Bloomberg)

- Music Mogul Buys Beach Boys Songs, Calling Band ‘Underappreciated’ (Bloomberg)

- Bob Pisani explains how ‘payment for order flow’ works (CNBC)

- Walmart shares fall on earnings miss, retailer sees sales growth slowing (CNBC)

- How Lamborghini learned to love the SUV (CNBC)

- No Pandemic Sugar Rush for Nestlé (Wall Street Journal)

- Robinhood heads to the Hill: What to watch at the Congressional hearing (Financial Times)

The “Roaring Kitty” Stock Market (and Sentiment Results)…

By now, everyone knows about Keith Gill (aka Roaring Kitty aka Deep F**king Value). He’s the guy who put out a relatively solid fundamental thesis on GameStop and got it more “right” than anyone could have anticipated. Continue reading “The “Roaring Kitty” Stock Market (and Sentiment Results)…”

Unusual Options Activity – Merck & Co., Inc. (MRK)

Data Source: barchart

Today some institution/fund purchased 2,626 contracts of Jan 2023 $75 strike calls (or the right to buy 262,600 shares of Merck & Co., Inc. (MRK) at $75). The open interest was just 1,059 prior to this purchase. Continue reading “Unusual Options Activity – Merck & Co., Inc. (MRK)”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Quote of the Day…

Be in the know. 20 key reads for Wednesday…

- Berkshire Reveals New Positions In Chevron, Verizon; Exits JPM; Trims Apple, Wells: Full 13F Summary (ZeroHedge)

- Goldman Tells Clients To “Add Energy” Stocks Which Are Badly Lagging Commodities (ZeroHedge)

- 5 Health Care Laggards With Healthy Upside Potential (24/7 Wall Street)

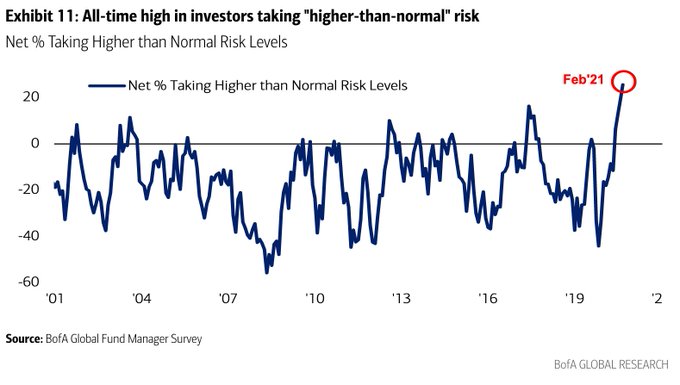

- February Bank of America Global Fund Manager Survey Results (Summary) (HedgeFundTips)

- This Is What Hedge Funds Bought And Sold In Q4: Complete 13F Summary (ZeroHedge)

- Waiting for Big Pharma’s Coronavirus Profits to Impress Wall Street (Wall Street Journal)

- Energy Transfer (ET) to Acquire Enable Midstream Partners (ENBL) in $7 Billion All-Equity Transaction (Street Insider)

- U.S. shale could face weeks of depressed oil production due to cold (Reuters)

- Baupost Group Takes a Large Stake in Intel (Institutional Investor)

- Mario Draghi lays out ambitious reforms for Italy (Financial Times)

- ‘We got lucky’: hedge funds that cashed in on the Reddit rally (Financial Times)

- Total chief warns of renewable energy bubble (Financial Times)

- The Riskiest Stocks Are in Favor. Why That Probably Won’t Change Soon. (Barron’s)

- Fed’s Yield-Curve Control Isn’t for Taming Long Bonds (Bloomberg)

- How Roblox, a video game platform for kids, became a $30 billion company (CNBC)

- ‘Big Short’ investor Michael Burry joins Warren Buffett in betting on Kraft Heinz (Business Insider)

- COVID-19 cases are dropping like a rock: Morning Brief (Yahoo! Finance)

- Why Rare Earths May Leave Europe and U.S. Vulnerable (Bloomberg)

- Building an Ice Rink in Your Backyard? ‘Water and Gravity Will Always Win’ (Wall Street Journal)

- Bulk Condo Buyers Descend on Manhattan, Looking for Cut-Rate Deals (Wall Street Journal)

February Bank of America Global Fund Manager Survey Results (Summary)

~204 Managers overseeing ~$614B AUM responded to this month’s BofA survey. Continue reading “February Bank of America Global Fund Manager Survey Results (Summary)”