- Banks Uncover Loophole to Buy Home Loans at Below-Market Prices (Bloomberg)

- The Fed Was Expecting More Fiscal Aid, Its Minutes Suggest. So Far There Is None. (Barron’s)

- High-Yielding Stocks Have Faltered in 2020—But Some See Value (Barron’s)

- How to Make a Profit on Lean Hogs (Barron’s)

- Why Investors Could Add Some Active Investing to a Portfolio (US News and World Report)

- Global Stocks Slump as Fed Minutes Show One Policy Option Shunted Aside (Barron’s)

- Bank of America Is Cautious. It’s a Reason to Buy the Stock. (Barron’s)

- JPMorgan Chase reportedly had talks about putting banks inside USPS locations

- Time Runs Out for Dollar Bulls That Stretched Valuations Too Far (Bloomberg)

- U.S.-China Trade Talks Delayed, Not Derailed (Wall Street Journal)

- Fed Sees Need for Additional Support but Is Vague on Timing (Wall Street Journal)

- Good Grounds for American Exceptionalism in Stocks (Wall Street Journal)

- Legendary investor Mark Mobius says investors should steer clear of gold until its price drops (Business Indsider)

- China, United States agree to hold trade talks, Chinese commerce ministry says (Reuters)

- OPEC PLUS Nightmare. The Energy Report. (Price Group)

The Lionel Richie “Dancing on the Ceiling” Stock Market (and Sentiment Results)…

This week we chose Lionel Richie’s classic song, “Dancing on the Ceiling” to embody the sentiment of the Stock Market. The salient lyrics are as follows: Continue reading “The Lionel Richie “Dancing on the Ceiling” Stock Market (and Sentiment Results)…”

Quoted in Bloomberg Wednesday:

Thanks to Moxy Ying and Ruth Carson for including me in their article on Bloomberg today:

“Decline of the Dollar Has Wall Street Rethinking Stock Strategy” You can read it here:

Unusual Options Activity – American International Group, Inc. (AIG)

Data Source: barchart

Today some institution/fund purchased 1,200 contracts of Feb. $30 strike calls (or the right to buy 120,000 shares of American International Group, Inc. (AIG) at $30). The open interest was just 239 prior to this purchase. Continue reading “Unusual Options Activity – American International Group, Inc. (AIG)”

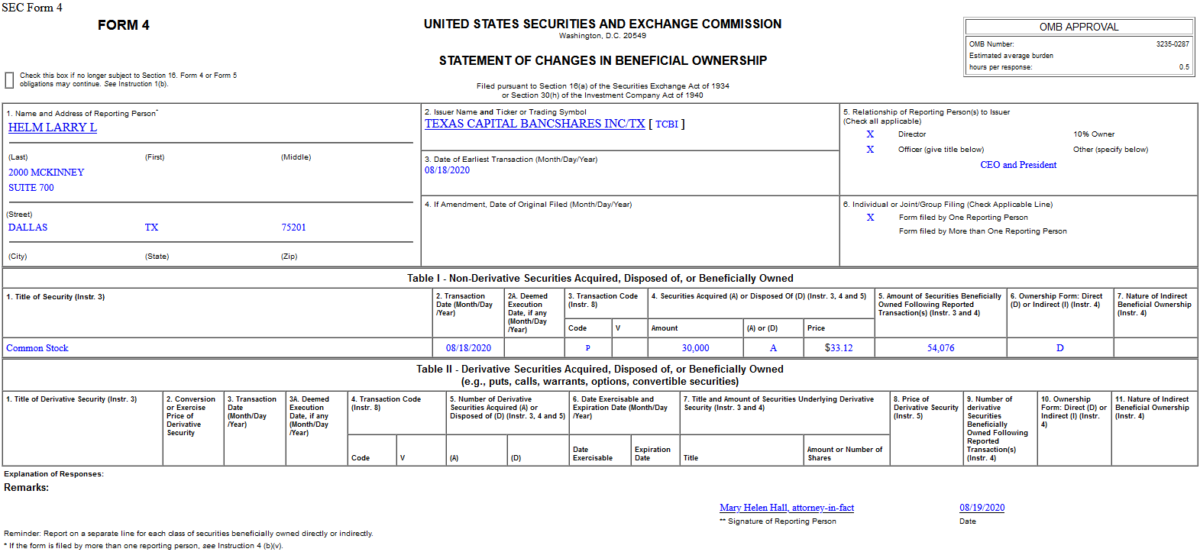

Insider Buying in Texas Capital Bancshares, Inc. (TCBI)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 20 key reads for Wednesday…

- New U.S. Coronavirus Cases Slip to Lowest Since Late June (Wall Street Journal)

- A Third of People Tested in Bronx Have Coronavirus Antibodies (Wall Street Journal)

- 8 Restaurant Stocks That Are Worth the Risk (Barron’s)

- Former GE CEO Jeff Immelt Buys Up Bloom Energy Stock (Barron’s)

- Fund managers are more optimistic on stocks than any time since the pandemic began (MarketWatch)

- U.S. tells universities to shed China share holdings ahead of potential delisting: report (MarketWatch)

- The Next Stimulus Bill Still Hasn’t Arrived. Why the Market Doesn’t Care (Barron’s)

- Fund Managers Believe This Is a Whole New Cycle (Institutional Investor)

- Oracle’s Ellison steps out of character with approach for TikTok (Financial Times)

- Investors increasingly unsettled by ‘overvalued’ markets (Financial Times)

- 4 Top Companies Benefit From More Americans Driving on Vacation This Summer (24/7 Wall Street)

- Warren Buffett’s $113 billion Apple stake and $147 billion cash pile now account for over half of Berkshire Hathaway’s entire market value (Business Insider)

- The narrative driving markets is about to get challenged on Wednesday — here’s why (MarketWatch)

- Target reports a monster quarter — profits jump 80%, same-store sales set record (CNBC)

- Jim Cramer: A U.S. dollar rally might be in the cards, according to the charts (CNBC)

- Democrats, GOP Probe for a Path Forward on Stimulus Talks (Bloomberg)

- Trump Team Sees Path to Pared-Down $500 Billion Stimulus Deal (Bloomberg)

- Walmart Flexes Its Scale to Power Through Pandemic (Wall Street Journal)

- Simon, the Biggest U.S. Mall Owner, Shows Two Sides: Innovator and Traditionalist (Wall Street Journal)

- The ‘Everything Bubble’ Isn’t Everything, and Maybe Not Even a Bubble (Wall Street Journal)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Unusual Options Activity – JPMorgan Chase & Co. (JPM)

Data Source: barchart

Today some institution/fund purchased 4,011 contracts of Sept. 2021 $170 strike calls (or the right to buy 401,100 shares of JPMorgan Chase & Co. (JPM) at $170). The open interest was just 155 prior to this purchase. Continue reading “Unusual Options Activity – JPMorgan Chase & Co. (JPM)”