Data Source: Finviz

Be in the know. 20 key reads for Friday…

- Why Mega-Cap Defense Stocks May Be the Best Idea for the Rest of 2020 (24/7 Wall Street)

- Employment in U.S. Increased by More Than Forecast in July (Bloomberg)

- Berkshire Hathaway Showing Signs of an Appetite Ahead of Earnings Report (Bloomberg)

- Schlumberger Stock Has Tumbled, but Director Mark Papa Just Scooped Up Shares (Barron’s)

- NYSE Owner Buys Mortgage-Software Firm Ellie Mae From Thoma Bravo for $11 Billion (Barron’s)

- Trump Order Targets Chinese Internet Giants TikTok, WeChat (Barron’s)

- A Covid Vaccine Could Be Ready Sooner Than You Think (Barron’s)

- Costco Same-Store Sales Climbed Again in July (Barron’s)

- A bullish ‘golden cross’ forms in the Dow industrials (MarketWatch)

- Meet Kanye West’s presidential running mate, Michelle Tidball (New York Post)

- Europe’s banks surprise markets with a strong quarter. (CNBC)

- OPEC’s second largest member just made its biggest commitment to curb crude production this month (Business Insider)

- People Are Flying Again—But Only for Cheap Vacations (Wall Street Journal)

- Pfizer (PFE) Announces Agreement with Gilead (GILD) to Manufacture Remdesivir for Treatment of COVID-19 (Street Insider)

- Rocket Companies jumps as much as 26% in its first day of public trading (Business Insider)

- Billionaire investor Howard Marks says the Fed’s emergency relief efforts saved the US from depression — but warns of long-term inflationary risk (Business Insider)

- Why the best way to play an economic recovery is to load up on industrial stocks, according to a Wall Street stock chief (Business Insider)

- New York exodus accelerating at ‘substantial’ pace, local movers say (Fox Business)

- New York City Comedy Clubs Move Laughs Outdoors (Wall Street Journal)

- Power Outages From Tropical Storm Isaias Could Last for Days (Wall Street Journal)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 20 key reads for Thursday…

- Better than Expectations: U.S. weekly jobless claims total 1.186 million, vs 1.423 million expected (CNBC)

- White House threatens executive action if it fails to reach coronavirus relief deal with Democrats (CNBC)

- Here’s How Congress Could Cripple a Faltering Recovery (Barron’s)

- President Trump Says He Supports Additional $25 Billion in Aid to Airline Industry (Barron’s)

- Novavax Stock Soars. Analysts Say Its Covid-19 Vaccine Might Be the Best. (Barron’s)

- Most S&P 500 Companies Have Reported Second-Quarter Earnings. Here’s What We’ve Learned So Far. (Barron’s)

- The market is underpricing the possibility of a vaccine, Goldman Sachs strategists say (MarketWatch)

- Brazil central bank cuts key rate to record low (MarketWatch)

- Oil Stocks are Surprising Winners (Barron’s)

- Millennials are snatching up ‘cheap old houses’ via Instagram (New York Post)

- Quicken Loans Parent Prices IPO at $18 (Wall Street Journal)

- Instagram’s Short-Video Feature Reels Debuts in U.S. as Threats to TikTok Mount (Wall Street Journal)

- Teva Pharmaceutical: Value at Last (Wall Street Journal)

- Deadline Nears for Stimulus Talks With Wide Gap Between Parties (Bloomberg)

- Barclays analyst breaks down why Pioneer is a top pick in the slumping oil sector (Business Insider)

- Why Devon Energy Stock Could Rise Another 50% to 75% Higher Into 2021 (24/7 Wall Street)

- COVID-19 vaccine approval could stall tech stocks boom: Goldman (Reuters)

- HollyFrontier posts smaller-than-feared loss as demand picks up (Reuters)

- States demand Iasias response probes as nearly 2 million are still without power (Fox Business)

- Jeff Bezos Sells Another $3B Worth Of Amazon Shares (Benzinga)

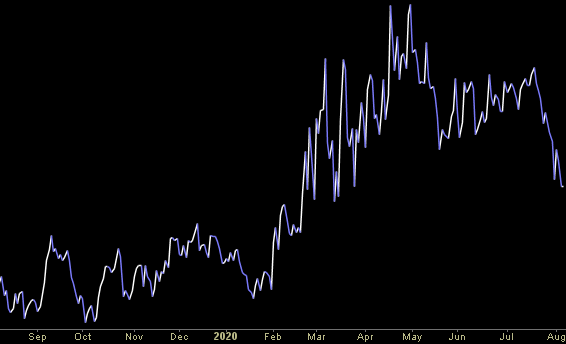

The Tim McGraw, “I Like It, I Love It” Stock Market (and Sentiment Results)…

This week I chose Country Legend Tim McGraw’s song, “I Like It, I Love It” to embody the current sentiment of the Stock Market. While anyone who has been around knows – it can change on a dime – right now, market participants are enjoying the ride and singing along:

But I like it, I love it, I want some more of it

I try so hard, I can’t rise above it… Continue reading “The Tim McGraw, “I Like It, I Love It” Stock Market (and Sentiment Results)…”

Tom Hayes – BBC News (World) Appearance – August 5, 2020

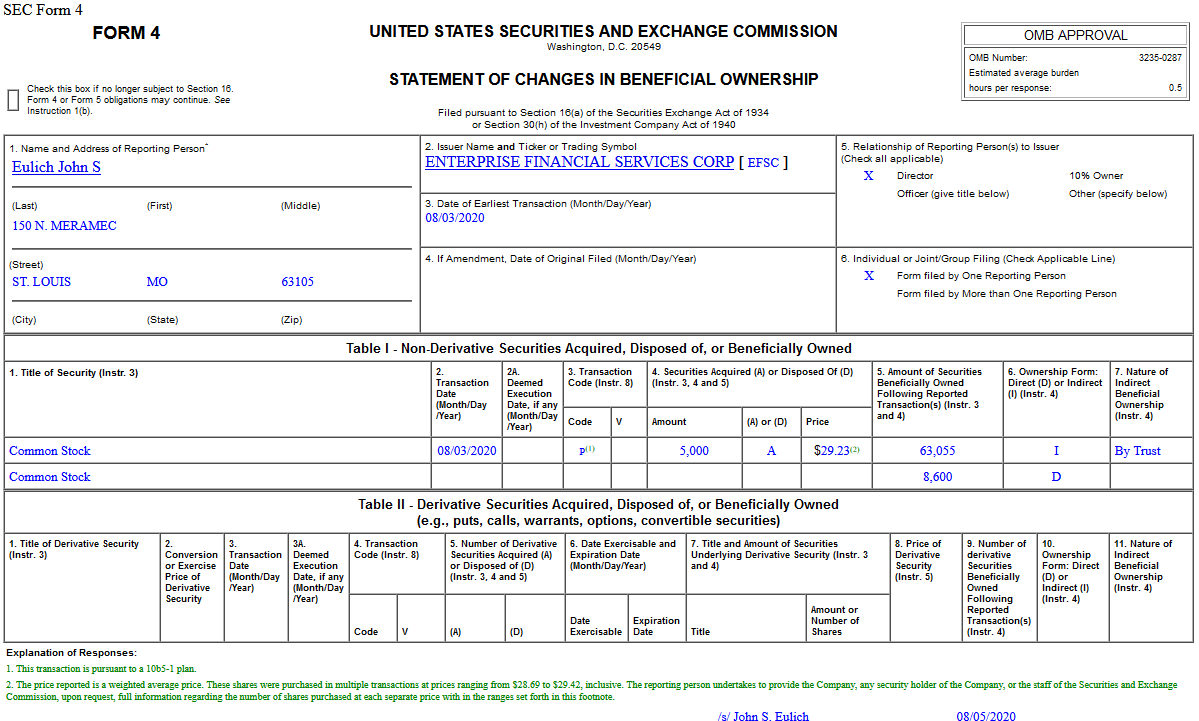

Insider Buying in Enterprise Financial Services Corp (EFSC)

Where is money flowing today?

Be in the know. 15 key reads for Wednesday…

- Warren Buffett plows another $337 million into Bank of America, boosting his stake to nearly 12%. (Business Insider)

- Forget Spas and Bars. Hotels Tout Housekeeping to Lure Back Travelers. (New York Times)

- Disney, Staggered by Pandemic, Sees a Streaming Boom (New York Times)

- U.S. and China Will Meet to Discuss Compliance With Trade Agreement (Barron’s)

- Treasury yields inch higher as eurozone retail sales returns to pre-crisis levels (MarketWatch)

- Winners and Losers Are Emerging in Airline Stocks (Barron’s)

- America’s Trade Gap Narrowed in June for First Time in Four Months (Bloomberg)

- J&J reaches deal with U.S. for 100 million doses of coronavirus vaccine (CNBC)

- The Fed is expected to make a major commitment to ramping up inflation soon (CNBC)

- Isaias causes 2nd-largest power outage in ConEd history: How long recovery may take (Fox Business)

- Fed Vice Chair Clarida still sees the economy staging a comeback this year (CNBC)

- David Einhorn Is Making a Big New Bet. (Institutional Investor)

- Wells Fargo to cut consultancy spend after internal backlash (Financial Times)

- Novavax Says Coronavirus Vaccine Generated ‘Robust Antibody Responses’ In Phase 1 Trial Participants (Benzinga)

- Covid-19 Researchers Hope Monoclonal Antibody Treatments Are a Bridge to Vaccine (Wall Street Journal)