Data Source: Finviz

Be in the know. 13 key reads for Tuesday…

- U.S. Counts Smallest Daily Rise in Coronavirus Cases in Weeks (Wall Street Journal)

- Pelosi, Mnuchin Signal First Glimmer of Progress on Stimulus (Bloomberg)

- Trump says U.S. may have coronavirus vaccine ‘far in advance’ of end of the year (CNBC)

- Bets Against U.S. Dollar Assume Early Virus Vaccine, BofA Says (Bloomberg)

- Ex-Trader Stephen Diggle Bets Big on Oxford’s Tiny Vaccine Maker (Bloomberg)

- Warren Buffett’s Berkshire Hathaway is allowed to double its Bank of America stake to almost 25%. (Business Insider)

- Trump Suggests He Could Suspend Payroll Tax by Executive Order (Barron’s)

- Gilead Will Get a Boost From Covid-Treatment Sales, Citi Says (Barron’s)

- FAA Formally Proposes Fixes for Return of Boeing’s 737 MAX Jets (Wall Street Journal)

- China only fulfils 5% of Sino-U.S. energy trade deal in first half of 2020 (Reuters)

- Hedge funds scour alternative data for edge on Covid and economy (Financial Times)

- Here’s what history tells us about U.S. stocks in a close election race and why the polls matter, Deutsche Bank says (MarketWatch)

- Google Pixel 4a Review: Why Spend $1,000 When You Can Spend $349? (Wall Street Journal)

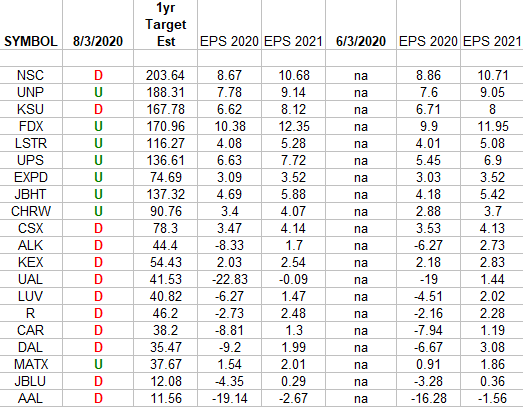

Transports Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Transportation Sector ETF (IYT) holdings. Continue reading “Transports Earnings Estimates/Revisions”

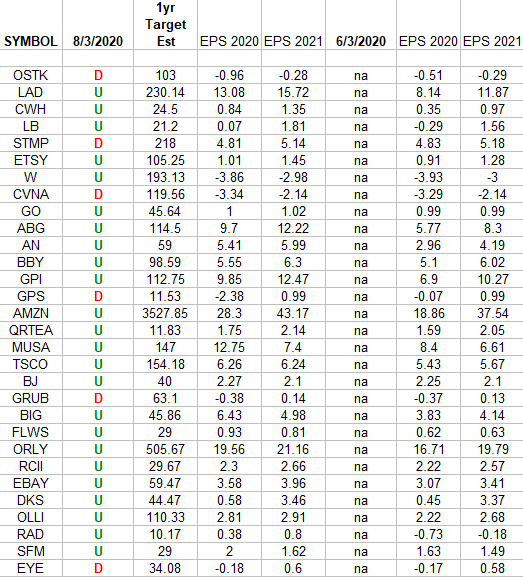

Retail Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 15 key reads for Monday…

- OPEC+ is facing a ‘very delicate, fragile balancing act’ in the oil market, strategist says (CNBC)

- Microsoft to continue discussions on potential TikTok purchase in the United States (Microsoft)

- Kinder Morgan Co-Founder Richard Kinder Bought the Slumping Energy Stock (Barron’s)

- Mnuchin says administration still backs $1,200 stimulus checks as talks continue (CNBC)

- Why stocks will hit new all-time highs within months, according to Fundstrat’s Tom Lee (Business Insider)

- Wall St. analysts are making the unusual move of raising earnings estimates: Morning Brief (Yahoo! Finance)

- AbbVie, Amgen and Takeda start testing drugs as COVID-19 treatments (MarketWatch)

- Warren Buffett’s Berkshire Takes a Turn for the Better (Barron’s)

- Treasury yields tick higher after data highlights recovering Chinese factories (MarketWatch)

- Eli Lilly starts late-stage study of coronavirus drug in nursing homes (CNBC)

- Fed Weighs Abandoning Pre-Emptive Rate Moves to Curb Inflation (Wall Street Journal)

- Consumers, Flush With Stimulus Money, Shun Credit-Card Debt (Wall Street Journal)

- Behind the Vast Market Rally: A Tumbling Dollar (Wall Street Journal)

- America’s Saw Mills Didn’t See This Building Boom Coming (Wall Street Journal)

- Baseball Draws Strong TV Ratings in Opening Week Amid Uncertainty Over Season (Wall Street Journal)

Be in the know. 12 key reads for Sunday…

- Fed Weighs Abandoning Pre-Emptive Rate Moves to Curb Inflation (Wall Street Journal)

- JPMorgan CEO Jamie Dimon’s morning routine: Wake up at 5 a.m. and ‘read tons’ (CNBC)

- Negotiators report progress in COVID-19 aid talks in Congress (MarketWatch)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- The Great American Housing Boom Has Begun (Forbes)

- Kanye West Is Still Trying to Get on the Ballot (New York Magazine)

- GMC Shares Video First Look at 1,000-HP Hummer Supertruck (Maxim)

- The Coronavirus Housing Boom

- Concerns about Waning COVID-19 Immunity Are Likely Overblown (Scientific American)

- How To Become a World Class Poker Player (Podcast) (Bloomberg)

- How Robinhood Makes Money On Free Trades (Podcast) (Bloomberg)

- This 1961 Ferrari 250 GT SWB Berlinetta by Scaglietti, is One of Ferrari and Pininfarina’s Greatest Achievements. (Luxuo)

Be in the know. 20 key reads for Saturday…

- Warren Buffett’s Berkshire Can Acquire Nearly 25% of Bank of America (Barron’s)

- For the First Time Ever, Uncle Sam’s Aid to U.S. Tops Quarterly GDP (Barron’s)

- Investors Are Too Wary as Earnings Reports Come in Strong (Barron’s)

- SPACs Are All the Rage, but These Private-Equity-Like Vehicles Are Complicated. Here’s What You Need to Know. (Barron’s)

- Warren Buffett Buys Bank of America Stock as Others Hedge. Who’s Right? (Barron’s)

- Microsoft Is Reportedly in Talks to Acquire TikTok (Barron’s)

- How to Invest in China’s Consumer Comeback (Barron’s)

- AT&T Director Stephen Luczo Buys Big Block of Stock (Barron’s)

- Why Brazil’s Stock Market Struggles to Rebound (Barron’s)

- Thinking For Oneself (Farnam Street)

- Berkshire Hathaway’s Great Transformation (Rational Walk)

- China Tries Its Favorite Economic Cure: More Construction (New York Times)

- What Bill Gates and Warren Buffett talk about during COVID-19 (Yahoo! Finance)

- Coronavirus Vaccine Trials Advance in Race for Covid-19 Protection (Bloomberg)

- Elon Musk says ‘China rocks’ while U.S. is full of ‘complacency and entitlement’ (CNBC)

- A Wall Street chief strategist breaks down the 4-part ‘superfecta’ that will keep stocks soaring (Business Insider)

- Ford already bombarded with 150,000 reservations for upcoming SUV (Fox Business)

- Gilead Analysts Downplay Q2 Miss Amid Remdesivir’s COVID-19 Opportunity (Benzinga)

- Private-Equity Firms Discuss Bid for Kansas City Southern (Wall Street Journal)

- A Beloved Connecticut Getaway, Refreshed and Waiting for Summer (Wall Street Journal)

Unusual Options Activity – Royal Dutch Shell plc (RDS-A)

Data Source: barchart

Today some institution/fund purchased 989 contracts of Jan 2022 $20 strike calls (or the right to buy 989,000 shares of Royal Dutch Shell plc (RDS-A) at $20). The open interest was just 221 prior to this purchase. Continue reading “Unusual Options Activity – Royal Dutch Shell plc (RDS-A)”