Data Source: Finviz

Quote of the Day…

Be in the know. 20 key reads for Friday…

- Third Plenum Promises to Fix “Insufficient Demand”, Week in Review (chinalastnight)

- Third Plenum Communique: CN to Implement Measures to Prevent & Resolve Risks in Property, Local Debts, Small/ Medium Financial Institutions, Others (aastocks)

- Why the Fed Should Cut Rates Now—Not Wait Until September (wsj)

- Big Tech shares lose lustre as US market rocked by violent rotation (ft)

- Why Income Seekers Should Consider Buying High Yield Dividend Stocks Now (barrons)

- American Express Profit Rises 39% as Affluent Consumers Keep Spending (barrons)

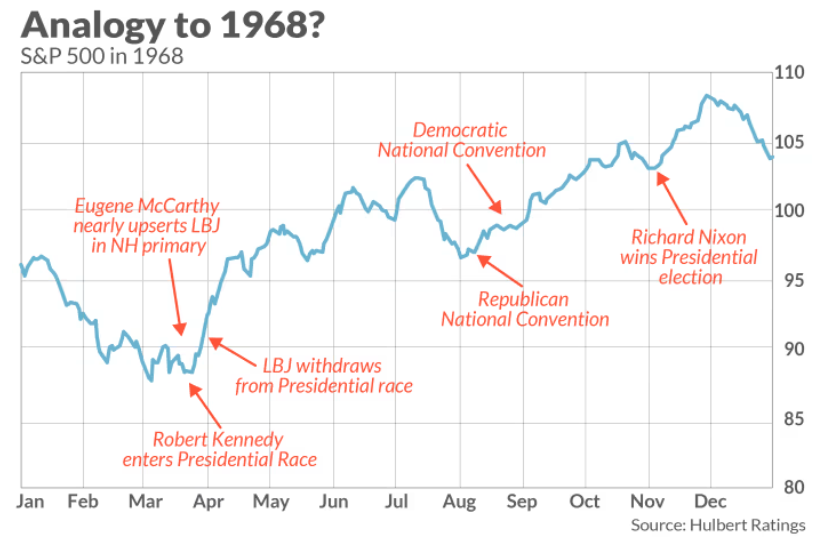

- Here’s how stocks performed the last time a president ended a re-election bid — in 1968 (marketwatch)

- This bearish strategist says there is a bubble in artificial-intelligence stocks, and it could be about to burst (marketwatch)

- Small-cap stocks are perking up. Here’s how to pick winners. (marketwatch)

- Citi advises investors to ‘election proof’ their portfolios — here’s how (marketwatch)

- Ford to Invest $3 Billion in Canada to Boost F-Series Pickup Production (wsj)

- Homeowners Couldn’t Build Pools Fast Enough During Covid. The Tide Might Be Turning. (wsj)

- Get Ready to Pay More for Less-Reliable Electricity (wsj)

- Amazon Prime Day 2024 breaks record, bumps US online sales to $14.2B (nypost)

- Why Is the Oil Industry Booming? (nytimes)

- More Gas Cars and Trucks, Fewer E.V.s as Automakers Change Plans (nytimes)

- China’s Leaders Offer High Hopes, but Few Details for Road to Recovery (nytimes)

- Millionaires Outpriced by Billionaires Flock to Florida’s Fort Lauderdale (bloomberg)

- High-tariff push roils Shein, Temu operations in South Africa, EU, other markets (scmp)

- BABA Demands Each Biz to Have ‘Sense of Operation’ & Further Clarify Focus of Inputs – Report (aastocks)

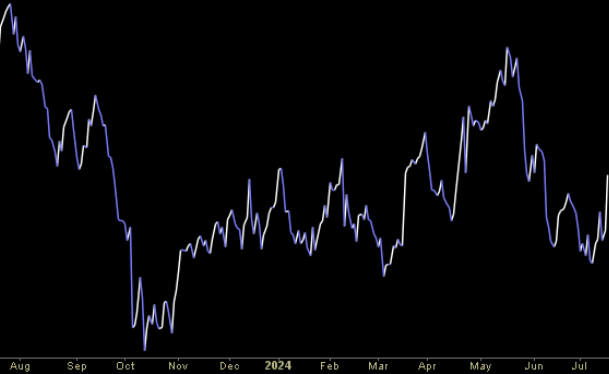

Where is money flowing today?

Quote of the Day…

Be in the know. 30 key reads for Thursday…

- Analysts believe China is more likely to have “positive” trade outcomes under a Trump presidency, given his “transactional nature.” (cnbc)

- China’s biggest money manager says fears about growth, corporate earnings excessive (scmp)

- Why Intel’s stock avoided the semiconductor sector’s worst selloff in four years (marketwatch)

- China’s biggest ETFs see huge inflows in latest sign of state buying amid third plenum (scmp)

- Third Plenum Communique: CN to Implement Measures to Prevent & Resolve Risks in Property, Local Debts, Small/ Medium Financial Institutions, Others (aastocks)

- Initial Jobless Claims in US Increase by Most Since Early May (bloomberg)

- Trump-Vance Administration Could Herald New Era for Dollar (nytimes)

- Full text: Communique of the Third Plenary Session of the 20th Central Committee of the Communist Party of China (people.cn)

- Ford Is Adding Capacity. Super Duty Trucks Are Seeing Surging Demand. (barrons)

- Google Is The Great Tech Disrupter. AI Upstarts Have It In Their Crosshairs. (investors)

- ECB Keeps Rates on Hold Having Forged Ahead of Fed With a June Cut (barrons)

- Amazon Has a $46 Billion ‘Hidden Gem’ to Boost Revenue (barrons)

- Alibaba, Tencent and Other Emerging Market Stocks This Investing Pro Likes (barrons)

- Delta Air Lines Director Buys Large Block of Stock (barrons)

- Magnificent 7 Stocks Got Hammered. Why It’s Not Time to Buy the Dip, and 4 Other Things to Know Today. (barrons)

- Third Plenum Communique: CN to Deepen Financial & Taxation Reform, Increase Capacity of Opening-up Through Expanding Int’l Co-op (aastocks)

- Bank Stocks Celebrate Return of M&A, Ignore the Health of the Consumer (barrons)

- The Smallest Stocks Have Staged an Epic Rally. Here’s What to Do Next. (barrons)

- Country Music Is Booming Again. This Time, the Fans Are in Charge. (wsj)

- Ray-Ban Maker EssilorLuxottica to Buy Supreme Brand for $1.5 Billion (wsj)

- Foreign Buyers of U.S. Homes Pay Record Prices, but Sales Dwindle (wsj)

- (China) Officials reaffirmed a 5% growth target for this year (wsj)

- Two top Fed officials hint rate cuts could come this year as inflation cools (nypost)

- GM to increase production of high-performance Cadillac Escalade V8 SUV (cnbc)

- Can Boeing get back to its glory days? (cnbc)

- U.S.-China tensions are not a ‘new Cold War,’ veteran Singapore diplomat Bilahari Kausikan says (cnbc)

- Is the Worst Over for New York Offices? (wsj)

- Big central banks are starting to cut rates, slowly (reuters)

- Ford pivots from EV plans to heavy-duty trucks at Canada facility (finance.yahoo)

- CPC Central Committee adopts resolution on further deepening reform comprehensively (people.cn)

‘Sea Change’ Activated! Stock Market (and Sentiment Results)…

In my last few public appearances – since late June – I had been saying we are on the “cusp of a sea change” (un-magnificent 493 would outperform the magnificent 7 in 2H 2024): Continue reading “‘Sea Change’ Activated! Stock Market (and Sentiment Results)…”