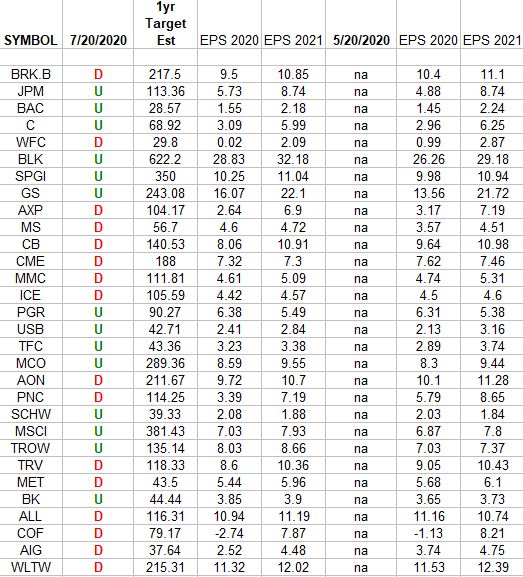

Data source: Finviz

Financials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Financials Sector ETF (XLF) top 30 weighted stocks. Continue reading “Financials (top 30 weights) Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

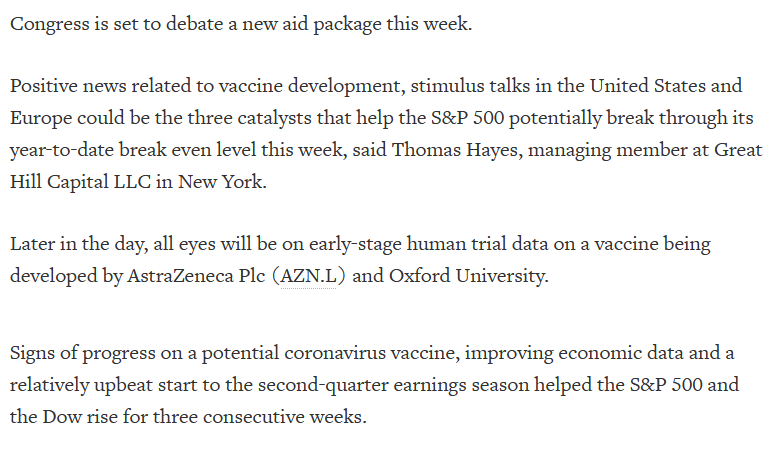

Tom Hayes – Quoted in Reuters article – 7/20/2020

Thanks to Devik Jain and Medha Singh for including me in their article on Reuters today. You can find it here:

Be in the know. 8 key reads for Monday…

- Barron’s Picks And Pans: Dollar General, IAC, Wells Fargo And More (Benzinga)

- Congress to Start Negotiations on Next Round of Coronavirus Aid (Wall Street Journal)

- Face Masks Really Do Matter. The Scientific Evidence Is Growing. (Wall Street Journal)

- Halliburton’s stock swings higher after reporting surprise profit but revenue that missed expectations (MarketWatch)

- High-Yield Hunger Should Give Cruise Lines a Lifeline Through at Least Mid-2021 (Barron’s)

- Chevron picks Noble in biggest U.S. energy deal since the oil crash (CNBC)

- The U.S. Dollar Index Is Poised to Plunge (Barron’s)

- How quickly is Europe’s economy rebounding? (Financial Times)

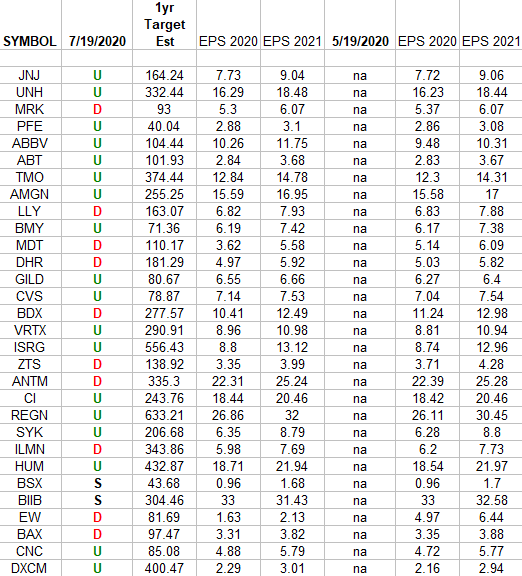

Healthcare (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the 2020 and 2021 earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”

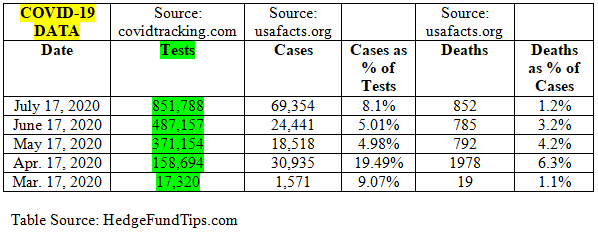

COVID-19 Data/Testing (and commentary)…

From April 17, 2020 (when testing infrastructure was fully up and running) to July 17, 2020, COVID-19 testing is up ~436%. Over the same dates, cases are up only ~124%. While it is correct to say we have “record cases,” it pales in comparison to the growth of “record testing.”

What is even more noteworthy over the same dates is the fact that Deaths (as a percent of cases) plummeted from 6.3% to 1.2% showing TREATMENT SUCCESS at a “Record High.”

We all want to see BOTH cases and deaths come down as fast as possible through the implementation of the “Holy Trinity” (Masks in Public, Social Distancing, Hygiene/Washing Hands), continued Treatment Success/improvement/discoveries, and possibly a Vaccine sooner than expected. However, in the interim, the data shows there is good reason to be cautiously optimistic (but not complacent).

Be in the know. 10 key reads for Sunday…

- Wells Fargo Stock Has Been Beaten Down. It Could Be a Buy. (Barron’s)

- COVID-19 Data/Testing (and commentary) (Hedge Fund Tips)

- From 1720 to Tesla, FOMO Never Sleeps (Wall Street Journal)

- Rep. John Lewis, Civil Rights Icon and ‘Conscience of Congress,’ Dies at 80 (Time)

- Mortgage Loan Servicer Ocwen Soars on Net Income (24/7 Wall Street)

- G20 officials pledge to keep cooperating to bolster global economy (Reuters)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- The risks of keeping schools closed far outweigh the benefits (Economist)

- A Conversation With Gary Cohn (NPR Planet Money)

- Ben Bernanke and Janet Yellen Give Republicans in Congress a Lesson on Coronavirus Economics (The New Yorker)

Quote of the Day…

Be in the know. 20 key reads for Saturday…

- Walgreens and 3 Other Companies That Raised Dividends This Week (Barrons)

- Are You Ready for a Cyclical Reversion? (WisdomTree)

- European Leaders Seek Historic Virus Bailout Deal at First Gathering in Months (Wall Street Journal)

- Sunscreen Chemicals Accumulate in Body at High Levels (Wall Street Journal)

- ‘Let’s Go Fly, for God’s Sake.’ Behind American Airlines Chief’s All-In Strategy (Wall Street Journal)

- N95 Face Mask Makers Ramp Up Production to Meet U.S. Covid-19 Demand (Wall Street Journal)

- Where to Find the Finest Fish Tacos (Wall Street Journal)

- FTC Considering Deposing Top Facebook Executives in Antitrust Probe (Wall Street Journal)

- Press a Button and This Plane Lands Itself (Wall Street Journal)

- Mnuchin Calls for Congress to Pass More Stimulus This Month (New York Times)

- Which stores require masks? See the full list. (USA Today)

- Banksy tags coronavirus-inspired graffiti as Italy returns his stolen artwork to France (USA Today)

- Here’s why all of the S&P 500’s gains since April came after the market closed: JP Morgan (MarketWatch)

- Travel Is Bouncing Back, but Tourists Stick Close to Home (Wall Street Journal)

- WHO Says Brazil’s Covid-19 Curve Has Plateaued (Bloomberg)

- Netflix Goes All-In With Ryan Gosling, Chris Evans, and the Russo Brothers (Vanity Fair)

- Watch a 3D Printer Spit Out an Entire Two-Story House (Futurism)

- Sam Zell talks REITs – NYU Summer Series (YouTube)

- The Complete Breakdown of Berkshire Hathaway’s Subsidiaries (vintagevalueinvesting)

- How Can We Be Sure That Value Investing Will Continue To Work? (Forbes)