Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 17 key reads for Friday…

- Warren Buffett may have found a stock he likes — his own (MarketWatch)

- China’s Economy Rebounds From Coronavirus, but Shares Fall (New York Times)

- U.S. housing starts accelerate in June (Reuters)

- U.S. Retail Sales Rose 7.5% in June as Stores Reopened (Wall Street Journal)

- How Banks Could Turn Covid Pain Into Eventual Gains (Wall Street Journal)

- Robinhood Is Democratizing Markets, Not Disrupting Them (Bloomberg)

- 5 Biopharma Stocks That Are Affordable And Growing (Barron’s)

- These Are Netflix’s 10 Most Popular Original Movies (Bloomberg)

- In a Republican Presidential Sweep, These Stocks Would Win (Barron’s)

- In a Democratic Presidential Sweep, These Stocks Would Win (Barron’s)

- Pelosi says $1.3T ‘not enough’ for coronavirus relief as reopenings stall (Fox Business)

- US 30-year mortgage rate falls below 3% for first time (Financial Times)

- Johnson & Johnson Says Late-Stage Coronavirus Vaccine Trials Moved Ahead To September (Benzinga)

- CEO of world’s biggest money manager says wearing masks will help economy avoid another shutdown (CNBC)

- The last time this happened, homebuilding stocks rallied double digits: Analyst (CNBC)

- Goldman Sachs Has 3 Top Aerospace and Defense Stocks to Buy Before Earnings (24/7 Wall Street)

- 7 Unpopular Value Stocks That Could Surge Into 2021 (24/7 Wall Street)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Where is money flowing today?

Be in the know. 25 key reads for Thursday…

- Warren Buffett Sees Natural Gas Sticking Around for a Long Time (Bloomberg)

- Domino’s Earnings, Sales Beat As At-Home Dining Stays Strong (Investor’s Business Daily)

- Morgan Stanley Crushes Views, BofA Beats, Capping Big Bank Results (Investor’s Business Daily)

- How A Medical Brainiac CEO Turned Brilliance Into Billions (Investor’s Business Daily)

- How Dell Can Spin off VMware (Barron’s)

- Dividend Aristocrats Roar Back After Early-Year Stumbles. These 10 Recently Raised Their Payouts. (Barron’s)

- OPEC+ move to taper output cuts may ‘keep a floor’ under prices (MarketWatch)

- Wall Street Defends Delta Stock After Steep Loss (Barron’s)

- Meet the man who’s been behind nearly every evolution of the fund industry for two decades (MarketWatch)

- J&J to start Phase 1 trial for coronavirus vaccine candidate next week (MarketWatch)

- All Walmarts, Sam’s Clubs to require shoppers wear masks (New York Post)

- Traders Are Betting the Fed’s Bond-Buying Binge Has Just Begun (Bloomberg)

- AstraZeneca Pressure Mounts as Investors Await Oxford Vaccine Data (Bloomberg)

- Greenwich Mansions With Pools Are All the Rage in Pandemic Era (Bloomberg)

- Billionaires Hunt Real Estate Bargains in Shadow of Pandemic (Bloomberg)

- Goldman Puts Capital Fears to Bed for Now, With Help From Fed (Wall Street Journal)

- China Is First Major Economy to Return to Growth Since Coronavirus Pandemic (Wall Street Journal)

- Consumer Appetite for Cars, Homes Bolsters U.S. Economy (Wall Street Journal)

- U.S. Industrial Production Picked Up Again in June (Wall Street Journal)

- Coronavirus Has Americans Hooked on Canned Tuna, and Producers Are Playing Catch Up (Wall Street Journal)

- The Billion-Dollar Broker Who Managed a Nation’s Oil Wealth (Bloomberg)

- Fauci bullish on prospects for U.S. vaccine, not worried about China winning race (Street Insider)

- China says will stick with U.S. trade deal (Reuters)

- Influencers with Andy Serwer: David Rubenstein (Yahoo! Finance)

- Six films to watch this week (Financial Times)

The Eagles, “Long Run” Stock Market (and Sentiment Results)…

This week we selected a legendary song from the Eagles entitled, “The Long Run” to embody the theme of our stock market commentary. The specific lyrics we want to focus on are:

You can go the distance

We’ll find out

In the long run (In the long run)

We can handle some resistance…

As Glenn Frey so eloquently sang, “We can handle some resistance…” Right now, we are knocking on resistance at the level that would make the S&P 500 go positive for the year. It is the second time we are knocking and we will find out if the door is finally opened. If so, it would not be unreasonable to fill the late February gap pointed out above.

On Tuesday, I was invited on CNBC Indonesia to talk about the U.S. stock market and recovery. Thanks to Maria Katarina and Yoliawan Hariana for having me on. In this segment I cover the following issues:

- U.S./China Relations

- U.S. Stock Market Overview and Current Outlook

- COVID spikes/declines/implications/resolutions.

- Value vs. Growth

- Emerging Markets Outlook/History

- U.S. Dollar

- Hedges For Inflation

- Thoughts on Gold

- Thoughts on safety

- Banks

- Commodity Trends and Outlook

- End of year Stock Market Outlook

- Great Rotation

On Monday, I was on Fox Business, “The Claman Countdown.” Thanks to Liz Claman and Ellie Terrett for having me on. In this segment I cover the following issues:

- Growth/Tech versus Value/Cyclicals.

- Under what conditions do each group outperform?

- Banks

On Tuesday I was on CGTN America. Thanks to Mike Walter and Zeina Al-Shaib for having me on. In this segment I cover the following issues:

- China Recovery/Data

- COVID Data/Resolution

- Economic Surprise Index

“Sell the rumor, Buy the news”

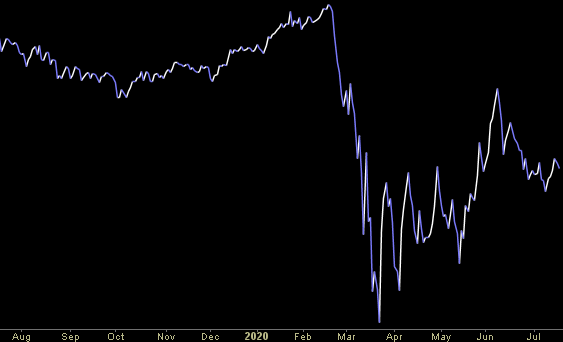

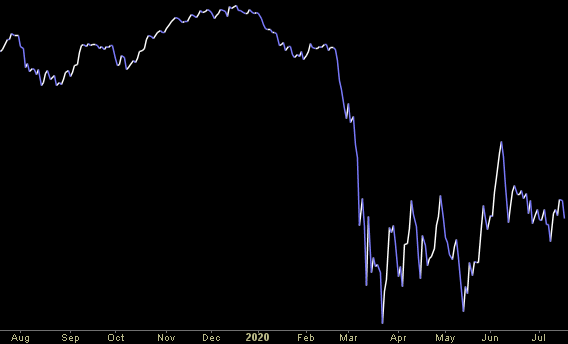

In the past few weeks we have been talking about the opportunity in banks – with emphasis on Wells Fargo. The thesis, (which you can read below) is that once the bad news (dividend cut and huge credit provisions) was out and fully “kitchen sinked” there would be few sellers left. So far the thesis is playing out:

It may not be a straight line up, but I anticipate this movie plays out well over time – as it has many times before.

In case you haven’t turned on a TV in the past few weeks (and especially days), this is not a popular point of view:

In last week’s note we also added further color from Warren Buffett’s interview (the last time Wells cut their dividend by 85% – this time was only 80%!) in 2009 (mid-way down the page):

The AC/DC “Back in Black” Stock Market (and Sentiment Results)…

On CNBC London (Wednesday morning) I talked about how due to the new CECL (pronounced Cecil) accounting requirements, banks were essentially required (for the first time) to take 100% of their expected credit losses for the entire cycle all at once and UP FRONT. They did that in this week’s earnings reports. Thanks to Sophie Rose for having me on the show. You can view the segment here:

The CFO of Wells Fargo was on CNBC America at 3pm – effectively saying he believes they are 100% provisioned at this point. A fancy way of saying they “kitchen sinked” everything now so they can beat like expectations like crazy moving forward. The market is beginning to sniff this out. You can view Wilfred Frost and Sara Eisen’s interview with WFC CFO John Shrewsberry here:

“We believe that we’ve captured all the loss content (in the portfolio).”

“The Contrarian Trade”

This week, Bank of America put out their monthly survey to ~200 asset managers that collectively run ~$500B AUM. We did a summary of the findings on Tuesday (which you can read below), but here are the key findings that stood out to me:

•Conviction in the recovery is low, just 14% saying it will be ‘V’ shaped.

•Cash up to 4.9% from 4.7%.

•74% say long US tech stocks are the most “crowded trade” – the most in the survey’s history.

As I covered in the segment with Liz Claman on Monday, cash flows into tech/growth when there is fear that the recovery will be slow and uneven (end of June/early July when Sunbelt cases spiked). Cash flows into cyclicals/value when it looks like the recovery will be fast (cases coming down like in May).

In my view “V” shaped is code for “Vaccine” and now that we have a considerable number of contenders exceeding timelines on expectations, money is beginning to move into cyclicals again this week.

Click Here To See All The Vaccines/Treatments and Timelines on Bloomberg

So with cash increasing, conviction decreasing, and overcrowding in tech, Bank of America put out a contrarian trade (which we have been discussing in recent notes). As you can read in my summary below, BofA says,for a contrarian trade:

Short Tech Stocks and Buy Banks and Energy

I agree with the latter as you can review in my previous weeks’ notes and VideoCast/Podcasts, but the former has to be nuanced. While I think cyclicals can and will outperform in the early stages coming out of the recession – as is historical precedent, I do not think tech is a blanket short. It is nuanced and outperformance of value/cyclicals does not have to be a zero sum game. Many tech stocks will perform even if/when cyclicals begin to outperform.

July Bank of America Global Fund Manager Survey Results (Summary)

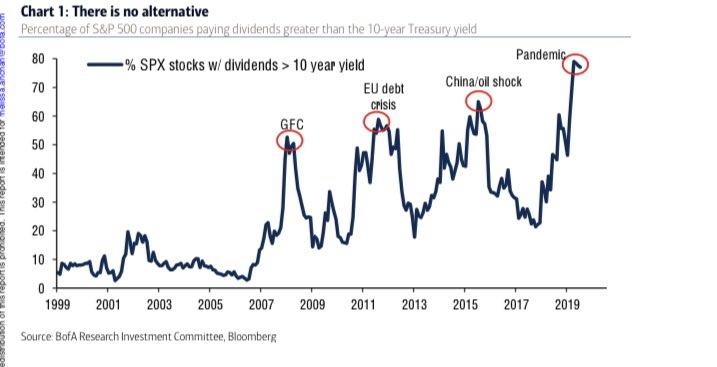

TINA – “There is no Alternative”

I came across this chart from Bank of America to re-emphasize a point I made in recent weeks. At each of these points (when the percentage of stocks in the S&P 500 with dividend yields greater than the 10 year Treasury exceeded 50%), it has paid to get and hold equity exposure.

I came across this chart from Bank of America to re-emphasize a point I made in recent weeks. At each of these points (when the percentage of stocks in the S&P 500 with dividend yields greater than the 10 year Treasury exceeded 50%), it has paid to get and hold equity exposure.

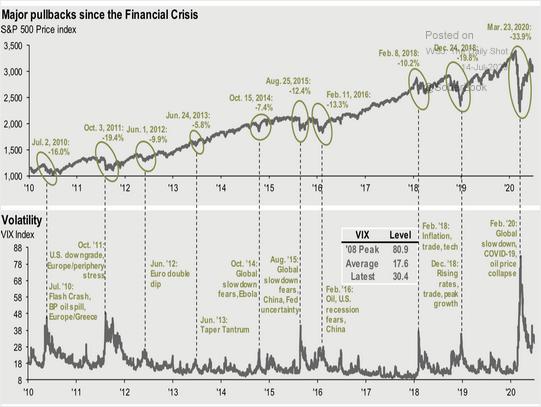

This also lines up with periods of declining volatility (following a crisis spike):

Source: Wall Street Journal

Now onto the shorter term view for the General Market:

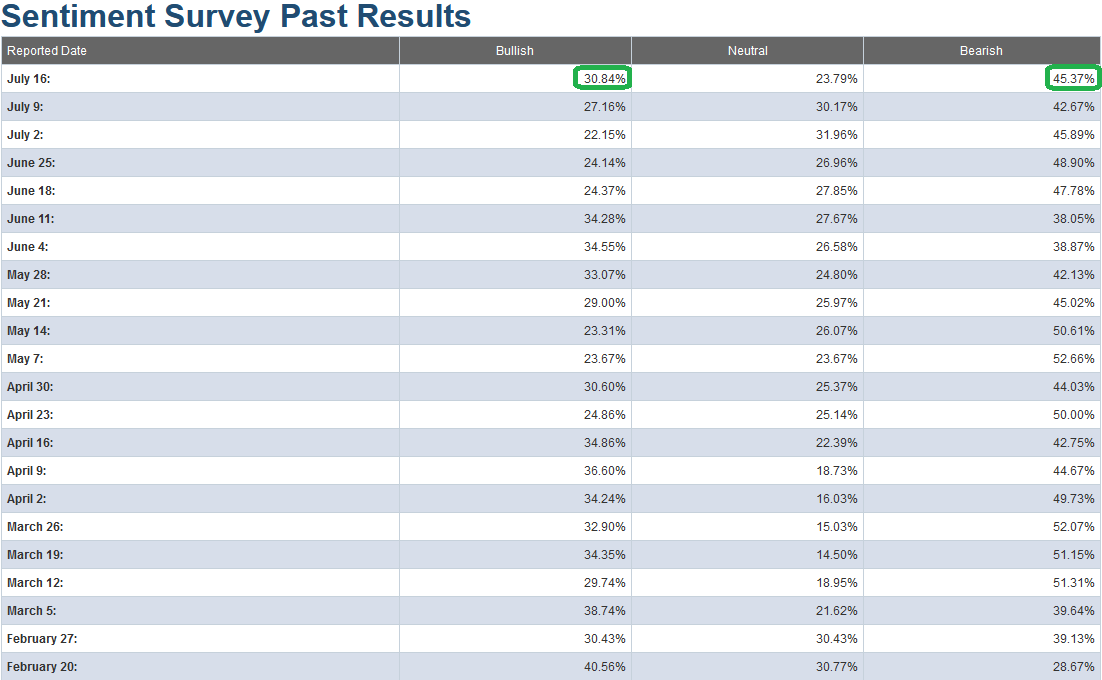

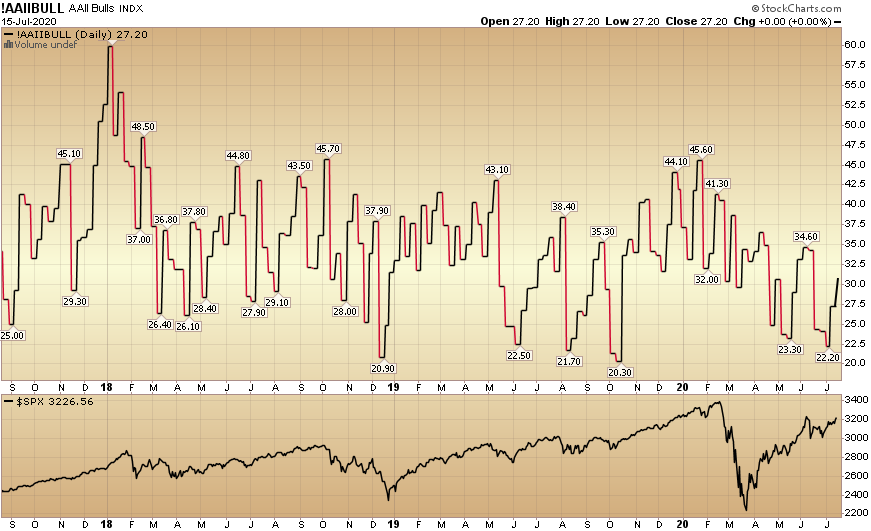

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 30.84% from 27.15% last week. Bearish Percent rose to 45.37% from 42.67% last week. These are levels that historically still favor being a buyer versus a seller. It is nice to finally see the extreme pessimism/skepticism of recent weeks beginning to thaw, but we have a long way to go until we are anywhere near euphoric levels on this measure (despite being at a four week high). Until then, we can climb the “wall of worry.”

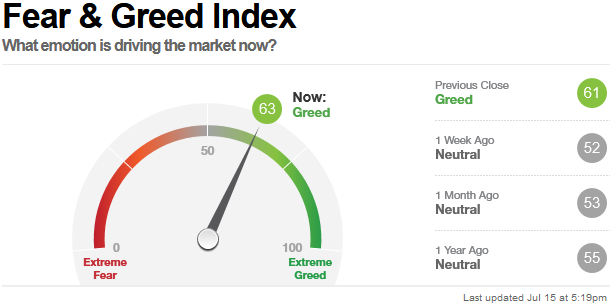

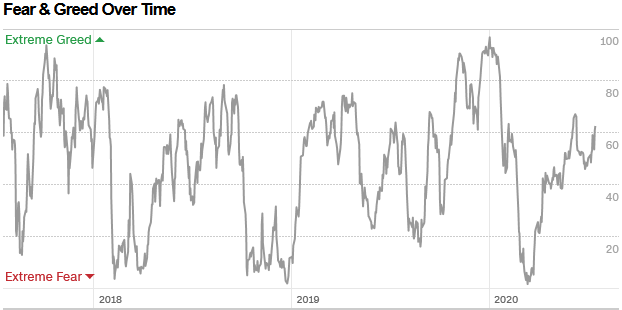

The CNN “Fear and Greed” Index moved up from 53 last week to 63 this week. Despite the market moving up >40+% off the lows, we have still not hit an extreme/euphoric level (>80/90) yet. You can learn how this indicator is calculated and how it works here: (Video Explanation)

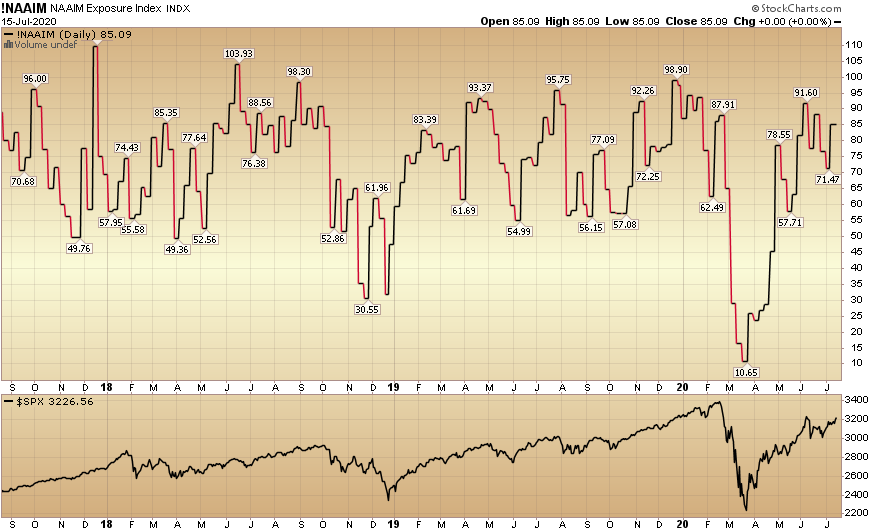

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) rose from 71.47% equity exposure last week, to 85.09% this week.

Our message for this week:

We remain very constructive in the intermediate term and will take advantage of any additional buying opportunities in laggard/cyclical names – should they arise over the Summer/Fall.

In the interim we will hold what we have and shave only in the event we DO hit levels of euphoria that we have not seen since February (we are not there yet).

Until next time:

You can go the distance

We’ll find out

In the long run…