- Hong Kong stocks rebound as Beijing ramps up support for institutional buying (scmp)

- The American Worker Is Becoming More Productive (wsj)

- FMC shares pop as KeyBanc says selloff is overdone (streetinsider)

- What stocks’ worst stumble since 1952 in the final days of 2024 may mean for 2025 (marketwatch)

- Hindenburg Research shorts Carvana, calling company’s turnaround a ‘mirage’ (cnbc)

- China’s central bank plans policy overhaul as pressure mounts on economy (ft)

- Baidu’s Robin Li predicts ‘exponential’ boom in AI apps in 2025 (scmp)

- Roaring Kitty’s Stock Memes Can’t Fix Unity Software (barrons)

- Why the U.S. economy is still strong despite the Fed’s 2022-’23 rate hikes (marketwatch)

- The Debt Ceiling Makes a Comeback. What It Means for Bonds. (barrons)

- <Research>M Stanley: BABA-W’s Full Sale of SUNART RETAIL Expected to Enhance Yr-end Shareholder Returns (aastocks)

Tom Hayes – Quoted in Reuters article – 1/2/2025

Thanks to Jaspreet Singh, Pranav Kashyap and Johann M Cherian for including me in their article on Reuters. You can find it here:

Click Here to View The Full Reuters Article

Where is money flowing today?

Quote of the Day…

Be in the know. 15 key reads for Monday…

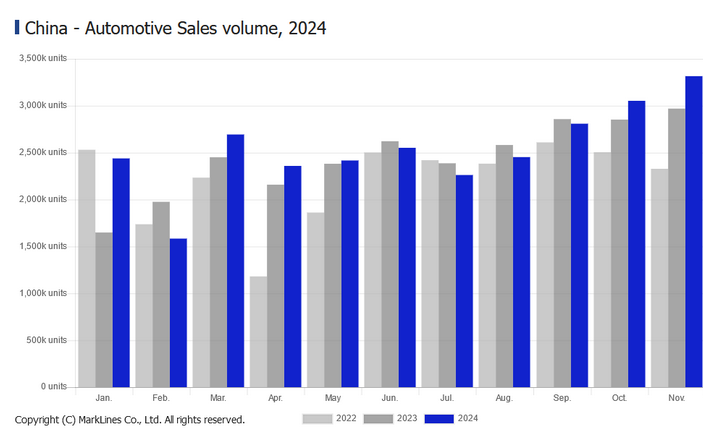

- Chinese EV makers BYD, Nio, Li and XPeng end 2024 on a sales high (marketwatch)

- Jobless claims drop to 8-month low to end 2024. Low U.S. unemployment fuels economy. (marketwatch)

- Natural gas prices spike on forecasts of colder than expected winter (foxbusiness)

- The Bull and Bear Case for 2025 (nytimes)

- PBOC Seen Delaying Reserve Ratio Cut After $233 Billion Cash Injection Last Month (bloomberg)

- China E-Commerce Giant Alibaba Sells Stake In Retail Firm Sun Art To Focus On Core Business (investors)

- Drug-Trial Results Could Shake Up Pharma Stocks in 2025. Watch Eli Lilly, Pfizer, and More. (barrons)

- The U.S. Dollar Is Riding High. Trump Could Put an End to All That. (barrons)

- 2025’s Five Highest Yielding Dogs of the Dow Could Explode Higher (247wallst)

- Stock Bears Are Going Extinct. Time to Worry? (bloomberg)

- China’s Xi Jinping Nods to ‘External Uncertainties’ in New Year’s Speech. Weeks before Trump takes office, country’s leader seeks to shore up confidence that its economy can withstand threats (wsj)

- The Levi Strauss Heir Elected to Save San Francisco (wsj)

- Beijing & Guangzhou Home Sales Rise In 2024, Tariff Concerns Lead To Risk Off (chinalastnight)

- Mexico, Betting Trump Is Bluffing on Tariffs, Sees an Opportunity. (nytimes)

- Why the Dow had such a miserable December versus other indexes (marketwatch)

No Value in Value? Stock Market (and Sentiment Results)…

In a year like 2024, it is easy to forget the fact that since 1927 “Value” has outperformed “Growth” by 4.4% per year: Continue reading “No Value in Value? Stock Market (and Sentiment Results)…”

Quote of the Day…

Be in the know. 11 key reads for New Year’s Day…

- 5 Value Stocks That Could Get a Bump From Activist Investors (barrons)

- Why the Dow had such a miserable December versus other indexes (marketwatch)

- Boeing and 6 More Contrarian Stocks for 2025 (barrons)

- Credit Spreads Haven’t Looked This Good Since the 2000s. Can They Get Better? (wsj)

- A Corvette, a Rolls-Royce, a Lowrider Legend: Our 10 Favorite My Ride Cars of 2024 (wsj)

- China’s December Home Sales Stay Flat in Sign of Stabilization (bloomberg)

- PBOC Steps Up Liquidity Injection With New Tools At Year-End (bloomberg)

- US Large Cap Dividend Stocks Should Roll in 2025: Our 4 Favorite Picks (247wallst)

- Forecasting the world in 2025 (ft)

- Alibaba’s Freshippo records 9 straight months of profit, CEO says (scmp)

- Services PMI Beats, Happy New Year! (chinalastnight)