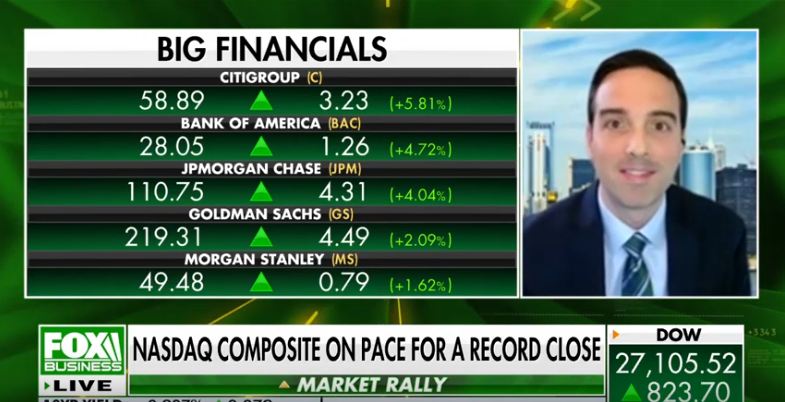

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 6, 2020

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 33

Article referenced in VideoCast above:

The Morgan Wallen “Chasin’ You” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 23

Article referenced in podcast above:

The Morgan Wallen “Chasin’ You” Stock Market (and Sentiment Results)…

Where is money flowing today?

Hedge Fund Trade Tip (PMN) – Position Management Notification

Be in the know. 20 key reads for Friday…

- Stocks Take Off as Jobs Come Back (Barron’s)

- China to Allow Foreign Airlines to Restore Some Flights After U.S. Pressure (Wall Street Journal)

- Time to Buy Emerging Markets? (Barron’s)

- Oil Rebounds as Market Waits for Production Cuts (Barron’s)

- Oil prices rise as OPEC+ seen setting stage for weekend meeting (MarketWatch)

- Casino Stocks Are Surging as Las Vegas Reopens (Barron’s)

- ‘Europe Finally Got the Message’: Leaders Act Together on Stimulus (New York Times)

- Researchers Retract Study Linking Malaria Pill to Heart Risk (Bloomberg)

- History Suggests the Handshake Will Survive the Pandemic (Bloomberg)

- Is the Coronavirus Really Getting Weaker? (Bloomberg)

- Trump Team Envisions Up to $1 Trillion for Next Stimulus Round (Bloomberg)

- Las Vegas Casinos Reopen With $30-a-Night Rooms on the Strip (Bloomberg)

- 10-year Treasury yield surges above 0.9% after better-than-expected jobs report (CNBC)

- The ‘Inconvenient Fact’ Behind Private Equity Outperformance (Institutional Investor)

- ‘The biggest payroll surprise in history’ — economists react to May jobs report (MarketWatch)

- India Stocks Set for Second Weekly Gain on Easing Lockdown (Bloomberg)

- European Central Bank Ramps Up Stimulus Program Beyond $1.5 Trillion (Wall Street Journal)

- Airlines Add Flights as Travel Slowed by the Coronavirus Starts to Pick Up (Wall Street Journal)

- Americans Are Saving More, but How Long Can It Last? (Wall Street Journal)

- Investors Climb Back Into Riskiest Emerging-Market Bonds (Wall Street Journal)

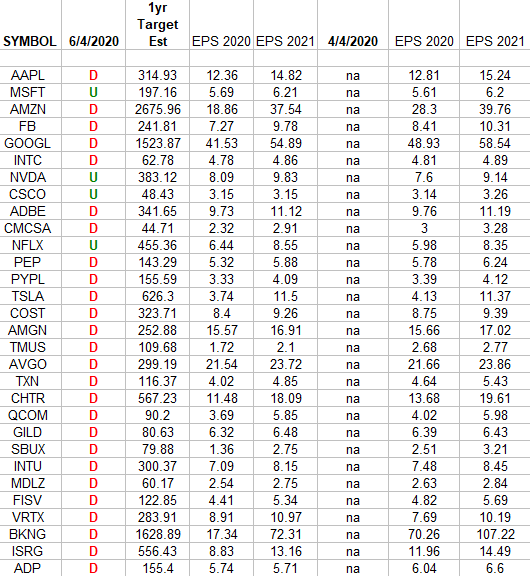

NASDAQ (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted Nasdaq stocks. I have columns for what the 2020 and 2021 estimates were on 4/4/2020 and today. Continue reading “NASDAQ (top 30 weights) Earnings Estimates/Revisions”

Unusual Options Activity – Royal Dutch Shell plc (RDS-B)

Data Source: barchart

Today some institution/fund purchased 1,004 contracts of Jan. 2022 $40 strike calls (or the right to buy 100,400 shares of Royal Dutch Shell plc (RDS-B) at $40). The open interest was 756 prior to this purchase. Continue reading “Unusual Options Activity – Royal Dutch Shell plc (RDS-B)”