Be in the know. 17 key reads for Friday…

- Global Equities Hold Gains as Jobs Figures Land (Barron’s)

- Why China’s Tech Stocks Are Rallying (Barron’s)

- Insurance Stocks Are Cheap. Lincoln Could Double, J.P. Morgan Says. (Barron’s)

- Norwegian Cruise Line CEO: ‘We expect to sail sometime in 2020’ (CNBC)

- Hertz Seeks Lender Leniency or Faces Bankruptcy Within Weeks (Bloomberg)

- Turning Oil Wells Back on Is Trickier Than Shutting Them Off (Bloomberg)

- ‘Who am I to be bold?’: Warren Buffett’s lack of stock purchases worries billionaire investor Leon Cooperman (Business Insider)

- The Defense Haven Isn’t Overcrowded Yet (Wall Street Journal)

- Royal Caribbean Cruises (RCL) says booked position for 2021 within historical ranges (Street Insider)

- What Americans Will Do With Their 11-Year-Old Cars (24/7 Wall Street)

- Top U.S., China trade officials agree to strengthen cooperation (Reuters)

- A Disney resort will partially reopen in America surprisingly soon (Fox Business)

- Michigan governor says auto plants can reopen Monday (MarketWatch)

- Chess Is the New King of the Pandemic (Wall Street Journal)

- Liberty Global, Telefonica to Combine U.K. Units, Creating $39 Billion Giant (Wall Street Journal)

- China’s Auto Market Rumbles Back to Growth (Wall Street Journal)

- ViacomCBS Shares Rise on Earnings Beat, Despite Slumping Revenue (Wall Street Journal)

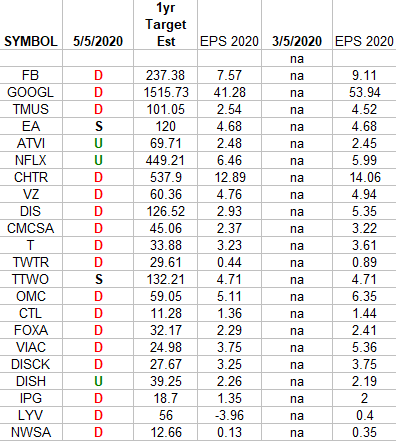

Communication Services Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Communication Services Sector ETF (XLC). Continue reading “Communication Services Earnings Estimates/Revisions”

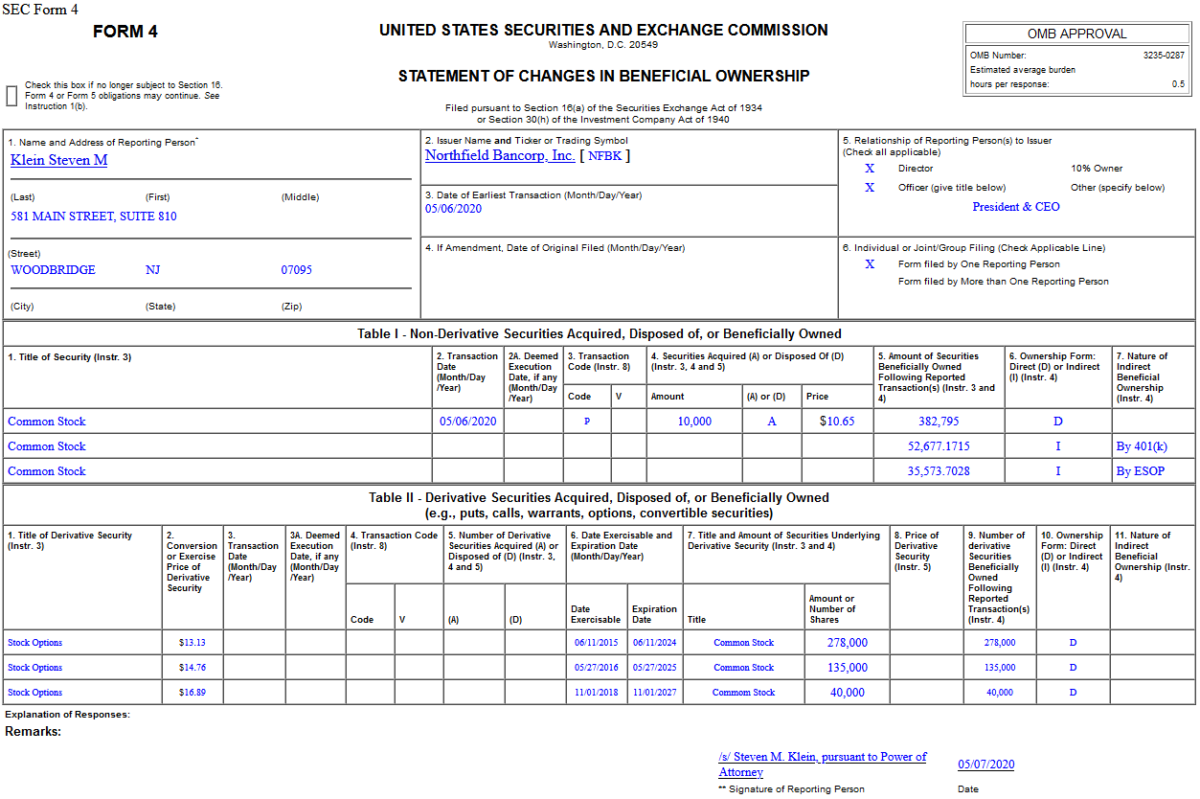

Insider Buying in Northfield Bancorp, Inc. (NFBK)

Quoted in Reuters article Thursday:

Thanks to Nivedita C and Medha Singh for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Where is money flowing today?

Be in the know. 20 key reads for Thursday…

- U.S. oil prices jump more than 8% as Saudi Arabia lifts prices, China crude imports climb (MarketWatch)

- The U.S. economy may already have clawed back 5 million jobs of the 20-million-plus positions eliminated during the pandemic (MarketWatch)

- Jobless Claims Drop,but Remain High (Barron’s)

- 10 Stocks for Right Now (Barron’s)

- Four-Legged City Dwellers Get Their Moment While Humans Are Stuck Inside (Wall Street Journal)

- One Car Maker That Will Emerge Stronger From the Pandemic (Barron’s)

- Nearly Half of Men Say They Do Most of the Home Schooling. 3 Percent of Women Agree. (New York Times)

- The Alarming Rise of Algorithms as Heroes of the Stock Recovery (Bloomberg)

- Mnuchin Spars With Guns N’ Roses Frontman Axl Rose on Twitter (Bloomberg)

- India Looks to Lure More Than 1,000 U.S. Companies Out of China (Bloomberg)

- Look Closely at Risk-Parity Funds’ Different Strategies (Barron’s)

- Germany to Reopen Most of Economy in Coming Weeks as Coronavirus Recedes (Wall Street Journal)

- New York Survey Yields New Insights Into Who’s Getting Infected With Covid-19 (Wall Street Journal)

- Wynn Resorts Details Coronavirus Damage (Wall Street Journal)

- A Stunt Driver Is Making Ford’s Unloved Fox-Body Mustang Cool Again (Bloomberg)

- John Malone Proves Market Wrong Again With Virgin Media Deal (Bloomberg)

- When will hospitals and doctors’ offices be open for normal business again? Experts weigh in (CNBC)

- Ulta to reopen 180 stores on Monday (MarketWatch)

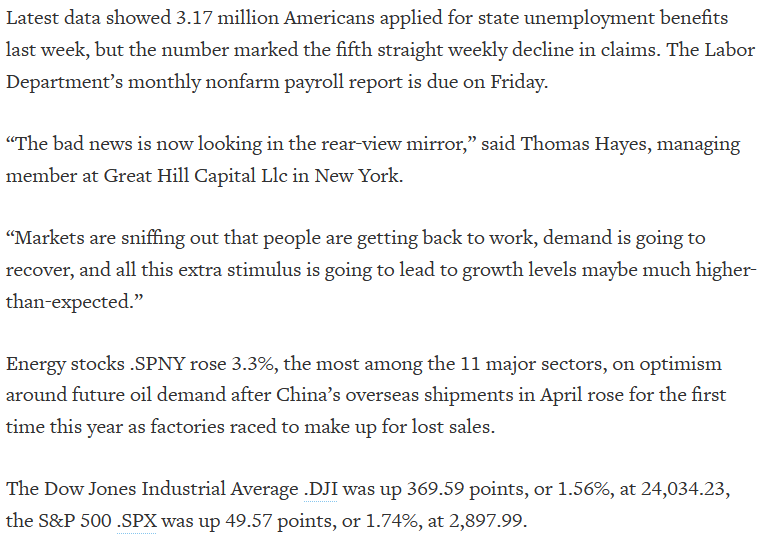

- China trade data lifts futures ahead of jobless claims (Reuters)

- FDA approves coronavirus vaccine candidate for Phase 2 study (Fox Business)

The Chainsmokers “Don’t Let Me Down” Stock Market (and Sentiment Results)…

The song we selected to embody the sentiment of the stock market this week is, “Don’t Let Me Down” by the Chainsmokers. Continue reading “The Chainsmokers “Don’t Let Me Down” Stock Market (and Sentiment Results)…”