- Banksy’s reworking of Claude Monet scene sells for nearly $10M at auction (New York Post)

- A top-ranked JPMorgan strategist says this group of beaten-down stocks will soon make a big comeback (Business Insider)

- Preparing for a Vaccine With Call Options (Barron’s)

- The Stock Market Is Preparing for a Blue Wave. That Could Be Premature, Researcher Says. (Barron’s)

- 5 Things CEO Elon Musk Said on the Tesla Earnings Call (Barron’s)

- Google Antitrust Fight Thrusts Low-Key C.E.O. Into the Line of Fire (New York Times)

- The Fed’s $4 Trillion Lifeline Never Materialized. Here’s Why. (New York Times)

- U.S. Initial Jobless Claims Fall for Third Time in Four Weeks (Bloomberg)

- Pelosi, Mnuchin to Talk Stimulus Again (Bloomberg)

- OAN Built a Safe Space for People Who Think Fox News Is Too Liberal (Bloomberg)

- Deceased AstraZeneca Trial Volunteer Didn’t Receive Vaccine (Bloomberg)

- Supercar Maker De Tomaso Is Ditching Italy for Detroit (Bloomberg)

- Investors Rewire Stock Trades to Find Trillions in Hidden Assets (Bloomberg)

- Oilfield Services Look Beyond Oil (Wall Street Journal)

- With Concho, ConocoPhillips Is Playing Offense (Wall Street Journal)

- JPMorgan’s Kolanovic Has Another Warning For Those Expecting A Crushing Biden Victory (ZeroHedge)

- Northrop Grumman (NOC) Tops Q3 EPS by 25c, Offers FY Guidance (Street Insider)

- Boeing eyes big move to compete with Airbus, bounce back from 737 MAX (Fox Business)

- Democratic voter registration and potential implications (Fox News)

- More money flowing into hedge funds amid global unrest (New York Post)

- Issa Brothers Go From Not Much to $24 Billion (Bloomberg)

- China Has Copper Flying Like a FANG Stock (Bloomberg)

- PulteGroup Crushes Earnings Estimates Because the Housing Market Is Hot (Barron’s)

- Goldman Sachs forecasts a structural bull market emerging for commodities in 2021- here is the breakdown of their analysis (Business Insider)

- Why the time is right for these three unloved small cap stocks, says fourth-generation money manager (MarketWatch)

- Tudor Jones sees a stock pop to start 2021 on stimulus, then pressure later from Biden tax plan (CNBC)

- Investors opt for the ‘do nothing’ trade ahead of US election (Financial Times)

- The WTO Couldn’t Change China, so Robert Lighthizer Found Another Way (Wall Street Journal)

- U.S. Economy Seeing ‘Slight to Modest’ Growth This Fall, Fed’s Beige Book Says (Wall Street Journal)

- Leveraged Buyouts Come Roaring Back After Coronavirus-Related Lull (Wall Street Journal)

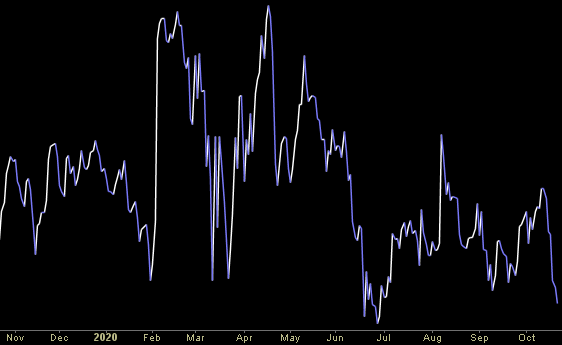

The Taylor Swift “You Need To Calm Down” Stock Market (and Sentiment Results)…

A little over a week ago my wife and I were at a local restaurant in CT (called Posa) with a few friends (I had the delicious Branzino). While we were waiting for our appetizers (Bufala Mozzarella) I overheard a gentleman at the table next to us saying, “this market is crazy, it’s a bubble, it’s going to crash, it can’t keep going up.” Continue reading “The Taylor Swift “You Need To Calm Down” Stock Market (and Sentiment Results)…”

Tom Hayes – Quoted in Reuters article – 10/21/2020

Thanks to Medha Singh for including me in her article on Reuters today. You can find it here:

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 19 key reads for Wednesday…

- Presidential Betting Markets Are Tightening. Is It Time to Hedge? (Barron’s)

- After Conoco’s Huge Purchase, Are 2 Top Permian Stocks Also Takeover Targets? (24/7 Wall Street)

- Covid-19 Vaccines Could Take a Critical Next Step in November (Barron’s)

- 10-year Treasury yield hits mid-June high after Pelosi boosts fiscal stimulus hopes (MarketWatch)

- Western Digital Stock Spikes 10% on Intel’s Plan to Sell Memory Chip Unit (Barron’s)

- Philip Morris Stock Got Crushed After Earnings. Why the Market Got It Wrong. (Barron’s)

- Defense Stocks Have a Joe Biden Problem (Barron’s)

- Home Builders Keep Building New Houses, Latest Data Show. Why They Won’t Stop. (Barron’s)

- Google Up Against Laws That Thwarted Microsoft (and Others Since 1890) (New York Times)

- Travelers Is Ready for Post-Pandemic Journey (Wall Street Journal)

- Antero Midstream upgraded to Outperform on lower perceived risk at Raymond James (TheFly)

- Coronavirus deal could come in next 48 hours: White House (FoxBusiness)

- The World Shut Down. This Is Who Hedge Funds Called. (Institutional Investor)

- Fed’s Brainard calls for more stimulus from Congress amid ‘highly uneven’ recovery (CNBC)

- JPMorgan Chase takes on Square and PayPal with smartphone card reader, faster deposits for merchants (CNBC)

- People earning a lot of money think differently: Morning Brief (Yahoo! Finance)

- Here’s How Much Investing $1,000 In Wells Fargo At Great Recession Lows Would Be Worth Today (Benzinga)

- Lockheed Martin Plans to Deliver New Presidential Helicopter Next Year (Wall Street Journal)

- How Next-Door Neighbors With Opposing Political Views Stayed Friends (Wall Street Journal)

Where is money flowing today?

Be in the know. 15 key reads for Tuesday…

- Gilead Defends Its Covid Treatment After WHO Study Finds It Ineffective (Barron’s)

- 3 Unloved Bank Stocks That May Be Worth Buying (Barron’s)

- Warren Buffett may have slashed his Wells Fargo stake because the bank ignored his advice and hired a Wall Street CEO (Business Insider)

- Technology stocks may be about to drown in their own greatness, says JPMorgan (MarketWatch)

- GE Stock Is in a Stealth Bull Market. Here’s Why. (Barron’s)

- Halliburton’s Cost-Cuts Boost the Bottom Line (Barron’s)

- Want to Buy Mortgage REITs? Here’s How to Pick Them. (Barron’s)

- NY, NJ could see taxes increase over 58 percent under Joe Biden: analysis (New York Post)

- With NYC Influx, Greenwich Area Home Prices Rise Fastest in U.S. (Bloomberg)

- An Obscure American Automaker Now Has the World’s Fastest Car (Bloomberg)

- Pelosi and Mnuchin make progress in stimulus talks, plan to speak again Tuesday (CNBC)

- HAMM: The 2020 election question: Are you ready for $6 a gallon gas? (Fox Business)

- Top Fed Official Says Policy Response Could Speed Faster Recovery (Wall Street Journal)

- Pioneer Natural Resources Is in Talks to Buy Parsley Energy (Wall Street Journal)

- DOJ to File Google Antitrust Lawsuit (Wall Street Journal)

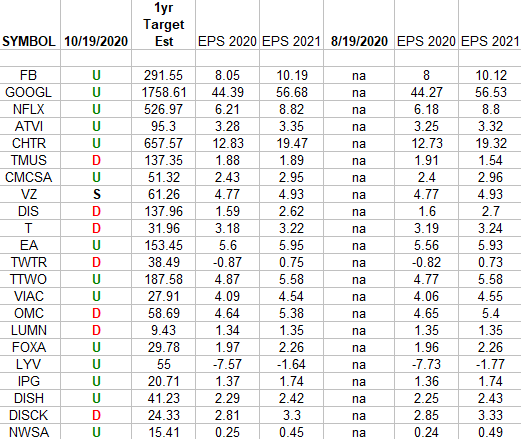

Communication Services Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Communication Services Sector ETF (XLC). Continue reading “Communication Services Earnings Estimates/Revisions”

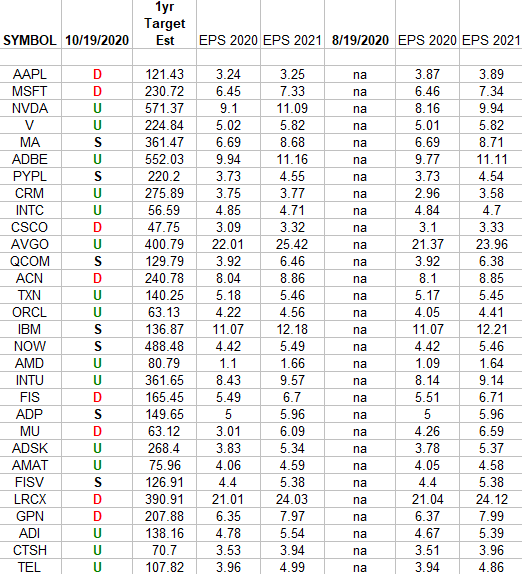

Technology Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Technology Sector ETF (XLK) top 30 weighted stocks. Continue reading “Technology Earnings Estimates/Revisions”