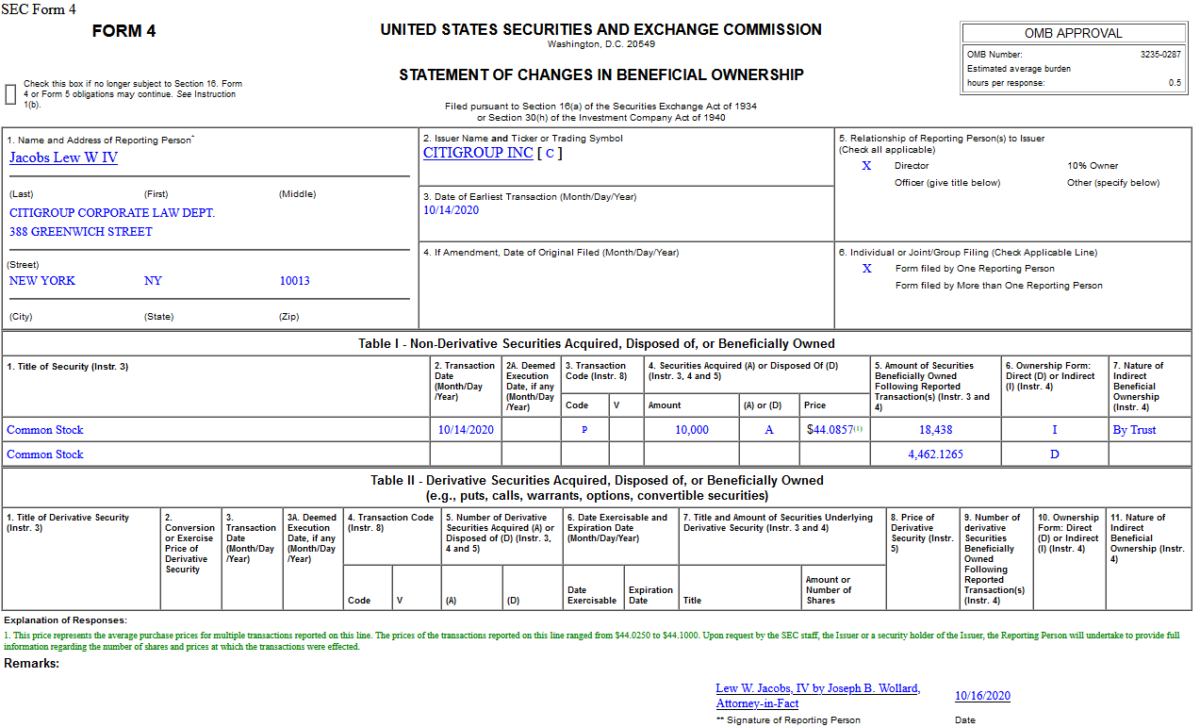

On Oct 14, 2020, Lew Jacobs IV – Director of Citigroup Inc. (C) – purchased 10,000 shares of C at $44.09. His out of pocket cost was $440,857.

Hedge Fund Trade Tip (PIN) – Position Idea Notification

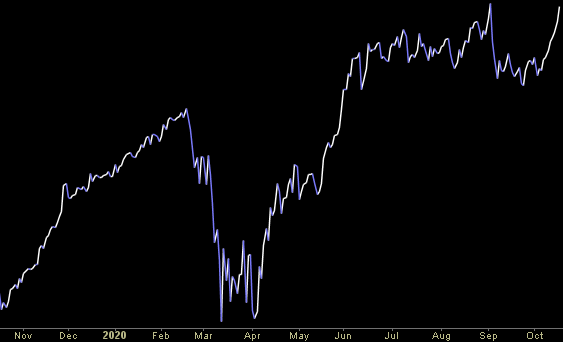

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 8 key reads for Monday…

- China Economy Grows 4.9% In Q3, Extending Virus Recovery (Barron’s)

- Big Contrarian Investor Sells AT&T and Gold Stocks. They Bought Wells Fargo. (Barron’s)

- Speculators Reverse Big Nasdaq Short (Bloomberg)

- Conoco to Buy Concho for $9.7 Billion to Create Shale Giant (Bloomberg)

- Pelosi gives White House 48 hours to reach coronavirus stimulus deal before election (CNBC)

- U.S. Army Medical Research and Development (USAMRDC) Develops COVID-19 Vaccine Candidate (SpFN) Now in Clinical Trials (TrialSiteNews)

- Stalemate. The Energy Report 10/19/2020 (Phil Flynn)

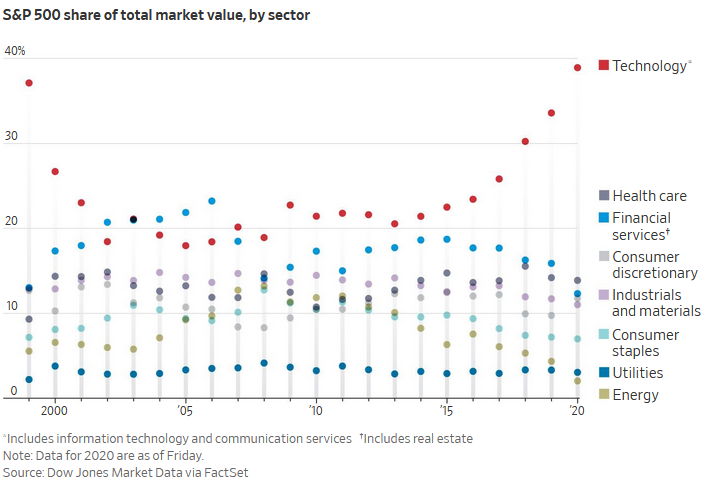

- Tech’s Influence Over Markets Eclipses Dot-Com Bubble Peak (Wall Street Journal)

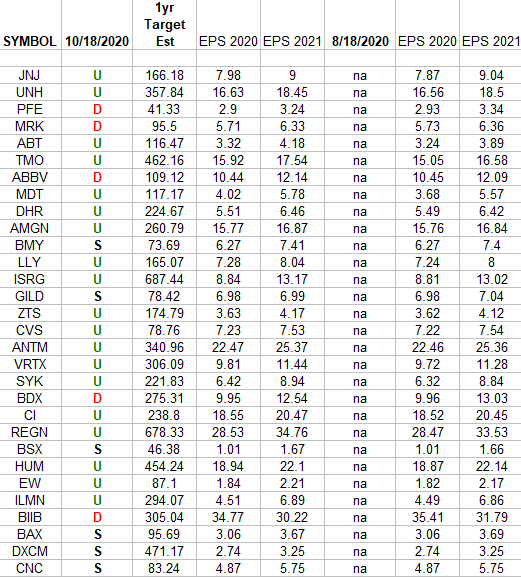

Healthcare (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the 2020 and 2021 earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 15 key reads for Sunday…

- Pfizer COVID-19 vaccine rolls off production line amid hopes for emergency approval (New York Post)

- Will New York Go for Another Wall Streeter as Mayor? (New York Times)

- Waiting to pass stimulus until after the election is a mistake, says economist Mark Zandi (Fortune)

- This year’s ‘October surprise’ could impact your portfolio for years to come (Fortune)

- Amazon Pays Big Bucks For Eddie Murphy’s ‘Coming 2 America’ (Maxim)

- A suspected-banksy with a hula-hooping girl appears in Nottingham (designboom)

- Valuing Exxon (Insider Monkey)

- The ‘I’m An Accountant’ Stock Market, And Sentiment Results (SeekingAlpha)

- ECRI Weekly Leading Index Update (AdvisorPerspectives)

- ‘How are you going to learn properly?’: JPMorgan CEO Jamie Dimon warns over increasing negatives of working from home (fn London)

- The Mad, Mad World of Niche Sports Among Ivy League–Obsessed Parents (The Atlantic)

- COVID & Global Valuations (Verdad)

- The Master Plan: Biotech player turned Ottawa Senators owner Eugene Melnyk faces off against COVID-19 (Financial Post)

- Don’t Fight T-Fed (Yardeni)

- The Phil Flynn Energy Report Riding the waves (futuresmag)

Be in the know. 35 key reads for Saturday…

- Breaking Big Tech (Advisor Perspectives)

- U.S. Money Managers Like the Outlook for Stocks, According to Barron’s Poll (Barron’s)

- GE’s stock gets a big boost after news that Boeing’s 737 MAX could fly again this year (MarketWatch)

- Bill Miller 3Q 2020 Market Letter (Miller Value)

- Why Read? Advice From Harold Bloom (Farnam Street)

- The 2020 Aston Martin Vantage Coupe is the Entry Level to the James Bond Fantasy Life (Barron’s)

- Look Who’s Really Chasing Hot Stocks Like Zoom (Wall Street Journal)

- Forget the Rent, Collect the Yield: Why Investors Looking to Retire Early Should Consider REITs (Barron’s)

- Here are Wall Street’s favorite stocks for an election-relief rally (MarketWatch)

- Looking for Yield? Mortgage REITs Offer Double-Digit Returns. (Barron’s)

- Pfizer says earliest U.S. filing for COVID-19 vaccine would be late November (Reuters)

- Trump says: ‘I’m ready to sign a big, beautiful stimulus’ — but many Americans are not banking on it (MarketWatch)

- Google now lets you search for a song by humming or singing its tune (New York Post)

- Warren Buffett plowed $5 billion into Bank of America during the debt crisis. Here’s the story of how the investor helped the bank and made a fortune in the process. (Business Insider)

- The wealthiest 1% of Americans will drive positive household demand for stocks in 2021, Goldman Sachs says (Business Insider)

- Mark Cuban on stalled stimulus negotiations: All of Congress is ‘complicit in the problem’ (CNBC)

- In Reversal, Twitter Is No Longer Blocking New York Post Article (New York Times)

- Stock-market bulls are counting on the consumer staying strong — should they? (MarketWatch)

- Behind the Stability in China’s Currency: Beijing’s Hidden Hand (Barron’s)

- An Analyst Plays Matchmaker With Chevron and Exxon (Barron’s)

- Walgreens Beats Estimates in Fiscal Q4, Returns to Profit (equities)

- Natural gas generators make up largest share of U.S. electricity generation capacity (eia)

- Boris Johnson throws down ‘no deal’ gauntlet to EU (Financial Times)

- Federal Reserve debates tougher regulation to prevent asset bubbles (Financial Times)

- ‘Value drought’ claims latest victim as growth stocks power on (Financial Times)

- The new Porsche Targa: is this the greatest 911 yet? (Financial Times)

- Will Value Stocks Overtake Growth Shares After The Election? (Investing.com)

- There’s More to Value Investing Than Low Prices (Morningstar)

- Buffett’s Disciples Should Pray for a Bond Bust (Bloomberg)

- Tale of Two Economies: Housing-Related Boom vs Pandemic-Challenged-Services Bust (Yardeni)

- Charlie Munger’s 10 Rules for Investment Success (DGS)

- Margin of Safety Still Matters (value stock geek)

- How to play on market’s reversion to the mean: Tobias Carlisle offers a few tips

(Economic Times) - Coming into Focus (Howard Marks)

- Elections and Markets (Investor Amnesia)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 52

Article referenced in VideoCast above:

The “I’m an Accountant” Stock Market (and Sentiment Results)…