- A Dozen Stocks That Will Make Both Growth and Value Investors Happy (Barron’s)

- 7 Value Stocks With Morningstar ‘Buy’ Ratings (Yahoo! Finance)

- Bank of America Beat Earnings Forecasts. Why Its Stock Is Dropping. (Barron’s)

- Goldman Sachs’s Third-Quarter Profit Nearly Doubles (Wall Street Journal)

- Exxon’s Dividend Is Still a Concern. Goldman Sachs Upgraded It Anyway. (Barron’s)

- Wells Fargo Profit Slumps on Severance, Remediation Charges, Revenue Beats (Bloomberg)

- Wells Fargo returns to profit after painful second quarter (Financial Times)

- A Wall Street chief strategist says US lawmakers need a deal on fiscal aid – even a small one will help save consumer spending. (Business Insider)

- Failure to provide more fiscal stimulus is a ‘significant mistake’ that could cause more businesses to fail, Moody’s chief economist says. (Business Insider)

- Warren Buffett’s Berkshire Hathaway is in talks to partner with Mitsui, the Japanese trading group’s CEO says (Business Insider)

- Should Fiscal Policy Get More Chinese? (Wall Street Journal)

- Hedge fund short sellers target pandemic winners (Financial Times)

- Derivatives trading surges for big US tech companies (Financial Times)

- Study of Eli Lilly Covid-19 Drug Paused Due to Safety Concern (Wall Street Journal)

- Regeneron’s Coronavirus October Surprise (Wall Street Journal)

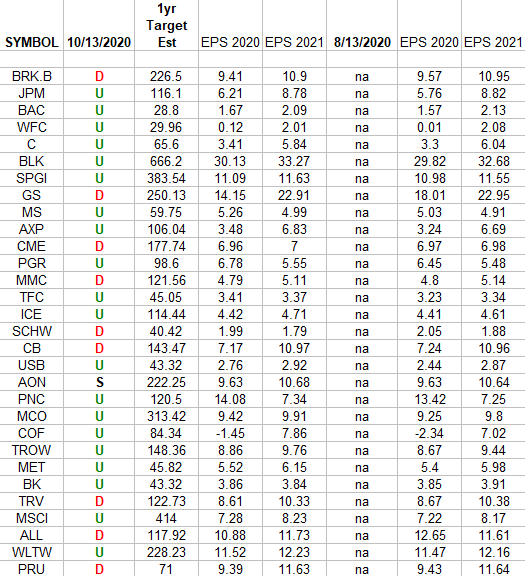

Financials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Financials Sector ETF (XLF) top 30 weighted stocks. Continue reading “Financials (top 30 weights) Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Unusual Options Activity – EOG Resources, Inc. (EOG)

Data Source: barchart

Today some institution/fund purchased 1,454 contracts of Jan $42.5 strike calls (or the right to buy 145,400 shares of EOG Resources, Inc. (EOG) at $42.5). The open interest was just 408 prior to this purchase. Continue reading “Unusual Options Activity – EOG Resources, Inc. (EOG)”

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

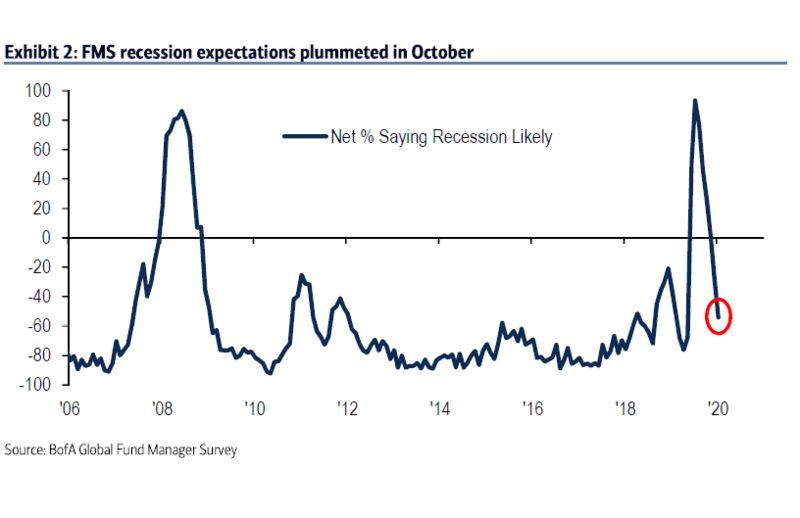

October Bank of America Global Fund Manager Survey Results (Summary)

~224 Managers overseeing ~$600B AUM responded to this month’s BofA survey. Continue reading “October Bank of America Global Fund Manager Survey Results (Summary)”

Be in the know. 25 key reads for Tuesday…

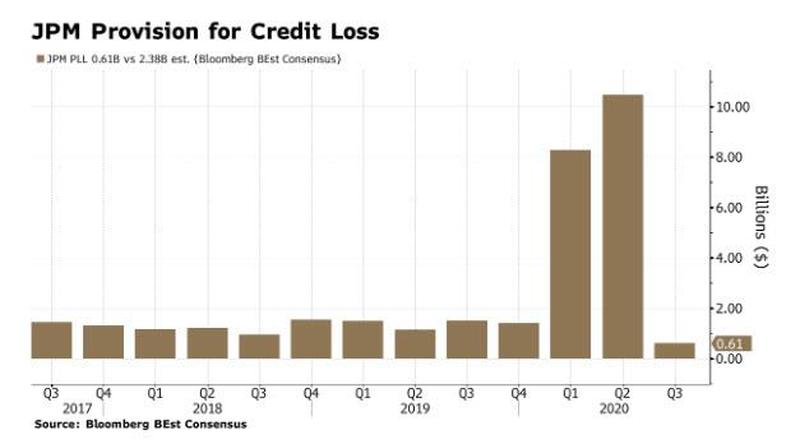

- Dimon Signals The All Clear: JPMorgan Earnings Smash Expectations As Loss Provisions Plummet 94% (ZeroHedge)

- Exxon Mobil upgraded to Neutral from Sell at Goldman Sachs (TheFly)

- Citi Posts Biggest Quarterly Profit of Pandemic (Bloomberg)

- Day-Trader Options Action Is Spotted Yet Again in Nasdaq Surge (Bloomberg)

- Desperate Americans hit by pandemic beg Congress, Trump to pass economic relief bill (Reuters)

- U.S. small business confidence at highest since February (Reuters)

- China’s imports, exports surge as global economy reopens (Reuters)

- Johnson & Johnson Covid-19 vaccine study paused due to illness: report (FoxBusiness)

- “Nancy Pelosi take this deal!” Andrew Yang, a former Democratic presidential candidate, tweeted on Saturday. “Put politics aside people are hurting.” (FoxBusiness)

- Why You Didn’t Notice a Japanese Stock Index Beating the Nasdaq This Year (Wall Street Journal)

- JPM: Credit costs of $611 million included $569 million of net reserve releases (Street Insider)

- Ford and General Electric are headed back to the double digits, Jim Cramer says (CNBC)

- JPMorgan’s Earnings Were Better Than Expected. Here’s How the Bank Did. (Barron’s)

- A New Roaring ‘20s Is Coming for Industrial Stocks (Barron’s)

- The American Dream: Bringing Factories Back to the U.S. (Barron’s)

- Lotus Goes Electric With a US$2.1 Million Hypercar (Barron’s)

- Oil bounces after sharp jump in Chinese imports (MarketWatch)

- JPMorgan beats analysts’ profit estimates as the bank sets aside less for loan losses (CNBC)

- Disney Elevates Streaming Business in Major Reorganization (Wall Street Journal)

- BofA Survey Shows Investors Braced for Contested U.S. Election (Bloomberg)

- Natural Gas Surges as Traders Brace for Cold Winter (Wall Street Journal)

- Key U.S. Inflation Gauge Rises at Slowest Pace in Four Months (Bloomberg)

- Warren Buffett once used LeBron James to explain the risk of diversification, and compared his return to Cleveland to new Coke’s demise (BusinessInsider)

- Top Analyst Raises Price Targets on 4 High Dividend-Paying Bank Stocks (24/7 Wall Street)

- Citi Posts Biggest Quarterly Profit of Pandemic. Loan provisions return to normal after surging in first half. (Bloomberg)

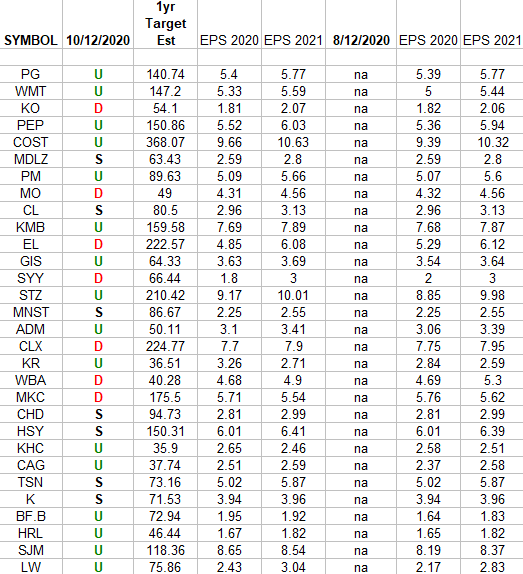

Consumer Staples (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Staples Sector ETF (XLP) top 30 weighted stocks. Continue reading “Consumer Staples (top 30 weights) Earnings Estimates/Revisions”

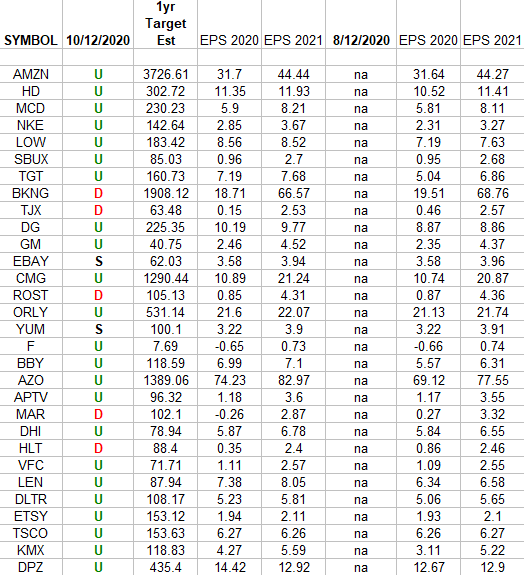

Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Discretionary Sector ETF (XLY) top 30 weighted stocks. Continue reading “Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions”