- Seoul’s Full Cafes, Apple Store Lines Show Mass Testing Success (Bloomberg)

- Bank Earnings Were Terrible. It’s Time to Buy the Banks. (Barron’s)

- Energy Hedge Fund That Shorted Oil Sees Chance for $100 a Barrel (Bloomberg)

- Charlie Munger: ‘The Phone Is Not Ringing Off the Hook’ (Wall Street Journal)

- Opinion: Vitamin D and Coronavirus Disparities (Wall Street Journal)

- Opening Up America Again (CDC/White House PDF Plan)

- Here’s why sauerkraut and kimchi sales have surged during the coronavirus (New York Post)

- Coronavirus Ushered in Medicine’s Digital Revolution (Barron’s)

- Big Pharma Sees Its Strengths Surface ()

- Reasons to Gobble Up Kraft Heinz’s Battered Shares (Barron’s)

- 3 Former United Technologies Stocks That Are Ready to Fly (Barron’s)

- Union Pacific Sees Biggest Insider Stock Buy in Years (Barron’s)

- Trump Announces $19 Billion Relief Program for Farmers (Wall Street Journal)

- Here Are the Companies Getting Federal Funds for Covid Relief (Bloomberg)

- ‘MacGyvering’: A Modern ‘Can-Do’ Approach To Bad Situations (Wall Street Journal)

- Wells Fargo, J.C. Penney, Amazon.com: Stocks That Defined the Week (Wall Street Journal)

- Procter & Gamble Posts Biggest U.S. Sales Gain in Decades (Wall Street Journal)

- Leaked Research: This Drug May Be Saving COVID Patients’ Lives (Futurism)

- Coronavirus latest: Hong Kong shows no need for total lockdown, says study (Financial Times)

- The Day of Reckoning for Private Equity (Institutional Investor)

- Warren Buffett’s financial crisis bailouts inspired the US government’s ‘big 4’ airline rescue deals (Business Insider)

- Pro golf plans to be the first major sport to return during the coronavirus pandemic (CNBC)

- Macy’s reportedly looking to use real estate to come up with cash during coronavirus pandemic (CNBC)

- Fed Says It Will Disclose Borrower Information in Crisis Lending (Bloomberg)

- These Are the Drugs and Vaccines That Might End the Coronavirus Pandemic (Bloomberg)

- Google seeks to launch a debit card with banks (USA Today)

- Standing on the Shoulders of Giants: The Key to Innovation (Farnam Street)

- A Primer On Reading Annual Reports (docdroid)

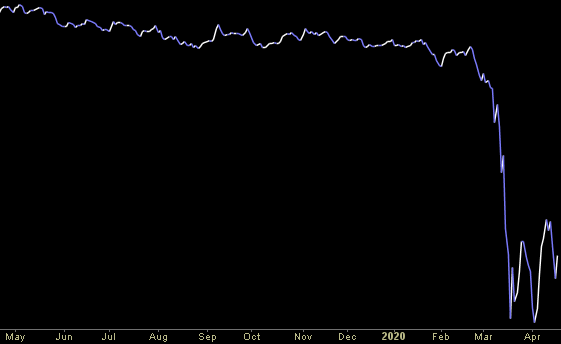

- Have Small Value Stocks Become a Bargain? (Morningstar)

- Gilead increases enrollment target for remdesivir trial in COVID-19 patients (Reuters)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 26

Article referenced in VideoCast above:

The Morgan Wallen, “Whiskey Glasses” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Episode 16

Article referenced in podcast above:

The Morgan Wallen, “Whiskey Glasses” Stock Market (and Sentiment Results)…

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Where is money flowing today?

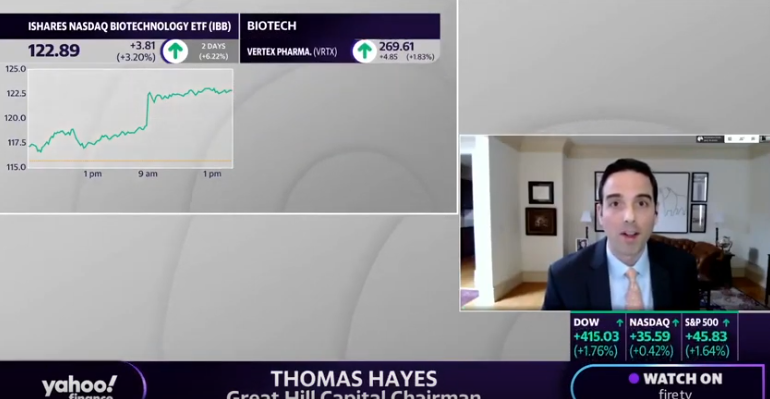

Yahoo! Finance TV Appearance on Friday (Video)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 15 key reads for Friday…

- “Maybe He Doesn’t Want to Be the Hero”: In the COVID-19 Crisis, Warren Buffett is Lying Low (Vanity Fair)

- Virus Vaccine May Be Ready for Mass Production By Autumn, Oxford Professor Says (Bloomberg)

- Gilead Gains on Report Claiming Coronavirus Drug Working (Bloomberg)

- Covid Report: Gilead Pops On Promising Sneak Peek For Coronavirus Drug (Investor’s Business Daily)

- The Fear Gauge Is Sending False Signals (Barron’s)

- Why Emerging Market Currencies Are Cheap (Barron’s)

- Treasury yields follow stocks higher on hopes for coronavirus drug MarketWatch)

- AMC Entertainment’s stock rockets after liquidity update, private debt offering (MarketWatch)

- Schlumberger swings to large loss, misses revenue and cuts dividend by 75%; stock surges (MarketWatch)

- Trump administration working to ease drilling industry cash crunch (Reuters)

- Johnson & Johnson execs offer upbeat view of second-half recovery from COVID-19 pandemic (MarketWatch)

- Fed’s Bostic says watching closely for signs of ‘unbearable’ stress among mortgage servicers (MarketWatch)

- Boeing to Restart Jetliner Production (Wall Street Journal)

- Mnuchin Under Growing Pressure to Help Struggling Mortgage Companies (Wall Street Journal)

- Screening Rooms That Bring Hollywood Home (Wall Street Journal)