Data Source: Finviz

Be in the know. 22 key reads for Wednesday…

- Weekly mortgage applications rise as rates drop to 30-year low, but it’s all refinances (CNBC)

- Could It Be Value Stocks’ Time to Shine? One Long-Skeptical Strategist Thinks So. (Barron’s)

- UnitedHealth beats quarterly profit on strength across its businesses (CNBC)

- Larry Kudlow’s War Bonds Are Coming But in a Plain Vanilla Wrapper (Bloomberg)

- China’s Data on Symptom-Free Cases Reveals Most Never Get Sick (Bloomberg)

- Pound May Turn Into Unlikely Winner From Europe’s Virus Troubles (Bloomberg)

- Tesla Wooed by $1 Billion Missouri Package for Cybertruck Plant (Bloomberg)

- Smartphone Makers Ordering Parts Like There’s No Pandemic (Bloomberg)

- Virus Sell-Off Turns Bonds Into ‘Fallen Angels.’ Here’s Why Downgrades Matter (Bloomberg)

- Why A 50% Drop in U.S. GDP May Not Be So Bad (Barron’s)

- Hedge Funds’ Top Holdings Are Beating the Market. They’re a Familiar Bunch. (Barron’s)

- Trump says close to plan to reopen economy possibly, in part, before May 1 (Street Insider)

- Saudi energy chief: Historic oil cuts more than double amount reported (Fox Business)

- Trump: At least 29 states ‘ready’ to reopen (Fox Business)

- Ray Dalio Said ‘Cash Is Trash.’ But Managers Are Hoarding It. (Institutional Investor)

- ByteDance looks to hire 10,000 thanks to TikTok boom (Financial Times)

- Saudi Arabia says price war was ‘unwelcome departure’ from oil policy (Financial Times)

- GlaxoSmithKline, Sanofi Announce Coronavirus Vaccine Program (Barron’s)

- Here’s How Much Of Delta Air Lines The Government Will Own After Rescue (Investor’s Business Daily)

- 3 reasons why Warren Buffett is so successful in bear markets (USA Today)

- When the Coronavirus Outbreak Could Peak in Each U.S. State (Bloomberg)

- Six Flags to offer up to $665 million of bonds to repay debt and fund operations (MarketWatch)

News 12 Appearance on Tuesday (video)

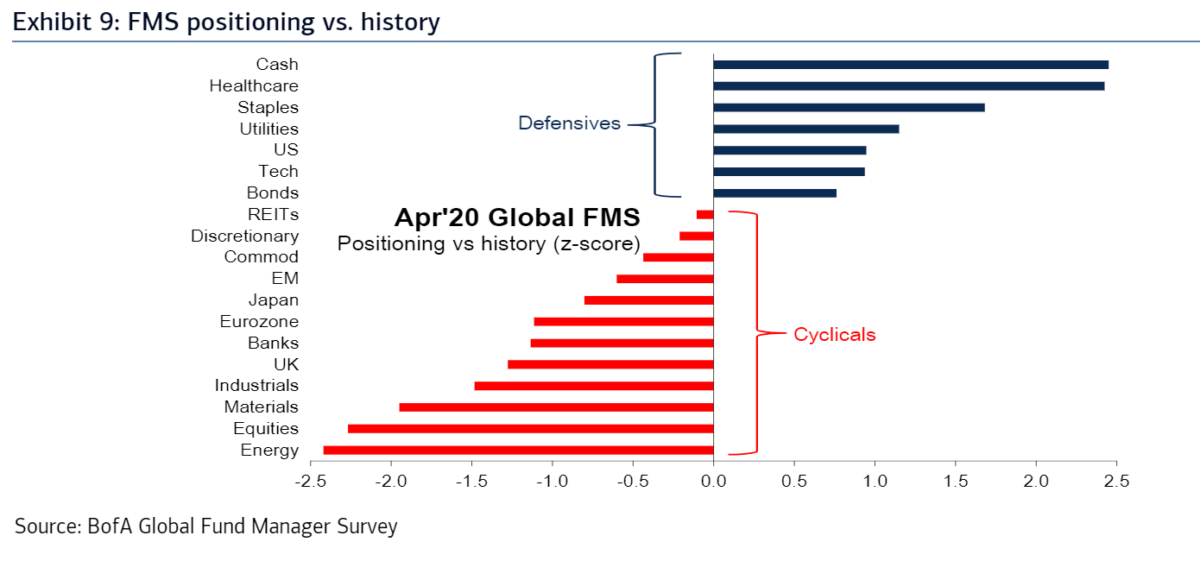

April Bank of America Global Fund Manager Survey Results (Summary)

Data Source: Bank of America

Each month, Bank of America conducts a survey of ~200 fund managers with ~$550B AUM. Here are the key takeaways from the survey published on April 14, 2020: Continue reading “April Bank of America Global Fund Manager Survey Results (Summary)”

Hedge Fund Trade Tip (PCN) – Position Completion Notification

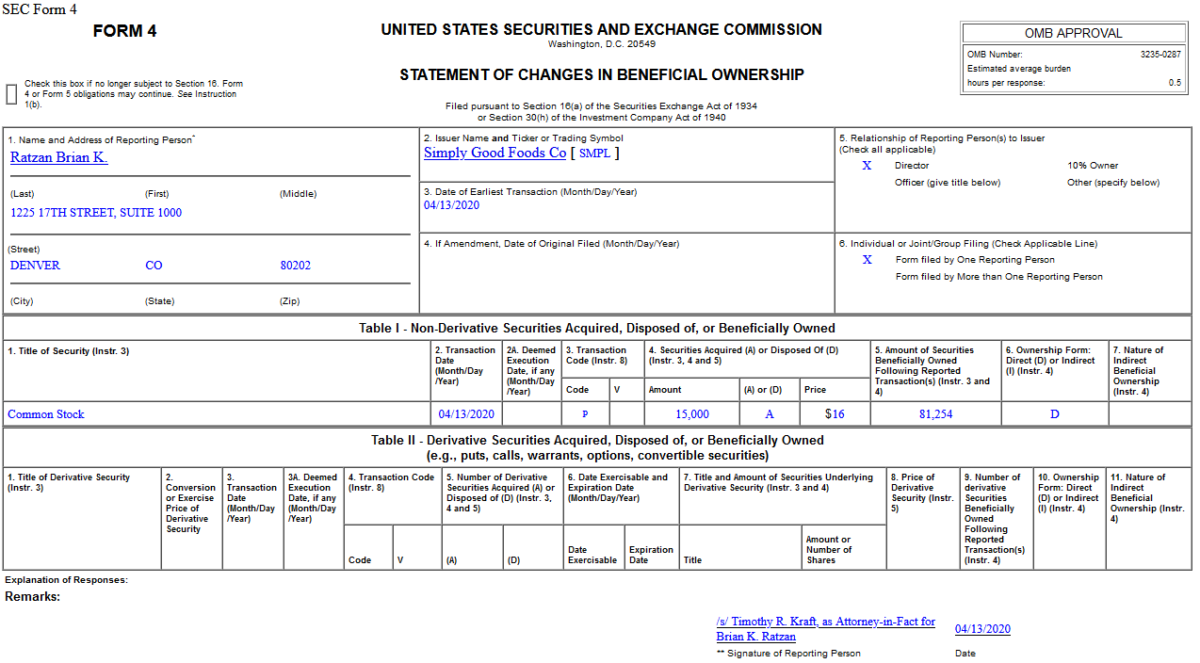

Insider Buying in The Simply Good Foods Company (SMPL)

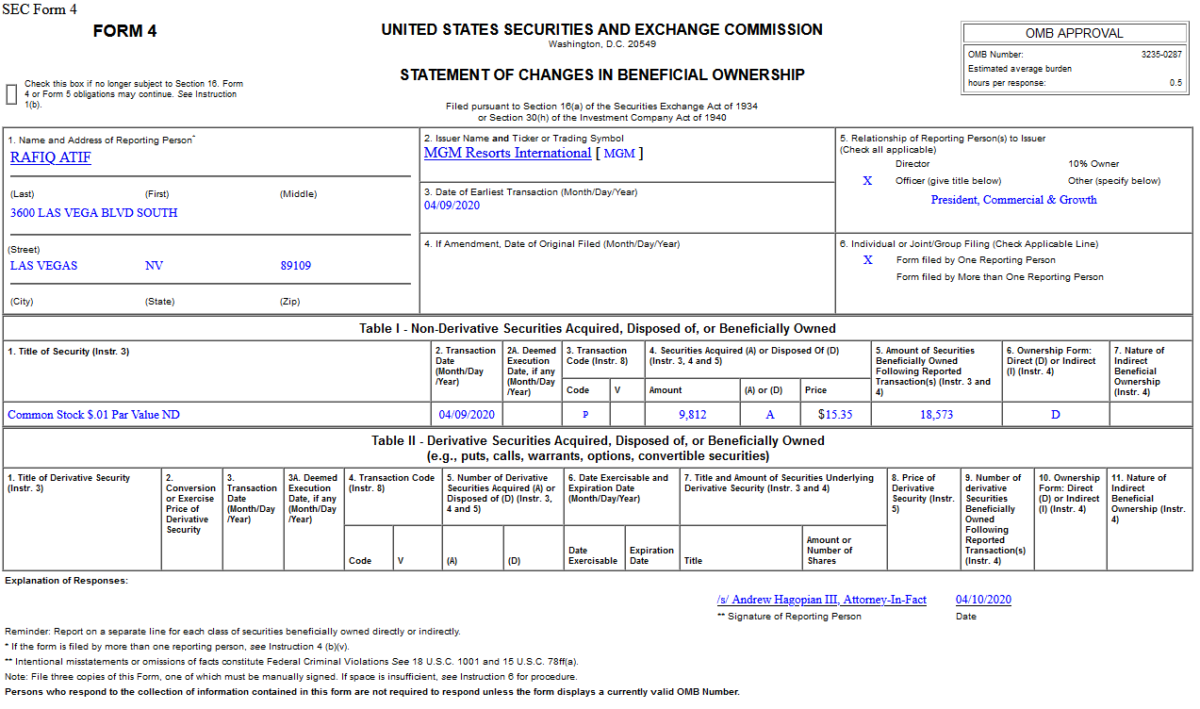

Where is money flowing today?

Be in the know. 10 key reads for Tuesday…

- Ten U.S. states developing ‘reopening’ plans account for 38% of U.S. economy (Reuters)

- Signs That New Virus Cases Have Peaked Push Stocks Higher (Barron’s)

- IPhone Sales Surged in China (Barron’s)

- States Move to Coordinate on Reopening Plans (Wall Street Journal)

- Private Equity Firms Plead With Government to Help Salvage Oil and Gas Industry (Institutional Investor)

- FDA approves coronavirus saliva test (Fox Business)

- Trump Negotiating to Lease Oil Storage Space to Nine Companies (Bloomberg)

- World Watches China’s Economy for Signs of Life After Lockdown (Bloomberg)

- Exxon borrows $9.5 billion as investment-grade companies race to fill war chests ahead of earnings (MarketWatch)

- Wells Fargo Earned 1 Penny in the First Quarter. Why the Stock Is Rising Anyway. (MarketWatch)