CGTN Global Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – October 6, 2020

Tom Hayes – The Claman Countdown – Fox Business Appearance – 10/6/2020

Where is money flowing today?

Be in the know. 12 key reads for Tuesday…

- A Prescription for What Ails CVS, Walgreens (Wall Street Journal)

- U.S. Boosts Crude Sales to China, Forcing Saudis to Find Other Markets (Wall Street Journal)

- Prospects for New Round of Stimulus and an Economic Rebound Are Boosting Stocks (Barron’s)

- The Big Banks’ Earnings Are Coming. Here’s What to Expect. (Barron’s)

- China’s Economy Is on the Mend. Here’s Where the Rebound Is Still Uneven. (Barron’s)

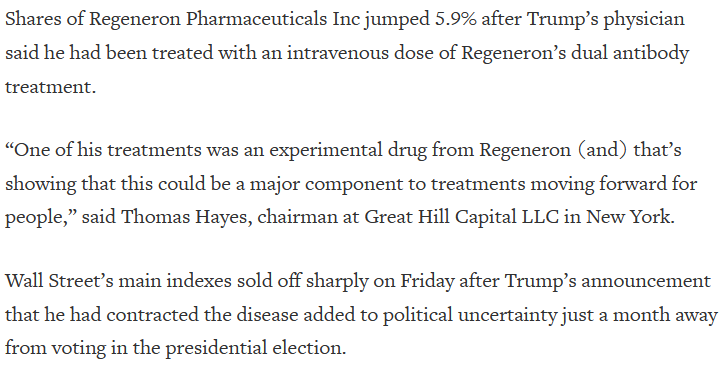

- Trump’s Use of Regeneron Antibodies Will Help It Become a Big Seller, Say Analysts (Barron’s)

- Mark Cuban on the ‘best investment’ he ever made: ‘Most people don’t put in the time’ to do it (CNBC)

- Energy companies brace for Hurricane Delta impact, begin rig evacuations (Fox Business)

- ‘The Price Is Right’ returns to production with redesigned set, no audience (Fox Business)

- Peltz, Ackman, Icahn: How Their ‘Hostile’ Reputations Really Work (Institutional Investor)

- Hedge funds seek out emerging markets as Covid-19 continues to wreak havoc (Financial Times)

- U.S. Steps Up Efforts to Counter China’s Dominance of Minerals Key to Electric Cars, Phones (Wall Street Journal)

Unusual Options Activity – Las Vegas Sands Corp. (LVS)

Data Source: barchart

Today some institution/fund purchased 13,026 contracts of March $50 strike calls (or the right to buy 1,302,600 shares of Las Vegas Sands Corp. (LVS) at $50). The open interest was just 2,082 prior to this purchase. Continue reading “Unusual Options Activity – Las Vegas Sands Corp. (LVS)”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Tom Hayes – CNBC Indonesia Appearance – 10/5/2020

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Tom Hayes – Quoted in Reuters article – 10/5/2020

Thanks to Devik Jain for including me in his article on Reuters today. You can find it here: