- The Art of the Oil Deal (Wall Street Journal)

- Gilead Sciences (GILD) Remdesivir Study Shows Two-Third of Severe COVID-19 Patients Improved (Street Insider)

- Fed’s Clarida says central bank has tools to avoid deflation: BBG (Reuters)

- Fauci: ‘Rolling re-entry’ possible in May (Fox Business)

- Photo credit: Emily Elconin

- Barron’s Picks And Pans: Berkshire Hathaway, Disney, SoftBank And More (Benzinga)

- OPEC and its allies strike historic agreement to cut nearly 10 million barrels a day (MarketWatch)

- Higher Natural Gas Prices Are On The Horizon (Yahoo! Finance)

- OPEC+ deal saved ‘more than 2 million’ jobs in the US: Russian wealth fund (CNBC)

- Historic OPEC+ cut is Trump’s ‘biggest and most complex’ deal ever: Dan Yergin (CNBC)

- Goldman Sachs abandons its bearish near-term view on stocks, says the bottom is in (MarketWatch)

- U.S. Stabilizes, CDC Says; 70 Vaccines in Progress: Virus Update (Bloomberg)

- Alaska Bought Up Berkshire Hathaway, Walmart, and AMD Stock (Barron’s)

- 12 Stocks That Are Beating the Market During the Coronavirus Crisis—and Can Keep on Growing After (Barron’s)

- Can Cruise Lines and Small Theme Parks Survive? (Barron’s)

Be in the know. 20 key reads for Easter…

- 7 Reasons Why Smart, Hardworking People Don’t Become Successful (Medium)

- A food safety expert on why you’re unlikely to get the coronavirus from groceries or takeout (Vox)

- Apple and Google want to turn your phone into a Covid-tracking machine (Vox)

- A Truce in the Oil Price War? (CFR)

- Early Experience With Remdesivir To Treat Severe COVID-19 Published (NPR)

- Episode 990: The Big Small Business Rescue (NPR Planet Money)

- How Close Are We To A COVID-19 Vaccine? (538)

- Unlikely Optimism: The Conjunctive Events Bias (Farnam Street)

- I Got a Pandemic Puppy, and You Can Too (The Atlantic)

- What Immunity to COVID-19 Really Means (Scientific American)

- How Anthony Fauci Became America’s Doctor (New Yorker)

- Airlines Are Negotiating a Bailout Package. The Details Could Emerge Over the Weekend. (Barron’s)

- The Fed Has Already Injected $2.3 Trillion Into the Economy — and it’s Just Getting Started (Time)

- Trump Makes It Official: We’re Mining the Moon (Popular Mechanics)

- Aston Martin V12 Speedster: A Puristic Limited Edition For The Most Demanding Drivers (Just Luxe)

- The Next Gauge of the Economy Will Be Corporate Earnings: Live Updates (New York Times)

- The S&P 500 has rebounded 25% in less than three weeks. Here’s what’s going on (CNBC)

- Mnuchin, Congress leaders to hold new talks on next coronavirus aid bill (Reuters)

- Everything Is Awful. So Why Is the Stock Market Booming? (New York Times)

- Poison Pills and Coronavirus: Understanding Glass Lewis’ Contextual Policy Approach (Harvard Law)

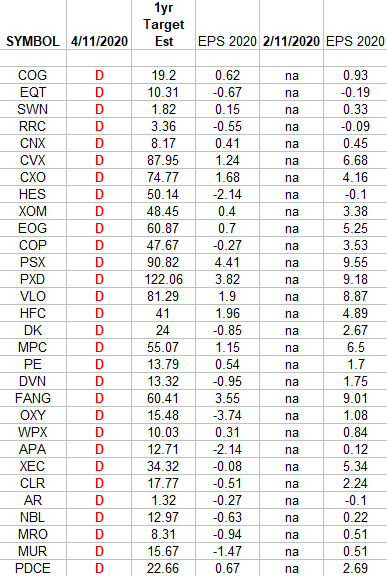

Exploration & Production Sector (XOP) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Exploration & Production Sector (XOP). I have columns for what the 2020 estimates were: 2/11/2020 and today. Continue reading “Exploration & Production Sector (XOP) – Earnings Estimates/Revisions”

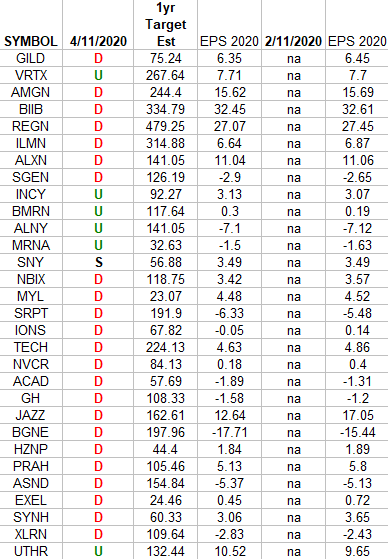

Biotech (top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Nasdaq Biotech ETF (IBB) top 30 weighted stocks. Continue reading “Biotech (top weights) Earnings Estimates/Revisions”

Be in the know. 20 key reads for Saturday…

- As Credit Markets Rebound, Neediest Borrowers Are Left Behind (Bloomberg)

- Majority of Americans who qualify for coronavirus aid are expected to receive direct deposits by April 15 (Business Insider)

- N.Y. Deaths Dip; Gilead Drug Shows Early Promise: Virus Update (Bloomberg)

- The Terrible Costs of Keeping—or Ending—the Lockdowns (Barron’s)

- Time to Hit ‘Buy It Now’ Button on eBay Stock (Barron’s)

- This Market Is Made For Warren Buffett. Why Has He Gone Quiet? (Barron’s)

- In the Face of a “Rare Mispricing,” an Oil-Services Bear Turns Bull (Barron’s)

- Fed’s Emergency Lending Has Peaked. At Least for Now. (Barron’s)

- Martin Scorsese Courts Apple and Netflix to Rescue Costly DiCaprio Film (Wall Street Journal)

- Apple, Google Bring Covid-19 Contact-Tracing to 3 Billion People (Bloomberg)

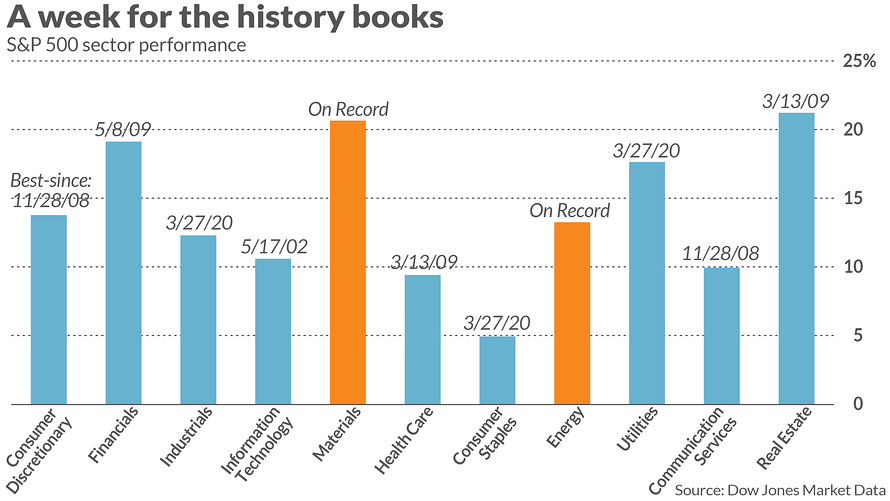

- 16 million people just got laid off but U.S. stocks had their best week in 45 years (MarketWatch)

- Ex-FDA commissioner says ‘widespread screening’ needed to reopen economy (CNN)

- The Asset Class That’s Not Getting Crushed by Coronavirus (Institutional Investor)

- The Relationship Between Earnings and Bear Markets (A Wealth of Common Sense)

- Markets Have Priced In the Lockdown Period. Now What? (Wall Street Journal)

- IRS Launches Registration Tool For Stimulus Checks (Forbes)

- Coronavirus: Is your auto insurer giving refunds? (ValueWalk)

- WEEKLY AND MONTHLY CHARTS SHOW IMPROVEMENT (John Murphy)

- America’s Best Trump Impersonator Has Some Thoughts About CNN And Dr. Fauci (Digg)

- Paul Walker’s 1969 Ford Mustang Boss 429 Is Headed to Auction (Maxim)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 25

Article referenced in VideoCast above:

The Rodney Atkins, “Keep On Going” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Episode 15

Article referenced in podcast above:

The Rodney Atkins, “Keep On Going” Stock Market (and Sentiment Results)…

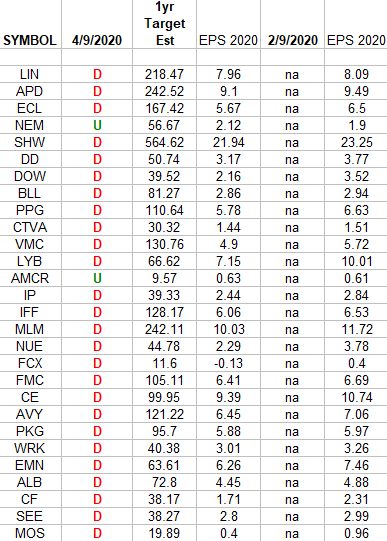

Basic Materials Sector (XLB) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2020 estimates were: 2/9/2020 and today. Continue reading “Basic Materials Sector (XLB) – Earnings Estimates/Revisions”

Be in the know. 15 key reads for Good Friday…

- Pfizer working on promising coronavirus treatment, vaccine (New York Post)

- OPEC and Russia Agree to Cut Oil Production (New York Times)

- With $2.3 Trillion Injection, Fed’s Plan Far Exceeds Its 2008 Rescue (New York Times)

- How the Fed plans to keep credit, a crux of the American economy, flowing to U.S. consumers during the pandemic (MarketWatch)

- Dr. Fauci: Antibody tests are coming soon (CNN)

- Why Blood From Coronavirus Survivors Could Be a Lifeline for the Sick (Wall Street Journal)

- Fed will continue to act ‘forcefully, proactively and aggressively,’ Powell says (Street Insider)

- OPEC+ To Cut Oil Output For Two Years But There’s One Holdout (Investor’s Business Daily)

- The Magic Kingdom Is Closed. Disney Can Keep Profits Flowing. (Barron’s)

- India’s Plunging Stock Prices May Yield Bargains for Investors (Barron’s)

- State Farm to slash $2 billion in car-insurance premiums amid pandemic (MarketWatch)

- Occidental Seeking Federal Lifeline For U.S. Oil Industry (Yahoo! Finance)

- Potential Coronavirus Drugs May Cost as Little as $1, Study Says (Bloomberg)

- NHL Stars Get Social in the Era of Social Distancing (Wall Street Journal)

- Fed Moves Spark Corporate Bond Rally (Wall Street Journal)