Data Source: Finviz

Quote of the Day…

Be in the know. 20 key reads for Thursday…

- This (Alibaba) May Be the Cheapest E-Commerce Play on Earth. Shares Could Rise 50% in 2025. (barrons)

- Boeing and 6 More Contrarian Stocks for 2025 (barrons)

- On thin ice Trump trolls Trudeau by promising Canucks he’ll lower taxes if Canada becomes ’51st state’ — and backs hockey legend for PM (nypost)

- Two famed NYC eateries were just named among the ‘most legendary’ restaurants in the world (nypost)

- 15 Cheap Mid-Caps With Great Odds for Solid Growth (barrons)

- Healthcare Stocks Had a Dismal Year. Therein Lies Opportunity, Says This Analyst. (barrons)

- ‘Christmas miracle’ Barstool Sports founder Dave Portnoy gifts $60K to struggling pizzeria in impromptu deal (nypost)

- Wealthy New Yorkers are spending as much as $50K tipping people for the holidays (com)

- BOJ’s Ueda Avoids Giving Clear Hint on Chances of January Hike (bloomberg)

- China Seeks to Spur Growth by Giving Local Officials Bond Leeway (bloomberg)

- Quantum Computing Is Finally Here. But What Is It? (bloomberg)

- China’s Finance Ministry Vows Greater, Faster Spending in 2025 (bloomberg)

- ‘A truly remarkable breakthrough’: Google’s new quantum chip achieves accuracy milestone (nature)

- Nvidia sees ‘remarkable’ influx of retail investor dollars as traders flock to AI darling (cnbc)

- Disney’s CEO search is a top priority for Bob Iger in 2025. Here’s who’s in the running. (yahoofinance)

- Rand Paul’s Annual Festivus List Highlights Over One Trillion Dollars In Government Waste (zerohedge)

- Buffett talks mortality and philanthropy in surprise shareholder letter (foxbusiness)

- China steps up campaign for single people to date, marry and give birth (ft)

- Ant Group splits Alipay into two business units in latest restructuring move (scmp)

- “First, Support The Expansion Of Domestic Demand” (chinalastnight)

Quote of the Day…

Be in the know. 5 key reads for Christmas…

- Japan corporate service inflation rises, bolsters BOJ rate-hike odds (reuters)

- Citic Securities sees room for the PBOC to cut rate, RRR (bloomberg)

- China’s Finance Ministry Vows Greater, Faster Spending in 2025 (bloomberg)

- Stock market’s December performance in balance as ‘Santa Claus rally’ begins (marketwatch)

- Nike has had a rocky year — here’s why a comeback will take time (cnbc)

Where is money flowing today?

Quote of the Day…

Be in the know. 25 key reads for Christmas Eve…

- “First, Support The Expansion Of Domestic Demand” (chinalastnight)

- China to ramp up fiscal support for consumption next year (reuters)

- Santa Claus Is a Reality for Markets. How History Points to a Rally. (barrons)

- China Plans Special Bonds Amid Vows to Spend (bloomberg)

- Oz ‘the Wall Street Mentalist’ leaves ‘Squawk Box’ hosts speechless (cnbc)

- China Mulls Record $411 Billion Special Bonds, Reuters Says (bloomberg)

- Why the mysteries of corporate longevity matter to investors (ft)

- Portfolio manager names Chinese and European stocks promising ‘strong returns’ despite market uncertainty (cnbc)

- Why the ‘Dogs of the Dow’ Stocks Just Might Deliver in 2025 (barrons)

- Quantum Computing Is Finally Here. But What Is It? (bloomberg)

- ‘They don’t play’ Busted thieves baffled by ‘new laws’ in California that make shoplifting a felony, police video shows (nypost)

- After Years of Going Big, American Car Buyers Are Downsizing (wsj)

- Prime real estate Munich Re scoops up Park Avenue tower in $500M-plus deal to give slumping NYC office market a major boost (nypost)

- Cocaine for moody rats and climate-focused drag show-on-ice top Rand Paul’s annual ‘Festivus’ list of outrageous government waste (nypost)

- The Year of the Ugly Shoe: What’s Next for On, Deckers, and Crocs? (barrons)

- This contrarian investor says the tech bubble is getting scary. Here’s his game plan. (marketwatch)

- Did Elon Musk kill a bill blocking investments in China to help Tesla? (marketwatch)

- This may be why Trump is again calling to buy Greenland after eyeing Canada and Panama Canal (marketwatch)

- Insurance and Taxes Now Cost More Than Mortgages for Many Homeowners (com)

- Billionaire Brothers Turn $12,000 Loan Into Empire of Cheap Toys (bloomberg)

- Emerging Market Assets Advance in Final Push for 2024 Gains (bloomberg)

- Under Trump, Will Keystone XL Remain A Pipe Dream? (zerohedge)

- Nearly 2,000 American CEOs Quit In 2024, Setting New Record (zerohedge)

- How we fell out of love with dating apps (ft)

- Defaults on leveraged loans soar to highest in 4 years (ft)

“The Crown” Stock Market (and Sentiment Results)…

Each week we like to cover 1-2 stocks we have discussed in previous podcast|videocast(s) and/or own for clients and personally. This week we’re going to cover: Continue reading ““The Crown” Stock Market (and Sentiment Results)…”

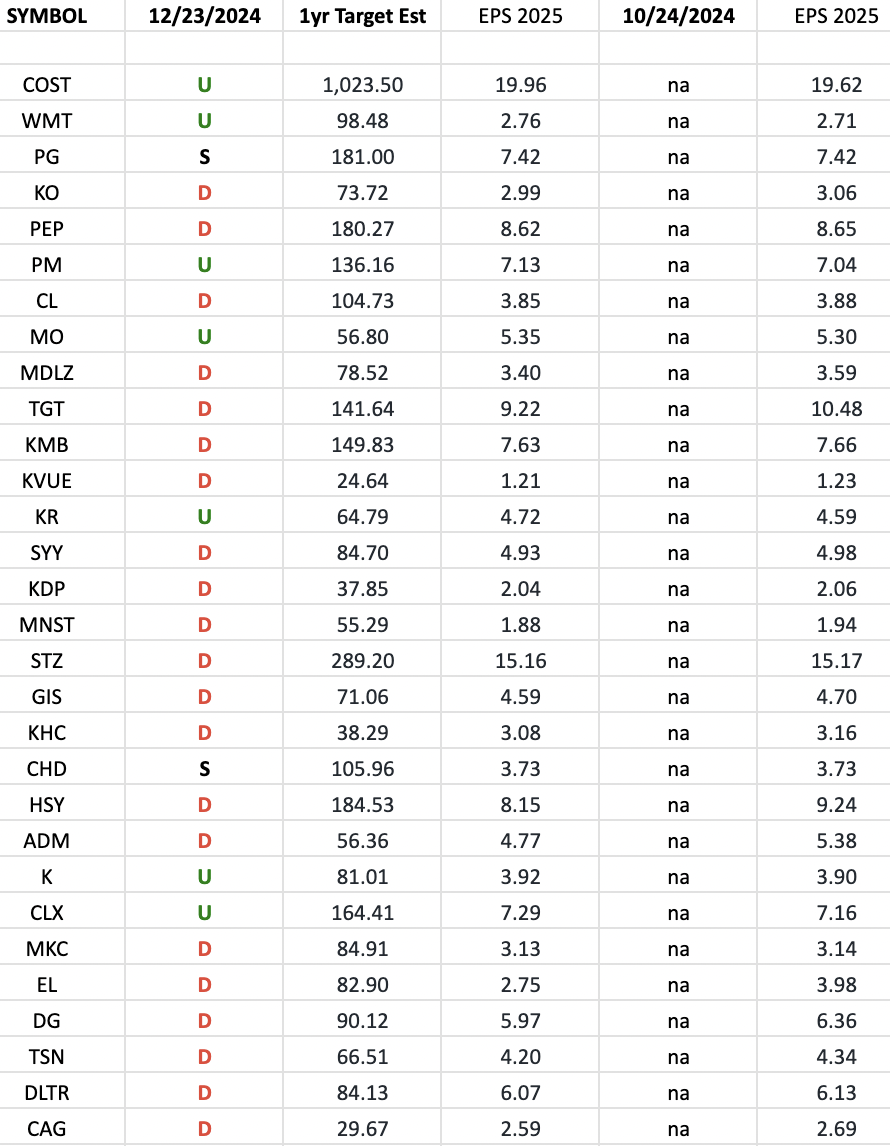

Consumer Staples (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Staples Sector ETF (XLP) top 30 weighted stocks. Continue reading “Consumer Staples (top 30 weights) Earnings Estimates/Revisions”