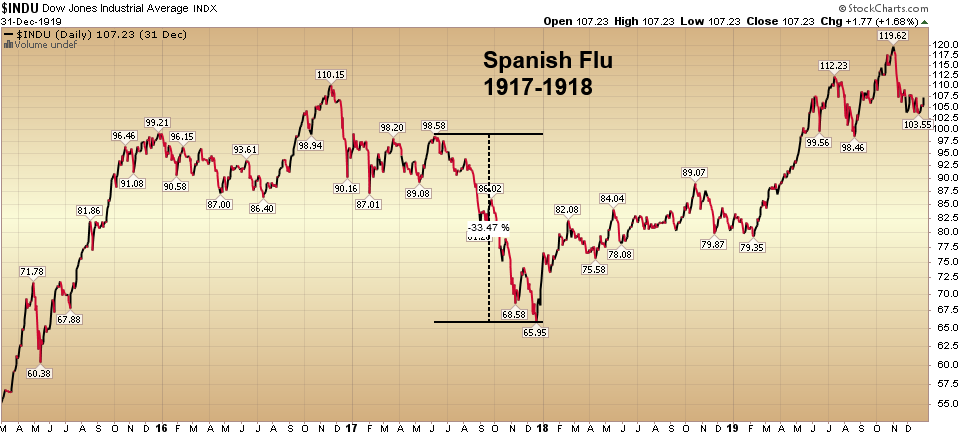

Thank you to Shawn Langolis and Barbara Kollmeyer for featuring me in this MarketWatch article today:

“Market action a century ago suggests worst could be over for stocks, if not for the coronavirus pandemic.” You can read it here:

Click Here to View The Full Article at MarketWatch