Data Source: Finviz

Be in the know. 15 key reads for Wednesday…

- AstraZeneca Pauses Coronavirus Vaccine Study (Barron’s)

- Buy NIO Stock Because Competition With Tesla Isn’t a Zero-Sum Game (Barron’s)

- Tesla Stock Drops as Wall Street Scrambles to Assign Blame (Barron’s)

- Southwest and 3 Other Airline Stocks Ready to Rebound, Says Morgan Stanley (Barron’s)

- Why Pfizer’s Drug Pipeline Will Outshine a Covid Vaccine (Barron’s)

- Citigroup Stock Is Earning Fans on Wall Street. Here’s Why. (Barron’s)

- Capri, a Getaway for the Rich and Famous, Misses Its Americans (New York Times)

- Paul Singer Wants a Piece of the Action in Chevron’s Deal for Noble Energy (24/7 Wall Street)

- Ex-Trump adviser Cohn raises more than planned in blank-check IPO (Reuters)

- Warren Buffett’s Berkshire Hathaway to buy $250 million worth of Snowflake’s shares in private placement (Yahoo! Finance)

- Zoom, Boston Beer, Nikola among Forbes 400’s newest members (Fox Business)

- Pfizer CEO says ‘we will have an answer by the end of October’ on coronavirus vaccine (Fox Business)

- Real Estate Mogul Sam Zell Is Launching A SPAC (Benzinga)

- Legendary investor Byron Wien says next ‘real opportunities’ in market are transportation and energy as tech falters (Business Insider)

- U.S.-China Chip-War Collateral Damage Will Range Far and Wide (Wall Street Journal)

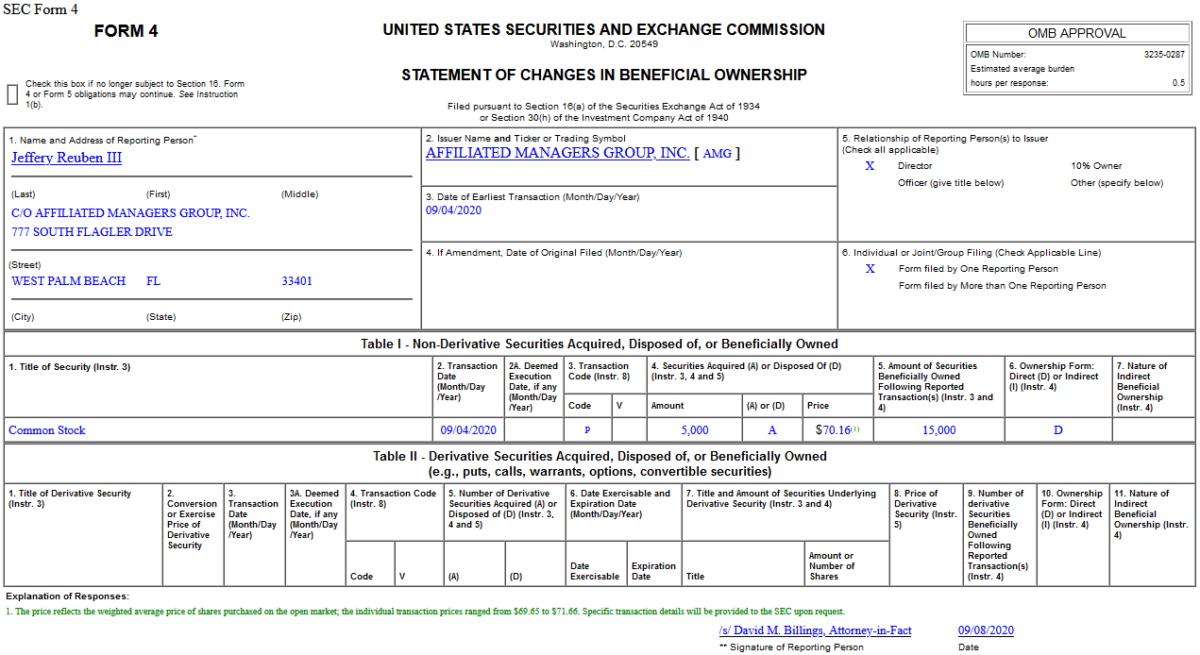

Insider Buying in Affiliated Managers Group, Inc. (AMG)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 15 key reads for Tuesday…

- 13 Stocks That Both Growth and Value Investors Will Love (Barron’s)

- Are the Bulls or Bears Right? One Strategist Offers Context. (Barron’s)

- Summer Sayonara. The Energy Report 09/08/2020 (Price Group)

- Pfizer-BioNTech vaccine could be ready for approval by mid-October — but there are still ‘unknowns’ (CNN)

- Mortgage Market Booms, Even as Virus Hits Economy (Wall Street Journal)

- Goldman Sachs Has 10 Reasons the Bull Market Has Room to Run (24/7 Wall Street)

- Nikola soars 47% after striking $2 billion manufacturing partnership with General Motors (Business Insider)

- Netflix’s Reed Hastings Deems Remote Work ‘a Pure Negative’ (Wall Street Journal)

- Don’t bet against the U.S. market, it’s likely going higher, BlackRock’s Rieder says (Reuters)

- White House’s Meadows says he is optimistic for COVID-19 funds before election (Reuters)

- Activists Say Some Poison Pills Are Bad Medicine (Barron’s)

- SoftBank sheds $8.9bn as ‘whale’ options bets unnerve traders (Financial Times)

- Ivermectin Moves Towards Mainstream (TrialSiteNews)

- Apple Drops on Negative Goldman Outlook, Possible iPhone Delays (Yahoo! Finance)

- Trump Vows to Sharply Scale Back U.S.-China Economic Ties (Bloomberg)

Quote of the day…

Be in the know. 10 key reads for Labor Day…

- Trump floats using extra $300B in coronavirus relief aid for second stimulus check (Fox Business)

- Want to Invest in Emerging Markets? Here’s How to With European, Japanese Stocks. (Barron’s)

- China’s August exports stronger than expected (MarketWatch)

- Intel CEO on How the Chip Maker Plans to Get Back on Track (Barron’s)

- Another Reason to Be Bullish About Bank Stocks (Barron’s)

- U.S. Weighs Export Controls on China’s Top Chip Maker (Wall Street Journal)

- ‘Fomo feeling’ propels Indian investors into stock market (Financial Times)

- Fake reviews are all over Amazon and it’s getting harder to spot them (CNBC)

- The stock market’s latest sell-off amounts to ‘healthy’ recalibration before it heads even higher, says BlackRock’s bond chief who oversees $2.3 trillion (Business Insider)

- Here’s why the Dow plunged last week and what’s ahead for the stock market (MarketWatch)

Be in the know. 15 key reads for Sunday…

- Which emerging markets are the most promising? (Fox Business)

- Kanye West files to appear on Kentucky, Mississippi ballots (The Hill)

- Ford is letting customers personalize their Mustang Mach-E before taking delivery (The Verge)

- The State of U.S. Infrastructure (CFR)

- The Murderer, The Boy King, And The Invention Of Modern Finance (NPR Planet Money)

- Why the Mint Julep Is the Official Drink of the Kentucky Derby (How Stuff Works)

- The Phrase ‘Riding Shotgun’ Came Way After the West Was Won (How Stuff Works)

- The 45 Best Movies on Netflix Right Now (Mental Floss)

- How A New Type of Money Caused The Financial Crisis (Podcast) (Bloomberg)

- 61 Books Elon Musk Thinks You Should Read (Entrepreneur)

- The Meaning Of Sanctuary: The Four Seasons Resort Los Cabos at Costa Palmas (Just Luxe)

- Kanye spends nearly $6 million on presidential campaign (Politico)

- ‘Jack Reacher’ Series at Amazon Casts Alan Ritchson in Lead Role (Variety)

- Gen Z Really Wants to Get Back to the Office (OZY)

- Japan’s Suga says would like to see continuation of easing policies: Nikkei (Reuters)

Be in the know. 25 key reads for Saturday…

- Today’s Bank Losses Could Become Tomorrow’s Profits. Here’s How. (Barron’s)

- This colorful billionaire reportedly played outsized role in recent market rally (New York Post)

- Tech Stocks Slide After a Summer-Long Rally. But This Is No Dot-Com Bubble. (Barron’s)

- Hedge Funds Lighten Up on Tech and Health Care. Should Investors Follow? (Barron’s)

- Warren Buffett Is Betting on Japan. Here’s How You Can Too. (Barron’s)

- 15 Affordable Stocks With Earnings Growth on the Way (Barron’s)

- Stocks Went Haywire Today. The Steepening Treasury Yield Curve Tells the Real Story. (Barron’s)

- U.S. Unemployment Rate Fell to 8.4% in August as Hiring Continued (Wall Street Journal)

- Retail Stores Add Jobs as Shoppers Return (Wall Street Journal)

- U.S. Government-Bond Yields Climb After Jobs Data (Wall Street Journal)

- Tony Hawk Wants to See Skateboarding Everywhere (Wall Street Journal)

- Manufacturers Are Coming Home. Are U.S. Workers Ready? (Bloomberg)

- Foreign Investors Pour Into India Stocks Despite Sinking Economy (Bloomberg)

- A top strategist says the S&P 500 has predicted the election winner 87% of the time in nearly 100 years, but ‘transformational’ events pose a challenge for 2020 vote (Business Insider)

- Many investors have never been so confident on Europe, crisis fund chief says (CNBC)

- Russia’s energy minister calls oil at $50 to $55 a barrel in 2021 (CNBC)

- 5 reasons COVID-19 is boosting cars, SUVs, pickups (USA Today)

- Elon Musk’s brother Kimbal made more than $8 million selling Tesla shares 2 days before he bought them (MarketWatch)

- Watch Ford’s Insanely Powerful Electric Mustang Pop a Wheelie on the Drag Strip (Futurism)

- Tesla spurned in S&P 500 reshuffle (Financial Times)

- Amazon deletes 20,000 reviews after evidence of profits for posts (Financial Times)

- Warren Buffett: His life in pictures (CNN)

- A Value Investor’s Lesson on Valuing People (Safal Niveshak)

- Buffett’s Investment in See’s Candy (Dividend Growth Investor)

- Some Thoughts On SPACs (AVC)