Be in the know. 25 key reads for Christmas Eve…

- “First, Support The Expansion Of Domestic Demand” (chinalastnight)

- China to ramp up fiscal support for consumption next year (reuters)

- Santa Claus Is a Reality for Markets. How History Points to a Rally. (barrons)

- China Plans Special Bonds Amid Vows to Spend (bloomberg)

- Oz ‘the Wall Street Mentalist’ leaves ‘Squawk Box’ hosts speechless (cnbc)

- China Mulls Record $411 Billion Special Bonds, Reuters Says (bloomberg)

- Why the mysteries of corporate longevity matter to investors (ft)

- Portfolio manager names Chinese and European stocks promising ‘strong returns’ despite market uncertainty (cnbc)

- Why the ‘Dogs of the Dow’ Stocks Just Might Deliver in 2025 (barrons)

- Quantum Computing Is Finally Here. But What Is It? (bloomberg)

- ‘They don’t play’ Busted thieves baffled by ‘new laws’ in California that make shoplifting a felony, police video shows (nypost)

- After Years of Going Big, American Car Buyers Are Downsizing (wsj)

- Prime real estate Munich Re scoops up Park Avenue tower in $500M-plus deal to give slumping NYC office market a major boost (nypost)

- Cocaine for moody rats and climate-focused drag show-on-ice top Rand Paul’s annual ‘Festivus’ list of outrageous government waste (nypost)

- The Year of the Ugly Shoe: What’s Next for On, Deckers, and Crocs? (barrons)

- This contrarian investor says the tech bubble is getting scary. Here’s his game plan. (marketwatch)

- Did Elon Musk kill a bill blocking investments in China to help Tesla? (marketwatch)

- This may be why Trump is again calling to buy Greenland after eyeing Canada and Panama Canal (marketwatch)

- Insurance and Taxes Now Cost More Than Mortgages for Many Homeowners (com)

- Billionaire Brothers Turn $12,000 Loan Into Empire of Cheap Toys (bloomberg)

- Emerging Market Assets Advance in Final Push for 2024 Gains (bloomberg)

- Under Trump, Will Keystone XL Remain A Pipe Dream? (zerohedge)

- Nearly 2,000 American CEOs Quit In 2024, Setting New Record (zerohedge)

- How we fell out of love with dating apps (ft)

- Defaults on leveraged loans soar to highest in 4 years (ft)

“The Crown” Stock Market (and Sentiment Results)…

Each week we like to cover 1-2 stocks we have discussed in previous podcast|videocast(s) and/or own for clients and personally. This week we’re going to cover: Continue reading ““The Crown” Stock Market (and Sentiment Results)…”

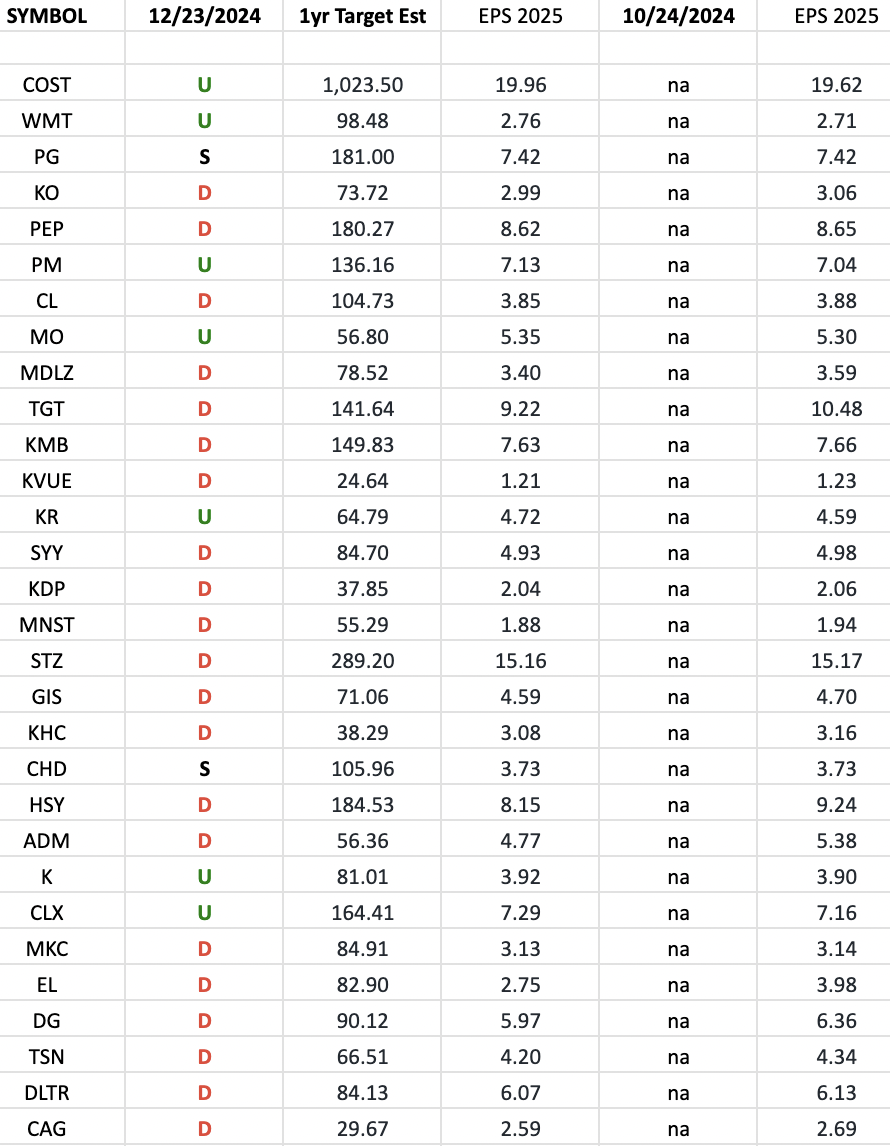

Consumer Staples (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Staples Sector ETF (XLP) top 30 weighted stocks. Continue reading “Consumer Staples (top 30 weights) Earnings Estimates/Revisions”

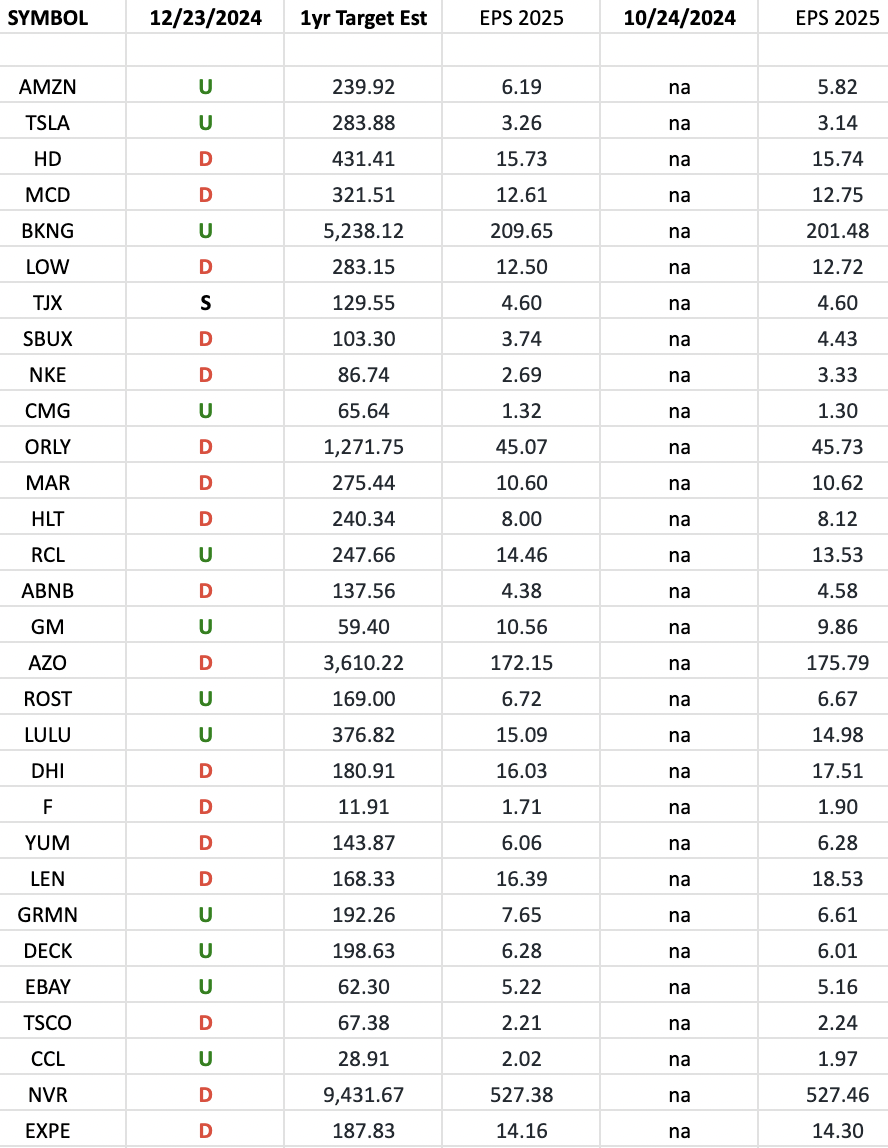

Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Discretionary Sector ETF (XLY) top 30 weighted stocks.

Continue reading “Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 21 key reads for Monday…

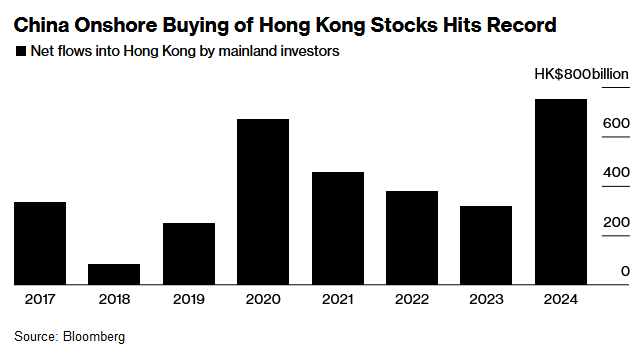

- Chinese Investors Buy Record Amount of Hong Kong Stocks Via Link. “Alibaba, Bank of China were among the most bought shares” (bloomberg)

- BABA-W (09988.HK) Officially Launches Operations in Morocco, Marking 1st Stop in Africa (aastocks)

- Small-Cap Stocks Get Hit Again. Be Patient. “Wall Street analysts forecast profits for small-cap companies to increase 16% next year, ahead of the 15% growth analysts predict for larger companies. And, small caps are also significantly cheaper. The S&P 600 trades at 15 times next year’s profits, compared to 22 for the S&P 500.” (barrons)

- “A broad group of value stocks tracked by SentimenTrader senior analyst Jason Goepfert is near its lowest level versus growth in over two decades. The last time relative prices were at these levels in the early 2000s, value stocks went on to outperform growth over the coming years.” (barrons)

- Disneyland places restriction on popular holiday item, as demand soars (foxbusiness)

- Here are the year’s losing stocks that could see a big rebound in early 2025 (marketwatch)

- There might be a bullish story underway for materials stocks in 2025 (marketwatch)

- Wall Street’s IPO Engine Picked Up in 2024 (barrons)

- These 2 Plastics Stocks Just Saw Big Insider Buys (barrons)

- These Are the Wildest, Weirdest Stock-Market Prices We’ve Ever Seen (wsj)

- The Investing Cult Fueling MicroStrategy’s Ascent: ‘Have Fun Staying Poor’ (wsj)

- Raimondo Says Holding Back China in Chips Race Is a ‘Fool’s Errand’ (wsj)

- Estée Lauder Says It Spent $366 Million on Restructuring So Far (wsj)

- Charlie Woods nails his first hole-in-one, shares huge hug with dad Tiger in wild PNC Championship moment (nypost)

- Portugal Home Prices Post Biggest Increase in Almost Two Years (bloomberg)

- Big Tech’s $62 Billion AI Spending Fuels Pick-and-Shovel Bets (bloomberg)

- Macao is becoming a city of sports and entertainment, Sands China CEO says, as President Xi urges diversification (cnbc)

- With cooler-than-expected PCE, would the Fed’s dot plot have looked different? (cnbc)

- Hedge Funds Pile Into Trades Dollar-Yen Will Rise as High as 165 (bloomberg)

- Trump Threatens To Take Back Panama Canal As He Declares “Golden Age Of America Is Upon Us” (zerohedge)

- 1 Growth Stock Down 44% to Buy Right Now (fool)

Where is money flowing today?

Quote of the Day…

Quote of the day…

Be in the know. 10 key reads for Sunday…

- Will The Santa Claus Rally Come In 2024? (carson)

- MIT-Linked Company Says It Will Build ‘World’s First Grid-Scale’ Nuclear Fusion Power Plant (gizmodo)

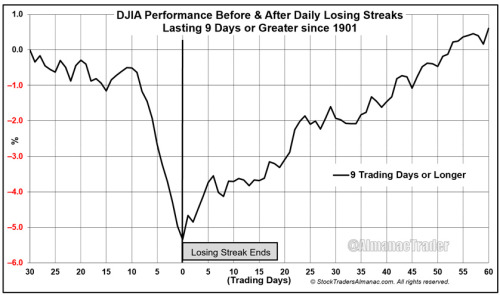

- DJIA’s Longest Losing Streak Since 1978 Not Likely to Cancel Santa Claus Rally (AlmanacTrader)

- Donald Trump tells EU to buy US oil and gas or face tariffs (ft)

- The spending bill that averted a shutdown shrank from more than 1,500 pages to just 100—here’s what was cut (fortune)

- How sports gambling blew up (npr)

- A Mysterious Health Wave Is Breaking Out Across the U.S. (theatlantic)

- Trump puts Panama on notice — and floats idea of US reclaiming canal: ‘Foolishly gave it away’ (foxbusiness)

- The U.S. is the King of Net Worth (scottgrannis)

- Materials are the worst performer in the S&P 500 this year. What 2025 holds for this beaten-down sector. (marketwatch)