- Famed Bank analyst Dick Bove upgrades Wells Fargo to Buy, citing its ‘formidable presence’ (Seeking Alpha)

- GlaxoSmithKline and Sanofi Launch First Human Trial of Their Covid-19 Vaccine (Barron’s)

- The High-Yield Bond Market’s Distress Signals Are Fading (Barron’s)

- Warren Buffett and the Market That Foreign Money Forgot (Wall Street Journal)

- ‘No Time to Die’ trailer: Bond is finally back in action after COVID-19 delays (New York Post)

- Women of the Century: Recognizing the accomplishments of women from the last 100 years (USA Today)

- The Run DMC, “It’s Tricky” Stock Market (and Sentiment Results) (ZeroHedge)

- Initial Jobless Claims 881K vs 950K Expected (StreetInsider)

- AMC (AMC) says 70% of U.S. Circuit to Be Open by Friday, September 4 (StreetInsider)

- ‘That was awesome!’: David Blaine lands high-flying, live balloon ride above the Arizona desert (USA Today)

- Fed’s Daly urges more government spending to boost economy (Reuters)

- Billionaire investor Mario Gabelli explains ‘problem’ with Tesla stock (Yahoo! Finance)

- KKR homes in on Japan property as companies offload assets (Financial Times)

- Chinese EV Manufacturer Nio’s August Deliveries Jump 104% Year-Over-Year (Benzinga)

- Rules That Warren Buffett Lives By (Investopedia)

- This new company is buying brands like Modell’s and giving them new life online (New York Post)

- Market guru makes bold prediction about presidential election (New York Post)

- Crucial Test Results for Promising Covid Vaccines Due in Weeks (Bloomberg)

- Laura’s Last Attack. The Energy Report. (Price Group)

- Brazil PMIs show economic activity in August strongest since 2013, but services still lag (Reuters)

- Investors have little to lose, much to gain with these three unloved stocks, says contrarian manager (MarketWatch)

- Here are Bank of America’s ‘must-know’ market stats that show ‘epic polarization’ (MarketWatch)

- France reveals fresh stimulus worth 100 billion euros – almost 4% of its GDP and bigger than any other European economy. (Business Insider)

- Where ‘Abenomics’ Succeeded and Failed (Barron’s)

- Southwest May Be as Good as It Gets for Airlines, Analyst Says (Barron’s)

- Fed Beige Book Finds Modest Economic Growth (Wall Street Journal)

- Trump Administration Asks States to Be Ready for Vaccine by November (Wall Street Journal)

- What to Watch: With ‘Cobra Kai,’ a Middle-Aged Karate Kid Feud Has Become a Netflix Hit (Wall Street Journal)

- The 1918 Pandemic Was Deadlier, but College Football Continued. Here’s Why. (Wall Street Journal)

- Cable, Satellite Operators Place New Bets on 5G Airwaves (Wall Street Journal)

The Run DMC, “It’s Tricky” Stock Market (and Sentiment Results)…

This week I chose the classic 1987 rap song, “It’s Tricky” by Run DMC to embody the current status of the market. They lyrics are self-explanatory:

It’s Tricky, it’s Tricky (Tricky) Tricky (Tricky) Continue reading “The Run DMC, “It’s Tricky” Stock Market (and Sentiment Results)…”

Unusual Options Activity – Gilead Sciences, Inc. (GILD)

Data Source: barchart

Today some institution/fund purchased 1,102 contracts of June $100 strike calls (or the right to buy 110,200 shares of Gilead Sciences, Inc. (GILD) at $100). The open interest was just 465 prior to this purchase. Continue reading “Unusual Options Activity – Gilead Sciences, Inc. (GILD)”

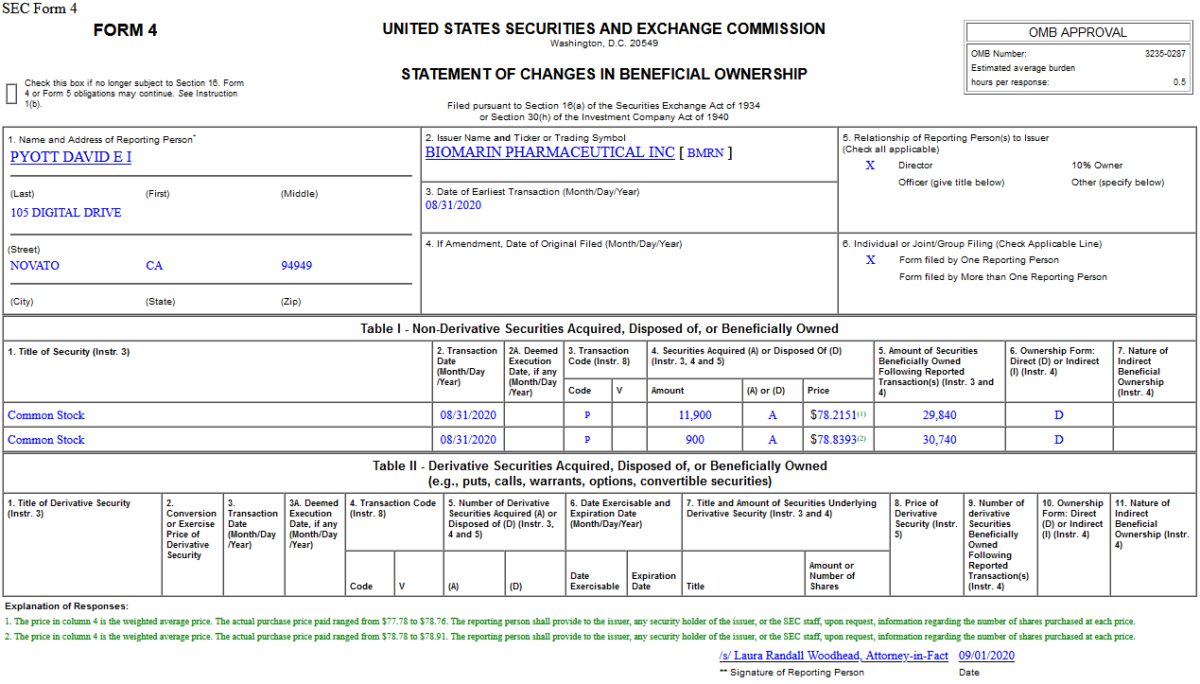

Insider Buying in BioMarin Pharmaceutical Inc. (BMRN)

Where is money flowing today?

Tom Hayes – CNBC Indonesia Appearance – 9/1/2020

Be in the know. 20 key reads for Wednesday…

- Coronavirus live updates: Fauci says vaccine could be available earlier than expected (USA Today)

- Natural Gas Posts Biggest Monthly Gain Since 2009 (Barron’s)

- Mnuchin Says Economy Is Recovering but ‘More Work’ Is Needed to Alleviate Pain (New York Times)

- Buffett Seen Liberating His Successor With Not-So-Buffett Moves (Bloomberg)

- An outdoor swimming pool in England is using geothermal energy to keep bathers warm (CNBC)

- Mortgage demand from homebuyers is now 28% higher than last year (CNBC)

- Barron’s Daily: Moviegoing Is Back—and AMC Stock Is Gaining (Barron’s)

- Hedge Funds Ditched Tech, Health Care for Financials, Industrials (Barron’s)

- Indian Stocks Look Poised for a Strong Rebound. These 2 Sectors Should Do the Best. (Barron’s)

- This stock-market metric has correctly predicted presidential election results since 1984 (MarketWatch)

- Tasteful Serenity is the Goal of the New Rolls-Royce Ghost (Barron’s)

- Billionaire investor Daniel Loeb reverses losses with bets on Amazon, Disney and Alibaba (fn London)

- Bridgewater’s Risk-Parity Shift Jolts a $400 Billion Quant Trade (Bloomberg)

- Gilead Sciences (GILD), Jounce Therapeutics (JNCE) Announce Exclusive License Agreement for Novel Immunotherapy Program (Street Insider)

- Can Steve Cohen Fix America’s Health Care Problem? (Institutional Investor)

- U.S. and Global Factory Output Picks Up, but Jobs Picture Is Mixed (Wall Street Journal)

- Germany Expects V-Shaped Economic Rebound From Coronavirus (Wall Street Journal)

- Covid-19 Plasma Treatment Could Offer Even More Hope (Wall Street Journal)

- Why Factories Are So Strong in a Pandemic (Wall Street Journal)

- Real Estate Is Now About Location, Location, Isolation (Wall Street Journal)

Tom Hayes – Cheddar TV Appearance – 9/1/2020

Cheddar TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – September 1, 2020