Data Source: Finviz

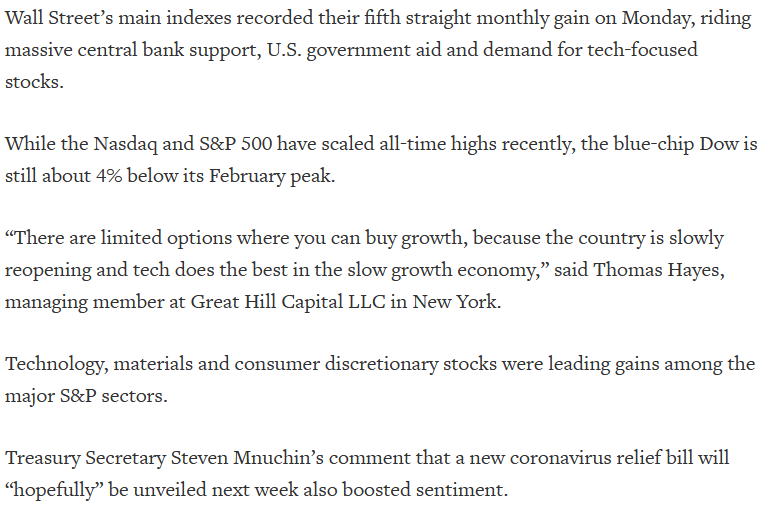

Tom Hayes – Quoted in Reuters article – 9/1/2020

Thanks to Medha Singh and Devik Jain for including me in their article on Reuters today. You can find it here:

Tom Hayes – One America News Network (OAN) TV Appearance – 8/31/2020

Tom Hayes – CGTN Global Business Appearance – 8/31/2020

Be in the know. 15 key reads for Tuesday…

- The Worst Is Over. Buy Bank of America and These 5 Other Stocks Now, Analysts Say. (Barron’s)

- Goldman Sachs boosts 2021 oil forecast and recommends Brent as an ‘effective’ hedge against uncertainty for investors (Business Insider)

- Why Warren Buffett’s Berkshire Hathaway Is Now Big on Japan (Barron’s)

- Opinion: New bull market in stocks could last three years and may produce another 30% in gains, veteran strategist says (MarketWatch)

- Buy Pfizer, Dump Salesforce? Exiles on Wall Street Are Worth a Look (Wall Street Journal)

- Shinzo Abe’s Unfinished Revolution Hangs in the Balance (Wall Street Journal)

- September has the worst track record for stocks but maybe not this year after August’s strong gains (CNBC)

- Trump re-election momentum could shock stock-market investors betting on Biden win, quantitative analyst says (MarketWatch)

- China’s Caixin PMI soars to near-decade high (MarketWatch)

- European manufacturing PMI records second month of improving conditions (MarketWatch)

- Snack company is in the chips as public dips into first day of trading (Fox Business)

- Tesla’s nickel quest highlights metal’s environmental burden (Financial Times)

- Buffett’s 1977 Letter Hints at Why He Likes Japan Trading Houses (Yahoo! Finance)

- Amazon gets FAA approval to deliver packages by drone (New York Post)

- Why Buffett’s bet on Japan could turn on higher inflation, weakening dollar (Reuters)

Where is money flowing today?

Be in the know. 5 key reads for Monday…

- Berkshire Buys Passive Stakes in 5 Japanese Trading Houses (Barron’s)

- FDA willing to fast track coronavirus vaccine before phase three trials end (CNBC)

- Coronavirus Has Left Banks With Lots of Cash and Little to Do With It (Wall Street Journal)

- China’s Theme Parks Ride a Boom as Tourists Have Nowhere to Go (Wall Street Journal)

- Shinzo Abe’s Unfinished Revolution Hangs in the Balance (Wall Street Journal)

Be in the know. 10 key reads for Sunday…

- FDA Expands Emergency Use of Gilead’s Remdesivir in All Covid-19 Hospitalizations (Barron’s)

- Citigroup Economic Surprise Index (Yardeni)

- Inside A Billionaire’s Fight With A Small Town Over A Tiny Vacant Lot (Forbes)

- Wall Street Week Ahead: Value bulls bang drum for cheap stock resurgence on Fed, vaccine hopes (Reuters)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- How Tom Cruise Made This Impossible Movie Stunt Possible (digg)

- Is A Major Oil Price Breakout On The Horizon? (Oil Price)

- Tiffany Reports 90% Sales Jump in China: First real sign of Pandemic Luxury Recovery (Luxuo)

- 5 of the World’s Most Exclusive Private Island Resorts (Just Luxe)

- The Most Beautiful Golf Clubhouses in the U.S. (Just Luxe)

Be in the know. 20 key reads for Saturday…

- Warren Buffett and the $300,000 Haircut (Wall Street Journal)

- Fed’s Bullard says the recession is over but rates will ‘stay low for a long time’ (CNBC)

- Activists May Focus on Energy and Health Care Next Year (Barron’s)

- Losing the extra $600 unemployment benefit may not have stopped Americans from spending money, J.P. Morgan credit card data shows (MarketWatch)

- The U.S. Housing Market Is on Fire. Two Ways to Play It. (Barron’s)

- Get Ready for a Crazy Wave of IPOs (Barron’s)

- New York City’s Offices Are Empty. How to Gamble on a Recovery. (Barron’s)

- The Secrets of Elite College Admissions (Wall Street Journal)

- Elon Musk unveils working prototype of ‘brain-implant’ device (New York Post)

- This Market Rally Has Legs, Six Strategists Say. Here’s Proof (Bloomberg)

- A Simple Recipe for Oyster-Sauce Scallops to Make at Home (Bloomberg)

- Why One Analyst Has His Eyes Set on Singapore’s Virus-Hit Small Caps (Bloomberg)

- Warren Buffett’s 90th birthday is on Sunday. Here are 5 of the legendary investor’s best birthday stories. (Business Insider)

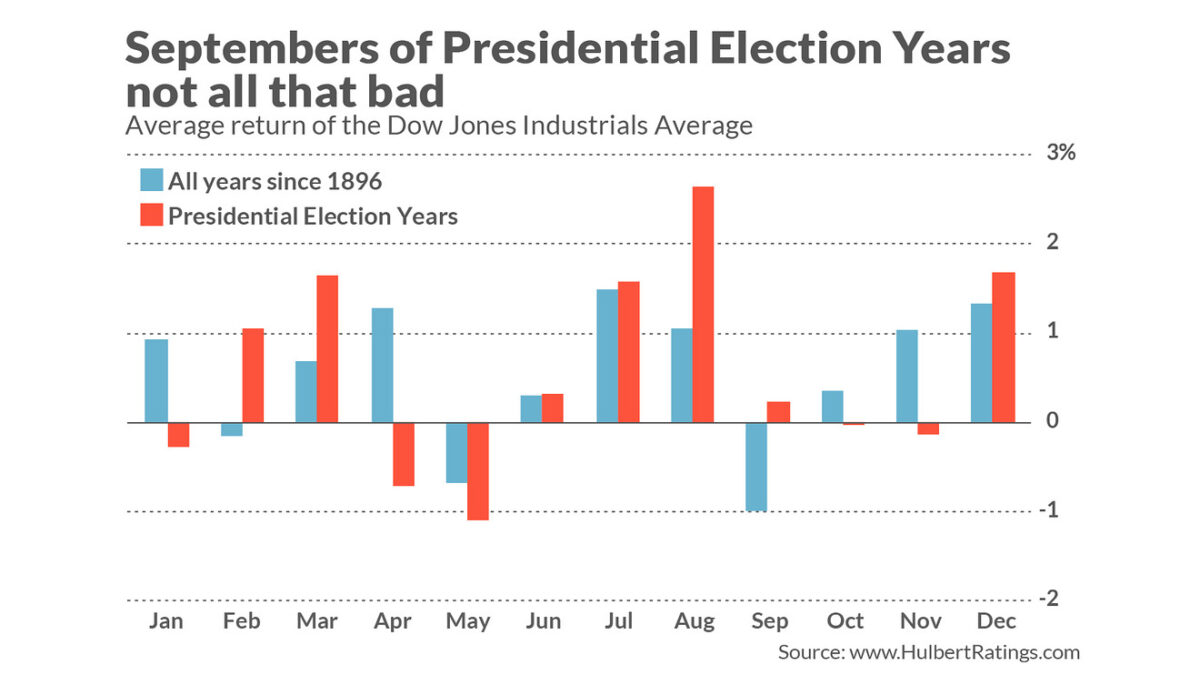

- Opinion: The stock market is on a tear, but now comes September, the worst month of the year. However, something curious happens in presidential-election years (MarketWatch)

- Cruise operators took a deep bruising from COVID-19, but history says they will recover (MarketWatch)

- Utz, maker of Zapp’s and Boulder Canyon chips, is going public (CNN Business)

- The United States set record for daily natural gas power burn in late July (EIA)

- Yield curve steepens after Fed policy shift (Financial Times)

- The Public and Private Markets (Investor Amnesia)

- Why Bank of New York Mellon Is Worth a Second Look (Barron’s)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 45

Article referenced in VideoCast above:

The Stevie Wonder, “Faith” Stock Market (and Sentiment Results)…