- Alibaba’s Ant Group files for blockbuster dual listing in Hong Kong, Shanghai (Reuters)

- Paul Ryan-chaired Executive Network Partnering sets IPO terms with plan to raise about $300 million (MarketWatch)

- U.S. Stock Market Bulls From UBS to BofA See More Gains Ahead (Bloomberg)

- Why 5 Legacy Tech Dividend Stocks May Be the Best Buys Now (24/7 Wall Street)

- U.S., China reaffirm commitment to Phase 1 trade deal in phone call (Reuters)

- UFC’s Dana White, a $1M Trump donor, gets key RNC speaker slot (Fox Business)

- Opinion: Exxon getting booted from the Dow Jones Industrial Average may be a blessing in disguise for its investors (MarketWatch)

- Gilead’s Remdesivir-Like Compound To Be Studied By NIH For Efficacy Against COVID-19 (Benzinga)

- Steve Cohen out to gobble up Hollywood big fish with new management company (New York Post)

- Salesforce, Amgen and Honeywell added to Dow in major shake-up to the average (CNBC)

- 4 Energy Stocks Left Behind in the Rally With Strong Balance Sheets (MarketWatch)

- Home prices show signs of recovery, rising 4.3% in June, according to Case-Shiller index (CNBC)

- More than half of states are now approved for the extra $300 per week in unemployment insurance (CNBC)

- Powell set to deliver ‘profoundly consequential’ speech, changing how the Fed views inflation (CNBC)

- Big Pharma Needs a Covid-19 Vaccine to Redeem Its Reeling Reputation (Bloomberg)

- 10 Cheap, Overlooked Stocks With Plenty of Upside (Barron’s)

- New Thinking on Covid Lockdowns: They’re Overly Blunt and Costly (Wall Street Journal)

- Oil Companies Brace for Twin Gulf Coast Storms (Wall Street Journal)

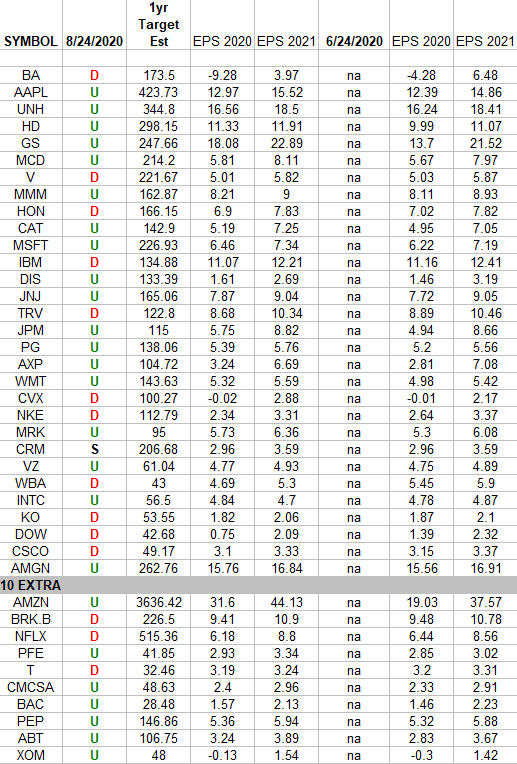

DOW + (10 S&P 500 top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the DOW 30 PLUS 10 of the S&P 500 top 30 weights [that are not either included in the DOW 30 or in the top 30 weights of the Nasdaq]. Continue reading “DOW + (10 S&P 500 top weights) Earnings Estimates/Revisions”

Unusual Options Activity – Gilead Sciences, Inc. (GILD)

Data Source: barchart

Today some institution/fund purchased 2,176 contracts of Feb 2021 $90 strike calls (or the right to buy 217,600 shares of Gilead Sciences, Inc. (GILD) at $90). The open interest was 945 prior to this purchase. Continue reading “Unusual Options Activity – Gilead Sciences, Inc. (GILD)”

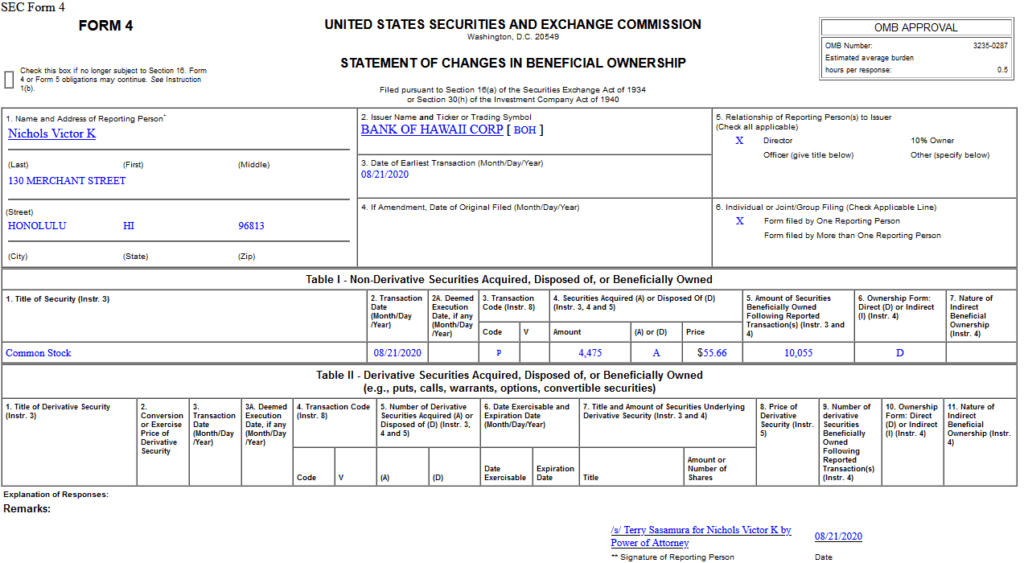

Insider Buying in Bank of Hawaii Corporation (BOH)

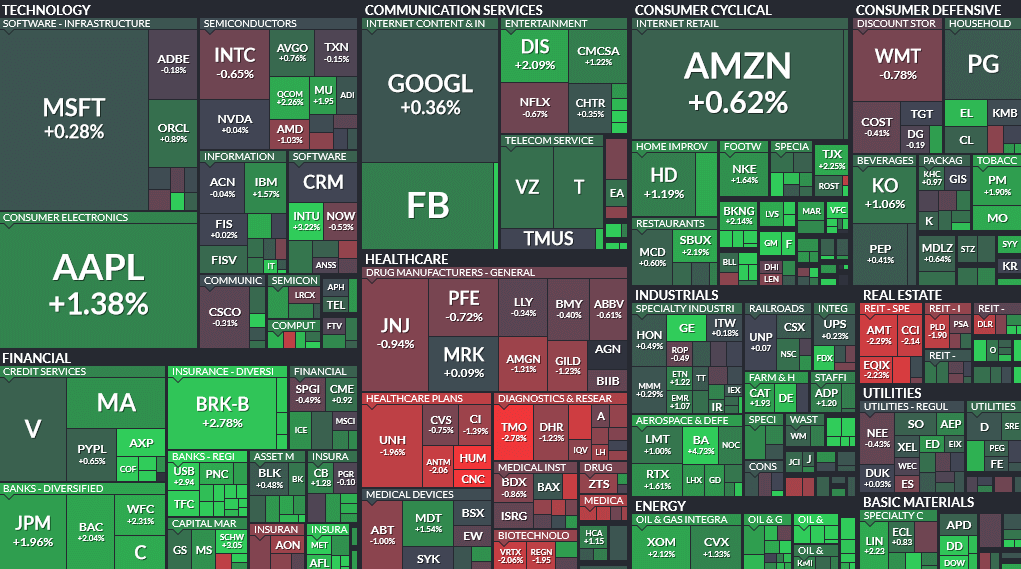

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

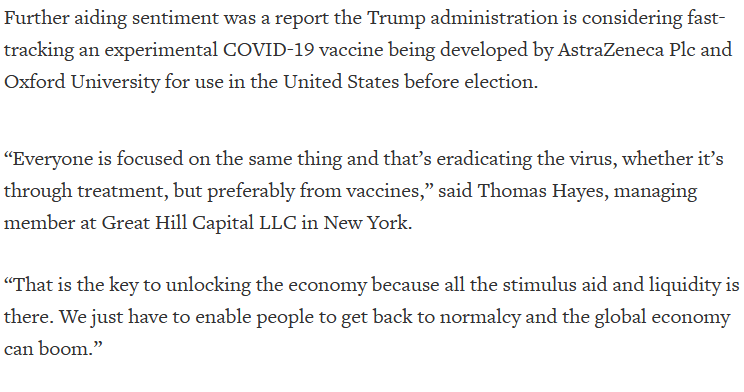

Tom Hayes – Quoted in Reuters article – 8/24/2020

Thanks to Medha Singh and Devik Jain for including me in their article on Reuters today. You can find it here:

Be in the know. 20 key reads for Monday…

- Stock Market Soars on FDA News (Barron’s)

- Market timing when ‘clocks have no hands’ — Warren Buffett’s warning is as relevant now as it was in 2000 (MarketWatch)

- M&A Was Dead. Why It’s Come Roaring Back. (Barron’s)

- AstraZeneca stock climbs on reports Trump considering fast-tracking COVID-19 vaccine (MarketWatch)

- Antibody Drugs Advancing to Fill Covid-19 Treatment Gap (Wall Street Journal)

- Why Steve Cohen’s SEC history shouldn’t hurt his Mets bid (New York Post)

- Blackstone Gains $5 Billion on Cheniere LNG Stake (Bloomberg)

- China’s Vaccine Front-Runner Aims to Beat Covid the Old-Fashioned Way (Bloomberg)

- These areas of the cyclical trade are set to outperform, $114 billion money manager says (CNBC)

- Opinion: These 15 stocks are ready to ride the bull market’s next leg up (MarketWatch)

- Russell Crowe’s ‘Unhinged’ off to a decent start as U.S. theaters slowly reopen (CNBC)

- What Is Covid-19 Convalescent Plasma? (Wall Street Journal)

- Intel (INTC) Initiates $10 Billion Accelerated Share Repurchase Agreements (StreetInsider)

- 5 Blue Chip Stocks to Buy Now That Pay a 6% or Higher Dividend (24/7 Wall Street)

- ‘Opportunity zones’ drew $75B in private investment in 2 years, White House says (Fox Business)

- Municipality of Lucknow in UP India Now Distributes Free Ivermectin via Kiosks to Treat COVID-19 (TrialSiteNews)

- S&P 500, Nasdaq set to hit new highs on COVID-19 treatment hopes (Reuters)

- This Market Is a Tech Market. If Bond Yields Rise, Watch Out. (Wall Street Journal)

- The Lionel Richie “Dancing on the Ceiling” Stock Market (and Sentiment Results)… (ZeroHedge)

- Schwarzman’s Blackstone buys Japanese drugs subsidiary (Fox Business)

Be in the know. 10 key reads for Sunday…

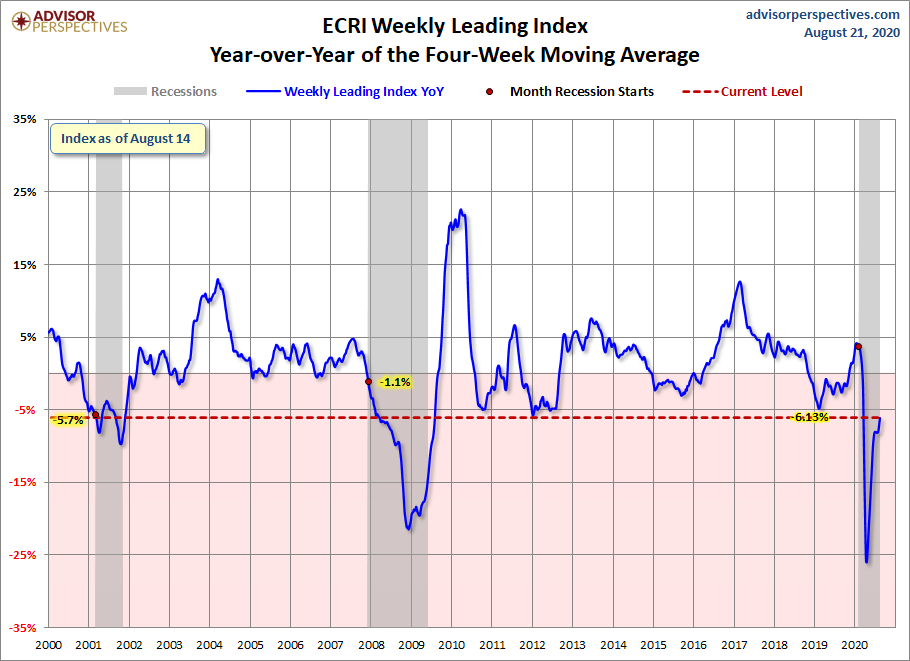

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Survey of India’s 9th-largest city finds COVID antibodies in 52% of the population (Fortune)

- This Bonkers New 314-Foot Expedition Yacht Has a Lounge That’s Half Submerged in Water (Robb Report)

- The U.A.E. and Israel Agree to Terms That Could Mean a Boom in Tourism (Architectural Digest)

- Watch A Foul Ball Hit A Teddy Bear Smack In The Head (DIGG)

- Williams Formula 1 Team Sold to American Investment Firm (The Drive)

- ‘Tenet’ is a time-bending spy thriller that makes the audience work hard (Mashable)

- Making the Middle Class Great Again (NPR Planet Money)

- The CEO of a $1.4 Billion REIT Explains Housing (Podcast) (Bloomberg)

- Comporta, Portugal May Be The Best Place On Earth (Luxuo)

Be in the know. 20 key reads for Saturday…

- US home sales hit a 14-year high amid coronavirus pandemic (New York Post)

- Wyndham Stock Is Well Positioned to Ride Out Pandemic (Barron’s)

- 5 New Stocks That Are Hedge Funds’ Favorites (Barron’s)

- The Fed May Have to Do More to Keep the Economy on Track. Here’s What Could Come Next. (Barron’s)

- The Next Big Test for the Economy: Getting America Back to School (Barron’s)

- Michael Eisner Bought Up IAC/InterActiveCorp Stock (Barron’s)

- Covid-19 Pay Cuts Coming to an End at Some Companies (Wall Street Journal)

- New Antibody Tests Offer Better Snapshot of Covid-19 Immunity (Bloomberg)

- Baupost Collects $3 Billion Wagering on PG&E’s Wildfire Claims (Bloomberg)

- Kanye West Off Ballot in Five States, Easing Risk to Biden (Bloomberg)

- BJ’s is adding a ton of new members to its roster, and many are young and digitally-savvy (MarketWatch)

- Home-Improvement Stocks Stay the Course Amid Nesting During Covid-19 (Wall Street Journal)

- Ben Affleck Will Return as Batman in The Flash (Vanity Fair)

- Florida Is Releasing Almost a Billion Gene-Hacked Mosquitoes (Futurism)

- A Conversation about Buffett, Berkshire & High-Quality Shareholders w/ Professor Lawrence Cunningham (Excess Returns)

- The Observer Effect: Seeing Is Changing (Farnam Street)

- Rob Arnott Weighs In On the Impact Of Fiscal And Monetary Policy On The Economy (TD Ameritrade Network)

- September Almanac: Only Modest Improvement in Election Years (Almanac Trader)

- The Inside Story Of Robinhood’s Billionaire Founders, Option Kid Cowboys And The Wall Street Sharks That Feed On Them (Forbes)

- 30 Most Popular Stocks Among Hedge Funds: 2020 Q2 Rankings (Insider Monkey)