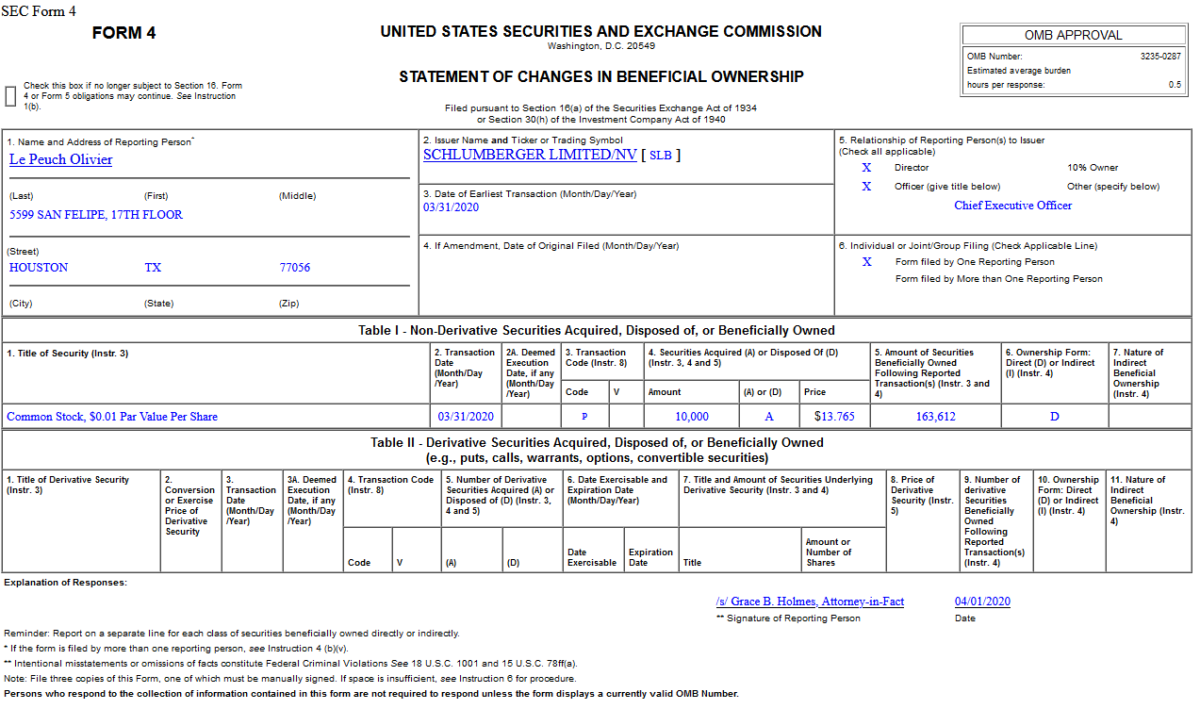

On March 31, 2020, Olivier Le Peuch – CEO of Schlumberger Limited (SLB) – purchased 12,000 shares of SLB at $11.94. His out of pocket cost was $163,612.

Where is money flowing today?

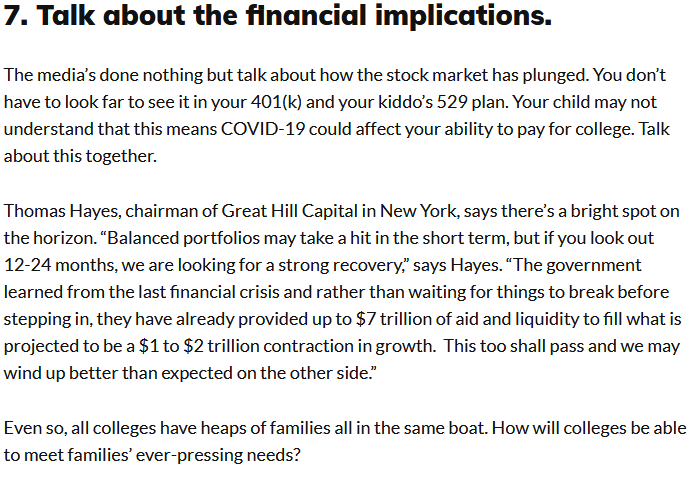

My quotes on College Money Tips Thursday:

Thanks to Melissa Brock for including me in her article on College Money Tips today, “7 Top Ways to Support Your High School Senior or Junior During COVID-19” You can read it here:

Click Here to View The Full Article on CollegeMoneyTips.com

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 20 key reads for Thursday…

- Oil jumps as Trump talks up truce hopes for Saudi-Russia price war (StreetInsider)

- No One Is Betting in Casinos—Or on Their Stocks ()

- Trump says expects Russia-Saudi oil deal soon, invites US oil chiefs to White House (Reuters)

- Oil rallies as Trump spurs hopes for Russia-Saudi pact (Financial Times)

- Detroit To Be The First City To Roll Out Abbott’s 5-Minute Coronavirus Tests (Benzinga)

- Kroger’s sales jump 30% as shoppers stock up amid coronavirus crisis New York Post)

- Retailers Under Growing Pressure to Let Workers Wear Masks New York Times)

- Mapping the Coronavirus Outbreak Across the World (Bloomberg)

- Walgreens earnings top estimates, says it can’t forecast the impact of coronavirus pandemic (CNBC)

- Trump To Talk Aid For Oil As Big Shale Firm Files For Bankruptcy (Investor’s Business Daily)

- Big Banks Get Temporary Reprieve (Barron’s)

- These 8 Aristocrats Have Safe Dividends. (Safe Being a Relative Term Right Now). (Barron’s)

- A Top Occidental Petroleum Executive Is Out as Company Grapples With Oil Rout (Wall Street Journal)

- The Fed Is Settling Into Its Role as the World’s Central Bank (Wall Street Journal)

- 5 Blue Chip Stocks to Buy Now With Huge Piles of Cash and Very Low Debt (24/7 Wall Street)

- Trump May Join Oil Talks Between Russia And Saudi Arabia (Yahoo! Finance)

- Workers Return to China’s Factories, but Coronavirus Hurts Global Demand (Wall Street Journal)

- Coronavirus Tests Aren’t Hard to Find Everywhere (Wall Street Journal)

- Telemedicine, Once a Hard Sell, Can’t Keep Up With Demand (Wall Street Journal)

- How a Mailman Still Carries On During Coronavirus (Wall Street Journal)

The “Work From Home” Stock Market (and Sentiment Results)…

Each week I try to tie the theme of the stock market to a song that embodies the news of the day. As we all fall into the rhythm of the “Shelter in Place” new normal, the song that came to mind was Fifth Harmony’s 2016 hit, “Work from Home:”

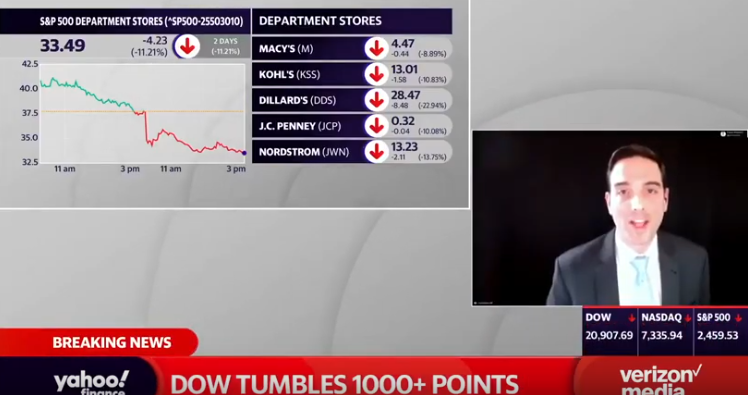

Yesterday afternoon, I was on Yahoo! Finance and I compared the size of the Stimulus Package to the size of the expected contraction in GDP. My statement was, “we are filling a $1.5-2 Trillion pothole with up to $7-9 Trillion of asphalt.”

Here’s the math behind it…

1.The Stimulus Package – $2T:

Contraction in GDP (estimates):

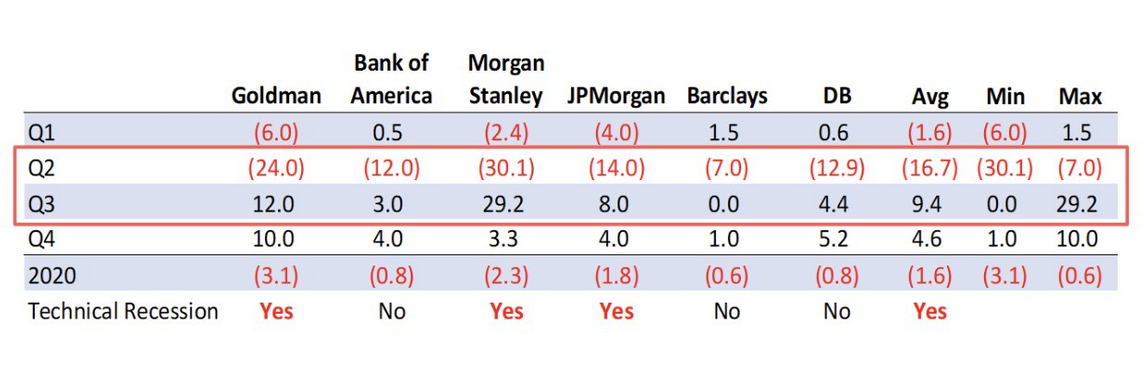

Source (above): DoubleLine

As you can see above, the Average estimated drop in GDP for Q2 is 16.7%. We did ~$21.42T in GDP last year or ~$535B per quarter. A 16.7% drop would be $893B. The worst estimate is a 30.1% contraction or $1.61T.

Let’s say it lasts a bit longer than expected and it’s a $2T hit to GDP. The size of the pothole is ~2T.

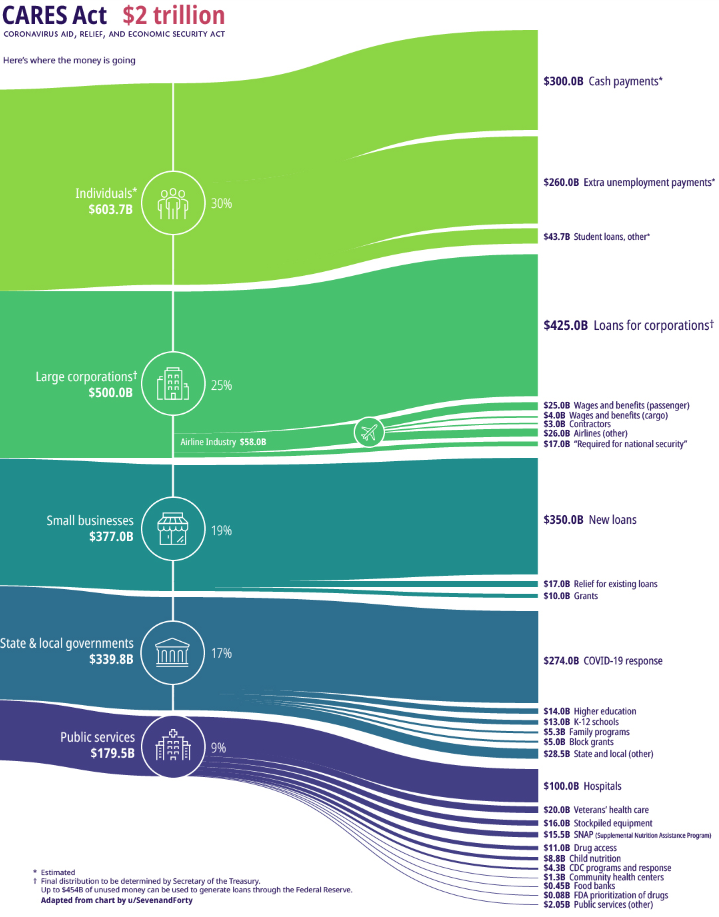

The Stimulus is much larger than the anticipated loss:

Source (picture above and detail below): VisualCapitalist.com

“Funds for Individuals

Amount: $603.7 billion – 30% of total CARES Act

In order to stimulate the sputtering economy quickly, the U.S. government will deploy “helicopter money” — direct cash payments to individuals and families.

The centerpiece of this plan is a $1,200 direct payment for those earning up to $75,000 per year. For higher earners, payment amounts will phase out, ending altogether at the $99,000 income level. Families will also receive $500 per child.

There are three other key things to know about this portion of the stimulus funds:

- There will be a temporary suspension for any student loan held by the federal government. This means no payments required and no interest accrued until the end of September 2020.

- Borrowers with federally backed loans can request forbearance on mortgage payments for up to six months.

- There will be an expansion of unemployment benefits, including a four-month enhancement of benefits. This plan includes freelancers, workers in the gig economy, and furloughed employees.

Big Business

Amount: $500.0 billion – 25% of total CARES Act

This component of the package is aimed at stabilizing big businesses in hard-hit sectors.

The most obvious industry to receive support will be the airlines. About $58 billion has been earmarked for commercial and cargo airlines, as well as airline contractors. Perhaps in response to recent criticism of the industry, companies receiving stimulus money will be barred from engaging in stock buybacks for the term of the loan plus one year.

One interesting pathway highlighted by today’s Sankey diagram is the $17 billion allocated to “maintaining national security”.

Small Business

Amount: $377.0 billion – 19% of total CARES Act

To ease the strain on businesses around the country, the Small Business Administration (SBA) will be given $350 billion to provide loans of up to $10 million to qualifying organizations. These funds can be used for mission critical activities, such as paying rent or keeping employees on the payroll during COVID-19 closures.

As well, the bill sets aside $10 billion in grants for small businesses that need help covering short-term operating costs.

State and Local Governments

Amount: $340.0 billion – 17% of total CARES Act

The biggest portion of funds going to local and state governments is the $274 billion allocated towards direct COVID-19 response. The rest of the funds in this component will go to schools and child care services.

Public and Health Services

Amount: $179.5 billion – 9% of total CARES Act

The biggest slice of this pie goes to healthcare providers, who will receive $100 billion in grants to help fight COVID-19. This was a major ask from groups representing the healthcare industry, as they look to make up the lost revenue caused by focusing on the outbreak — as opposed to performing elective surgeries and other procedures. There will also be a 20% increase in Medicare payments for treating patients with the virus.

Money is also set aside for initiatives such as increasing the availability of ventilators and masks for the Strategic National Stockpile, as well as providing additional funding for the Center for Disease Control and expanding the reach of virtual doctors.

Finally, beyond the healthcare-related funding, the CARES Act also addresses food security programs and a long list of educational and arts initiatives.”

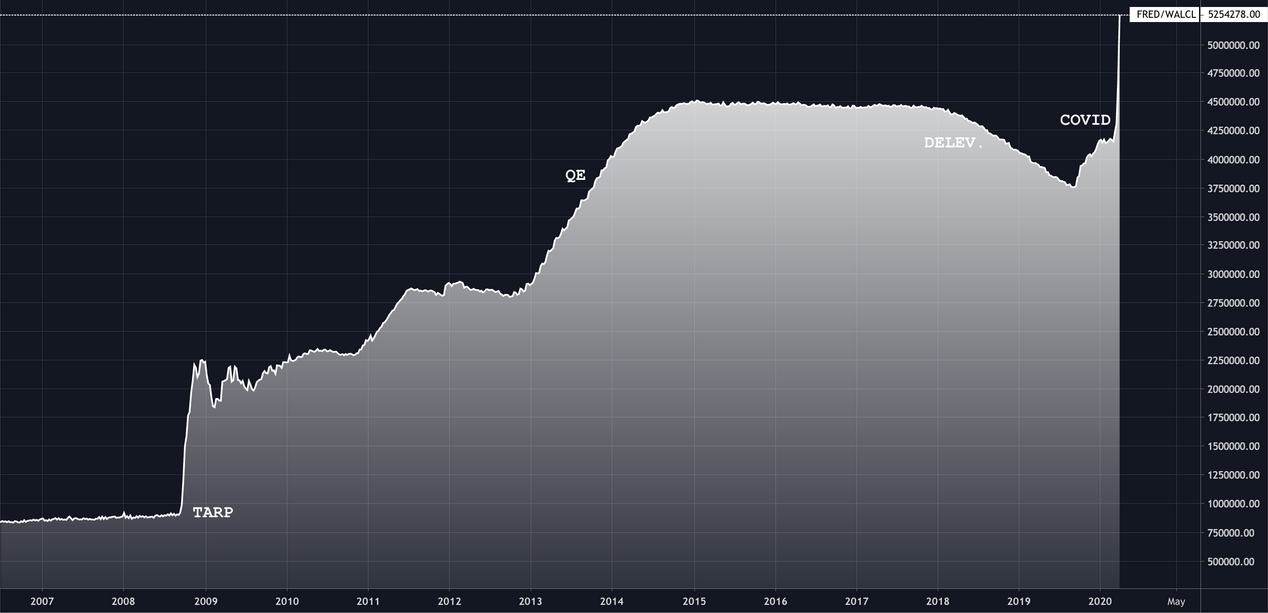

2.The Federal Reserve – $5T:

Source: TradingView/CoronaCrosby

a. The Federal Reserve has increased its balance sheet by ~$1.5T since Summer – with more than half of that expansion coming in the last few weeks.

b. Up to $4T of loans to businesses:

New York Times Explanation on how this works (Article) :

“The central bank’s emergency lending authorities, given to it by the Federal Reserve Act, allow it to make these loans to businesses. When the Fed declares that circumstances are unusual and exigent, and Treasury signs off, it can set up special programs that essentially buy debt from — or extend loans to — businesses large and small.

The Fed could simply print the money to back that lending, but it avoids taking on credit risk, so it asks for Treasury funding to insure against losses. But those taxpayer dollars can be leveraged: Because the Fed expects most borrowers to pay back, it does not need one-for-one support. As a result, a mere $10 billion from Treasury can prop up $100 billion in Fed lending. And voilà — the $454 billion Congress dedicated to Fed programs in the aid bill can be multiplied many times. A separate $46 billion in the package will go to specific industries.”

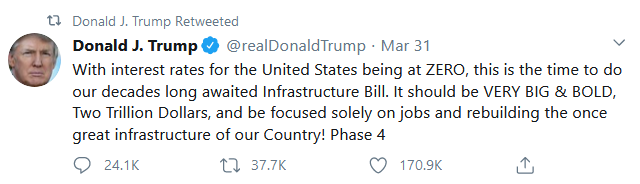

3. “Phase 4” Infrastructure Bill- $2T:

On Tuesday of this week, President Trump encouraged Congress to pass a $2 trillion infrastructure bill to boost the economy amid the COVID-19 pandemic.

Speaker Nancy Pelosi told reporters in a conference call following President Trump’s tweet that the House’s, “interest in infrastructure has always been bipartisan.”

In last week’s note we listed a number of potential catalysts:

The Luke Combs, “Beer Never Broke My Heart” Stock Market (and Sentiment Results)…

Let’s take a look at this week’s revised list:

- $2T stimulus package. (Make workers and business whole until back to office). DONE

- Up to $4T of loans to businesses. Forgivable if they retain employees on payroll. DONE

- Fed: Has backstopped almost all asset classes at this point (unlimited). $1.5T balance sheet expansion since August (lagged effect. 1/2 was in last couple of weeks). (more to come) DONE

- Phase 4 POTENTIAL up to $2T Infrastructure package. PENDING

- Positive test results from Remdesivir due soon. Also, 10,000 dose test in NY Hydroxychloroquine/Z-Pack started last Tuesday (should have results soon). PENDING

- New cases peak in the US. 3-8 WEEKS OUT

- OPEC+ reverses their decision and cuts production (either voluntarily because it’s in their interest OR with pressure/sanctions from US). This would stabilize credit markets quickly. PENDING (calls from POTUS to Putin/MBS)

- Vaccine needed ideally by Fall/Winter. PENDING

Now onto the shorter term view for the General Market:

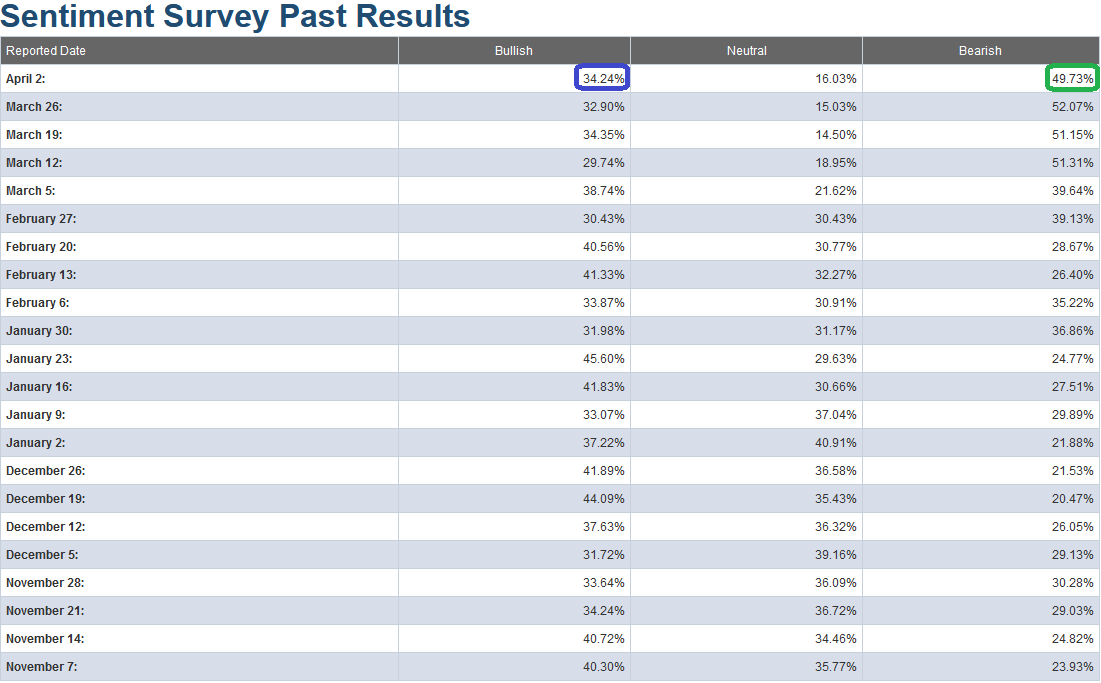

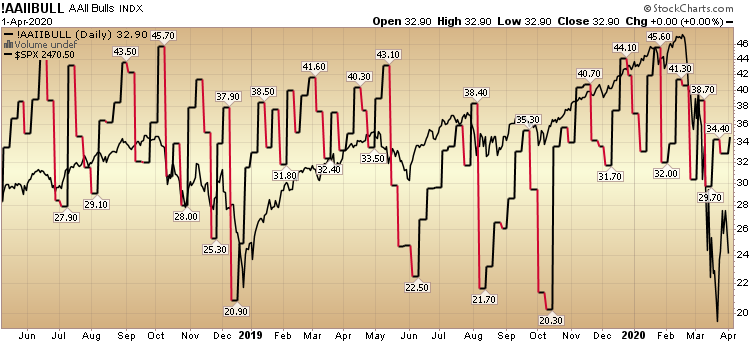

This week’s AAII Sentiment Survey result Bullish Percent (Video Explanation) ticked up to 34.24% from 32.90% last week. Bearish Percent ticked down to 49.73% from 52.07% last week. What is sitting in the back of my mind is the fact that while Bearish Percent is at/near an extreme level, the Bulls never got washed out in this crash.

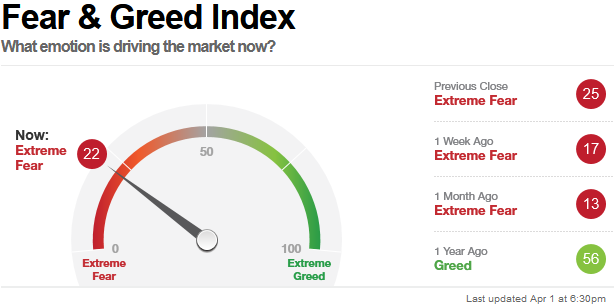

The CNN “Fear and Greed” Index rose from 17 last week to 22 this week. The fear is slowly thawing and will move in fits and starts in coming weeks. You can learn how this indicator is calculated and how it works here: (Video Explanation)

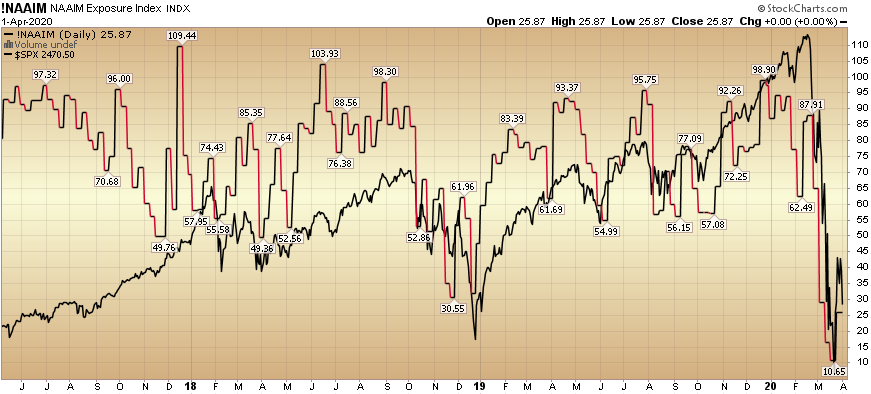

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation Here) rose from 10.65% equity exposure last week, to 25.87% this week. As I said last week, “Active managers will have to regain exposure in coming weeks as the worst of the news starts to move into the rear view mirror. We are not there yet. The worst news is still ahead but it will get better. It always does…”

Our message for this week is the same as the last few weeks:

We are selectively and slowly adding to those stocks/sectors which are nearing valuation levels that we would define as “pricing in at/near the worst case scenario.”

Most stocks do not yet meet this measure (as the “worst case” is unlikely to materialize), but for those that do we are adding and will continue to do so as opportunity presents itself in coming days and weeks.

But for now, it’s day by day and opportunistic execution…

Yahoo! Finance TV Appearance on Wednesday (Video)

Click Here to Watch directly on Yahoo! Finance

Thank you @MylesUdland and @OliviaBalsamo and for having me on the show with @readDanwrite, @melodyhahm and @SPYJared this afternoon… https://t.co/z8RQqDHgJi

— Thomas J. Hayes (@HedgeFundTips) April 1, 2020