Where is money flowing today?

Be in the know. 20 key reads for Wednesday…

- New U.S. Coronavirus Cases Slip to Lowest Since Late June (Wall Street Journal)

- A Third of People Tested in Bronx Have Coronavirus Antibodies (Wall Street Journal)

- 8 Restaurant Stocks That Are Worth the Risk (Barron’s)

- Former GE CEO Jeff Immelt Buys Up Bloom Energy Stock (Barron’s)

- Fund managers are more optimistic on stocks than any time since the pandemic began (MarketWatch)

- U.S. tells universities to shed China share holdings ahead of potential delisting: report (MarketWatch)

- The Next Stimulus Bill Still Hasn’t Arrived. Why the Market Doesn’t Care (Barron’s)

- Fund Managers Believe This Is a Whole New Cycle (Institutional Investor)

- Oracle’s Ellison steps out of character with approach for TikTok (Financial Times)

- Investors increasingly unsettled by ‘overvalued’ markets (Financial Times)

- 4 Top Companies Benefit From More Americans Driving on Vacation This Summer (24/7 Wall Street)

- Warren Buffett’s $113 billion Apple stake and $147 billion cash pile now account for over half of Berkshire Hathaway’s entire market value (Business Insider)

- The narrative driving markets is about to get challenged on Wednesday — here’s why (MarketWatch)

- Target reports a monster quarter — profits jump 80%, same-store sales set record (CNBC)

- Jim Cramer: A U.S. dollar rally might be in the cards, according to the charts (CNBC)

- Democrats, GOP Probe for a Path Forward on Stimulus Talks (Bloomberg)

- Trump Team Sees Path to Pared-Down $500 Billion Stimulus Deal (Bloomberg)

- Walmart Flexes Its Scale to Power Through Pandemic (Wall Street Journal)

- Simon, the Biggest U.S. Mall Owner, Shows Two Sides: Innovator and Traditionalist (Wall Street Journal)

- The ‘Everything Bubble’ Isn’t Everything, and Maybe Not Even a Bubble (Wall Street Journal)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Unusual Options Activity – JPMorgan Chase & Co. (JPM)

Data Source: barchart

Today some institution/fund purchased 4,011 contracts of Sept. 2021 $170 strike calls (or the right to buy 401,100 shares of JPMorgan Chase & Co. (JPM) at $170). The open interest was just 155 prior to this purchase. Continue reading “Unusual Options Activity – JPMorgan Chase & Co. (JPM)”

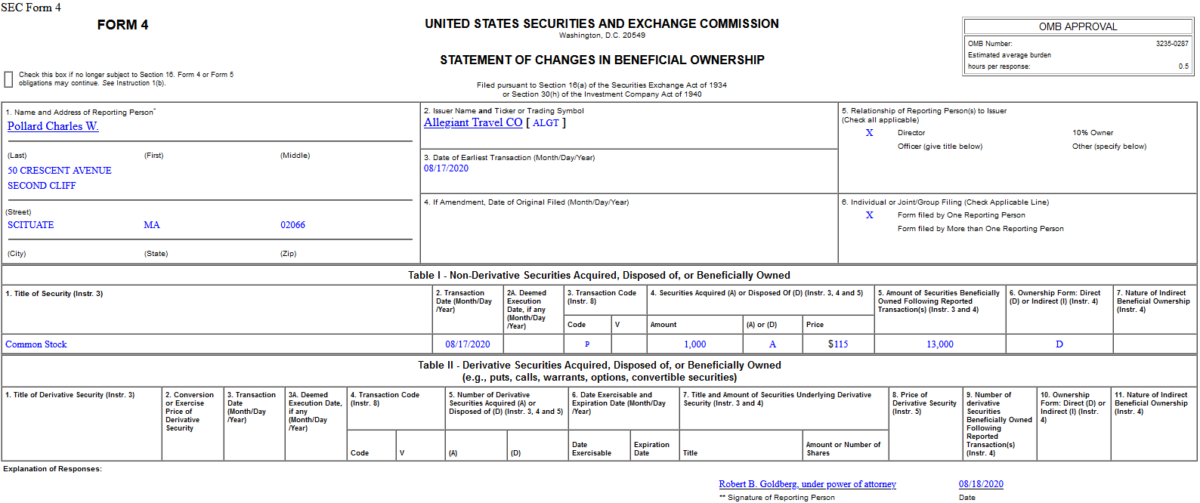

Insider Buying in Allegiant Travel Company (ALGT)

Where is money flowing today?

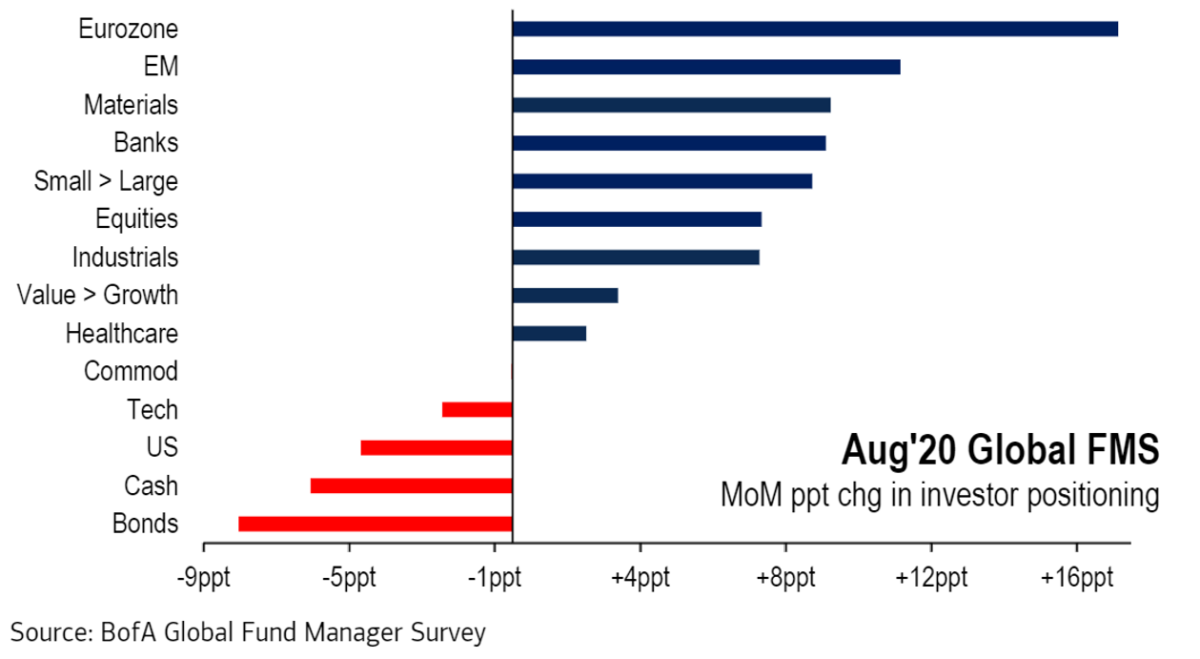

August Bank of America Global Fund Manager Survey Results (Summary)

~200 Managers overseeing $500B AUM responded to this month’s BofA survey. Continue reading “August Bank of America Global Fund Manager Survey Results (Summary)”

Be in the know. 10 key reads for Tuesday…

- Big Deals Return as Mergers Show Signs of a Rebound. Here’s Why. (Barron’s)

- Oracle (Yes, Oracle) Reportedly Enters Bidding for TikTok’s U.S. Unit (Barron’s)

- The Storied French Brand Delage Returns, Aiming at Both Road and Track (Barron’s)

- Worried About Inflation? Bonds and Gold Don’t Care (Bloomberg)

- Walmart second-quarter results crush estimates, as e-commerce sales jump 97% (CNBC)

- Home Depot quarterly sales soar 23% as consumers take on more DIY projects in pandemic (CNBC)

- Kohl’s shares jump as quarterly sales hold up better than expected in pandemic (CNBC)

- Wealthier parents are more likely to send their kids back to physical classrooms — here’s why (MarketWatch)

- Bank of America Clients With $489 Billion Finally Trust This Bull Market (Bloomberg)

- Gilead announces another cancer deal (MarketWatch)

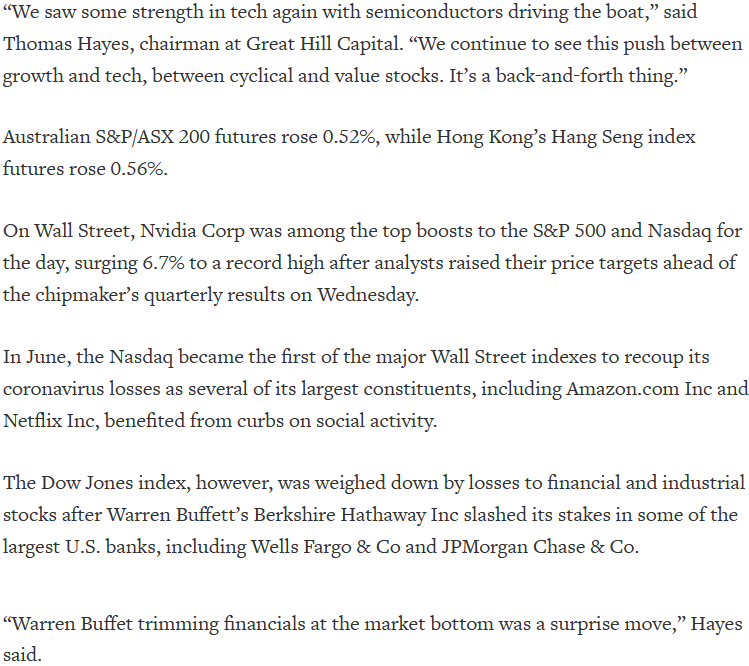

Tom Hayes – Quoted in Reuters article – 8/17/2020

Thanks to Chibuike Oguh for including me in his article on Reuters today. You can find it here: