Quote of the Day…

Be in the know. 29 key reads for Friday…

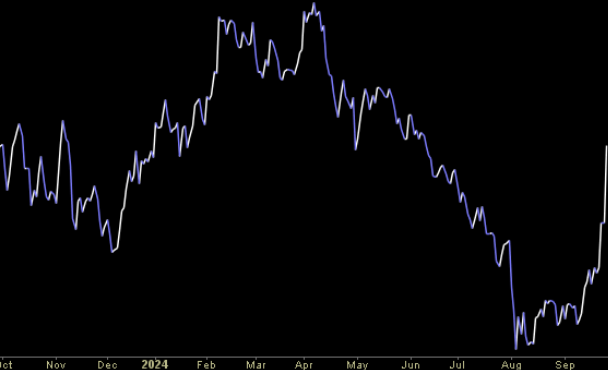

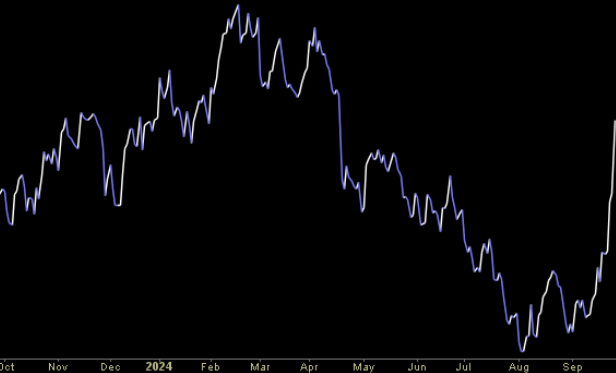

- Hedge fund billionaire David Tepper says he’s loading up on Chinese stocks after the nation’s stimulus bazooka (businessinsider)

- China’s biggest stock buying frenzy in years overwhelms exchange (yahoo)

- Intel and US race to finalise $8.5bn in chips funding by year’s end (ft)

- China stocks see best week since 2008 on stimulus impact as most Asia markets rise (cnbc)

- Chinese stocks could surge higher as investors get ‘FOMO,’ Goldman Sachs says (marketwatch)

- Arm Is Rebuffed by Intel After Inquiring About Buying Product Unit (bloomberg)

- PayPal’s stock is having its best year since 2020, and this is a big reason why (marketwatch)

- Alibaba, NIO and Other Chinese Stocks Rise Again. Stimulus Is a Gift That Keeps on Giving. (barrons)

- Fed’s Rate Cut Is Jolting Small Businesses to Spend Again (wsj)

- Fed’s Preferred Inflation Gauge Cooled in August (wsj)

- Boeing’s Union Declines Vote on the Company’s ‘Best and Final’ Offer (barrons)

- Wall Street Wants More Big Rate Cuts. Fed Officials Don’t Agree. (barrons)

- Why Fed bets were so out of whack: Waller explains what put him ‘over the edge’ for a jumbo rate cut (marketwatch)

- CPC Follows Up Monetary Stimulus With Fiscal Measures (chinalastnight)

- China ETFs set for best week on record after Beijing fires policy ‘bazooka’ to boost economy. Is it time to jump in? (marketwatch)

- Global stock-market capitalization is set to surpass its highest level in three years after the Federal Reserve cut interest rates and China began stimulating its economy this month. (marketwatch)

- Why stock-market investors are freaking out over economic data they used to ignore (marketwatch)

- Fed Gets a Boost From China Stimulus. How It Impacts U.S. Rate Cuts. (barrons)

- PayPal CEO Marks a Year on the Job. The Race for Change at the Fintech Is a ‘Marathon.’ (barrons)

- Don’t Wait for More Shoes to Drop. Nike Stock Is a Bargain. (barrons)

- Spirits maker Diageo confirmed its outlook for the near and medium term (wsj)

- Disney slashes 300 jobs this week as CEO Bob Iger continues belt-tightening (nypost)

- Quant Hedge Funds Trapped in Short Squeeze After China Glitch (bloomberg)

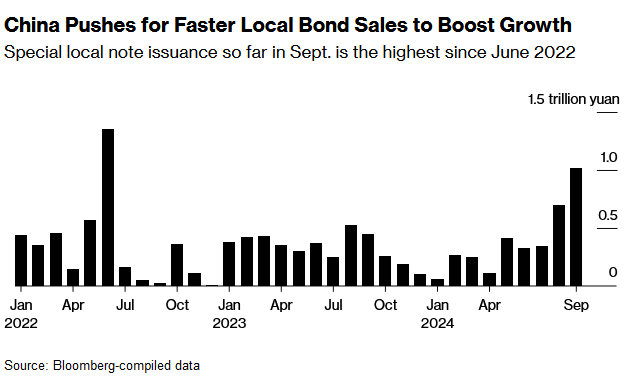

- Xi’s Big Stimulus Week Aims to Draw a Line Under China Slowdown (bloomberg)

- China’s central bank, top political leaders appear to be abandoning a reluctance to act forcefully on the economy (wsj)

- When Will Money-Market Funds Lose Their Allure? (wsj)

- Why analysts are calling Cava the next Chipotle (cnbc)

- Alibaba, Tencent rally as Beijing stimulus plans push China’s tech stocks to 13-month high (cnbc)

- Yen bounces back as veteran lawmaker Ishiba wins PM contest (streetinsider)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Tom Hayes – Yahoo! Finance Appearance – 9/26/2024

Yahoo! Finance Appearance – Thomas Hayes – Chairman of Great Hill Capital – September 26, 2024

Watch in HD directly on Yahoo! Finance

Tom Hayes – NYSE TV Appearance – 9/26/2024

NYSE TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – September 26, 2024

Watch in HD Directly on NYSE TV

Where is money flowing today?

Quote of the Day…

Be in the know. 20 key reads for Thursday…

- Intel Has a Great Chip for the First Time In Years (barrons)

- China’s Politburo Supercharges Stimulus With Housing, Rates Vows (bloomberg)

- China pledges to ensure fiscal spending among steps signaling urgency (bloomberg)

- Hedge Funds Snap Up Chinese Equities on Stimulus Optimism (bloomberg)

- House, Senate Approve Spending Bill to Keep Government Open (barrons)

- Alibaba’s Singles’ Day preparation includes US$5.7 billion in aid to merchants (scmp)

- China Weighs Injecting $142 Billion of Capital Into Top Banks (bloomberg)

- China Seeks to Resolve Structural Issues to Shore Up Employment (bloomberg)

- Fed’s Kugler Sees Plenty More Rate Cuts Ahead (barrons)

- Why now may be a good time to take ‘opportunistic’ profits in gold and silver (marketwatch)

- The Policy Dragon Awakens As Mainland China & Hong Kong Rally (chinalastnight)

- Visa Is in the Hot Seat. MasterCard and Others Could Benefit. (barrons)

- Boeing, Union to Resume Pay Talks as Strike Nears Third Week (bloomberg)

- Tracking Hurricane Helene’s Latest Path (bloomberg)

- PayPal expands services to allow merchants to buy and sell crypto (cnbc)

- Here are the most important days for the stock market between now and the November election, according to BofA (businessinsider)

- Wall Street just got another sign that dealmaking is on its way back (finance.yahoo)

- Dollar General asks shareholders to reject investment firm’s stock-purchase offer (marketwatch)

- China’s yuan continues upward climb after Beijing’s stimulus roll-out (scmp)

- Chinese homeowners cheer Beijing’s move to cut mortgage rates by a half point (scmp)